Budgeting is an essential survival skill that every person should get a handle on. It lets you know where your money is going every time you get your salary, make adjustments, and control your financial life. Regardless of how much you earn every month, budgeting is something you should not live without.

Contrary to what you might have supposed, budgeting does not mean sacrificing your happiness and focusing on what matters to survive day by day. It is about knowing how much money you take home and where each dime goes and finding a way to allocate funds better. This article will help you understand the budgeting process and learn a simple rule.

The budgeting process

Learning how to budget is a process you can learn and master if you do it consistently and seriously enough. To get started, you need to desire to take control of your finances and your life. Once you have the will, you can begin learning the process. Here are the steps in a typical budgeting process.

Determine your take-home pay

If you live off your day job, the amount you take home is typically lower than what is stipulated in your contract as basic pay. It’s because you are going to pay taxes, government-mandated contributions, loan deductions, and others. If this applies to you, you might think that the net amount is your take-home pay. This is not correct, though.

Your take-home pay is your basic pay fewer taxes. That is why it is called after-tax income. If you have other sources of income, subtract taxes, and you will get the take-home pay. Add up all your take-home pays, and you will come up with your overall after-tax income.

Select a budgeting method

- Japanese kakeibo

- Envelope budgeting

- Zero-based budgeting

- Sixty percent method, etc.

Any budgeting method divides your money into needs, wants, savings, and emergencies in varying proportions. This post will introduce you to the 50-30-20 budgeting rule.

Monitor your progress

Find a way to monitor your spending habits. You can use a notebook, a spreadsheet, or even a mobile application to easily check if your spending is on track with your budget.

Automate savings and expenses

To follow your budget plan, find a way to automate your savings and expenses. For example, if you are using online or mobile banking, you can automatically set up your account to pay specific bills when certain dates come. You may also arrange with your payroll system to auto-deduct exact amounts for savings or investments.

Adjust your budget as necessary

Change is part of life. Over time, your priorities and income may change, so do your expenses. When change happens, tweak your budget as necessary, but stick to the new budget.

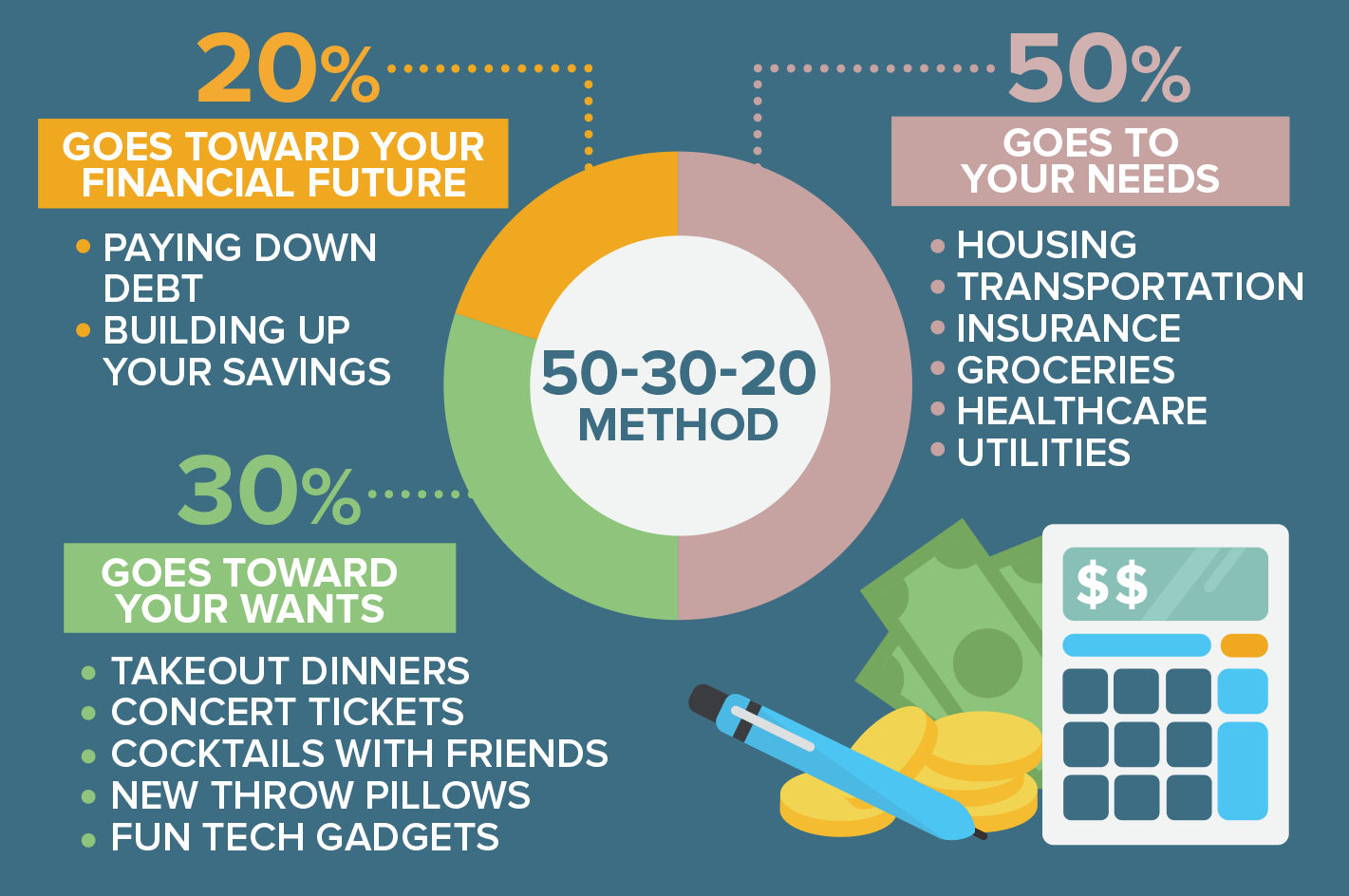

The 50-30-20 budgeting rule

This rule is the most popular budgeting method these days. More and more people see it’s worth as a budgeting strategy as it allows them to enjoy their lives while following a budget. With this method, you will allocate your after-tax income in the following percentages:

- 50 percent on needs

- 30 percent on wants

- 20 percent on savings and debt payments

Take note that this rule puts your wants at 30 percent. This allocation is high enough to allow you to enjoy yourself a little each month. As long as you stay on budget, you can indulge your passion or cravings for something you love.

№ 1. Allocate 50% on needs

Allocate 50 percent of your take-home pay to your needs, such as:

- Food and grocery

- Transportation

- Insurance

- Utility bills

- Minimum debt payment

If you pay more than your minimum debt, you should put the additional payment to the 20% category. What if you exhaust your 50% allocation and you still have to satisfy a need?

In this case, you have no choice but to take out money from the wants category. However, this should be an exception rather than a rule. If your expenses in the needs category are less than maximum, consider adjusting your budget to other items in your needs. Maybe you want to upgrade to a better smartphone plan.

№ 2. Allocate 30% on wants

Distinguishing between wants and needs can be an arduous task if you have tried doing so. The simplest way to define a need is that it is something you need to live. Wants include subscriptions to your favorite cable channels, buying coffee at Starbucks, or traveling to incredible destinations. Meanwhile, you can live without satisfying your wishes, which are only pleasant additions to your life.

There are some expenses that you may find challenging to categorize either as a want or a need. The easiest way to decide is to understand your intention and consider other less costly options. Take gym membership, for example. To maintain your physical fitness, you can engage in active sports or jogging, biking, or brisk walking. You can also convert a space in your home into an exercise room. If there is no room for a gym subscription in your wants category, let it go for the time being.

Do not put every desire in your wants and expect to satisfy each other at one time. You might need to schedule them for another month or more. It is better to have extra cash left in your wants category that you can use for unexpected expenses in your needs category.

№ 3. Allocate 20% on savings and debt payment

Never forget about your future even if you try to enjoy life. Although you allocate only 20 percent of your after-tax income to savings and debt payment, what is essential is you are preparing for your future and looking to take back control of your life.

To prepare for your future, you must release yourself from the chains that are holding you back. We are talking here about loans or debts, especially those that carry high interests. To this end, list down all your debts and plan out how to settle those debts. Figure out how much you should pay every month and when the debts will become fully paid.

Once you have settled your debts or are on your way to a debt-free life, you are now ready to start an emergency fund. You will use this fund to survive during rainy days, such as hospitalization, helping a relative in need, getting laid off from your job, etc. Experts suggest an emergency fund equivalent to three months or six months of living expenses. To make the saving process less challenging, set an amount you can achieve. Just be consistent. What is important is that your fund grows regularly.

Final thoughts

Budgeting can be challenging, but you will get the hang of it in time. If you follow the 50-30-20 rule, you can be ensured of a balanced life. It allows you to live comfortably, enjoy life, and provide a happy future for you and your family. While there is no one-size-fits-all solution in budgeting, this budgeting method might work for you if you give it a try.

Comments