Income tax in the US began when the Civil War erupted in the 1860s. Concurrent with the introduction of income tax was forming a governmental body that oversaw the collection of taxes. Today, this body is known as the Internal Revenue Service (IRS). However, the law’s enactment concerning federal income tax was not until 1913, but corporate income taxation commenced four years earlier, in 1909.

Let’s learn about some basics of income taxes. Whatever amount of income you make or whatever the economic situation may be, taxes are certain. You have to live with them and understand how they affect your financial life.

What is income tax?

Governments charge one form of tax on income made by corporations and citizens operating and residing within their territory. As the law requires, you must file an income tax return each year with the tax-collecting body in your country to determine your tax dues.

Why are governments imposing and collecting taxes in the first place?

Governments need funds to implement projects and provide services that will benefit the citizenry. Most of these funds come from income taxes. For instance, the federal government generates about 50 percent of its budget from individual income taxes.

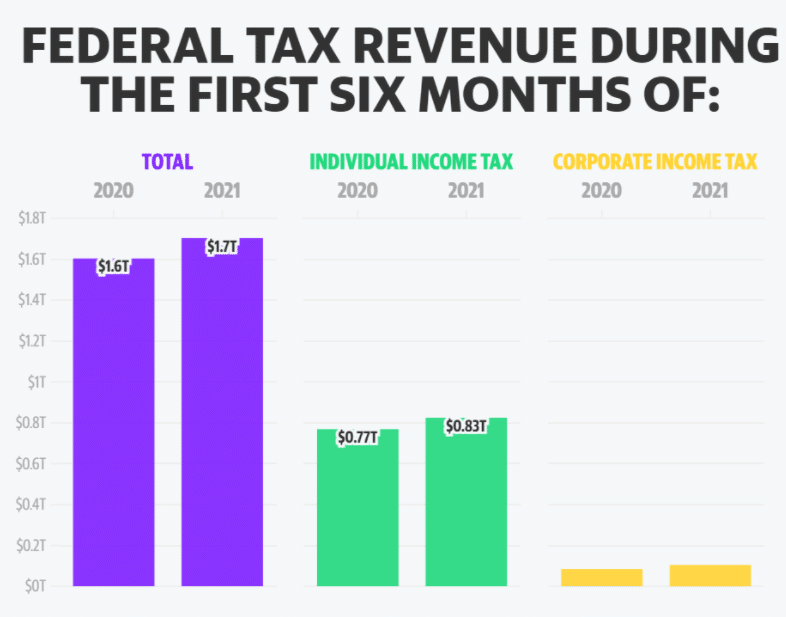

The figure below shows the sizable difference between the budget generated by the government from individual income taxes compared to corporate income taxes.

How does income tax work?

Several countries use a method of taxation known as a progressive system when levying income taxes. This means that individuals and corporations with higher income must pay higher tax percentages than those with lower income. In the United States, the government agency that collects taxes is the IRS. Also, it is this agency that enforces federal tax laws across the different states.

Be aware that the rules and regulations governing tax rates, taxable income, credits, deductions, etc., can be very complex as the IRS uses them. This agency also handles taxes on various types of income, including salary, wage, investment, commission, and business revenue.

Types of income tax

There are three types of income taxes being levied by the federal government. That is what we are going to discuss in this section.

Individual income tax

It is the same as personal income tax. For this category, the tax that you pay may come from several sources, such as salary, wage, and others. Whatever the source, you must give the government its due in terms of personal income tax. However, it is possible that the tax amount you pay is not a certain percentage of your total income. This is because there are credits, deductions, and exemptions you can take advantage of.

The IRS gives taxpayers a chance to lessen taxes applied on personal income by providing a set of credits and deductions. As the name suggests, a deduction may pull down the income amount used for tax calculation and the tax percentage applied. Meanwhile, a tax credit has the same effect of lowering your income tax but is accomplished differently.

At the end of the year, the IRS will check if the withheld amount from your paycheck is more significant or lower than the tax you should pay. If more money has been withheld than necessary, you will get a tax refund. If less money has been deducted from your paycheck, you will pay the difference. The second case may occur but very rarely.

Here are some expenses wherein you can avail tax deductions:

- Investments

- Healthcare costs

- Education costs

For instance, if you earn $150,000 and qualify for a deduction of $30,000, your taxable income will lower down to $120,000.

The IRS offers a tax credit to help taxpayers settle their tax obligations. The agency creates tax credits for the benefit of households within the low-income and middle-income brackets. For instance, if your tax obligation is $25,000, but you qualify for a tax credit of $5,000, then your new tax obligation will go down to $20,000.

Business income tax

The IRS also imposes taxes on income generated by businesses, such as partnerships, corporations, startups, and contractors. Depending on the business structure, someone will report the gross income of the business to the IRS, such as the owners, management, or shareholders, noting down the business’ capital and overhead costs. The taxable income is left after you deduct the capital and overhead costs from the gross income.

State and local income tax

In addition to the income taxes imposed by the federal government within its jurisdiction, most states also charge individual income taxes. However, eight states do not levy individual income taxes for their residents.

Just because a state does not impose income taxes does not mean living in that state is cheaper than another that levies such tax. States that do not mandate income taxes may provide reduced services or apply other types of taxes. The cost of living in a state considers several factors, such as the cost of healthcare, availability of job opportunities, and others.

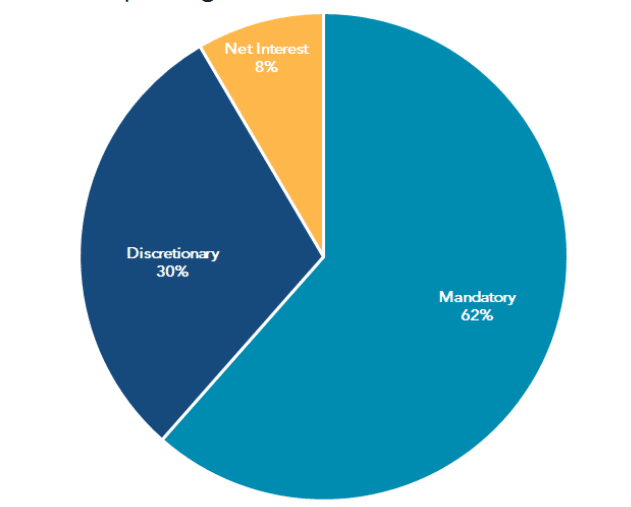

How the government spends income tax

Mandatory

This type of spending is deemed mandatory because the underlying programs are perpetual, and the federal government cannot adjust the amount to spend on each program to its liking. Here are some of the mandatory expenses:

- Social security

- Income security programs

- Veterans program

- Medicare

- Medicaid

- Federal civilian and military retirement

Discretionary

Discretionary spending refers to the expenses that are determined and budgeted yearly. This type of budget has two main categories:

- Defense

- Nondefense

Defense includes the Department of Defense, State Department, and Homeland Security. Nondefense covers education, veterans assistance, housing, and urban development.

Debt interest payment

In 2021, the US government will devote $300 billion to pay for interest incurred on the national debt. This amount is close to nine percent of the total revenue collected from last year. Judging by this allocation, you can say that the government is spending more budget on debt payment than on technology, science, education, and transportation combined.

Final thoughts

Now you have the basics of what constitutes this type of taxes. If you are a student studying taxation, we hope this short post has given you a good introduction. If you own a business or work for another person, you must learn about income taxes to help yourself or your business.

Comments