Paying taxes is a concern for everyone who generates income. Stock market investors are not exempt from this responsibility. Therefore, it pays to know how the IRS taxes investors. As an investor and taxpayer, you must understand the cost basis, among other concepts.

Remember that you are duty-bound to report any profits or losses from your stock investments to the IRS. If your investments are profitable, you must file your tax return on Schedule D of Form 1040. Your tax return filing should contain information about the cost basis.

Including tax planning in your investing strategy is something you must consider. You usually focus on profits and losses as an investor. However, to save money on income tax, you must give due attention to the cost basis and the average holding period of your investments.

This article will learn about cost basis and its importance, how to compute it, and what factors can impact its computation.

What is the cost basis?

Cost basis refers to the amount paid to buy an asset and extra fees such as commission and transaction cost. When you liquidate your holding, your tax due depends on the original price of buying the asset (i.e., cost basis) and the selling price. If the selling price is higher than the purchase price, the transaction is profitable. The difference is your profit, which is taxable. See the definition of capital gains in the image below.

Two factors affect how much you end up paying for taxes related to capital gain. These factors are the holding period and your tax category. This transaction is deemed a long-term investment if you buy and hold an asset beyond one year and then sell it.

As such, you will pay lower tax rates than normal income does. Meanwhile, if you hold the asset in less than a year, it becomes a short-term investment, and you will pay tax rates at the same level as regular income tax.

Capital gains definition

What is the importance of cost basis?

Monitoring the cost basis is essential for a number of reasons. You should keep this figure every time you make transactions for the following purposes:

- Get an estimate of your short-term investment tax rate. Keep in mind that investments held for a short duration are subject to high tax rates approaching the level of regular income.

- Get a ballpark figure of your long-term investment tax rate. Holding investments longer than one year before liquidation is subject to tax rates lower than that for regular income. In this case, your tax rate will depend on the level of income.

- Tracking the cost basis allows you to monitor the performance of your investments. Through this process, you will determine if your strategies make you money or not over time. This way, you can adjust your approach if you are losing or finetune your technique to generate more income.

How to compute the cost basis?

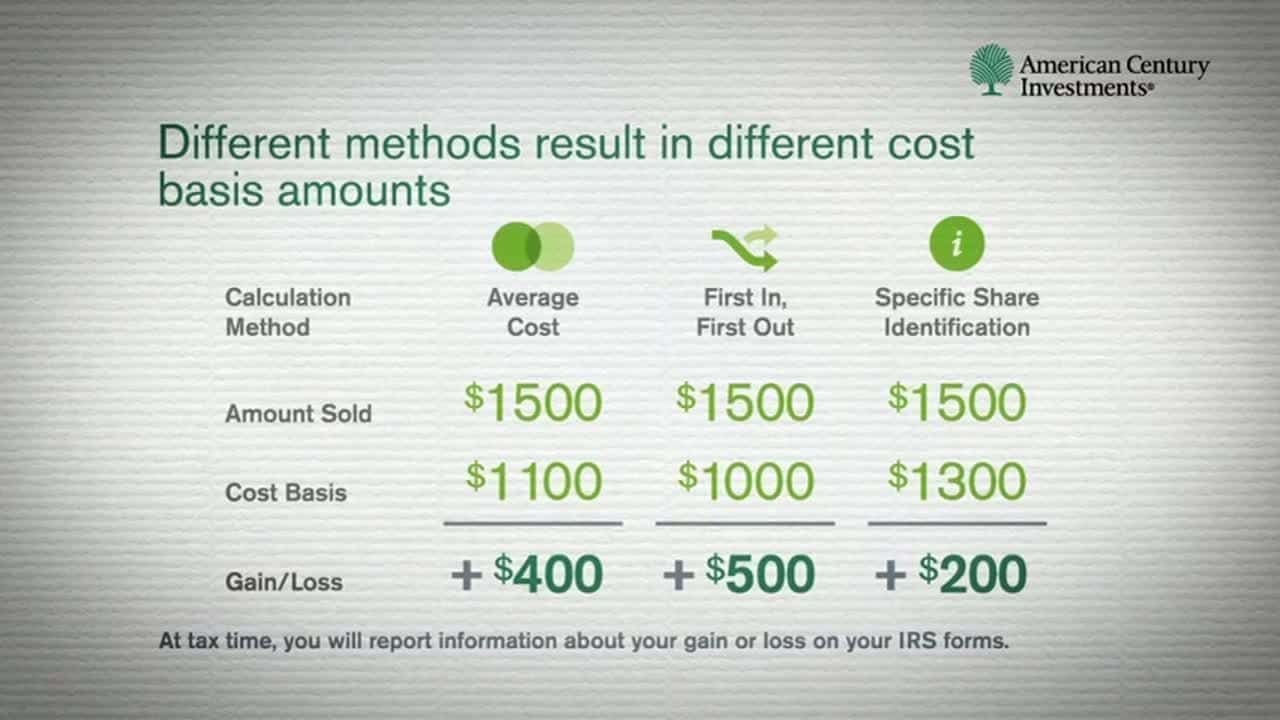

There are two common ways to calculate cost basis. These are the average cost technique and FIFO technique. The image below shows three techniques, but the last technique is not fairly common.

Average cost technique

As the name of the technique suggests, you must determine the overall cost of the stocks at the time of purchase and divide it by the total number of shares. Let us assume you buy fractional shares of three stocks at $3, $4, and $5. With the average cost technique, sum up the purchase prices of the shares ($12), divide it by three, and then you will get $4. The cost basis is then $4.

FIFO technique

The IRS generally uses the FIFO technique when computing for taxes related to capital gains. Let us say you buy 300 shares of stock ABC for $30 per share in January. Then you buy 60 more shares in March for $20 per share. What is the cost basis when you sell 330 shares out of the total 360? Using the FIFO technique, the cost basis is (300 x $30) + (30 x $20) = $9,600.

Cost basis calculations

Which calculation technique is better?

We cannot say one cost basis calculation technique is better than the other because each one has its own upsides and downsides. You have the freedom to choose which method to use when computing the cost basis. When you do this, think about your financial condition and goal.

If your holdings are fairly limited and you think closely monitoring when you buy which stock and when is not critical, you can use the average cost technique. On the other hand, if your holdings are substantial and you are managing multiple stock investments, the FIFO technique might make sense for you.

Factors affecting cost basis

There are several factors that can impact the cost basis of your holdings. We list down three factors below.

Manner of acquiring the investment

If you purchase your securities yourself, the cost basis is simply the overall cost of the investment at the time of purchase. If someone gives you an asset, the same cost basis as that of the original owner applies. If you receive an investment as an inheritance, the market value of the asset at the time of passing of the original owner will be the cost basis.

Stock split

A stock split happens when the board of directors of a company decides to increase the total number of shares. The decision to split the stock is entirely at the discretion of the company. For instance, if the company wants to double the number of existing shares, the new price of each share is half the original share price prior to the split.

Capital improvements

When the company makes an improvement to the stock, resulting in the appreciation of the sale price, it is known as capital improvement. As an analogy, you can boost the value of your house by adding a swimming pool or doing repainting.

Final thoughts

Tracking the cost basis allows you to stay on top of your tax obligations related to capital gain. This will help you save money on taxes when you liquidate investments. Therefore, keeping a record of the cost of investments, the number of shares, and the date of purchase is important. It is a good idea to cover tax planning in your investing strategy to realize tax advantages over the long haul.

Comments