Like small business owners, self-employed people should pay taxes to the government to finance social and medical care. The IRS requires self-employed people to pay taxes when they generate a net income of at least $400 for the applicable tax year or at least $108.28 for tax-exempt religious organizations.

Some self-employed make the mistake of not filing tax returns when they encounter financial setbacks. They hope that their financial situation will improve, after which they could catch up on their tax obligations. This method often fails. If you use the same strategy, it will only put you in a more difficult situation. Be aware that not filing income tax will result in a 5 to 25 percent penalty applied monthly to your tax due.

To avoid uncomfortable situations, make sure you settle your tax dues in full in due time. This article will provide the steps you can follow when filing taxes as self-employed.

Should you pay tax as a self-employed?

IRS considers you as self-employed if any one of the following is true:

- You have a small business, operate a business with a partner, or engage in a limited liability partnership.

- You are a private contractor.

- You are an individual trader.

- You have a side hustle that you carry out on your own time, providing your equipment to do your work.

- You do something that generates income for yourself and not for someone else.

- You are given the form 1099 K or 1099 MISC and not W2.

Self-employed qualifications

Types of taxes paid by the self-employed

The self-employed pay two types of taxes:

- Self-employed tax

- Income tax

At first look, it appears you pay more taxes than an employee does. When you dig deeper, you will find out that your tax as self-employed encompasses tax payments for social and medical care. In essence, your taxes are commensurate with the taxes paid by employed individuals.

The term commensurate here is an essential qualifier. For employees, employers have a counterpart in the taxes paid by their workers. For the self-employed, you pay all the taxes by yourself. The next logical point is how much you will pay for the self-employed tax. This leads us to the next section. The most straightforward answer is the tax varies by your income.

How much tax should you pay?

You pay two types of taxes as self-employed. Here is a rundown of the taxes:

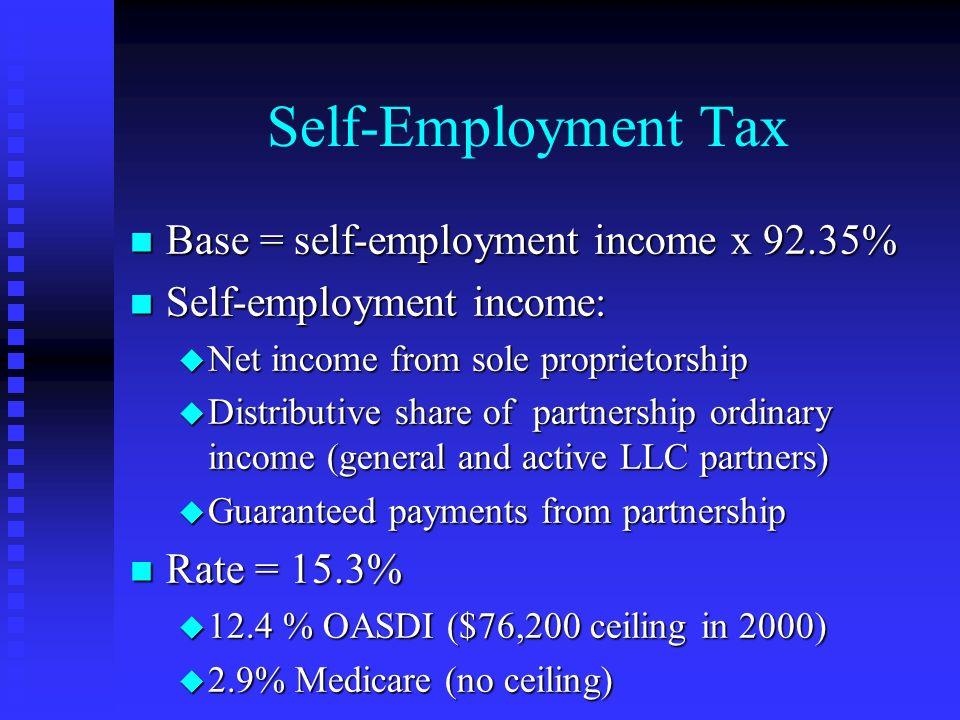

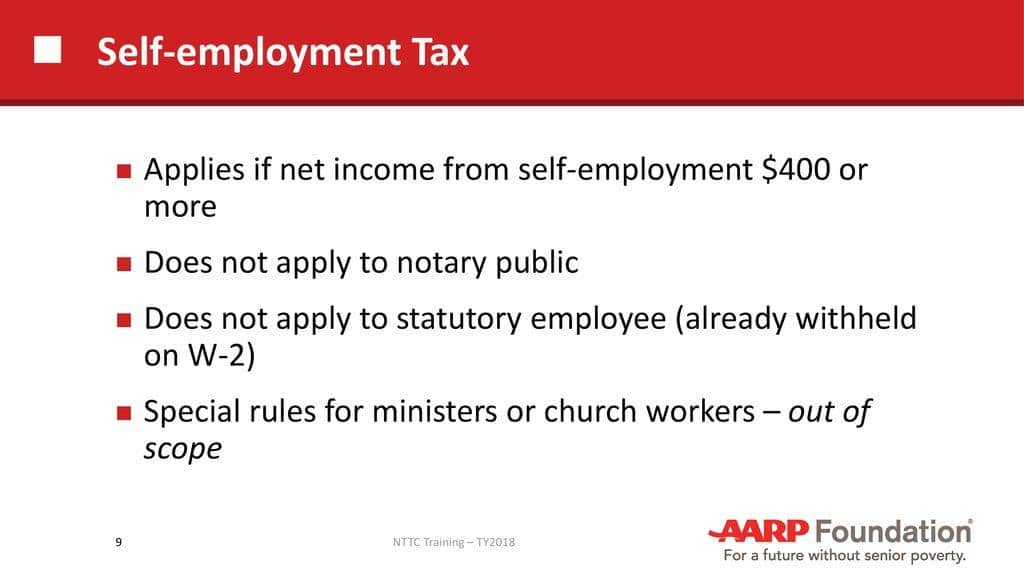

Self-employed tax

The basis of self-employed tax is 92.35 percent of your net income. This is waived if your net income in a given taxable year is below $400. According to the tax law, you will pay 2.9% tax for medical care and 12.4% tax for social care. Be aware that there is an upper limit of the portion of your net income being subjected to social care tax, and this amount changes every year.

Additional tax

Depending on your net income, you may pay an extra tax equal to 0.9% of the net income. This will happen if the total income from all sources equals the following amount:

- More than $200,000 for an unmarried person.

- More than $125,000 for a married individual who makes a separate filing.

- More than $250,000 for a married individual who makes a joint filing.

Take note that your self-employed tax is not the entirety of your tax return. Apart from the self-employed tax, you may be paying other taxes to the IRS. This type of tax is only the portion of tax you pay to the federal government. You must satisfy other taxes and obligations, including licenses, permits, fees, state taxes, and municipal or regional taxes.

Self-employment taxes

How to compute the taxable income

The IRS provides a simple method for you to compute your taxable income. First, you must find out if you made a profit or not over the course of one year of operation. To do this, deduct the overhead cost from the gross income. If the result is positive, then you made an income. Otherwise, you lost money.

If you are profitable and made at least $400, include this amount in your taxable income. If you made a net loss, deduct that amount from the taxable income. When you have a net loss, deducting the loss is not always a straightforward approach. There are specific guidelines you must follow about losses.

Steps for filing self-employed tax

Here are the steps you should take to file self-employed taxes:

Step 1. Find out if you must pay taxes

This first step is pretty obvious. Before you file taxes, you have to know if the law requires you to do so. Are you a self-employed worker in the first place? Refer to a preceding section for guidance. If you have just opened a business and have not reached a net income of $400 within the year, you are not required to pay this tax.

Step 2. Identify all sources of income

Sit down and list down all possible sources of income. Are you a freelancer with multiple side hustles and are working on different platforms? You must report all income using Form 1099-NEC.

Step 3. File your taxes

If you are filing your taxes yourself, give it enough time to avoid the pressure of beating the deadline. You are probably aware that you should file your taxes by April 15 of every year. Prepare your tax filing weeks before the deadline to avoid making errors.

Step 4. Plan ahead

Filing a return can be challenging. Learning from your experience, you should prepare ahead of time. Start preparing your return filing for next year today while you are in the right frame of mind. This will save you the trouble of accomplishing forms under pressure when the tax due is close at hand.

Minimum income requirement

Staying on top of your tax obligations

You have to integrate paying taxes into your daily operations to make your life easier. To do that, here are some tips that can help:

- Always pay your tax dues on time and in full. Feeling the burden of paying taxes now is much better than facing penalties for late tax payments.

- Seek help. If you are not sure how much tax you should pay, work with a tax expert to get the right figures.

- Allocate funds for taxes. Every quarter, stash away an amount you expect to pay for taxes. This way, you will not feel the pain of taking out a portion of your net profit at the end of the year. The rule of thumb is to set aside 25% to 40% of your quarterly income for taxes.

- Track all business-related expenditures throughout the year and keep all invoices. Just keep those invoices officially part of your overhead costs for your purchases.

Final thoughts

The good thing about paying taxes as self-employed is that it indicates your small business is returning a profit. To avoid problems befalling your business, be mindful of all your legal obligations. This includes renewing your business license regularly, paying taxes, satisfying contractual commitments with clients and partners, maintaining your business insurance, etc.

Comments