SIEA Zen works by opening a set of trades and closes them out respectively or at the end of each month. It uses a risk management system to control the drawdown on the account. Our article will detail all the information about the algorithm and provide a verdict if you should invest in it or not.

The robot was first published on the MQL 5 marketplace on June 7, 2021, which means that the system has been online for a short duration. Myfxbook records have also started tracking recently. The developers made many claims about their company and the system’s profitability, which came to our attention, and we decided to review the product.

What is behind the SIEA Zen?

Valerii Gabitov is the author of the product who resides in Russia. He has a total rating of 4.8 for 415 reviews. The developer has 15 products published on the MQL 5 marketplace and has 102 subscribers for his services. He has experience of more than seven-year in the financial industry. There is no other information on him on the website.

How it works

The robot can be downloaded directly on your MetaTrader platform after purchasing through the MQL 5 marketplace. After that, place the algorithm on the respective chart and enable the auto-trading button.

Key features

The robot has the following key features with their services:

- It comes with a built-in news filter to avoid trading in volatile conditions

- It uses a risk management system to maintain a low drawdown

- It has a swap management system that avoids trades that will cause overnight fees

- It requires a minimum account balance of 2500 euros to work

Trading strategy

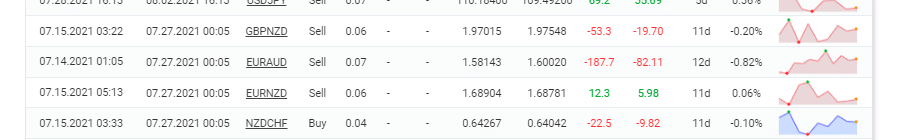

It is quite sad to note that there is no information on the algorithm’s strategy. We use the history on Myfxbook to determine the game plan. From there, we observe that the robot uses a correlation strategy between multiple currencies as many trades from different instruments are closed simultaneously. There is no stop loss attached to positions in most instances.

Trading history on Myfxbook

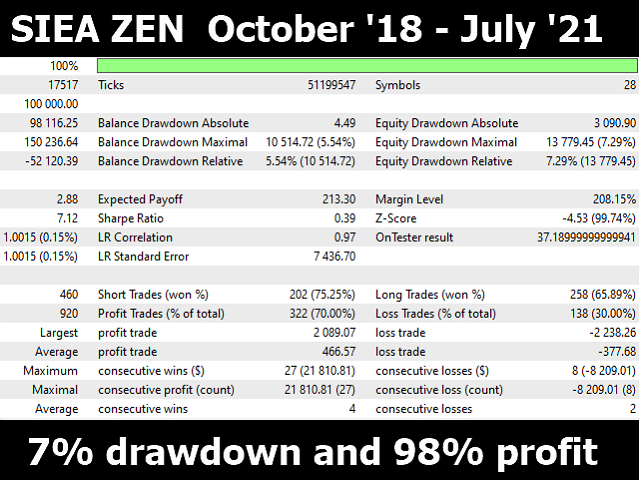

Backtesting results are available for unknown currency pairs and duration. For the instrument, the robot had a relative drawdown of 7.29%. The winning rate was 70.00%, with a profit factor of about 2.88. The robot tanked an average profit of $1939651.62 during this period. There were 920 trades in total. The best trade was $2089.27, while the worst one was -$2238.26.

Backtesting on unknown currency pair

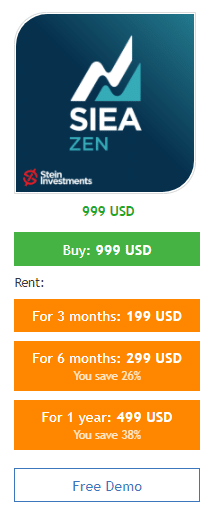

Pricing

The indicator can be bought for an asking price of $999. It is also possible to rent it 3,6, and 12 months for $199, $299, and $499, respectively. There is a 60-day money-back guarantee available.

The pricing model of the robot

Trading performance of SIEA Zen

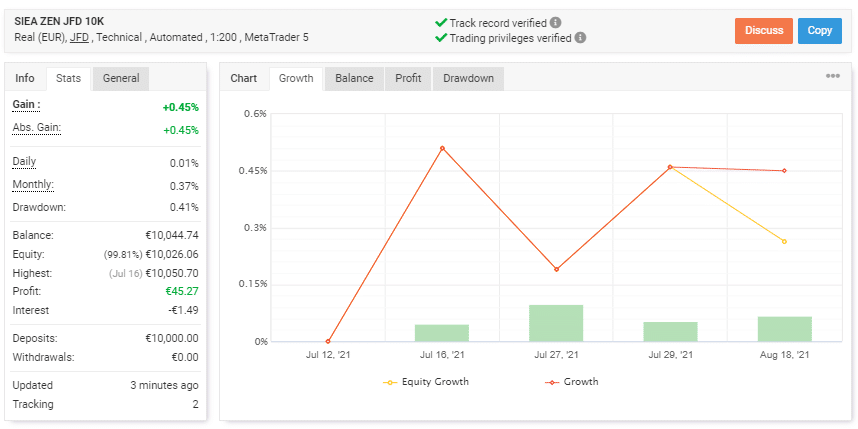

Live trading results are available on Myfxbook, which show performance from July 12, 2021, till the current date. The system made an average monthly gain of 0.37%, with a drawdown of 0.41%. The winning rate stood at 40%, with a profit factor of 2.41. The best trade was 50.87 Euros, while the worst was -21.68 Euros. There were a total of 5 trades with 0.35 lots traded. The developer made 10000 Euros in deposits and 0 Euros in withdrawals. The records are for a short duration which is not enough to verify the system output.

Live trading records on Myfxbook

Customer support

Customer support is only available by the MQL 5 community. The developer does not share his availability hours.

People feedback

There are only two customer reviews present at the MQL 5 marketplace. Traders state that the robot is currently new in the market and has to go under different conditions, after which they will be able to judge the true output.

Customer review on FPA

Comments