Cryptocurrencies are taxable assets with specific clarification. In the past years, taxpayers and the IRS considered these digital assets a low priority for taxiing. As the crypto-verse continues to grow, the marketplace has become wider. The IRS comes up with specific clarifications about common questions that arise when someone seeks to file tax for crypto assets.

However, when it comes to filing crypto tax, it is mandatory to know what taxable events are and how to calculate tax for your cryptos. This article will briefly discuss calculating profit loss and how to file crypto tax.

Profit and loss calculation

When filing taxes, it is mandatory to know how to calculate profit and loss. The IRS lists cryptos as assets like rental properties. Every time someone transfers, spends, swaps, sells, or gifts crypto, there will be profit or loss when you sell your crypto for more than your purchase price.

Profit/loss crypto

- Making profit

When the sale price is higher than the purchase price. For example, someone purchases an Ethereum at $3500 and sells the same ETH coin for $4200. Meanwhile, the transaction fee he pays is $150. So the profit he makes is $550.

- Making loss

The author faces a loss when the sale price is lower than the purchase price. For example, someone purchases an ETH coin for $3500 and sells it for $3000. Meanwhile, he pays a $150 transaction fee $150. So he has a total $650 loss.

When does someone need to pay crypto taxes?

In the beginning, the crypto market was smaller, and no one cared much about it. The crypto industry drew attention when it became a trillion-dollar marketplace. BTC touched $69k, and ETH reached the $5k mark last Nov. Government publishes official guidelines about filing crypto taxes.

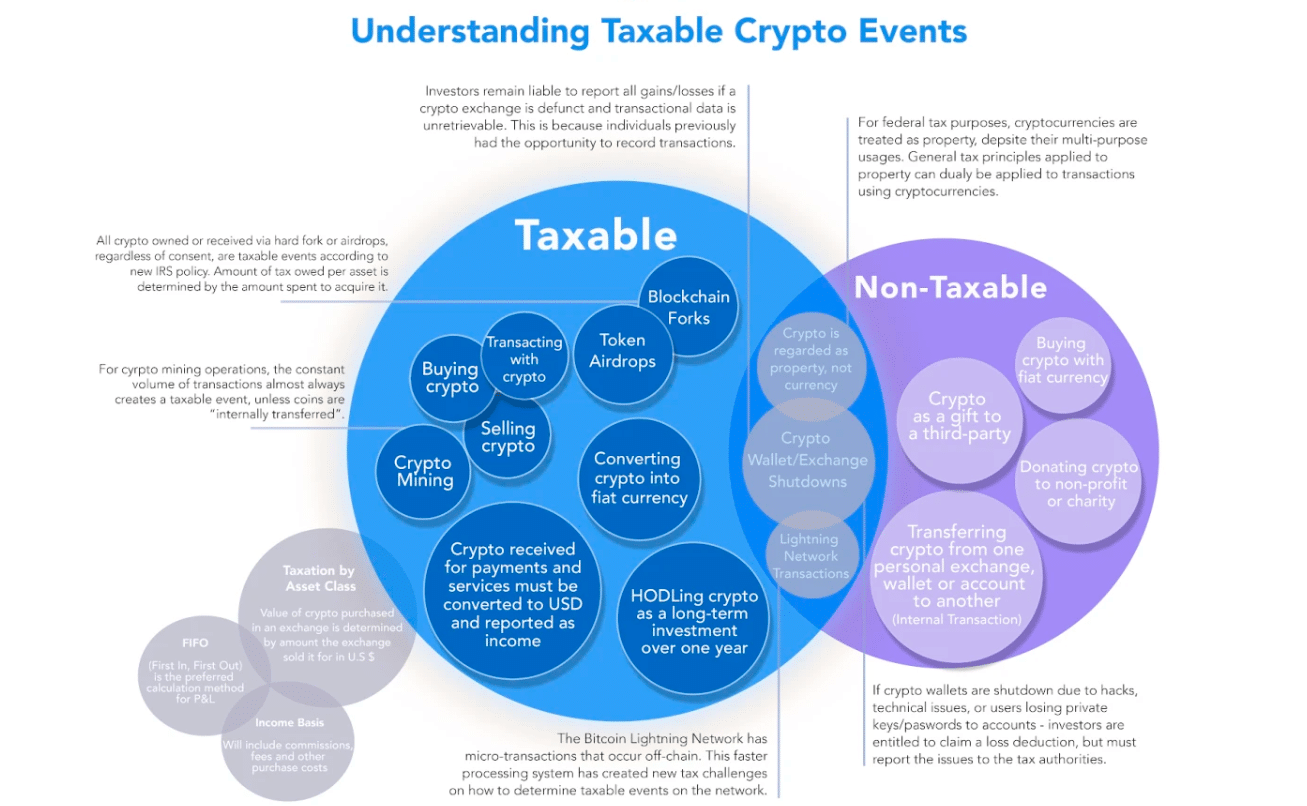

Taxable crypto events

Let’s have a look at events that will occur taxable gain or loss.

- Crypto sell

When you sell your crypto for profit, crypto tax is applicable, either short-term or long-term.

- Mining crypto

When you generate profits from crypto, mining income tax is applicable.

- Trading stablecoin

It is a taxable event when someone trades cryptocurrencies for stablecoins.

- Hard forks and airdrops

Once someone gains possession of cryptos, the taxable period initiates.

- Exchanging and trading crypto

Crypto tax is applicable when someone exchanges or trades one cryptocurrency for another.

- Making payment or purchase using crypto

When someone purchases any goods or service using crypto, crypto tax is applicable according to the value of that crypto.

- Receive payments, signup perks, bonuses

When someone gets a bonus in BTC from any exchange or platform for signing up or receiving payments in LTC, crypto tax is applicable.

Non-taxable crypto events

Although tax rates and taxable events are different in different due to the change in legislation, we have found these events out of the taxes for major countries:

- Donating crypto

It is not a taxable event when someone donates to any charity through crypto.

- Gift crypto to family or friends

When someone gifts crypto assets to his family or friends, he doesn’t need to pay any tax. Tax is applicable when he sells crypto.

- Purchasing crypto

When someone purchases any crypto or hold, he doesn’t need to pay tax.

- Token and con swap

No tax is applicable when someone owns any crypto coin or token and later changes the name or the underlying technology.

Cryptocurrency taxes

Since they consider cryptocurrencies property, any capital gain, exchange, cash out in the USD, make payments, or purchase can be reckoned as taxable events. Any gain/loss or the difference between purchase and sale price subject to tax depends on the duration of holding that asset. We are attaching a chart of the capital gain tax rate for crypto.

| Long-term capital gains rate | Taxable income |

| Single filters | |

| 0% | $0 to $40.400 |

| 15% | $40.401 to $445.850 |

| 20% | $445.851 or more |

| Married filling joinly | |

| 0% | $0 to $80.400 |

| 15% | $80.401 to $501.600 |

| 20% | $501.601 or more |

Capital gain tax rate

Any investor can qualify for paying a long-term capital gain rate of 0% or 15%, or 20% depending on his taxable income and the holding period has to be more than one year. Meanwhile, when you exchange or trade crypto assets for a shorter period of less than one year, that may trigger your payable tax rate. The tax rate remains up to 37% for top earners with regular taxes. Check the marginal tax bracket for joint tax filing.

| Taxable income | Taxes owed |

| $0 to $19.900 | 10% of taxable income |

| $19.901 to $81.050 | $1.990 plus 12% of amount over $19.900 |

| $81.051 to $172.750 | $9.328 plus 22% of amount over $81.050 |

| $172.751 to $329.850 | $29.502 plus 24% of amount over $172.750 |

| $329.851 to $418.850 | $67.206 plus 32% of amount over $329.850 |

| $418.851 to $628.300 | $95.686 plus 35% of amount over $418.850 |

| $628.301 or more | $168.993.50 plus 37% of amount over $628.300 |

Marginal tax bracket for joint tax filing

We are attaching the marginal tax bracket chart for single individuals.

| Taxable income | Taxes owed |

| $0 to $9.950 | 10% of taxable income |

| $9.951 to $40.525 | $995 plus 12% of amount over $9.950 |

| $40.525 to $86.375 | $4.664 plus 22% of amount over $40.525 |

| $86.376 to $164.925 | $14.751 plus 24% of amount over $86.375 |

| $164.926 to $209.425 | $33.600 plus 32% of amount over $164.925 |

| $209.426 to $523.600 | $47.843 plus 35% of amount over $209.425 |

| $523.601 or more | $157.804.25 plus 37% of amount over $523.600 |

Marginal tax bracket chart for single individuals

Many surveys show that crypto investors usually trade cryptocurrencies frequently rather than invest or hold them for longer. These assets are volatile and allow making a huge profit within a short period.

Now check the capital gain tax events at a glance:

- Spending crypto or purchasing something with crypto.

- Selling cryptos for fiat currencies.

- Donate/gift crypto — depending on your location.

- Swapping crypto with another crypto — depending on your location.

Crypto income tax events:

- Earning crypto

- Referral bonuses

- Staking

- DeFi interest

- Mining

- Forks

- Airdrops

- Financial instruments like options or futures — depending on your location

Tax-free events:

- Moving crypto between crypto wallets

- Purchasing any crypto

How to estimate crypto tax?

Step 1.

In the first step, estimate how much you can make from selling crypto already in your possession. For example, you may currently have three BTC worth $15k, and your purchase price was $10k. So your investment amount was $30k and can make a profit of ($45k-$30k) $15k.

Step 2.

In the following step, define your category according to duration as the amount is different for short-term and long-term. Any holding period below one year is short-term and 365 days or above is long-term.

Step 3.

Many investors use crypto tax software to reduce hassles as this software tracks users’ crypto transactions and automatically estimates the tax amount over a particular period. Now you know your profit/income and the duration. So generating tax amounts becomes easier.

Final thought

Tax filing is complicated and mixing cryptos with it becomes more complex. However, many efficient tools help you get your crypto tax automatically by tracking your transaction with many exchanges or other payments. So individuals can file crypto taxes more efficiently and easily.

Comments