Interest in crypto mining stocks has surged since Bitcoin hit highs, putting cryptocurrencies back in the spotlight. It comes after the SEC approved the first New York Stock Exchange trading of BTC futures ETF.

Crypto miners generate income by digital mining currency using computers to solve computational problems to verify transactions. By 2026, Sector Research predicts that the global cryptocurrency mining industry will grow at a CAGR of 16.8 percent from 2016 to 2026, reaching an estimated value of $2.6 billion in revenue.

Corporations are eager to profit from this trend and have launched new brands, even addressing environmental issues typically tied to energy usage in the sector. Let’s look at three of the most popular crypto mining stocks.

What are crypto mining stocks?

Before going into the best crypto mining stocks, it’s essential to understand the relevance of crypto mining companies in the ecosystem and their business methods.

To create blocks of transactions, miners validate each transaction and merge them into a single block. Then, after encrypting the block’s transaction data, miners compete to solve a cryptographic puzzle and deliver “proof of work.”

Block rewards are set at 6.25 BTC for each block and the first miner to answer the puzzle. This process creates a chain of blocks, thus the term “blockchain.” This operation takes place around once every ten minutes on average. Higher “hash rates,” or computer capability, provide miners a better chance of completing the challenge faster and so boosting their chances to get block rewards. Those interested in making a profit by mining do so by reducing their production costs while simultaneously increasing their hash rate.

Top three crypto mining stocks to buy in 2022

Let’s look at the top three crypto mining stocks to buy in 2022.

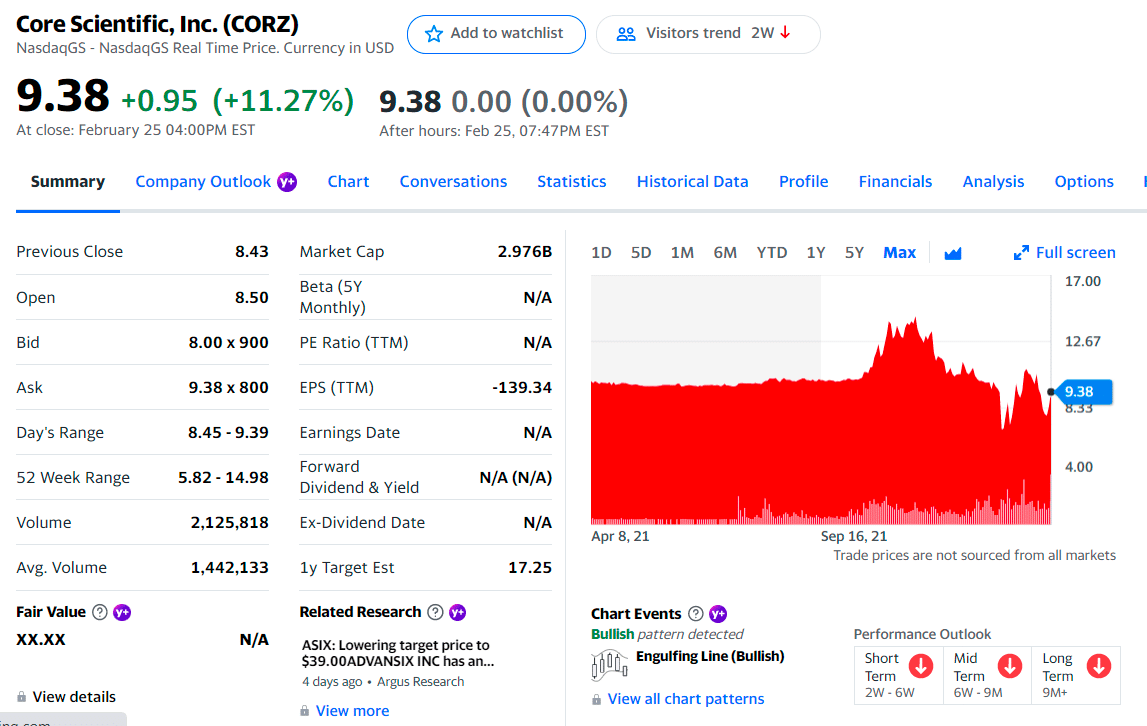

No. 1. Core Scientific (CORZ)

Price: $9.38

EPS: -139.34

Market cap: $2.621B

CORZ price chart

Using the SPAC (special-purpose acquisition company) procedure, Bitcoin miner Core Scientific started trading on Thursday and is the first new crypto stock of 2022. Blackrock, Inc., was the primary investor.

Core Scientific differentiates itself by mining its Bitcoin and providing infrastructure and technology to third-party miners. In North America, it is one of the significant Bitcoin miners with 6.6 exahashes of mining power, more than twice as much as most of its rivals.

A total of 6.9 exahashes are owned by its customers. Digital asset mining is a specialty of the company, on which it has filed more than 70 patents. A Texas site is also on the horizon, as is a presence in the U.S. states of Gwinnett, Kentucky, North Carolina, and North Dakota. In addition, it intends to keep its operations carbon-neutral by using green power and acquiring credits for that purpose.

Even though Core Scientific has yet to reveal its 2021 financial results, revenues are predicted to be $493 million, with EBITDA at $203 million. Core Scientific had a net loss of $75 million as of September of last year. EBITDA of $572 million is forecast for 2022.

CORZ summary

The top three holdings of CORZ are as follows:

- Blackrock Inc. — 9.90%

- Rubric Capital Management LP — 6.40%

- Toroso Investments — 3.71%

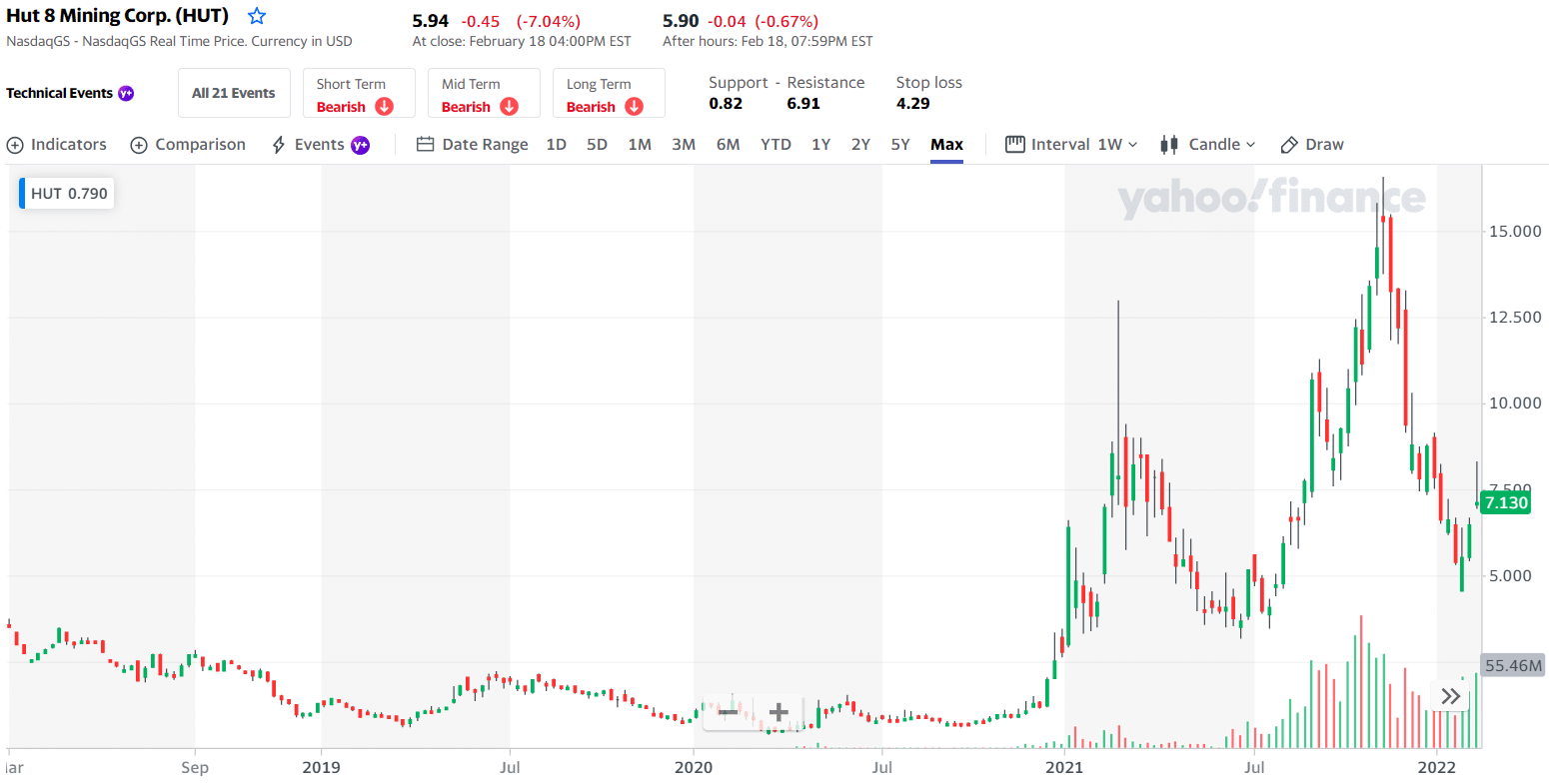

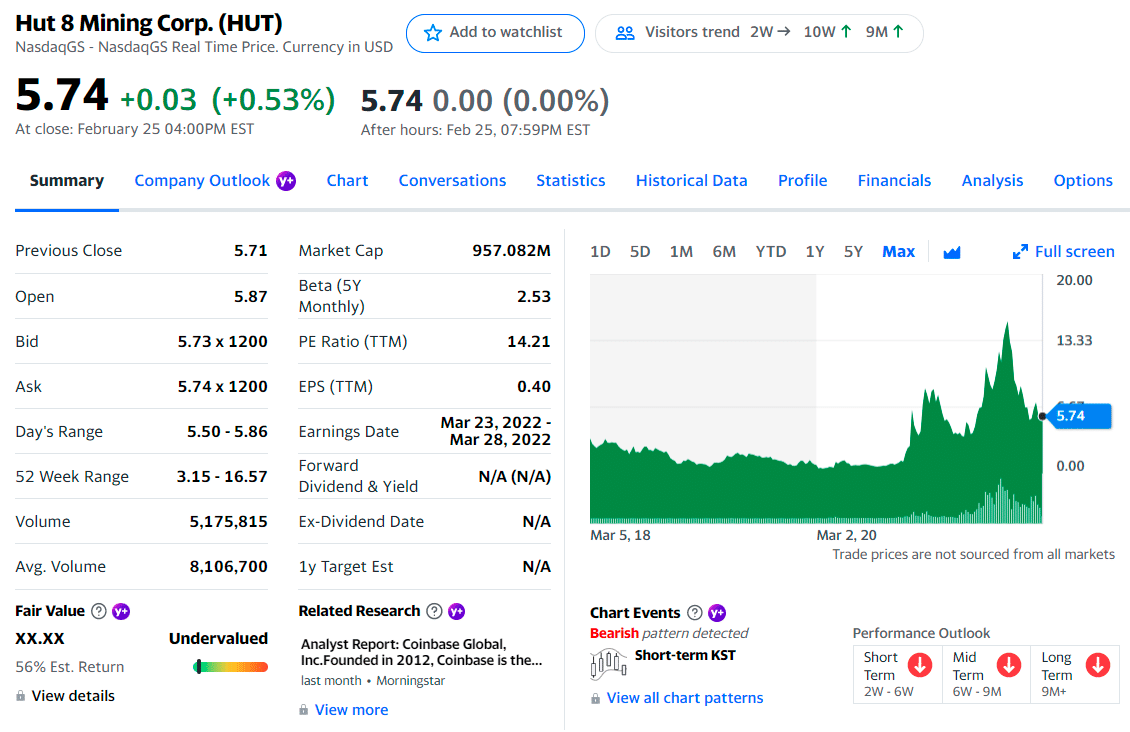

No. 2. Hut 8 Mining (HUT)

Price: $5.74

EPS: 0.40

Market cap: $994.74B

HUT price chart

Hut 8 has the most self-mined Bitcoins in North America. As a result, Hodl, as a strategy, will continue to be emphasized, and the firm is intentionally avoiding “selling Bitcoin,” according to its most recent financial report.

Hut 8’s management team is focused on accumulating and increasing the company’s BTC balance sheet. The balance sheet is the lens through which it views all its activities. The company is now worth ten times more than the BTC it has on hand. In addition, there is a target of 6.0 E/H by the middle of 2022 for Hut 8’s hash rate.

Marathon predicts that Hut 8’s hash rate will treble in the same period. In the future, both metrics will be constantly watched. Hut 8 is an excellent firm to consider if you’re optimistic about Bitcoin. However, it can become a Bitcoin platform-play in the future because of its significant BTC holdings.

HUT summary

The top three holdings of HUT are as follows:

- FMR, LLC — 4.50%

- Invesco Ltd. — 1.54%

- Citadel Advisors LLC — 1.49%

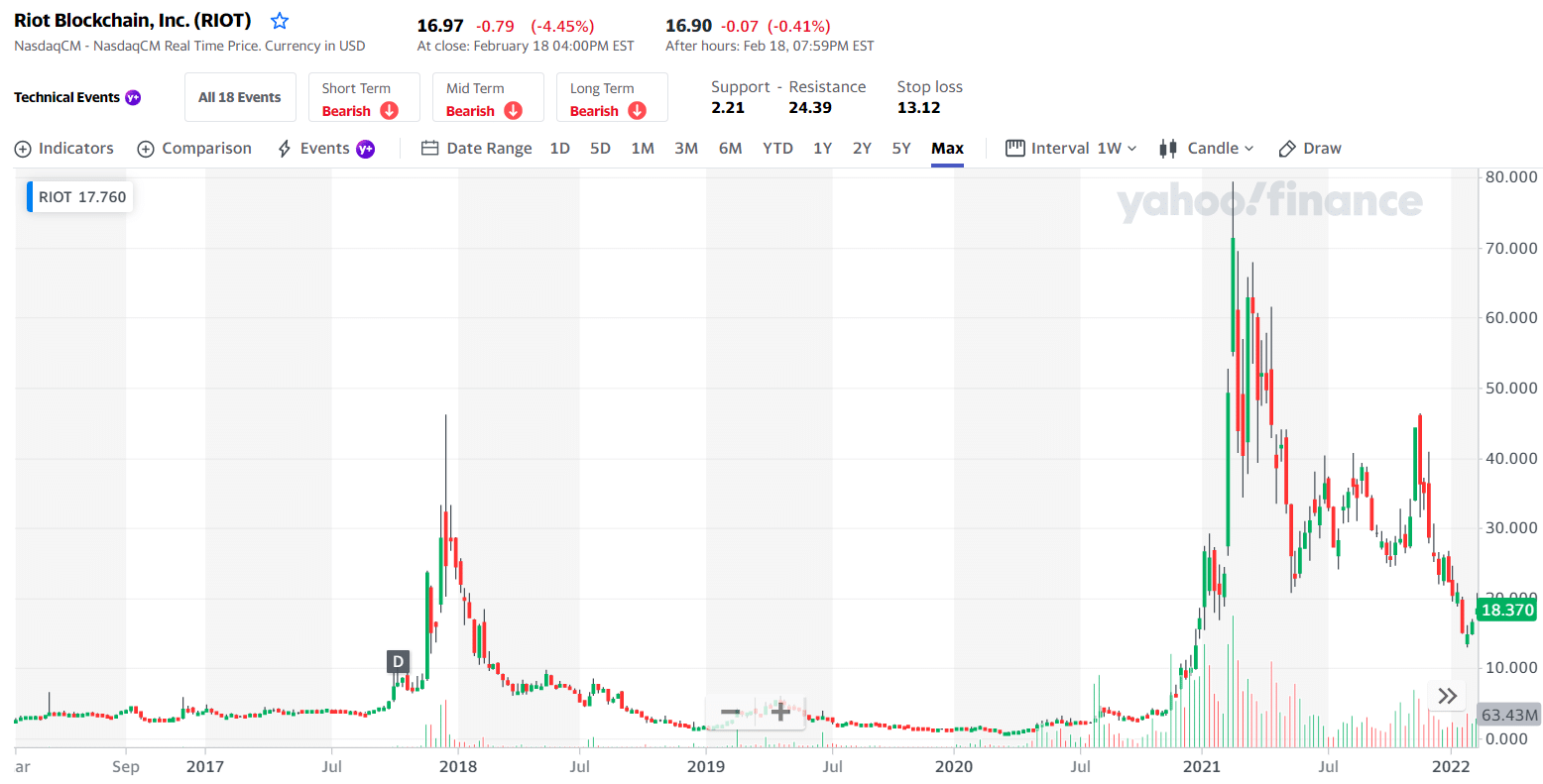

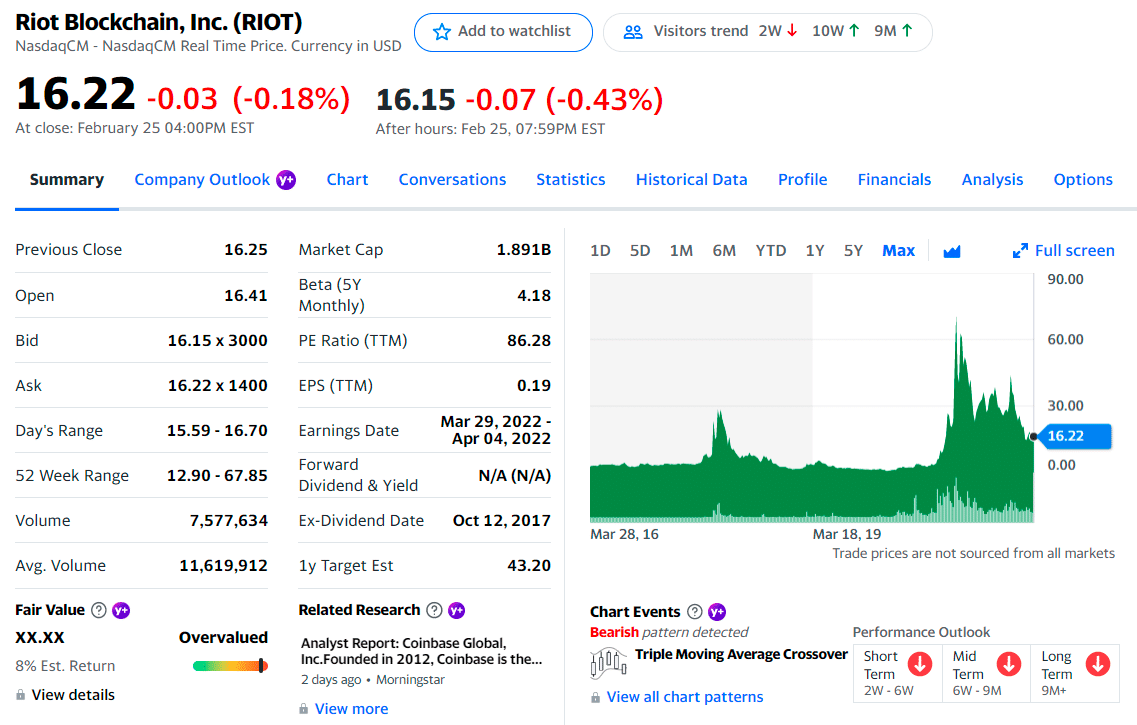

No. 3. Riot Blockchain (RIOT)

Price: $16.22

EPS: 0.19

Market cap: $1.978B

RIOT price chart

Riot is the second-largest North American miner behind Marathon with the third-biggest self-mined BTC stockpile.

It recently purchased Whinstone, North America’s most significant Bitcoin hosting facility, to diversify its profits and increase capacity. Whinstone is the most significant milestone in Riot’s development to date, putting Riot as an industry leader in Bitcoin mining, said Riot CEO Jason Les.

The largest single Bitcoin mining plant in North America is Whinstone’s Texas operation (now Riot’s). To put it another way, Riot now consumes around 73.5 megawatts (MW) of power to run. In addition, more than 58,000 Bitmain miners are expected to arrive in Riot. As a result, a total of 7.7 EH/s of hash power will be available to the corporation by the end of Q4 2022.

RIOT summary

The top three holdings of RIOT are as follows:

- Vanguard Group, Inc. — 8.61%

- Blackrock Inc. — 4.92%

- Susquehanna International Group — 2.59%

Final thoughts

Since the emergence of the Bitcoin industry, mining companies all around the globe have enjoyed substantial profits. Instead of Bitcoin or Ethereum, seasoned cryptocurrency investors purchase mining stocks in the same way they would buy gold mining equities in the traditional sense. As a result, the market volatility of these cryptocurrency mining equities has been minimized. In the case of cryptocurrency investments, mining stocks are a risk-free way to go about things.

Comments