No one can fully prepare for a recession, nor can we predict it accurately. When recession hits, everyone is affected, from the wealthiest billionaires to the most impoverished communities. The high rolling investors are worried about their funds tied to a possible stock market crash. And the average working-class citizen is concerned about job security and how they will feed their family.

Although a recession can last for a relatively short term, there have been occurrences in history that lasted for a few years. Not many economies can survive this, and we must protect our money to weather the storm.

Let’s go through the list of tips to follow so that you can be in better financial shape before and during a recession.

What is a recession?

The technical defining criteria is a decline in economic growth, usually a negative GDP, for two consecutive quarters. It occurs when the economic growth rate declines rapidly, and it can last for months to a few years. Other economic indicators that contribute are declining retail sales, high unemployment, and a reduction in manufacturing.

When recession strikes, companies cannot sell goods because fewer people are buying, and they, therefore, have to cut down on labor since they cannot afford to pay salaries. This leads to high unemployment rates; consequently, it is a chain reaction of economic decline.

We know the impact of the recession, but let’s see the causes that lead up to an economic downfall.

What are the causes of recession?

-

Shock to the economy

A sudden and shocking event that arises from a problem can lead to rapid financial damage. An example is the recent Covid-19 pandemic, businesses had to close, and countries had to instate restrictions for travel. The world was in complete lockdown for several months. This type of shock caused the global economy to decline at a rapid rate.

-

High inflation

Inflation rises at a passive rate over decades, and it is not necessarily bad since the prices of goods change. And when inflation rises, the country’s currency value declines. It becomes too expensive to live in such a country. However, excessive inflation is exceptionally damaging. To balance high inflation, the reserve bank has to control inflation by increasing interest rates.

An example of this was in 1970 when the Federal Reserve had to raise interest rates drastically to control high inflation. This resulted in less spending, which depressed economic activity and caused a recession.

-

High debt

Increased debt among households and businesses is another contributing factor. Maintaining the debt becomes too costly, and defaulting on payments leads to companies having to liquidate. This type of debt has to be significant. However, it occurred during 2007 – 2009 due to the housing bubble, which led to the Great Recession.

Five bits of advice to recession-proof your budget

1. Create an emergency fund

If you haven’t already started a savings fund for emergencies, you should make provision for one. Emergency funds are there to assist you financially when your primary income source is compromised. You can use this money for daily expenses so that you can pay the more considerable debt with your salary.

The recommendation is to save six months’ worth of living expenses and to keep it in an interest-bearing account so that the money can earn some interest.

2. Create two budgets

You can create a budget for monthly expenses and an additional budget for recession only. In your recession budget, you plan for extremely critical expenses. The things that you cannot live without if a financial crisis should occur. Examples are your mortgage payments or rent, retirement savings, life and health insurance, and food.

3. Do not cash out your 401k plan

Your retirement plan should remain intact, and you should make provisions in your recession budget to continue investing. This is your nest egg, and you have to protect as much as any other investment. You might want to cash out some of the money. However, you should be aware of tax levies.

Furthermore, retirement plans are long-term, and recessions only last for short periods, after which the markets usually recover gradually. Therefore, you should avoid panicking and make mindful decisions about your retirement investments.

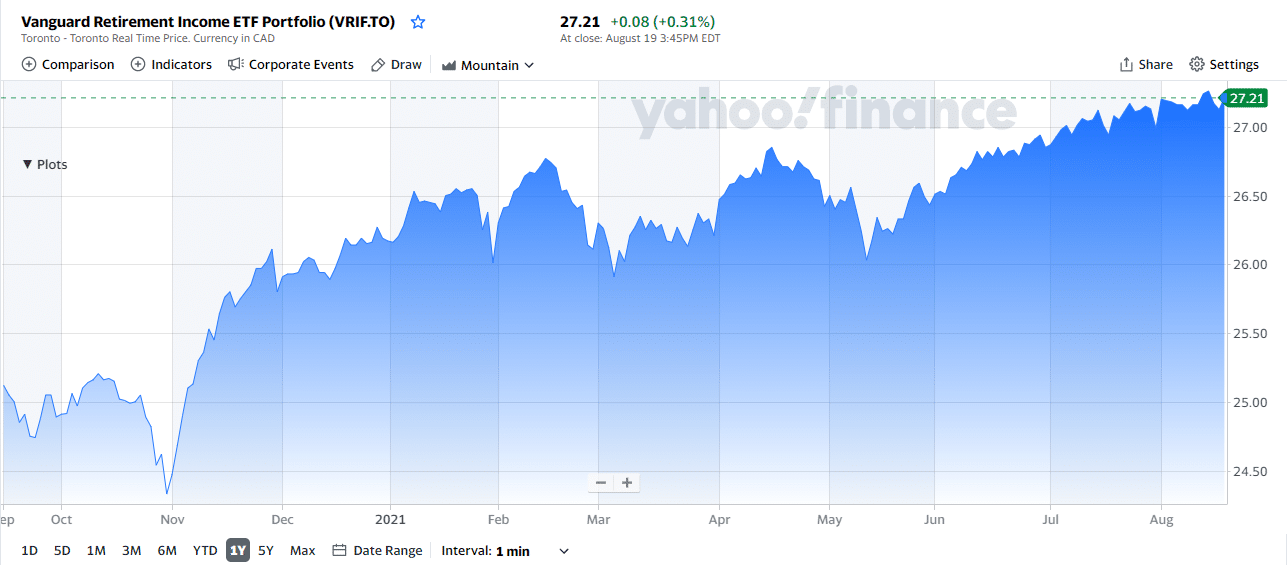

Vanguard Retirement Income ET chart

Vanguard Retirement Income ETF is a Canadian fund, which seeks to provide consistent income with the possibility of some capital appreciation by investing in equity and fixed-income securities.

4. Reduce debt

The worst situation is to have excess debt during a recession. The best move would be to cut down on existing debt like credit cards and increase your installments to save on paying interest. Another tip is not to use the available credit once you have paid it up because you will put yourself in a dark hole of unending debt payments.

Pay up credit card debt, start with the high-interest ones and close those accounts immediately. Then you can move onto the smaller debts. In addition, you should also cut down on spending on unnecessary items and stop compulsive buying.

5. Diversify your investments

If you are lucky enough to have money invested in stocks or other funds, you should also care for those funds. Since recession leads to a stock market crash, you need to protect your investments. The rule is to invest 40% of your capital in short-term bonds or cash derivatives. The remaining you can diversify in stocks or commodities to continue profiting.

BMO Short Federal Bond Index ETF chart

BMO Short Federal Bond Index ETF is an example of a short-term bond, which replicates the performance of the FTSE Canada Short Term Federal Bond Index. The fund invests in various debt securities, primarily with a term to maturity between one and five years.

Final thoughts

When we think about recession, it’s all negative and worrying thoughts that come to mind. We think of it as doomsday, and we need to prepare for the worst. However, when a recession hits, there is no time to prepare. Markets are crashing, unemployment rises, and goods become expensive. It can leave behind extreme economic destruction, and we are left to pick up the pieces.

Furthermore, not all nations can recover quickly, and they lack the funding to support their citizens financially. Large and stable economies like the US or the UK can provide relief, but some countries don’t have the resources.

Therefore, it’s essential that while the economy is thriving, we make provision for the unpredictable storm and implement these valuable tips to overcome the catastrophes that a recession brings about.

Comments