The current surge in Bitcoin prices and other classes of cryptocurrencies has attracted the attention not only of investors but also of hackers. As more and more investors are gravitating toward crypto, hackers up their game to try and steal these valuable assets. It is generally difficult to track the activities of these hackers as they can remove digital traces after their operations.

In addition, when hacking occurs, the affected investor has no legal recourse available as digital currency is not regulated by a central bank or government body. Therefore, as an investor, protecting your investment rests on your shoulders. In this article, we will outline ways you can protect your money against crooks.

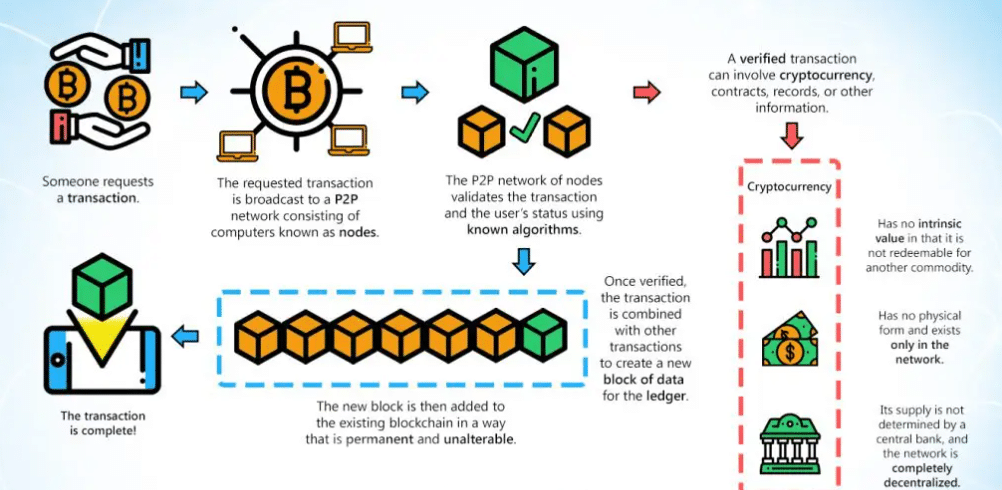

Where and how is cryptocurrency stored?

Each cryptocurrency is stored in its dedicated blockchain network. To access your crypto and make transactions, you need to supply public and private keys every time. Since your keys are a complex combination of characters, you have to store them somewhere safe and retrieve them at your disposal. This is where hot and cold storage comes in.

There are several ways to store your private keys:

- On a personal computer

- On a web service (exchange)

- On paper

When storing cryptocurrency on a computer, Bitcoin clients are used, for example, Armory, Electrum, etc., which encrypt and protect the wallet with a password. The wallet’s security is increased provided that the computer does not have an internet connection, the wallet.dat file is backed up, and the file itself is deleted from the computer.

There are also online exchanges for storing cryptocurrency, access to which is quick and straightforward. If you want to use a wallet, you need to have a mobile device and access the internet. However, anonymity is ruled out due to legal requirements: sending identity documents to the exchange is necessary.

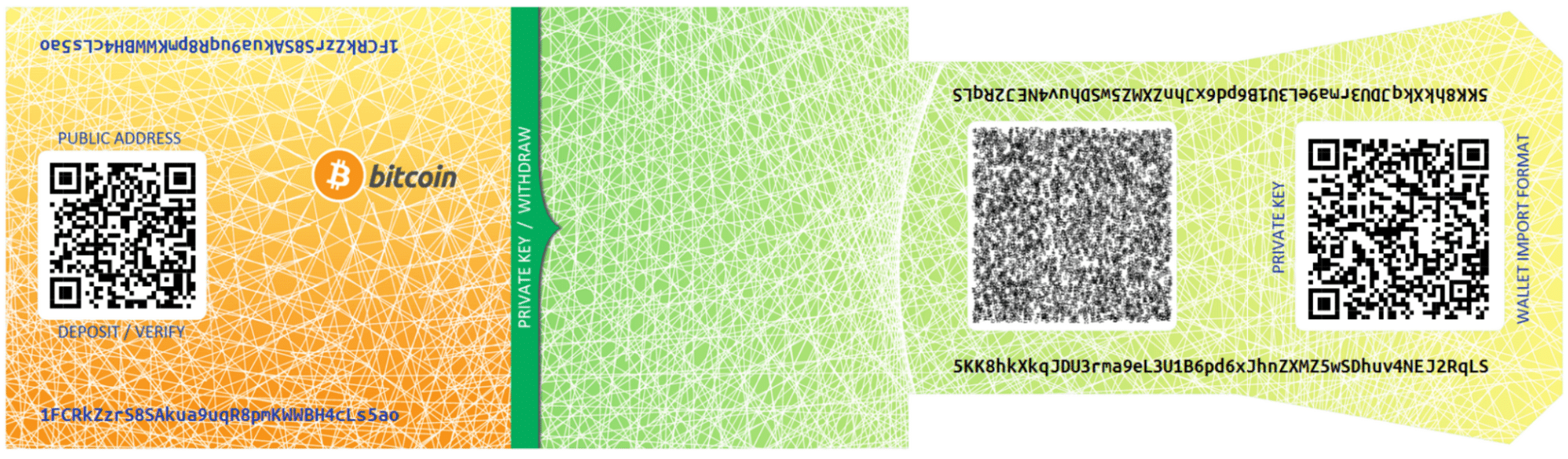

Also, there is no guarantee of a refund if the exchange is hacked. When storing cryptocurrency on paper, it is enough to print out a Bitcoin wallet, while the user receives a 100% guarantee of confidentiality of private keys and bitcoin addresses.

Here is an example of a paper wallet.

Let’s see some valuable tips for protecting your crypto.

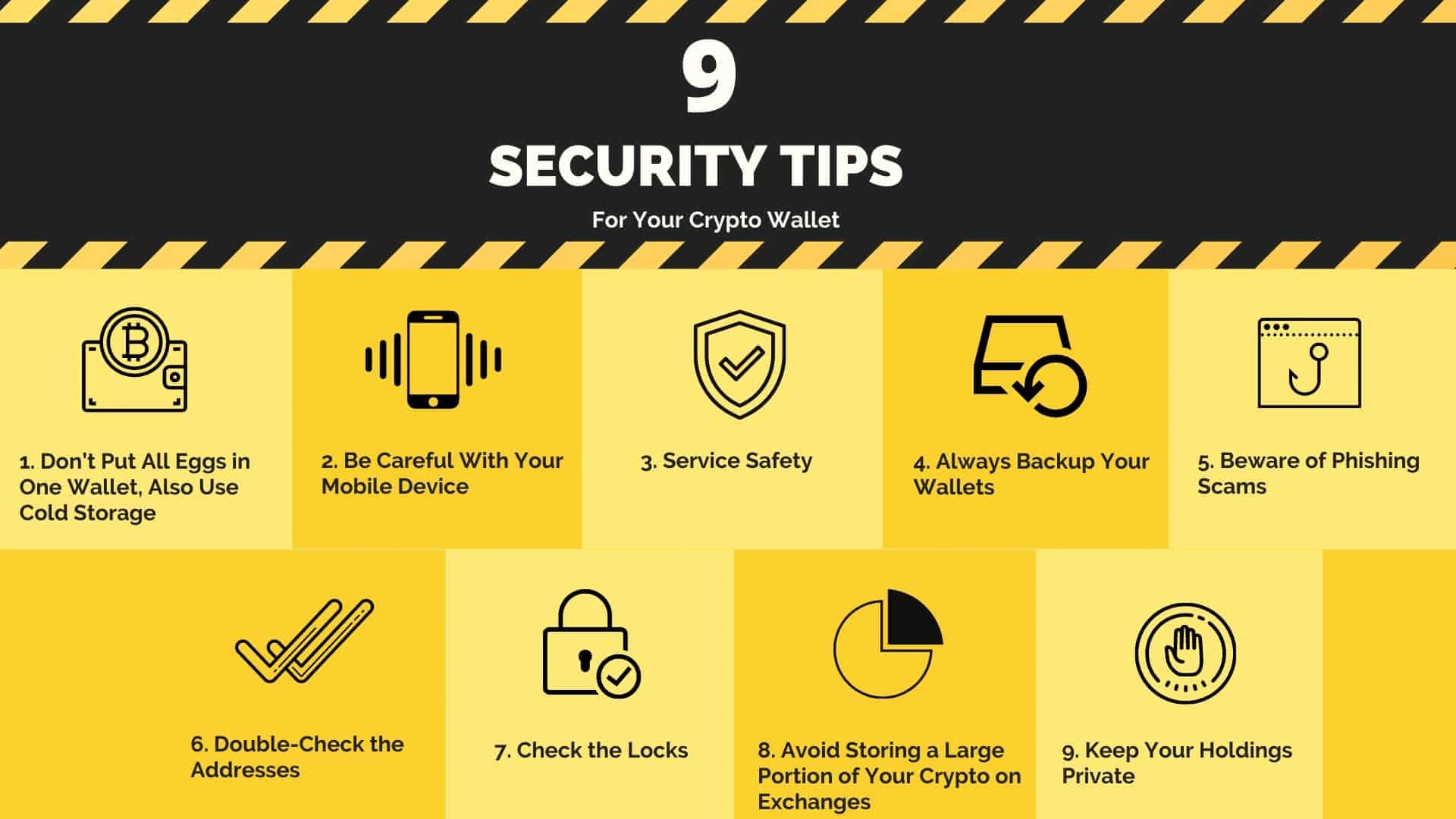

Use a hybrid approach to crypto security

Due to the increase of online services accepting crypto as payment, online wallets have proliferated. This activity did not go unnoticed by the prying eyes of bad actors. That is why experts suggest that investors store most of their crypto assets in physical or offline wallets and keep only a tiny portion in hot wallets.

Here are some tips to secure your physical wallets:

- Store your physical wallet in a safe place (e.g., safety deposit box).

- Separate your public and private keys.

- Secure your keys with strong passwords and, where possible, multi-factor authentication.

As more and more business establishments start accepting crypto payments, more conventional ways of storing them will appear in time. Just keep your hopes up. For the time being, you are on your own when it comes to protecting your crypto investments.

Apply multiple security measures

You can use standard practices in protecting online accounts in securing online wallets. For example, when engaging in social media, you make sure that your personal information is safe from hackers. Likewise, you can apply the same set of safety precautions to your precious crypto investments.

Here are some of the things you should do to protect your online wallets:

- Do not use the same password in your online wallets.

- Nominate a solid password for each of your digital wallets.

- Enable two-factor authentication when accessing and sending crypto payments.

- Change your passwords regularly, say, every quarter.

- Use a reputable password manager (e.g., KeyPass) to manage your passwords. Not only does it keep your credentials secure, but a password manager also removes the need for you to memorize your passwords.

Work with reputable exchanges and wallets

Using different platforms of wallets and exchanges can help manage the risk to your crypto assets. However, before you decide which platforms to go for, do your research first. Try to understand what security features each platform offers and how it protects your data.

Check if the following safety measures are in place:

- Multi-factor authentication

- SSL/TLS encryption

- Air-gapped network security

Be aware that the use of multiple platforms has its own unique set of challenges. As pointed out in the previous section, a strong password is crucial to protecting your accounts.

Also, it would help if you used different passwords for each account. Otherwise, when you lose one account, you will lose all the other accounts. Of course, forgetting about your passwords is a big issue. To address this, use a reputable password management application.

Secure your mobile wallet

Many users with crypto wallets manage their assets using mobile apps. Hackers are aware of this user behavior, so they target mobile wallets as well using phishing campaigns. The goal is to steal the user access credentials of investors. They may send you phishing text messages, calls, or emails so that you reveal your account information. In addition, they may use social engineering tactics through social media to trick you into divulging your information.

Another potential source of risk is free mobile applications. Many users are not aware that the developers of some of these free applications have ulterior motives.

These applications are capable of performing any illegal activities, including:

- Storing your data in their servers and selling them to parties involved in marketing.

- Accessing your other mobile accounts without permission.

- Logging your keystrokes to guess your passwords.

- Monitoring the activities on your screen.

Just be aware of the above risks and be on top of your accounts. Installing a legit antivirus is a good idea. Reviewing which applications access which accounts is another safety measure available to you. Remove the access of applications whose services are no longer relevant to you. Before even installing free apps, check first if they are legit and do not hide dangerous codes.

Do not share the private key

Blockchain uses your private key to authenticate any transaction. It will try to determine if you own the wallet sending or receiving coins. Your private keys are your tickets to the crypto network, so you should not share them. Cold storage offers a safe way to store your secret keys.

Essentially, this type of storage entails printing your keys and removing any digital copies. Since it is easy for hackers to infiltrate computer systems, the old way of keeping hard copies of keys seems to work wonders in this digital age.

Do not let your provider hold your keys

Do not allow your providers to hold your private keys for you. Providers store the secret keys in their servers, which you have no control over. This could be the worst decision you can make as an investor. The only slight advantage you can get with this option is less hustle on your part. However, the risks far outweigh this advantage.

These are the risks associated with allowing your provider to hold your keys:

- A data breach occurs on the server of your provider.

- Your provider gets out of business.

- The government takes over the platform of your provider.

While you can store your keys on your laptop or computer, it is a known fact that hard disks deteriorate over time until they malfunction in the end. When that happens, your keys are lost, so are your investments. Plus, hacking is another nagging issue. The better option is to use hardware wallets. At present, these devices are a bit pricey. However, buying one or two might be worth the investment if you hold substantial crypto assets.

Final thoughts

Crypto investing can be challenging. While anyone can quickly enter this business, exit can be difficult. The challenges include converting digital currency back to fiat money, technological limitations, hacking, and user oversight. Until you have found some solutions to these problems, you are better off not investing in crypto at all. Otherwise, your investment might go down the drain. Think hard and long before you invest in crypto.

Comments