Bitcoin ETFs have brought cryptocurrency trading to a new level. More seasoned stock traders may find a more accessible and safer way to invest in cryptos. European, Canadian, and Latin American investors are embracing Bitcoin ETF shares.

BTC ETFs were given a solid start last year when the SEC allowed ProShares Bitcoin Strategy ETF to join the New York Stock Exchange.

Learn more about the Bitcoin ETF in the following article. Then, identify the best funds for 2022 and learn how to buy them.

What are Bitcoin ETFs?

Exchange-traded funds that track Bitcoin’s performance are known as Bitcoin ETFs. You’re not buying the underlying stock or other assets when you buy an ETF. Purchases of this kind are not directly investing in BTC. Instead, they are acquiring shares of a fund that makes investments in or attempts to duplicate the performance of an index.

Currently, no Bitcoin ETFs can be directly held in an account. There are no regulations for cryptocurrencies or other digital currencies because of the Securities and Exchange Commission (SEC). SEC applications for Bitcoin ETFs have been received from several ETF and investment companies, including Cathie Wood’s Ark Invest. Still, the agency doesn’t seem to be prioritizing crypto funds at this time.

How to buy blockchain ETFs?

The Bitcoin Strategy ETF, which trades BTC futures on the Chicago Mercantile Exchange, is the only cryptocurrency ETF currently available in the United States. There will be more chances like this in the US in the future, but they already have a worldwide audience. Think about working with a financial advisor if you’re thinking about investing in digital assets like cryptocurrencies in the United States.

Top five Bitcoin ETFs to buy in 2022

Let’s look at the top-five to buy in 2022.

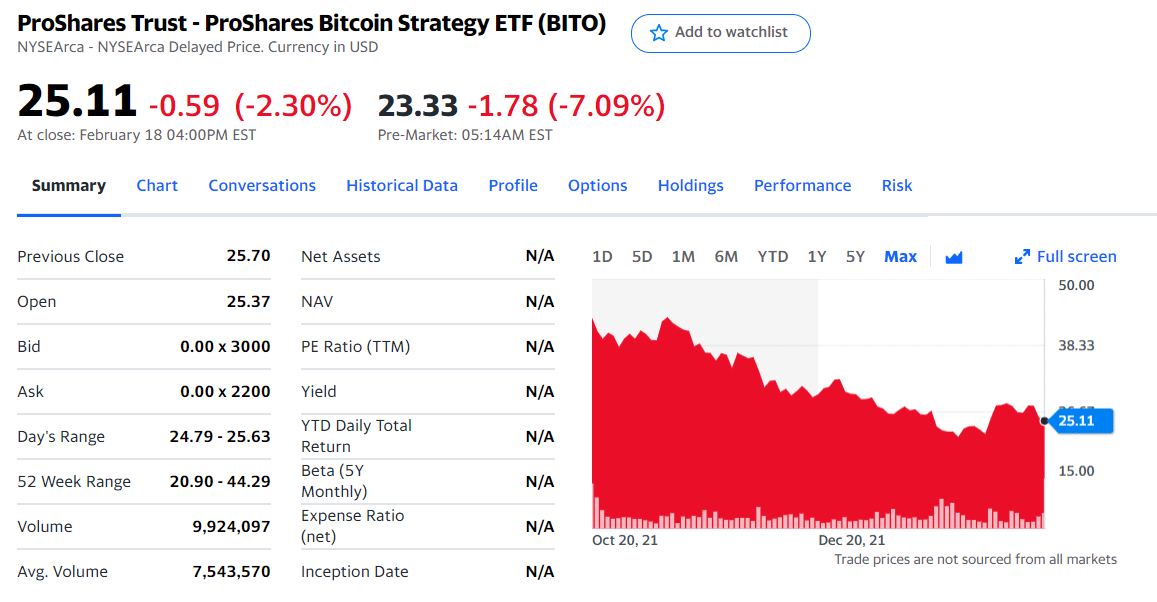

ProShares Bitcoin Strategy ETF (BITO)

BITO price chart

This ETF is currently trading at $25.11 per share and has net assets of $1.15 billion. The Chicago Mercantile Exchange is where BITO invests in short-term Bitcoin futures. This fund does not make direct investments in Bitcoin, but it does monitor the currency’s progress. In terms of volatility, this fund is identical to BTC.

Bitcoin ETF stocks may be purchased directly through BITO or via a broker. It has a substantially lower annual fee of only 0.95 percent, or $9.50, for every $1,000 invested than most other ETFs. Due to improved liquidity in the Bitcoin futures market and its relatively low fee solution, experts predict BITO will come back despite its recent decrease in assets.

BITO price chart

The first three holdings with their asset percentage are:

- FUTURES — 34.63%

- US Dollar — 34.63%

- United States Treasury Bills 0.0% 19-MAY-2022 — 30.74%

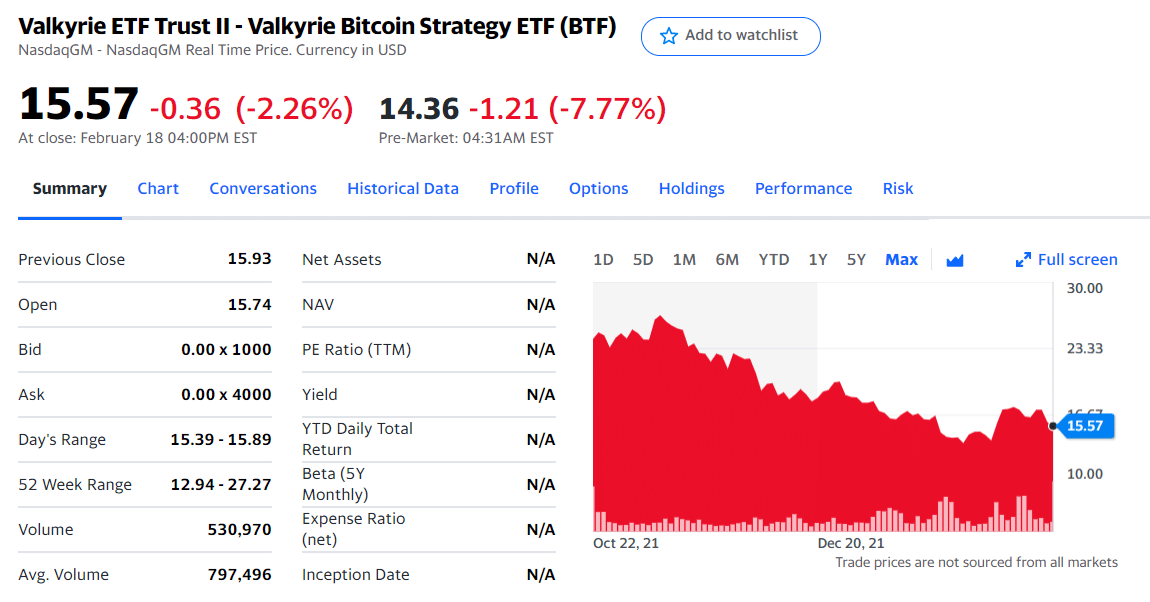

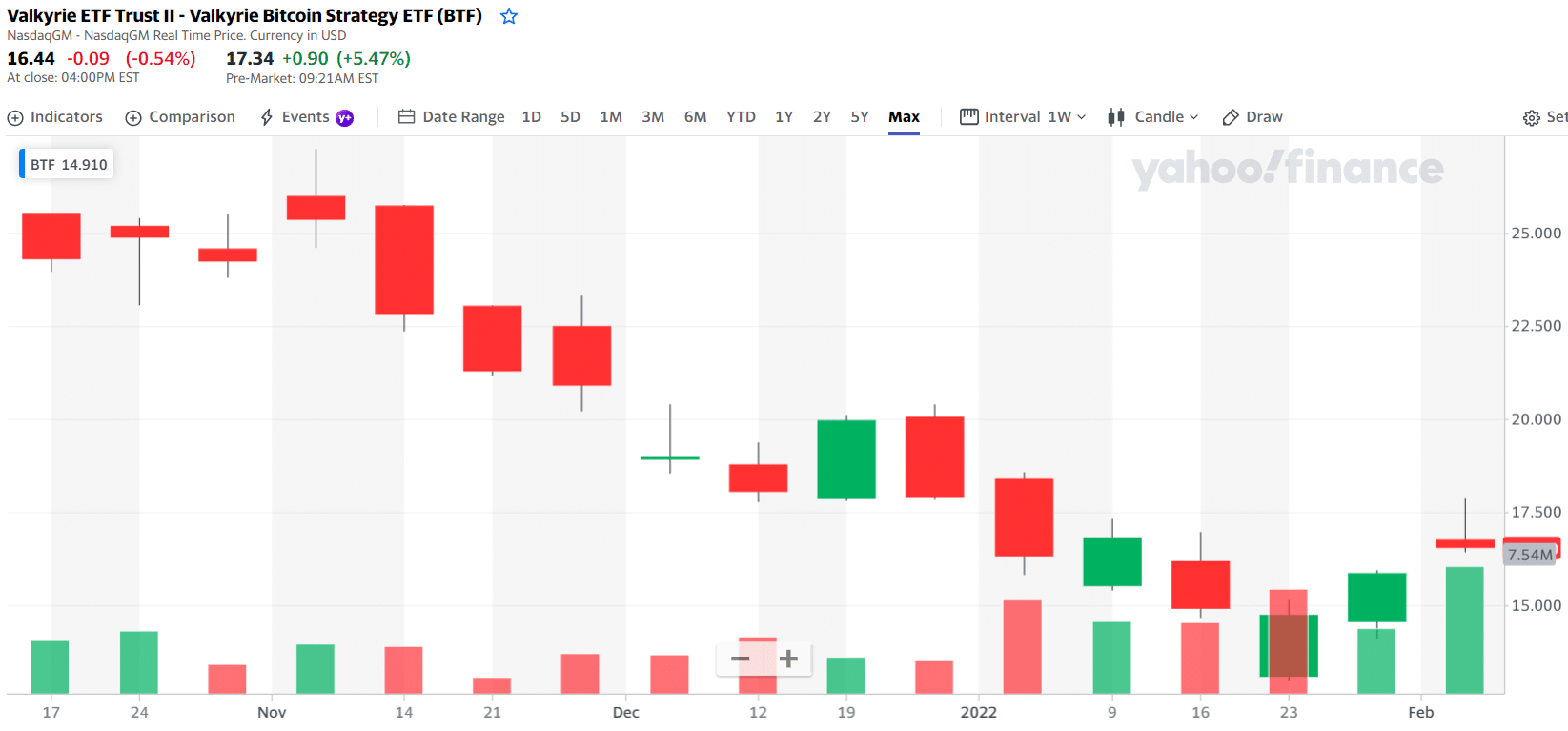

Valkyrie Bitcoin Strategy ETF (BTF)

BTF price chart

Three days after BITO, Valkyrie Asset Management in Tennessee launched its Bitcoin Strategy ETF or BTF. Bito had a far better start, amassing $60 million in its first few days of operation. With assets under management estimated at $71.9 million and a share price of $15.57 in January 2022, BTF, by contrast, continues to gain traction.

BTF is similar to BITO in many aspects. There are no direct Bitcoin investments; however, the Chicago Mercantile Exchange trades Bitcoin futures. In addition, there is an annual charge of 0.95 percent. Because Valkyrie is listed on the Nasdaq stock market, it’s the only difference. The platform also provides trusts for other cryptocurrencies such as Bitcoins, Polkadots, and many more.

BTF price chart

The first three holdings with their asset percentage are:

- MUTUAL FUND (OTHER) — 54.49%

- The United States Treasury Bills — 40.90%

- The United States Treasury Bills — 2.32%

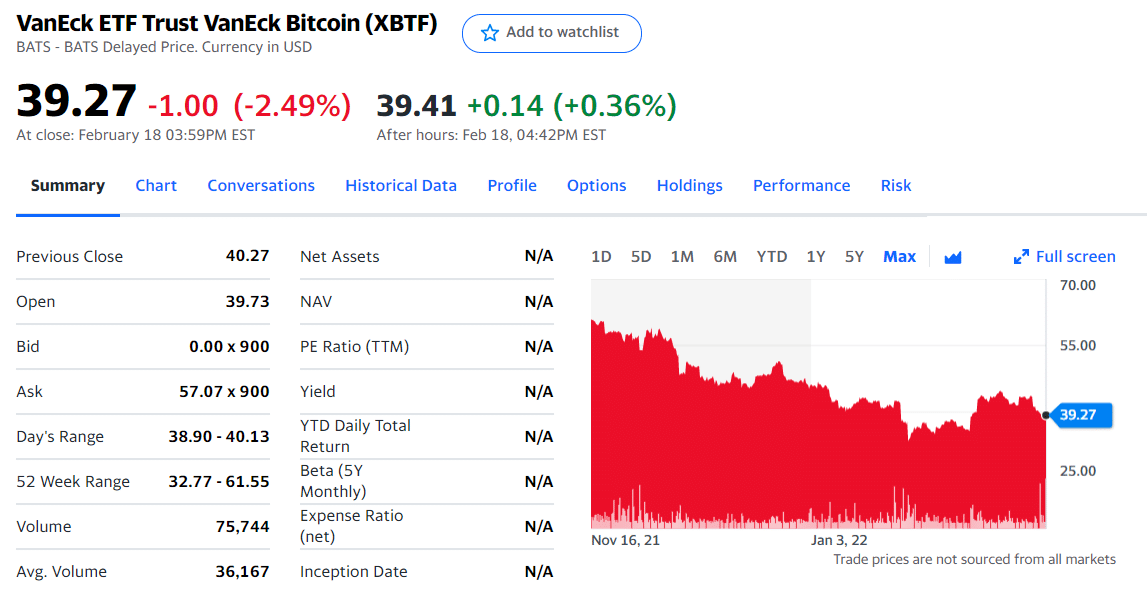

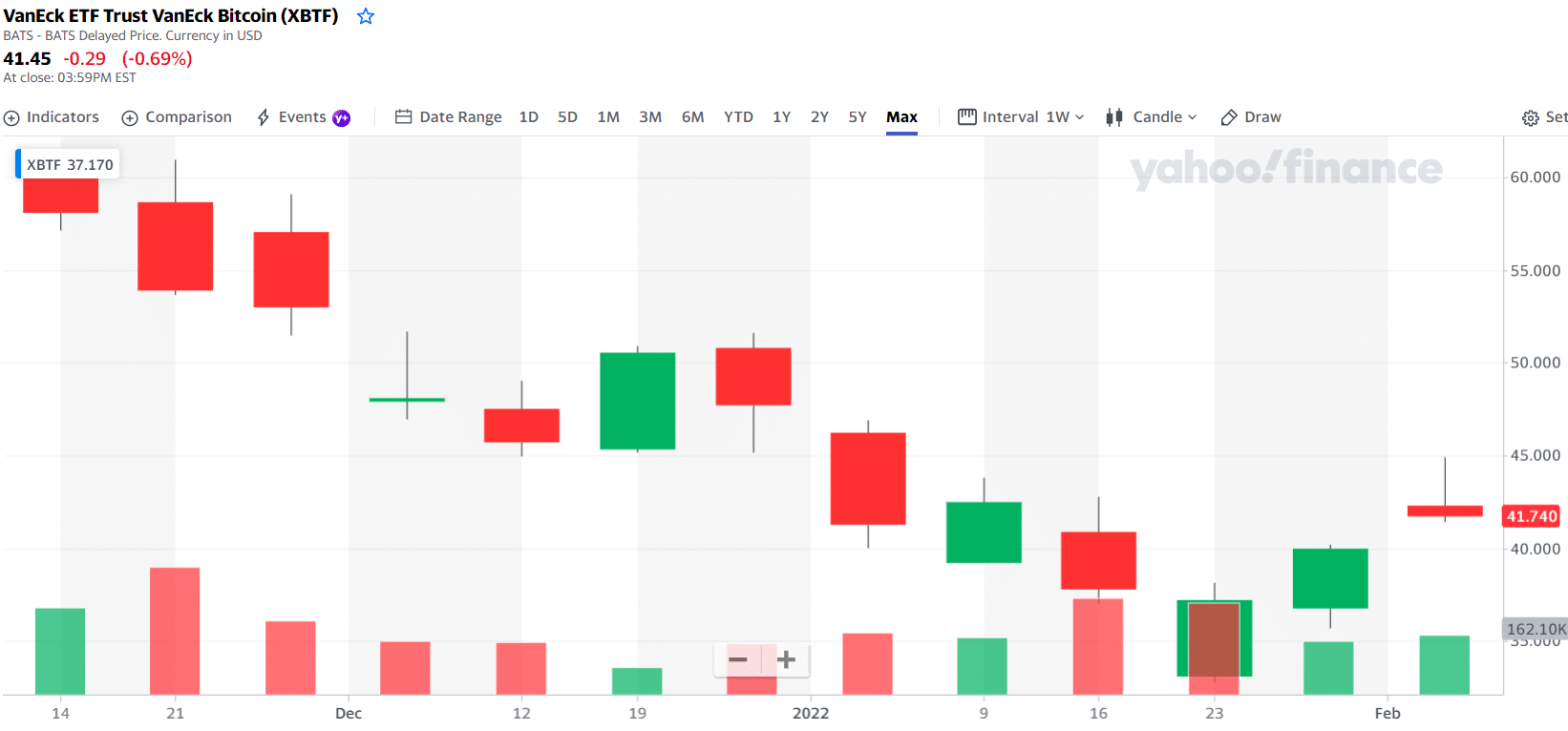

VanEck Bitcoin Strategy ETF (XBTF)

XBTF price chart

Reaction to VanEck Associates’ refusal of a Bitcoin ETF that would hold actual Bitcoins prompted the company to shift its attention to trading futures. Bitcoin ETF trading began on November 15, 2021, after the Securities and Exchange Commission approved it. The fund was launched on the New York Stock Exchange with the code XBTF. As of January 2022, it managed $15.8 million in assets worth $39.27 per share.

As with BITO and BTF, XBTF trading is based on the Bitcoin futures. Two things set it apart from its predecessors, though. First, to put this in perspective, the annual cost of XBTF was merely 0.65 percent, a far cry from 0.95 percent for the first two options.

XBTF price chart

The first three holdings with their asset percentage are:

- United States Treasury Bill — 41.59%

- United States Treasury Bill — 17.69%

- United States Cash Management Bill — 10.62%

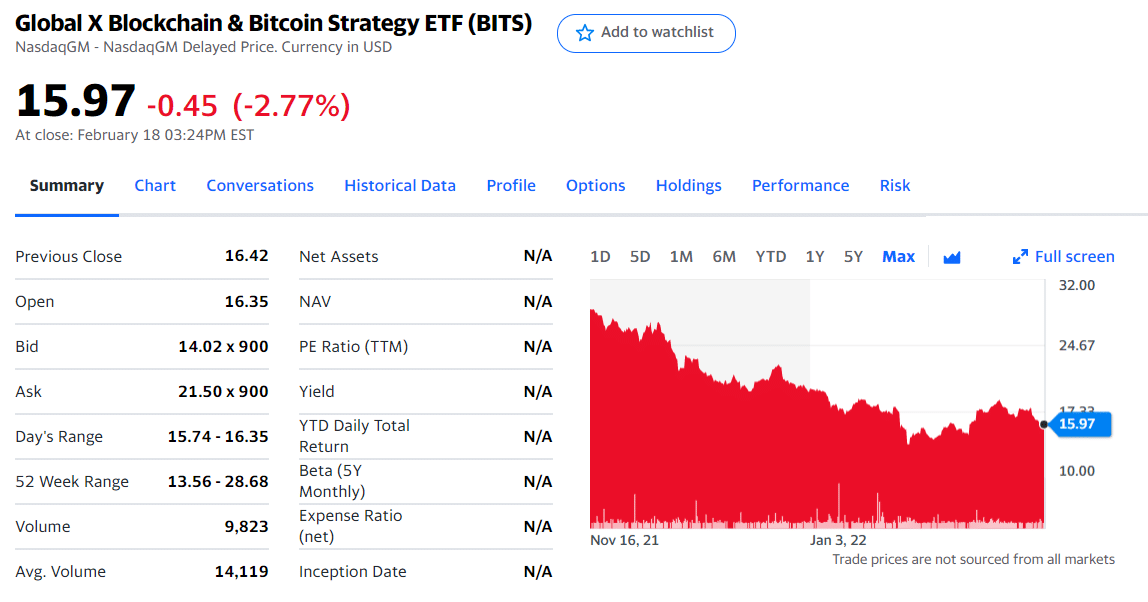

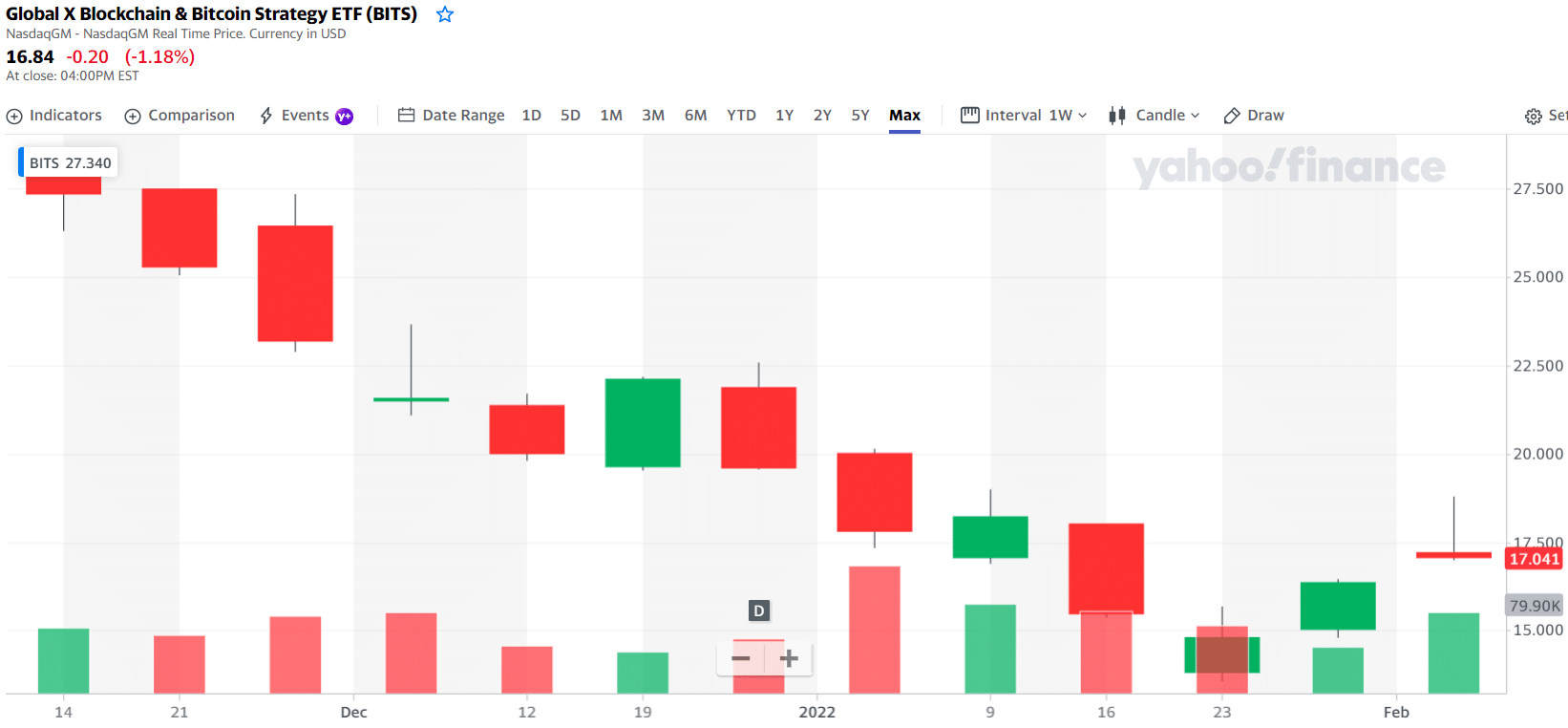

Global X Blockchain & Bitcoin Strategy ETF (BITS)

BITS price chart

BKCH and BITS are two Nasdaq-listed Global X ETFs that focus on the blockchain and Bitcoin strategy. BITS was released only one day after XBTF, making it the younger of the two. As of January 2022, BITS was in charge of $8.6 million in assets, valued at $15.97 per share.

Since its assets are divided evenly between Bitcoin futures and blockchain equities, BITS is a unique exchange-traded fund. Stocks of companies that actively use and invest in, and produce goods to benefit from blockchain technology in both direct and indirect ways constitute what is known as a “blockchain equity,” for want of a better name.

BITS only reduces the cost of a roll by a measly 2.5%. This strategy significantly reduces BITS roll expenditures since only half of the BITS roll is allocated to futures. BITO futures, for example, have projected roll fees of 10-15 percent.

On the other hand, BITS has a more limited daily relationship with Bitcoin. BITS has a correlation coefficient of 0.82, whereas BITO has a correlation coefficient of 0.99. Experts agree that the lower roll costs of BITS will benefit investors in the long term, making BITO appealing to traders. Investment in blockchain technologies by Global X is estimated to grow to US$19 billion annually by 2024.

BITS price chart

The first three holdings with their asset percentage are:

- Global X Blockchain ETF — 47.89%

- BTCH2 Curncy — 42.81%

- BTCG2 Curncy — 8.55%

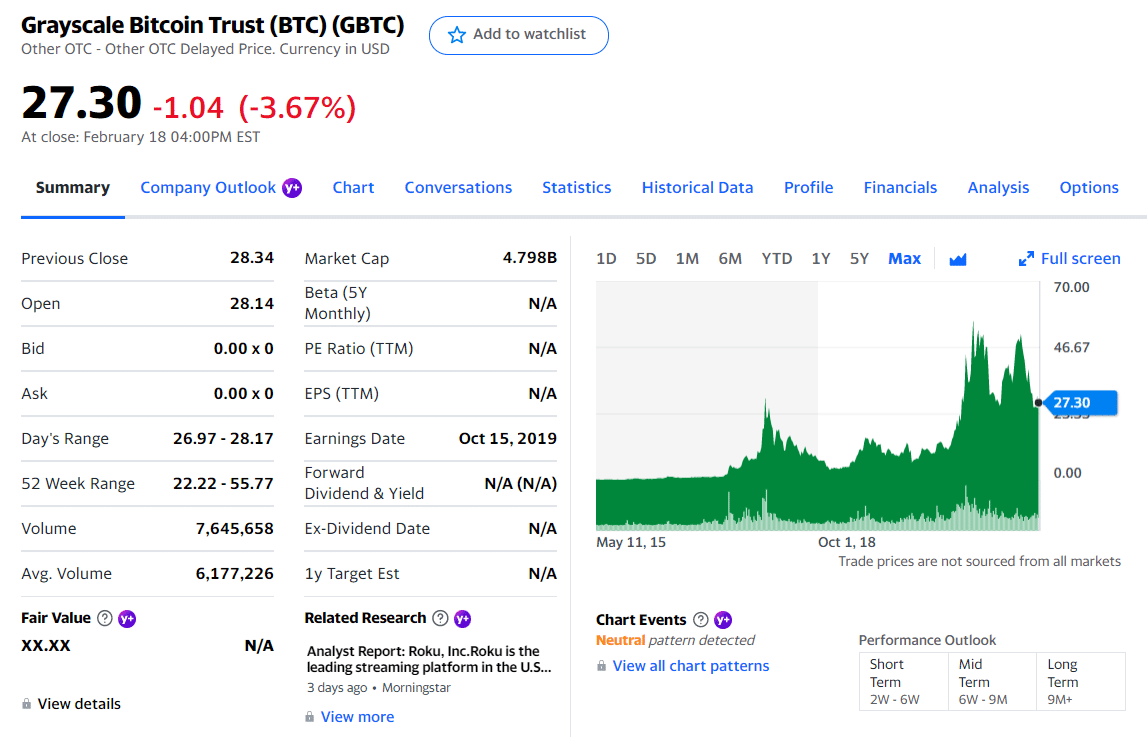

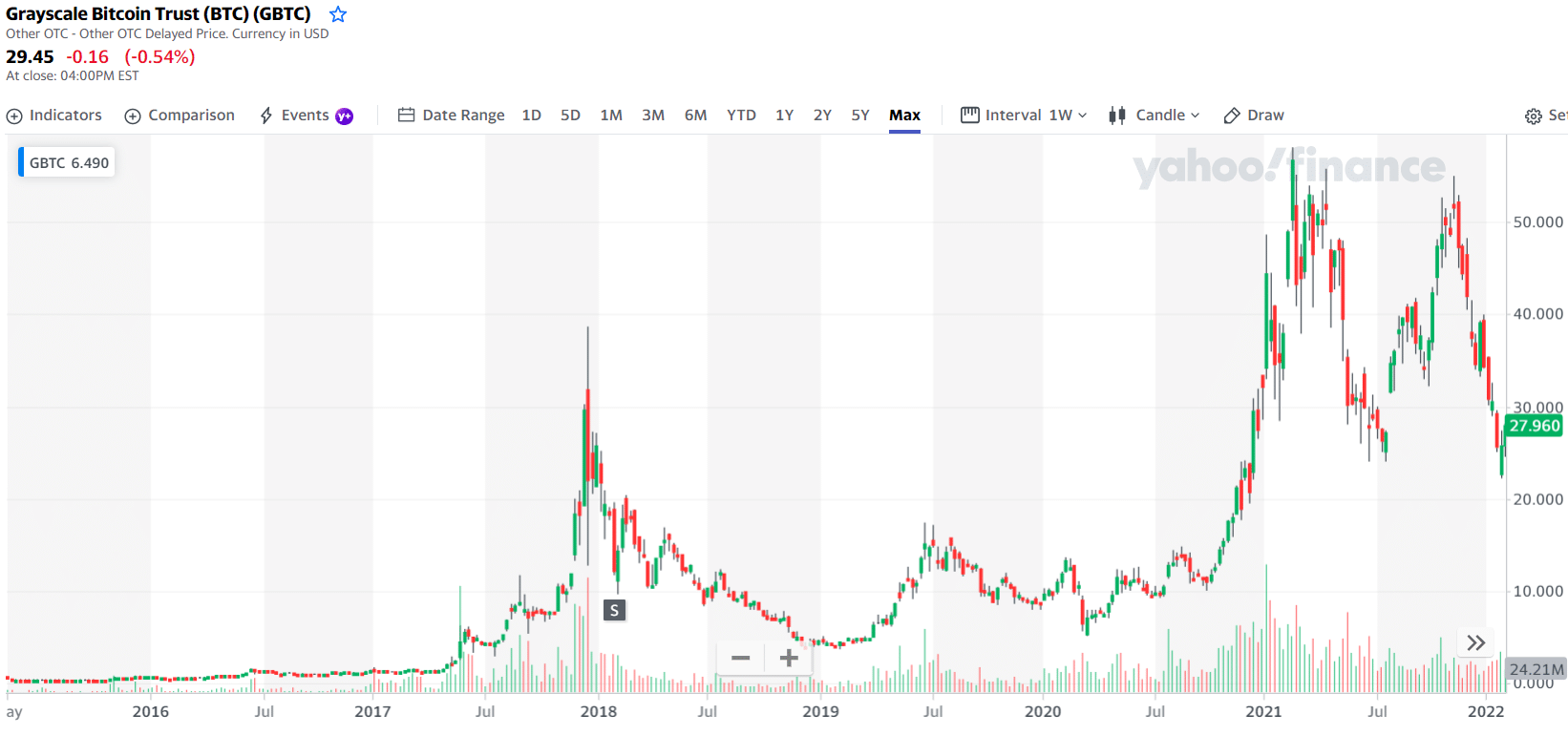

Grayscale Bitcoin Trust (GBTC)

GBTC price chart

One of the world’s largest Bitcoin Trusts is run by Grayscale. As a digital asset management company, it has been a significant player since 2013. As of January 2022, it is predicted that its assets under administration would be worth $38 billion. As a result, it was decided that the price per share would be $31.15.

GBTC is not an ETF but rather a financial vehicle that enables investors to invest in trusts. A large amount of Bitcoin is now owned by these trusts. As a result, the SEC’s decision on a Bitcoin Spot ETF proposal was postponed until July 2022.

GBTC’s worth is mainly influenced by its holdings of Bitcoin, which make up the vast bulk of its assets. Bitcoins have a 1.49 percent acquisition or selling fee, with an average holding time of 53 days. GBTC charges investors a 2% management fee. The fee seems to be high when compared to Bitcoin ETFs.

GBTC price chart

The first three holdings with their asset percentage are:

- Kingfisher Capital LLC — 0.02%

- Tru Independence Asset Management — 0.02%

- Rg Liquid Alts LP — 0.02%

Final thoughts

The general public may invest in Bitcoin ETFs without owning any digital currency. However, a well-balanced portfolio is essential if you’re just getting started with ETFs. Many low-risk ETFs with a wide range of assets are on the market. So spare no expense for riskier investments, such as BTC. This article explains the Bitcoin ETF in simple terms.

Comments