For short-term investors, volatility is a factor they look into when investing in the stock market. Such traders know that volatility varies by the hour of the day or day of the week. If you have been trading stocks for a while, you are likely familiar with the power hour phenomenon.

Intensive trading in the stock market occurs during power hours. Typically, investors consider each trading day’s opening and closing hours as power hours. However, since volatility is not consistent throughout the trading week, power hours may cover the two most volatile trading days each week. These days are Monday and Friday.

While profits may come quickly during active market hours, the risk of losing big is equally possible. Knowing when the power hours occur is insufficient to succeed at stock investing. It would help if you found a way to put this knowledge to use.

In this post, let us closely examine the power hours, understand how to invest in power hour stocks, and learn some of the power hour stocks you can buy.

What are power hour stocks?

They are those stocks that tend to make large movements compared to other stocks during specific times of the day. There is no official documentation specifying when the power hours occur, so investors use a rule of thumb.

Below is the generally accepted schedule of power hours:

- Morning power hour (between 2:00 PM and 3:30 PM GMT)

This is the time when the US stock market begins trading. In this period, investors hurry to catch up on overnight and morning news and decide what to do with their trades from the previous day. For this reason, you often see an increase in trading activity during this hour.

- Afternoon power hour (between 8:00 PM and 9:00 PM GMT)

This time coincides with the last hour of the trading day. Volatility peaks during this time as day traders finalize trading transactions and liquidate open positions. Most investors regard this hour as the legit power hour.

As already pointed out, investors also think of Monday and Friday as power hours, or shall we say power days. The logic is similar to the morning and afternoon power hours just discussed. Monday is the beginning of the trading week, while Friday is the end of the trading week. During these days, the stock market tends to see active trading.

Power hour schedule

How to buy power hour stocks?

Before you buy power hour stocks, there are some things you must consider. Below are two metrics you must look into.

P/E ratio

The P/E ratio is a valuable stock metric that helps investors make sound investment decisions. With this metric, you can estimate whether a stock is overvalued or undervalued. Generally, a value of 25 and above suggests a company whose stock is priced higher than its actual book value. This stock often behaves erratically during the power hour sessions.

FOMC announcement

Be aware that FOMC can have a significant impact on the stock market. For example, an FOMC announcement of a drop in employment or a shift in the FOMC rate may shake the stock market. During the power hours, such announcements have the most excellent effect as traders rush to adapt to the new market condition.

Top three best power hour stocks

Below are three stocks you can add to your stock list when trading during the power hours.

No. 1. Tesla (TSLA)

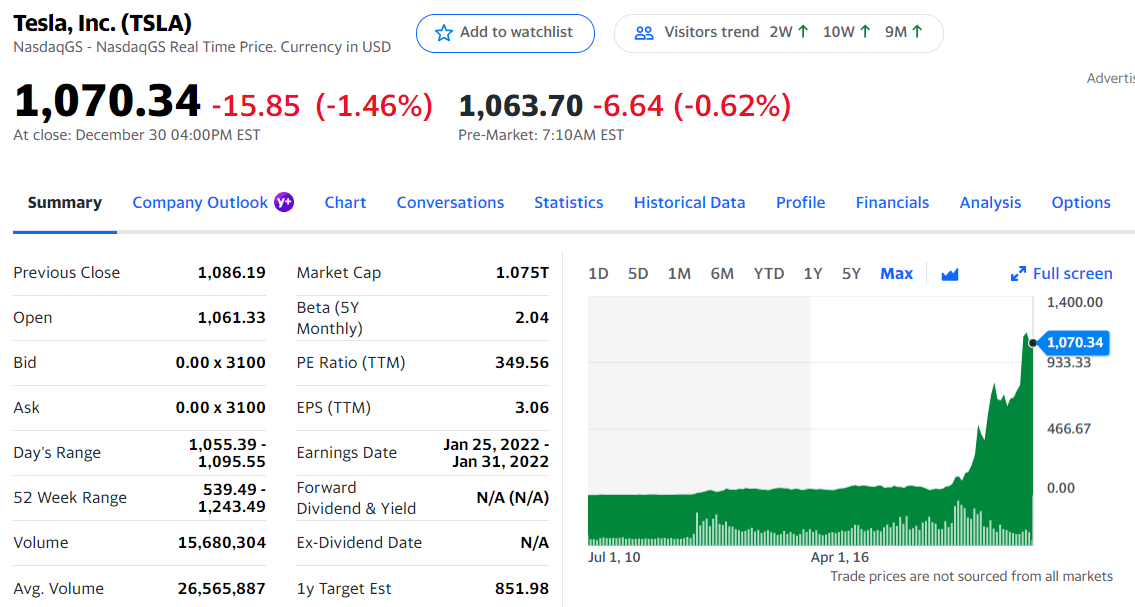

Price: $1,070

EPS: 3.06

Market capitalization: $912.119 billion

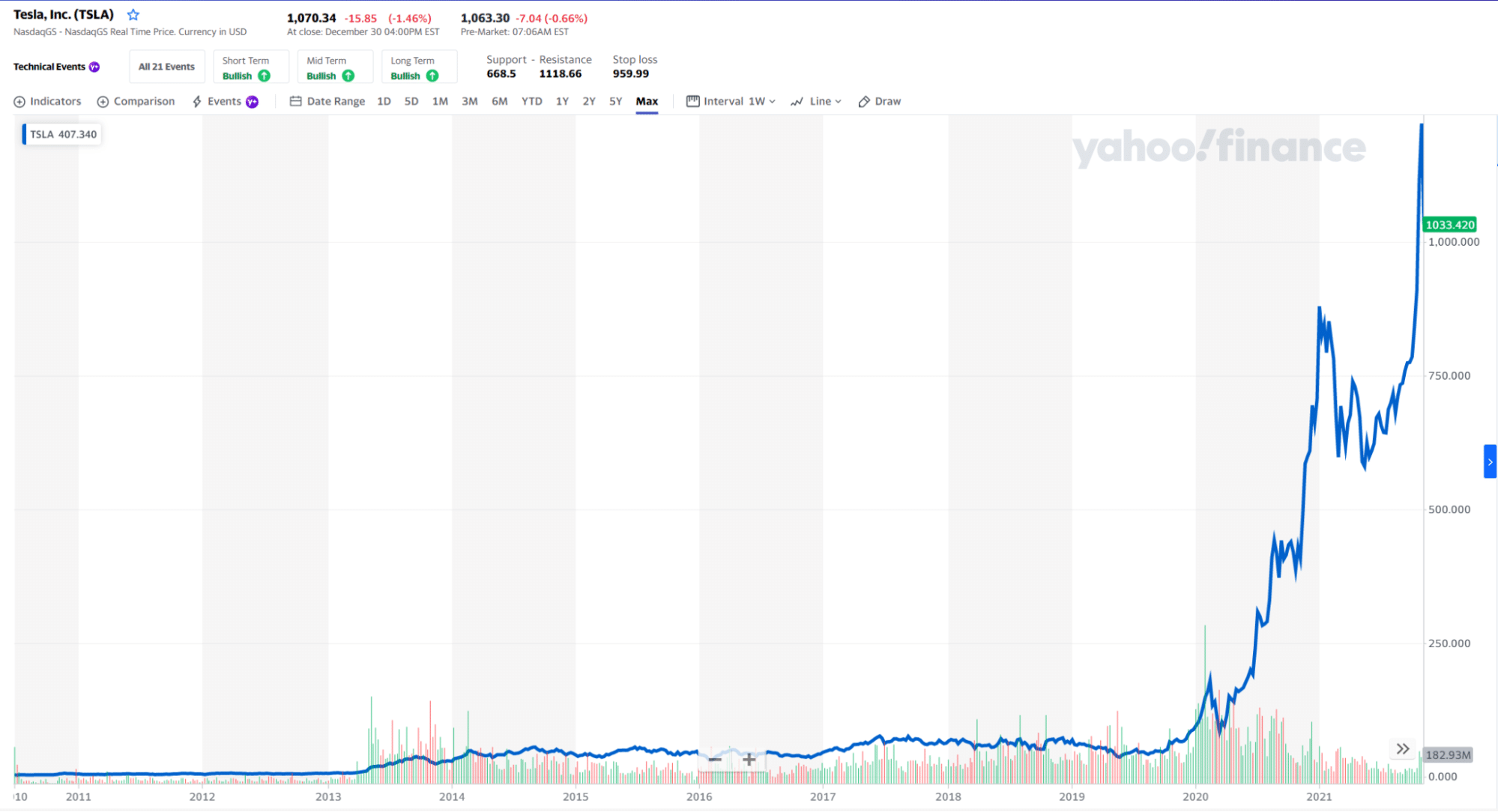

TSLA stock price chart 2011-2021

Tesla is the biggest car manufacturer globally in terms of market value. Its business revolves around designing, building, and marketing electric cars, energy storage systems, and power generation systems. Some of the products manufactured and sold by the company are sports vehicles and sedans. Some services provided by Tesla include charging stations, body shops, and car servicing.

Tesla stock summary

Tesla is headed by business magnate Elon Musk, a popular public figure due to his activity in social media. The company is a strong player in the automotive industry. By the end of 2020, Tesla generated $31.5 billion in total earnings, out of which it netted $862 million. As of October 2021, the size of Tesla in terms of market cap is equivalent to the combined value of five automakers behind it.

No. 2. Pinterest (PINS)

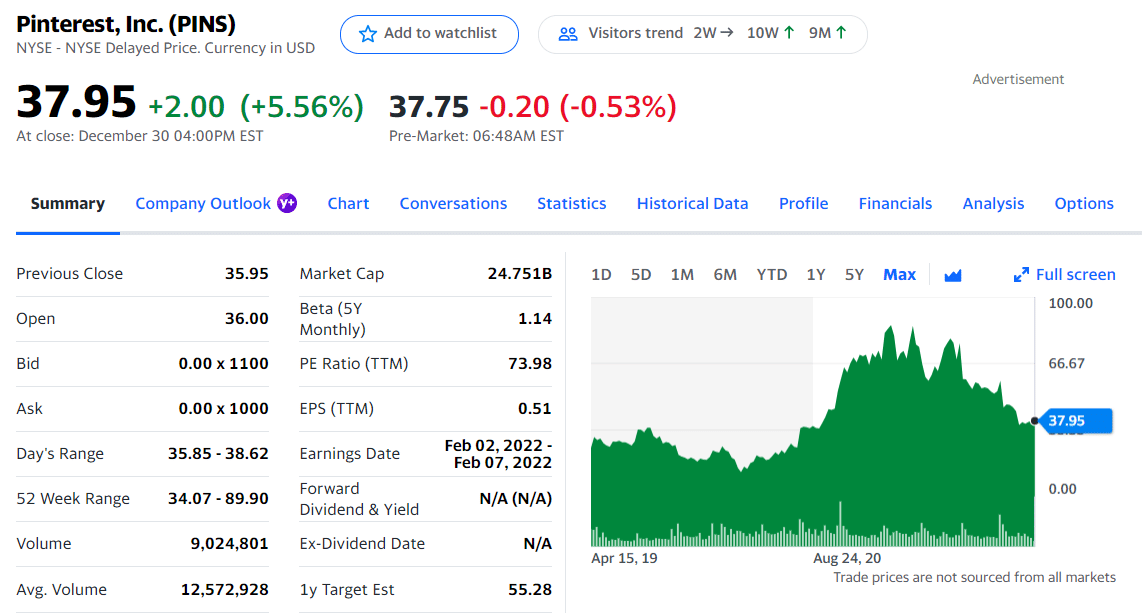

Price: $37.95

EPS: 0.51

Market capitalization: $23.523 billion

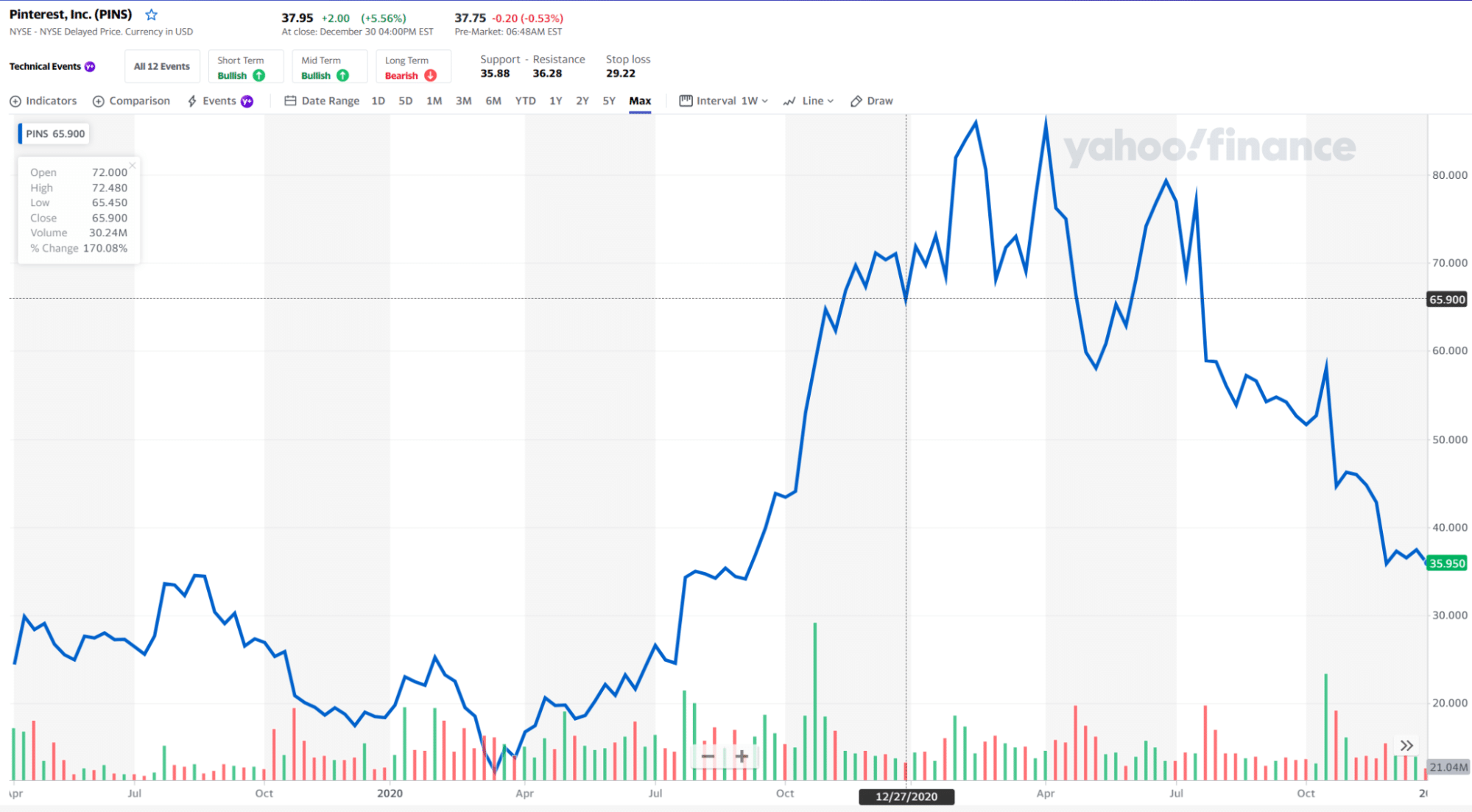

PINS stock price chart 2020-2021

Pinterest came into existence in 2010 and became a publicly-traded company on 18 April 2019. At the IPO stage, the stock traded at $19 per share, allowing the company to generate $1.4 billion in the capital. By 3 December 2021, Pinterest reached $23.3 billion of market capitalization.

Pinterest stock summary

Pinterest experienced success during the pandemic, with its share price and popularity spiking. However, the new normal that follows is not on its side. The stock hit its yearly low of $43.30 in the middle of December 2021, and its price is now sitting around a level 50% below its February 2021 all-time high.

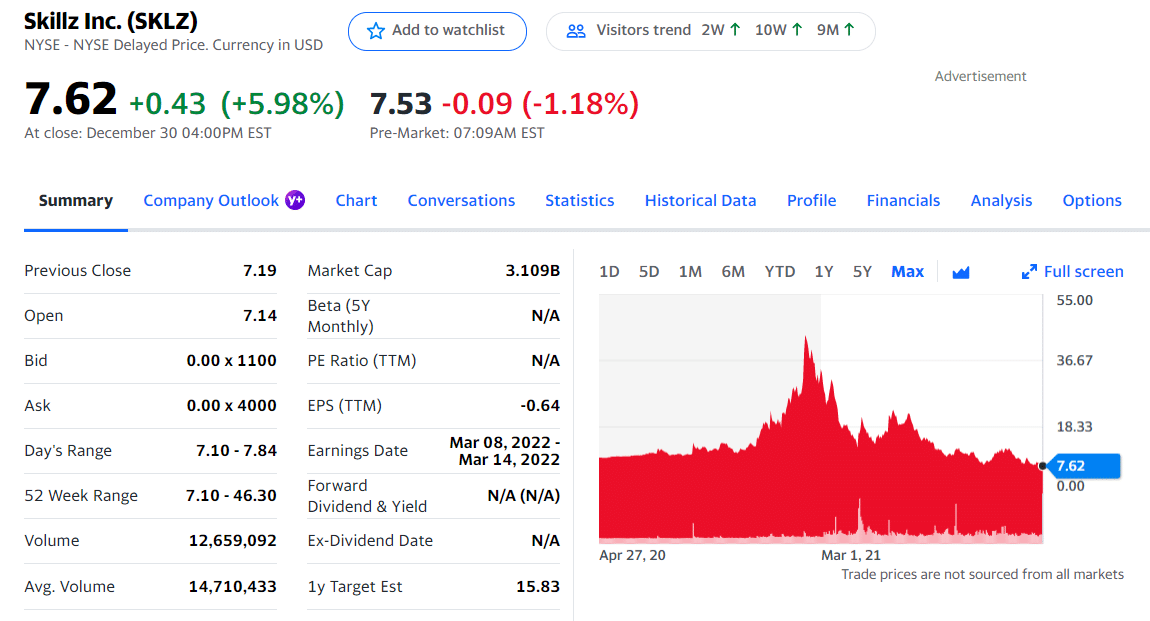

No. 3. Skillz (SKLZ)

Price: $7.62

EPS: -0.64

Market capitalization: 3.464 billion

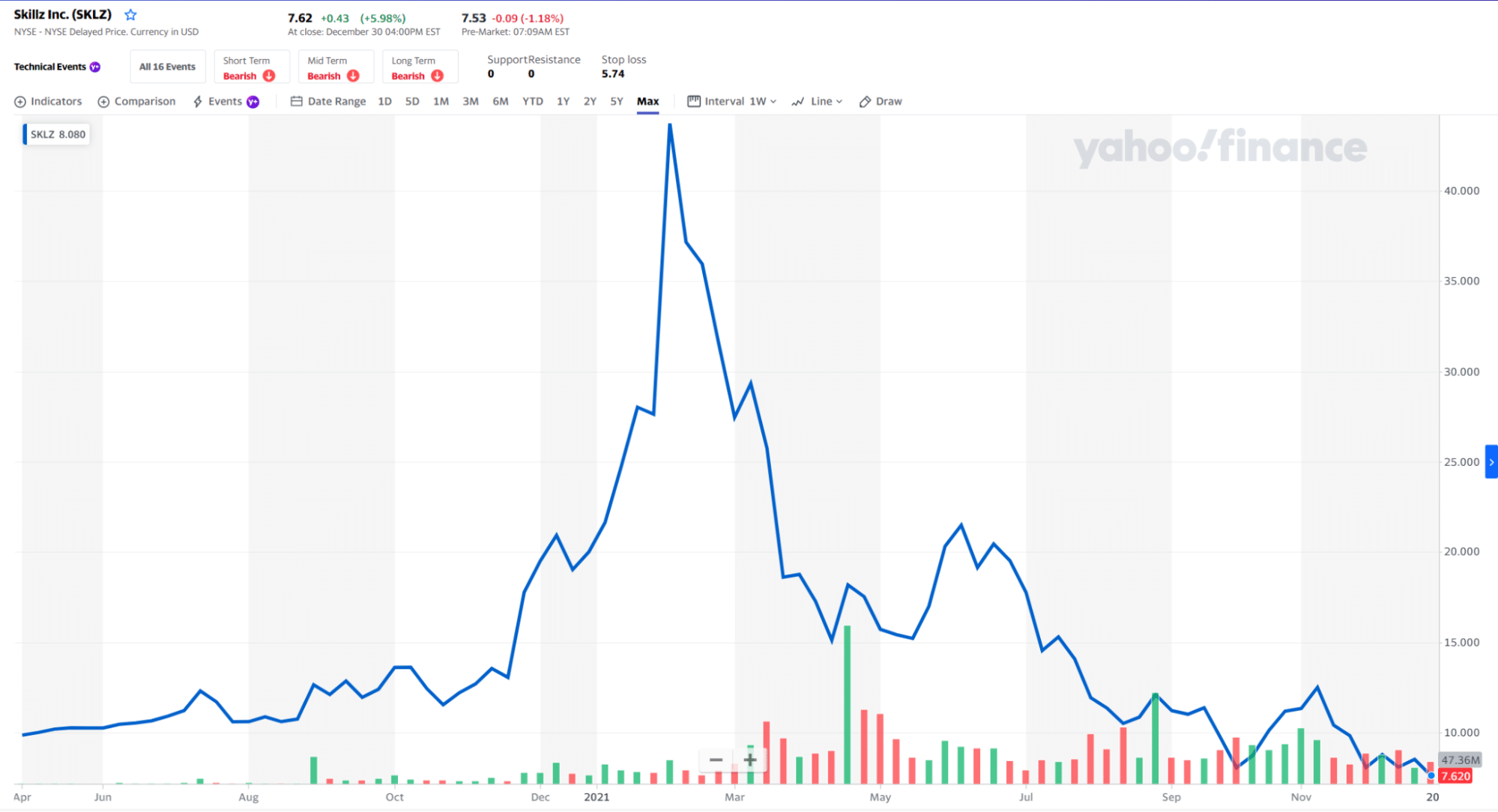

SKLZ stock price chart 2020-2021

Skillz is a platform that supports competitions among gamers playing video games online through mobile. This platform has been integrated into various Android and iPhone games. The company was established in 2012 in Boston, but now its headquarters are located in San Francisco.

Skillz stock summary

At the time of writing, Skillz has been trading below $10 per share after the middle of October 2021. The company was traded under a special purpose acquisition company back in March 2020. As such, it is normal for the stock to have a share price a little above or below its IPO price until it undergoes a merger. If you believe this stock has a good future ahead of it, today may be the best time to buy it.

Final thoughts

If you are busy and have limited time to trade the stock market, trading at specific times of the day or week may make sense to you. Trading during the power hour sessions can help you make quick profits as the market tends to make sizable moves.

However, trading during power hour times and power hour stocks is not without risks. Make sure you have a trading plan in place before you trade power hour stocks. You can either use scalping, day trading, or swing trading. What is important is that you have a plan to exit winning and losing positions without subjecting your account to large drawdowns.

Comments