The footwear industry is not growing as fast as new industries, but it sees a stable demand year after year. Consumers worldwide spend about $400 billion every year on shoes, and their demand is gradually but continuously growing. Because of this, newcomers to the industry may find and establish a niche that might attract customers.

Footwear is among the few products that people worldwide will always find valuable. Regardless of your race, age, religion, sex, weight, or height, you would like to get one or more pairs of shoes. Because shoes are subject to wear and tear, you have to replace them regularly. This makes footwear kind of like a commodity that requires you to spend money over and over again.

Due to the reasons discussed above, owning shoe stocks both in the short term and long term is not a bad idea. The question that remains is which stocks you should buy. This article will give you a starting point and share insights on buying such stocks.

What are shoe stocks?

Shoe stocks are companies designing, manufacturing, and marketing shoes. They may engage in producing sports equipment, apparel, bags, and other consumer products. However, the main focus of the business is the creation of shoes and sneakers of different types. They may put stalls in shopping malls to market their shoes and sneakers.

Several corporations participate in the footwear industry, and they tend to show dominance over small designers. In 2020, the global shoe industry was worth more than $365 billion. By 2026, the industry could become a $440 billion market. These numbers show that this sector is still growing despite the number of players entering the scene.

Shoe gallery

How to buy shoe stocks?

Be aware that consumers are very critical and conscious about the brand regarding shoes. As you make your shoe stock selection, find one or two with a solid customer base and are still building their market presence. Nowadays, social media plays a significant role in branding and marketing. Try to find companies with a healthy social media following when you shop around for stocks.

Year-on-year revenue is one metric you must consider when assessing potential shoe stocks to buy. When you do this, dig deeper to understand why a stock is such a success. See what drives the company’s profits. Is it innovation, low-cost production, or another factor? A successful stock normally does something differently, allowing it to keep pace with the competition.

Top three shoe stocks to buy in 2022

We compiled a list of our favorite three stocks to own in 2022. Our basis for selecting these stocks is purely market capitalization. We arrange the list below in the order of market cap from highest to lowest.

No. 1. Nike (NKE)

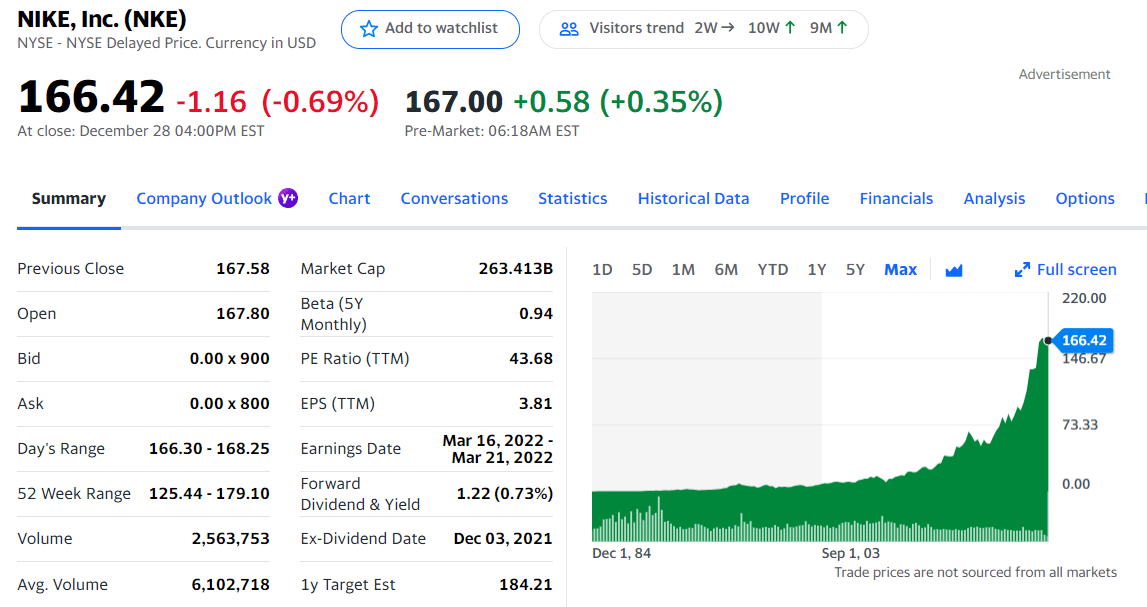

Price: $166.42

EPS: 3.77

Market capitalization: $255.404 billion

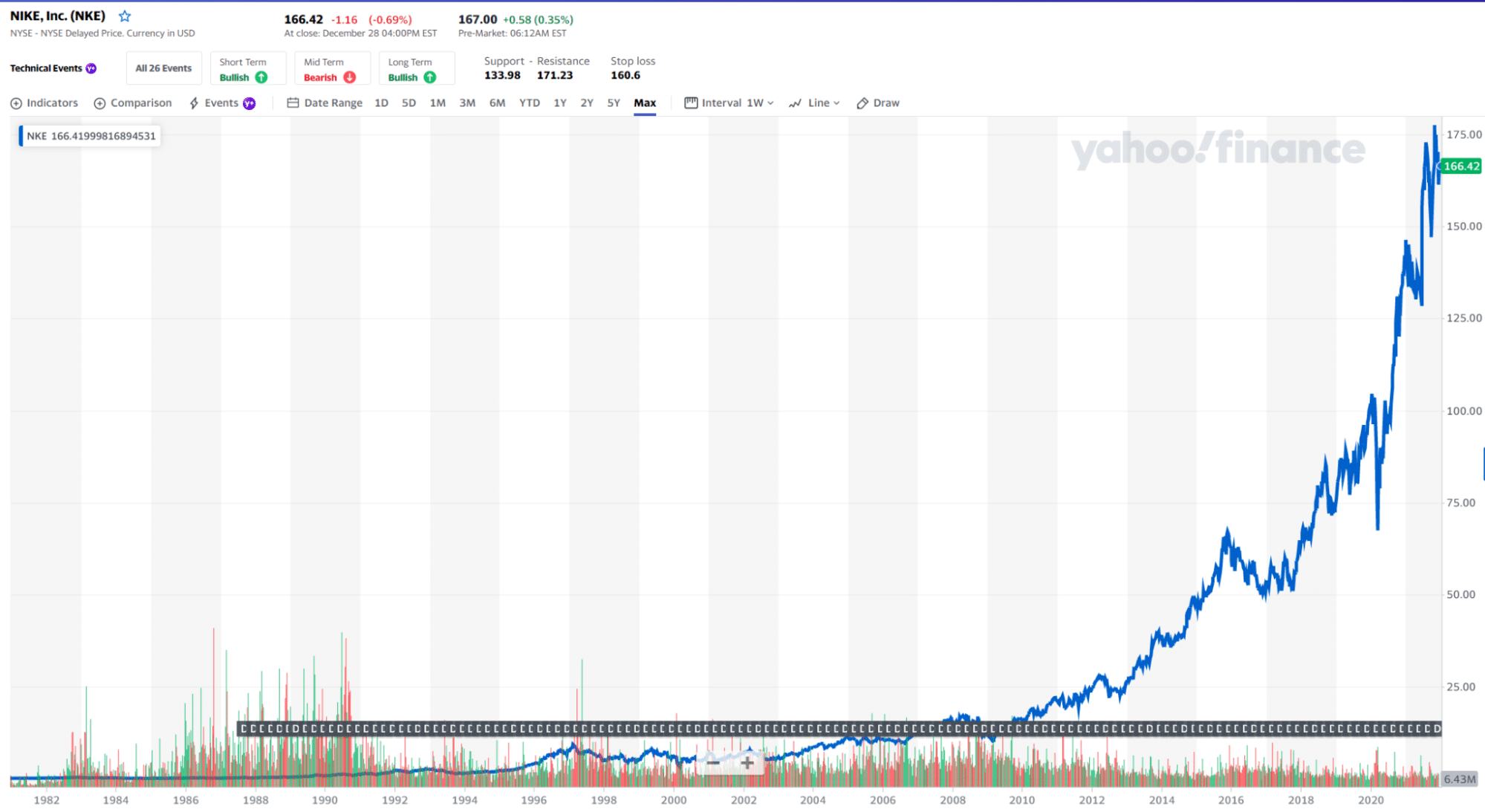

NKE stock price chart 1981-2021

In spite of being a tremendously popular brand for years, Nike keeps on innovating and signing the best athletes in various fields to maintain its position in the footwear industry. No wonder the stock has grown 185 percent over the last five years and managed to reach its highest income so far in 2021.

Nike stock summary

The Nike brand has already established a strong market presence. Despite this, its pipeline is still full of innovative ideas. With its Consumer Direct Offense, the company can connect better with customers through digital innovation and direct selling. It appears Nike is looking to dominate the global shoe industry by establishing a solid presence in China and many other countries.

No. 2. Adidas (ADDYY)

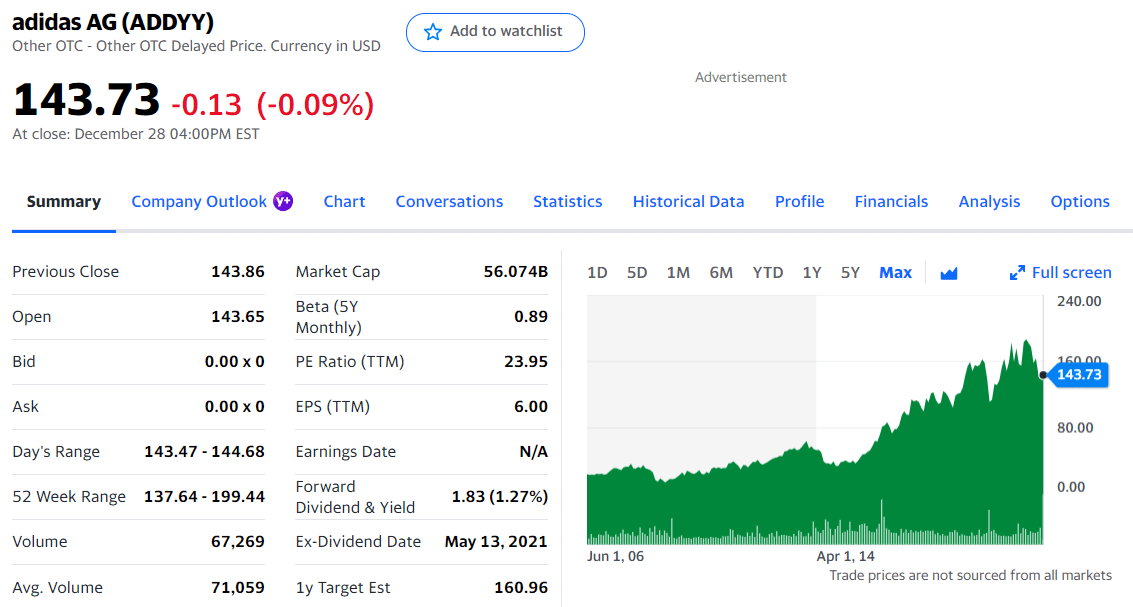

Price: $143.73

EPS: 5.95

Market capitalization: $55.863 billion

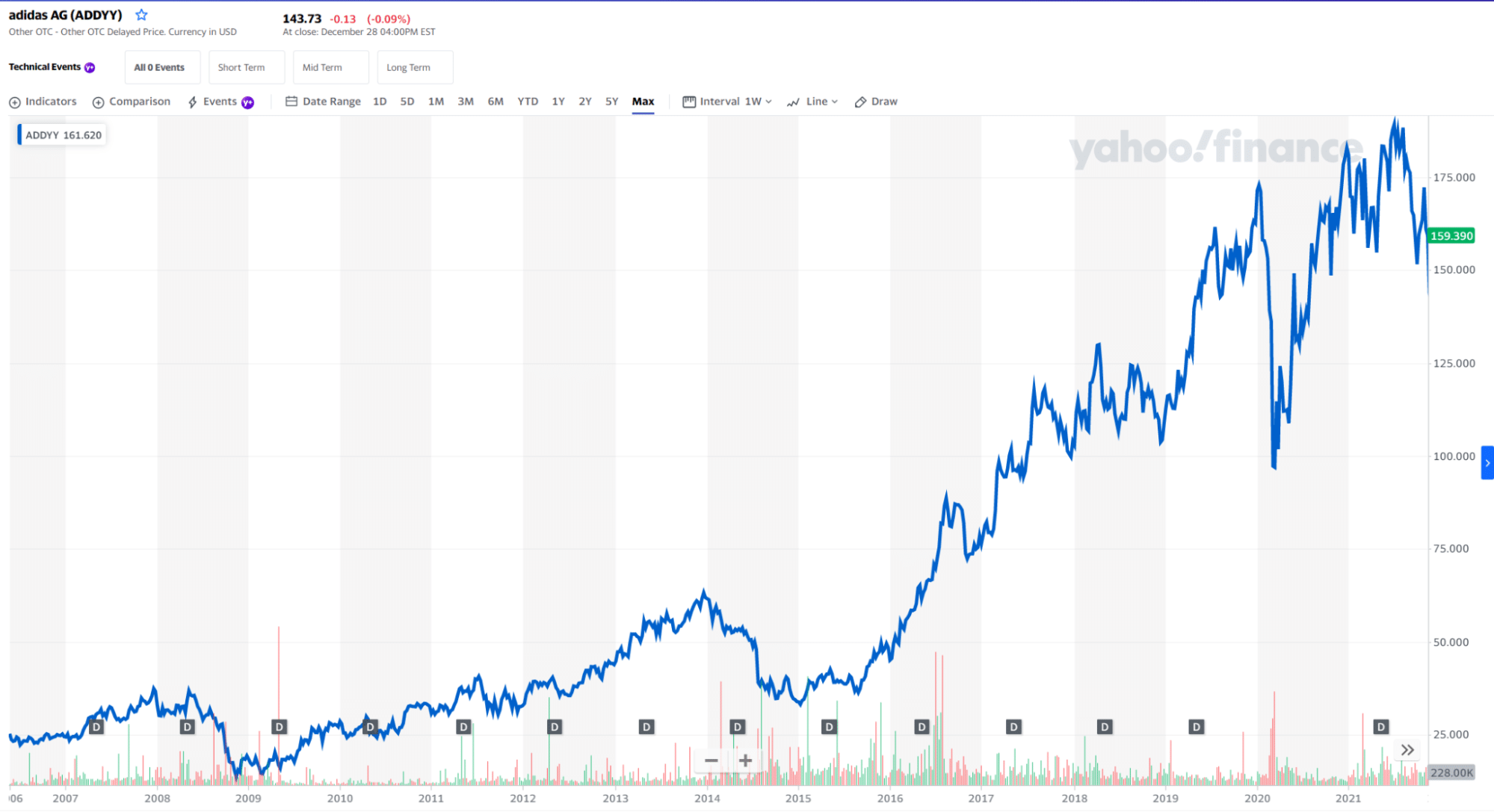

ADDYY stock price chart 2007-2021

Adidas works with its affiliates to design, produce, distribute, and market sports and athletic lifestyle products worldwide. It sells apparel, footwear, golf products, and other accessories under the Reebok and Adidas names.

Adidas stock summary

Adidas is not one of the fastest-growing stocks out there, and you cannot receive dividends as an investor. However, the company has a big future before it, although it is not growing as fast as other shoe brands. It maintains a wide array of shoe products from casual to sports to limited-edition items that an assortment of shoe lovers will love.

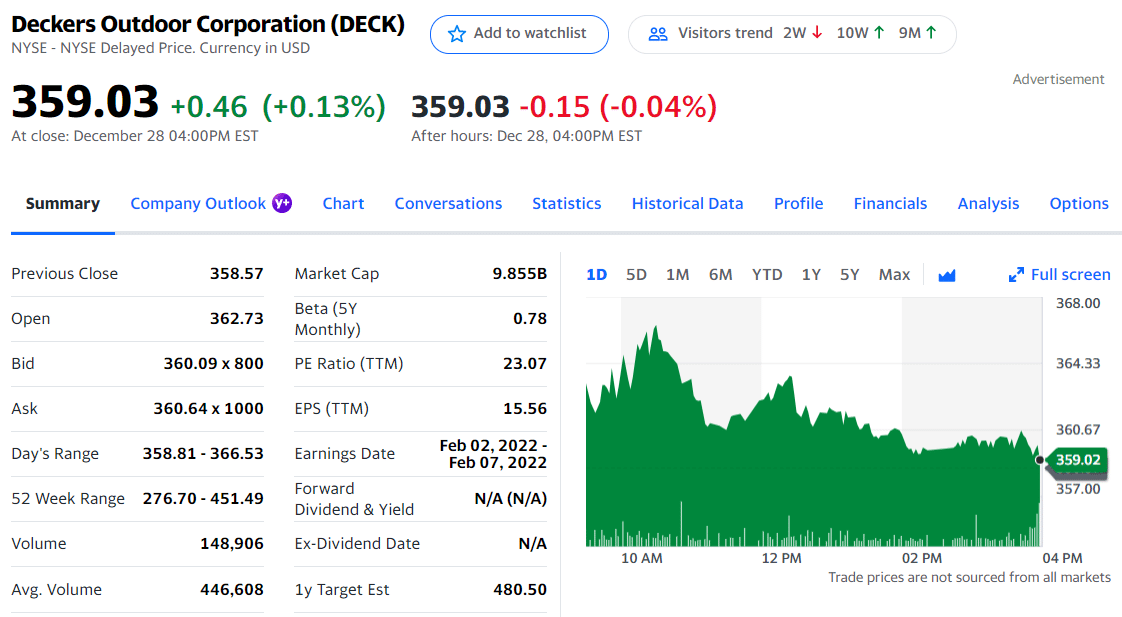

No. 3. Deckers Outdoor (DECK)

Price: $359.03

EPS: 15.56

Market capitalization: $9.774 billion

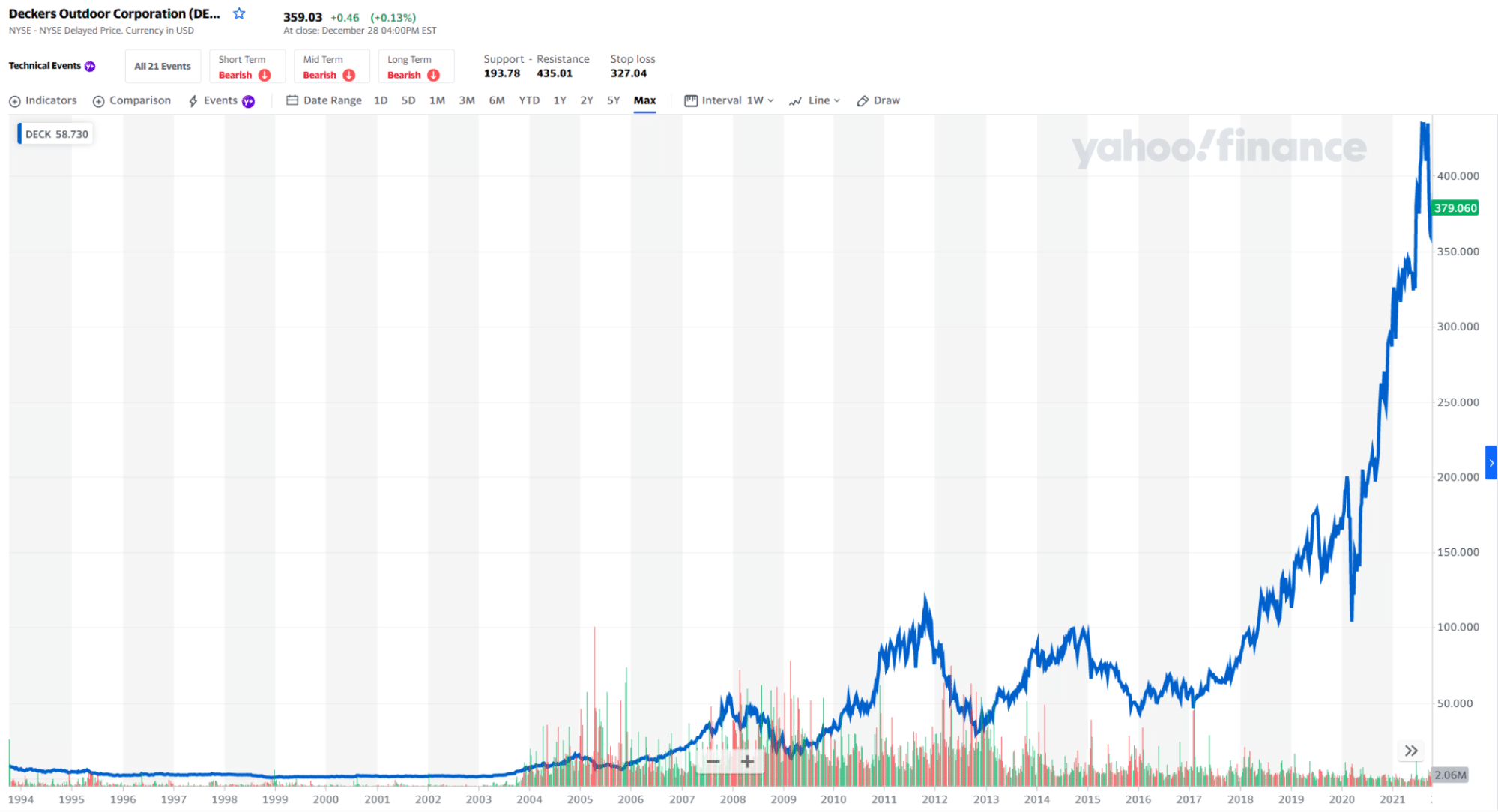

DECK stock price chart 1994-2021

Deckers works alongside its daughter companies to model, produce, distribute, and market apparel, footwear, and accessories needed for high-intensity activities and everyday lifestyle use. It markets boots, shoes, and sandals through the Teva brand; apparel, footwear, and accessories through the UGG brand; and casual sandals and shoes through the Sanuk brand.

Deckers stock summary

Deckers experienced some growth over the past decade of operation. Because of its outdoor and casual footwear products, Deckers managed to score a huge sales volume during the pandemic. At this time, the market demand for hiking and running gear, boots, and sandals has dramatically increased. We cannot say for sure if Deckers take advantage of this demand. However, the company is already among the best-performing growth stocks in the footwear industry at present.

Final thoughts

The shoe sector, in general, is not a growth industry. Because shoes are valuable collectible items, any new company can name the industry by finding a unique niche that will appeal to customers. However, some brands have lingering charm and show potential as stable investments.

No matter how you end up choosing the shoe stocks to include in your portfolio, be sure to select those with the potential for long-term growth. Consider what projects are in the pipeline for the shoe stocks you consider buying. Is the company looking to release a new line of sneakers shortly? Any development that improves the status of a shoe stock can affect its performance.

Comments