Metals are crucial to our economy. Industrial base metals such as copper, iron ore, and aluminum are essential building blocks for infrastructure, buildings, appliances, vehicles, and other equipment. Many metals are also becoming crucial for lower-carbon energy. Meanwhile, precious metals like gold and silver have industrial uses and are essential for investors. These demand drivers should help boost metals prices in the future.

Investors have several metals and metal-related investment opportunities that could help them profit from rising metals demand and prices. Of those options, ETFs offer an easy way to invest in the metals sector broadly.

Here’s a closer look at some of the leading metals-focused funds.

What are steel ETFs?

A steel ETF owns shares in any company that’s involved in the steel lifecycle. That could be a company that produces it, manufactures steel products, transports them to retailers, or sells them.

Sector ETFs offer a way to gain exposure to an industry without cornering the market on all stocks that trade in that sector. Say you want to invest in the steel industry. Owing to its popularity and high demand, steel has been among the leading metals as an investment choice.

How to buy steel ETFs?

Buying and selling funds is a simple process that can be done the same way as any ordinary stock. As with any other investment type, choosing the best steel funds to suit an investor’s needs may begin with an ETF screener narrowing the choices.

You could buy a steel ETF instead of making many trades to collect shares of steel firms in your portfolio. These funds also come with certain tax benefits.

Top five steel ETFs to buy in 2022

There are lots of ETFs focused on the metals and mining sector. Several of them focus on precious metals, including gold and silver funds. They provide investors with broad exposure to the precious metals mining sector or a specific precious metal. Likewise, several ETFs concentrate on leading industrial base metals such as aluminum, iron ore, and copper, plus emerging metals for the green energy sector such as lithium. Here are some of the top funds.

№ 1. VanEck Steel ETF (SLX)

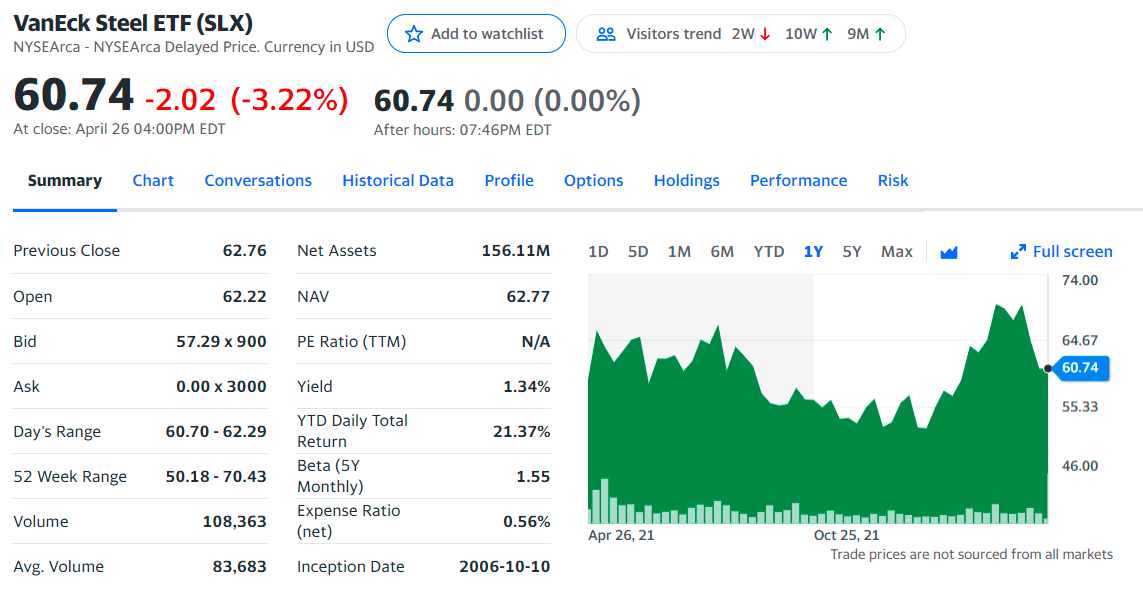

SLX ETF summary

The first, and so far only, steel ETF is run by VanEck. It lets investors track the steel industry by owning shares in a broad representation of companies in the sector and has been available since 2006.

While the ETF owns a wide range of steel companies, it is weighted heavily towards a handful; almost 50% of the fund’s money is invested in five businesses. Rio Tinto and Vale Sa are the largest, so SLX’s success relies heavily on their performance.

However, the fact remains that it is the best way to gain exposure to the steel industry. In recent times, it boasted good returns; its share price has increased by 10% over the past five years and by more than 30% in the last 12 months.

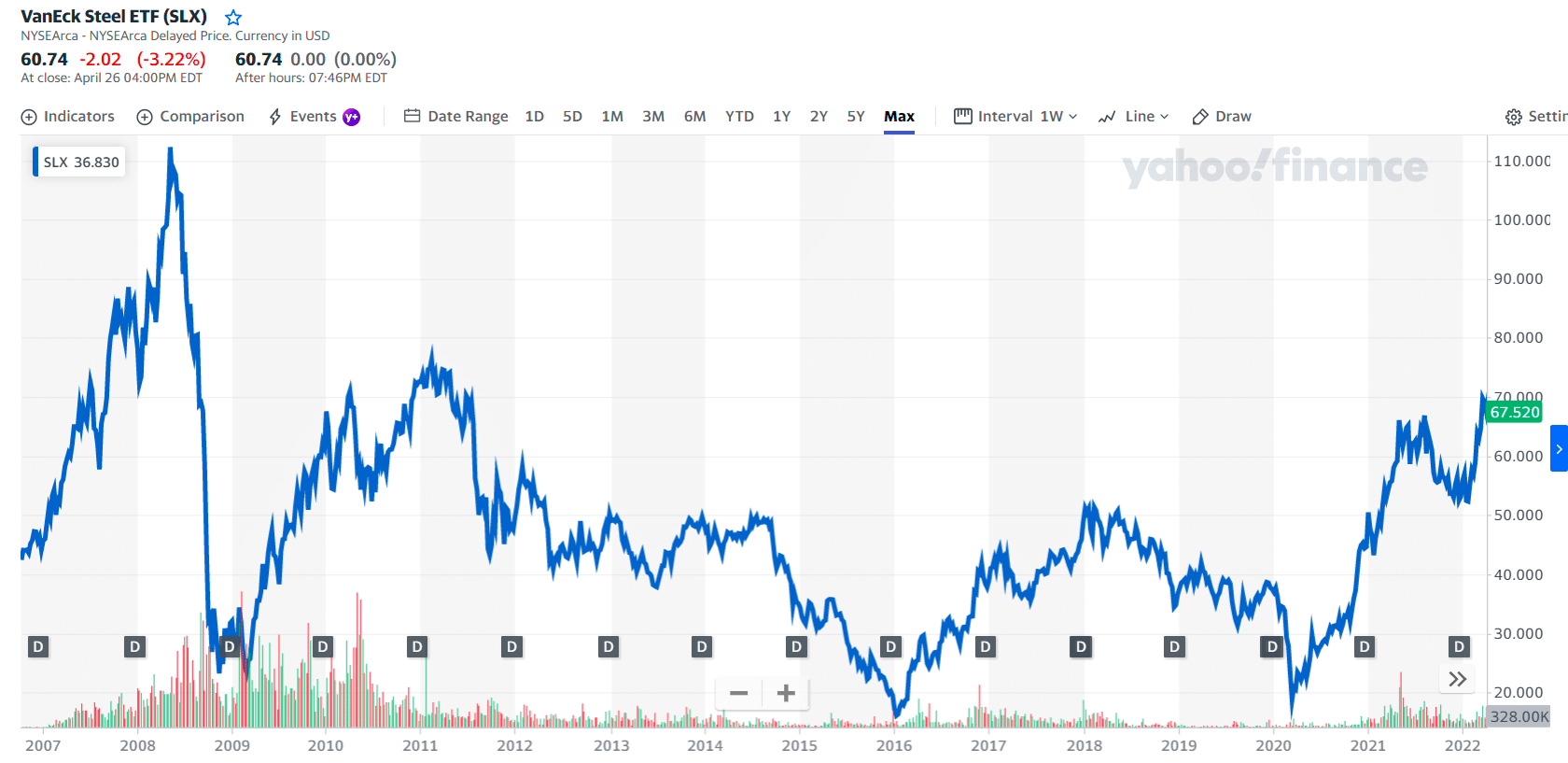

SLX price chart

Over the past three months, the SLX, the lone steel sector-specific ETF, increased 22.3%. The Wall Street Journal reports that pig iron, the primary raw metal used in steel production, dwindled in supplies in the weeks after Russia invaded Ukraine.

A vast majority (86%) of steel buyers were polled last November by an industry source expecting another round of price increases from steel mills, and the likelihood is that prices will continue to rise, which should bode well for SLX.

The first three holdings with their asset percentage are:

- Rio Tinto PLC ADR — 13.59%

- Vale S.A. ADR — 13.37%

- Nucor Corp. — 7.68%

№ 2. SPDR S&P Metals & Mining ETF (XME)

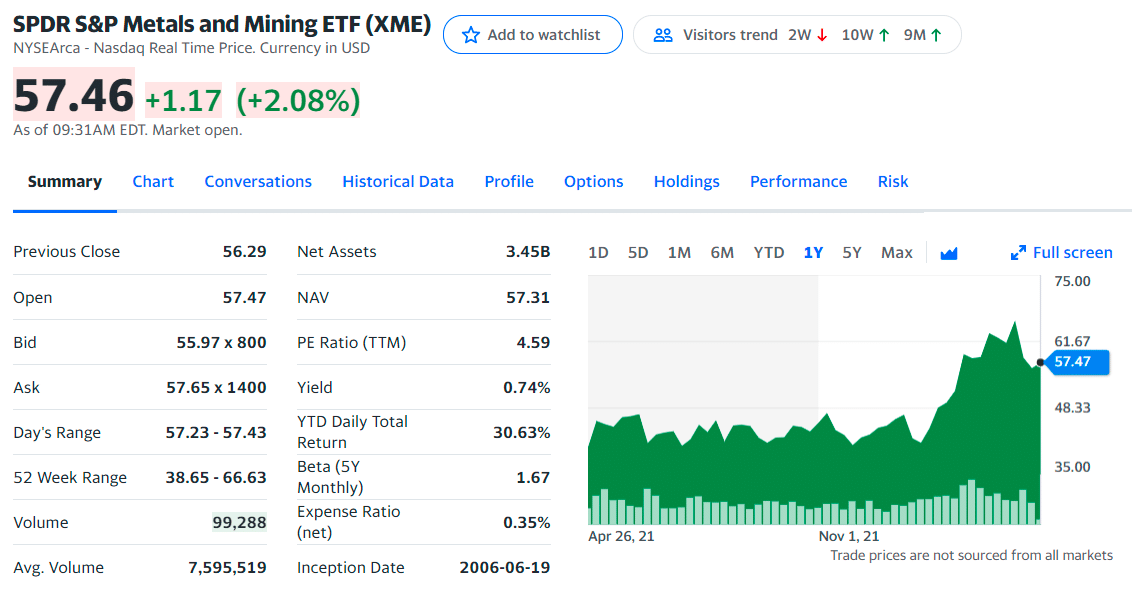

XME ETF summary

The fund was formed on June 19, 2006, and is domiciled in the United States. The fund seeks to track the performance of the S&P Metals & Mining Select Industry Index by using representative sampling techniques.

The SPDR S&P Metals & Mining ETF seeks to expose investors to metals and mining stocks in the S&P Total Market Index. It holds shares of mining companies in the following subsectors of the metals and mining sector: aluminum, coal and consumable fuels, copper, diversified metals and mining, gold, precious metals and minerals, silver, and steel. The ETF had 32 holdings as of early 2022.

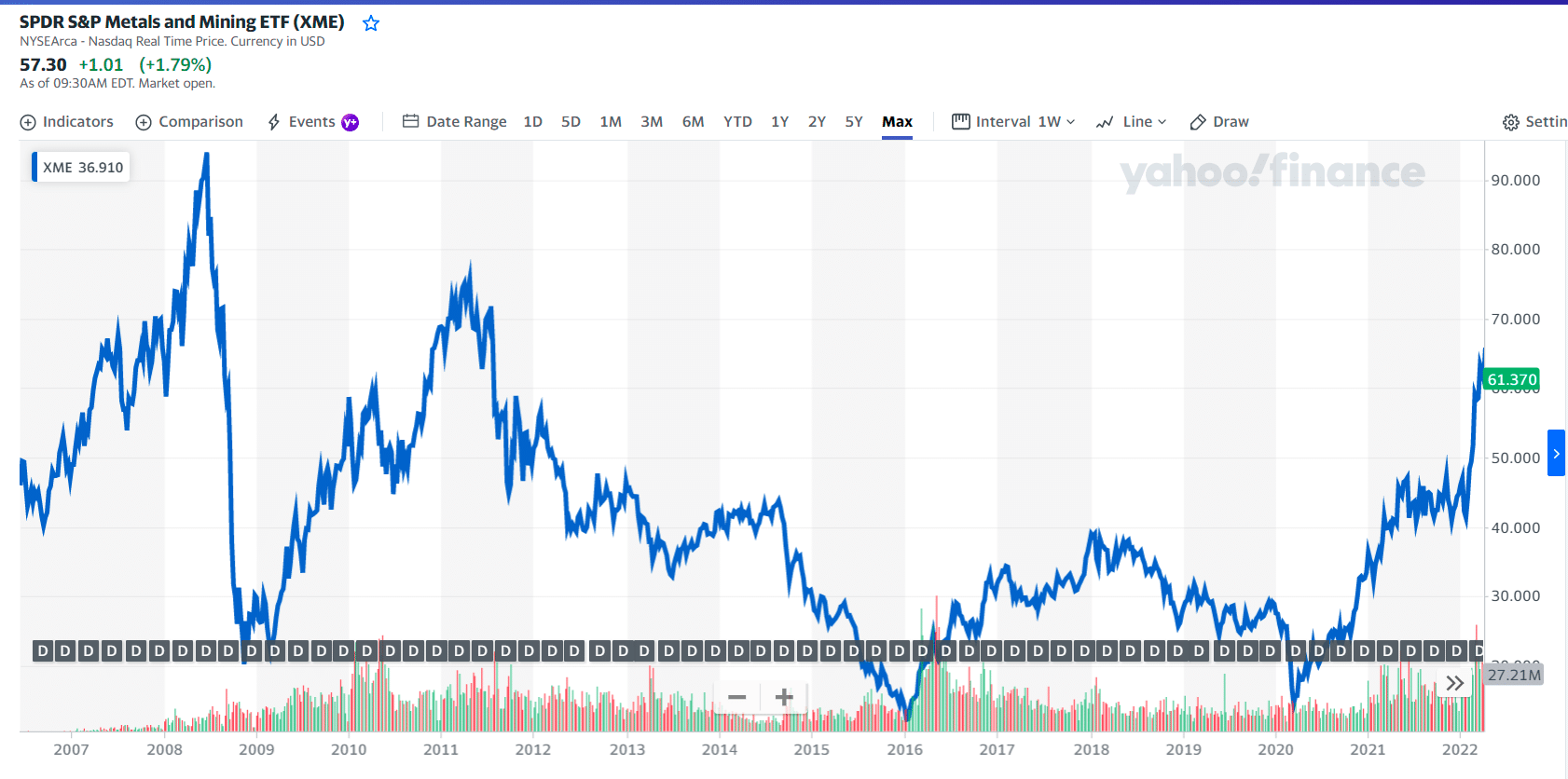

XME price chart

The ETF is ideal for people seeking an investment focused on the US metals sector. It uses an equal weight strategy, which provides investors with targeted exposure to the entire US metals and mining sectors, including precious metals. It charges a relatively low ETF expense ratio of 0.35%.

The first three holdings with their asset percentage are:

- MP Materials — 5.6%

- Cleveland-Cliffs. — 5.3%

- Steel Dynamics — 4.9%

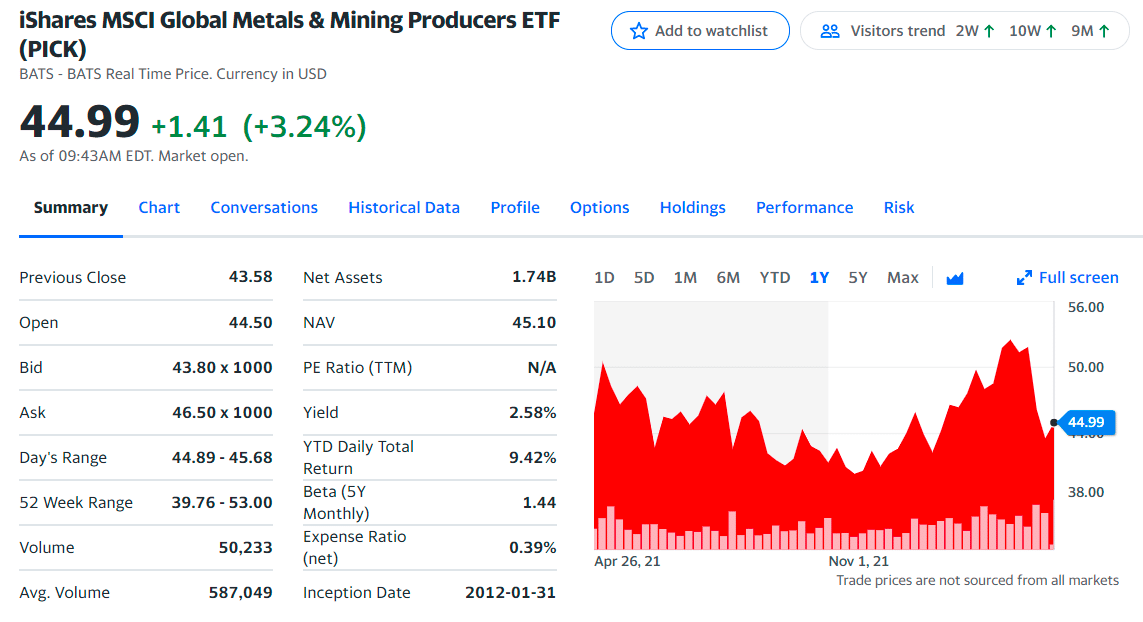

№ 3. iShares MSCI Global Metals & Mining Producers ETF (PICK)

PICK ETF summary

The investment seeks to track the investment results of the MSCI ACWI Select Metals & Mining Producers ex Gold and Silver Investable Market Index. The fund will invest at least 80% of its assets in the component securities of the index and in investments that have economic characteristics that are substantially identical to the component securities of the index.

The index measures the combined performance of equities of companies in both developed and emerging markets that are primarily involved in the extraction or production of diversified metals.

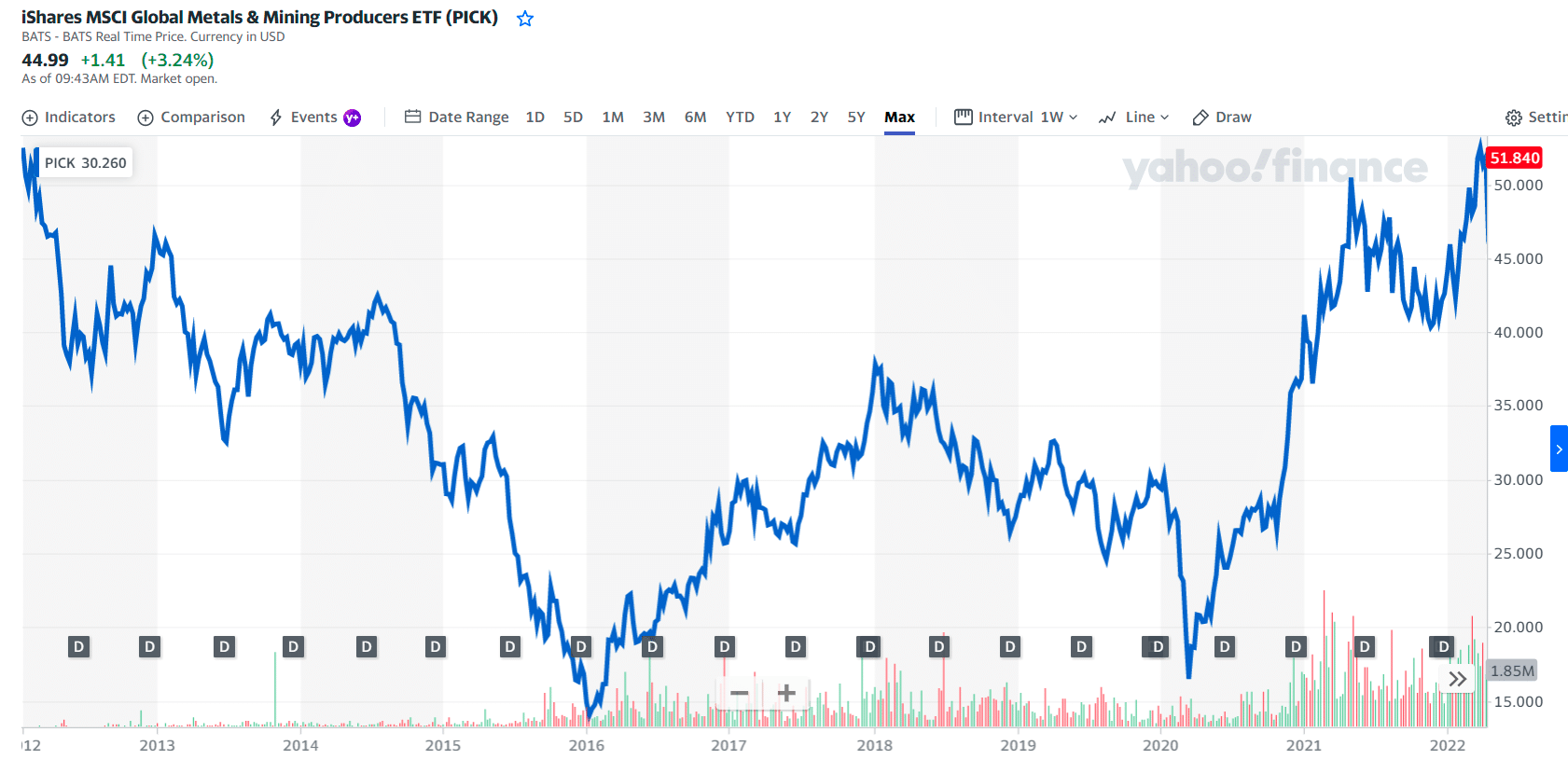

PICK price chart

This fund takes a market-weighted approach to the global non-precious metals mining sector. It charges a reasonable expense ratio of 0.39%. The fund’s features make it ideal for people seeking to invest in an ETF weighted toward the largest non-precious metals miners in the world.

The first three holdings with their asset percentage are:

- BHP Group — 14.6%

- Rio Tinto — 6.6%

- Vale S.A. ADR — 5.7%

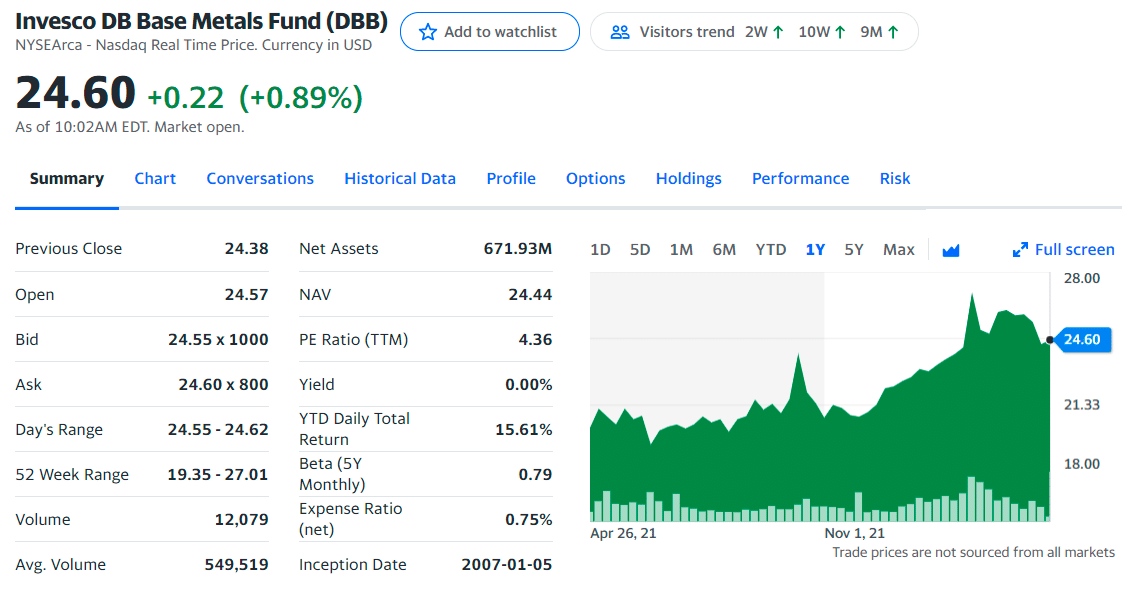

№ 4. Invesco DB Base Metals Fund (DBB)

DBB ETF summary

This fund enables investors to conveniently and cost-effectively invest in commodity futures. It focuses on some of the most liquid and widely used base metals, such as aluminum, zinc, and copper. The ETF uses leverage and collateralized futures contracts with US Treasury bills and other Invesco products built around government debt.

The fund is best for sophisticated investors who want to make a short-term trade on the thesis that base metals prices will rise sharply in the near term. The fund is somewhat speculative since futures contracts can be very volatile. It charges investors a modest expense ratio of 0.77%.

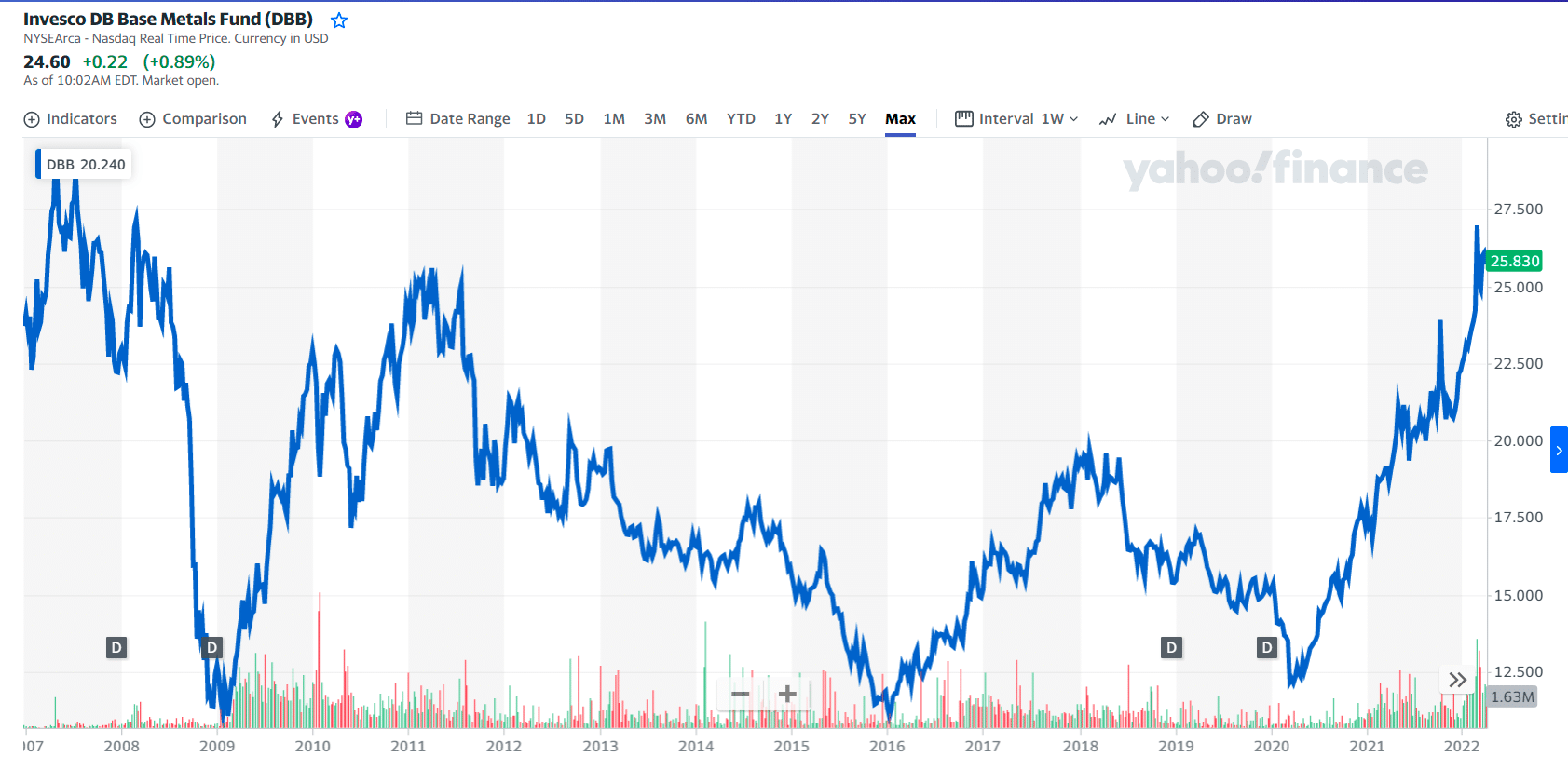

DBB price chart

The first three holdings with their asset percentage are:

- Aluminum futures — 74.5% of net assets

- Copper futures — 56.7%

- Zinc futures — 44.1%

№ 5. Global X Silver Miners ETF (SIL)

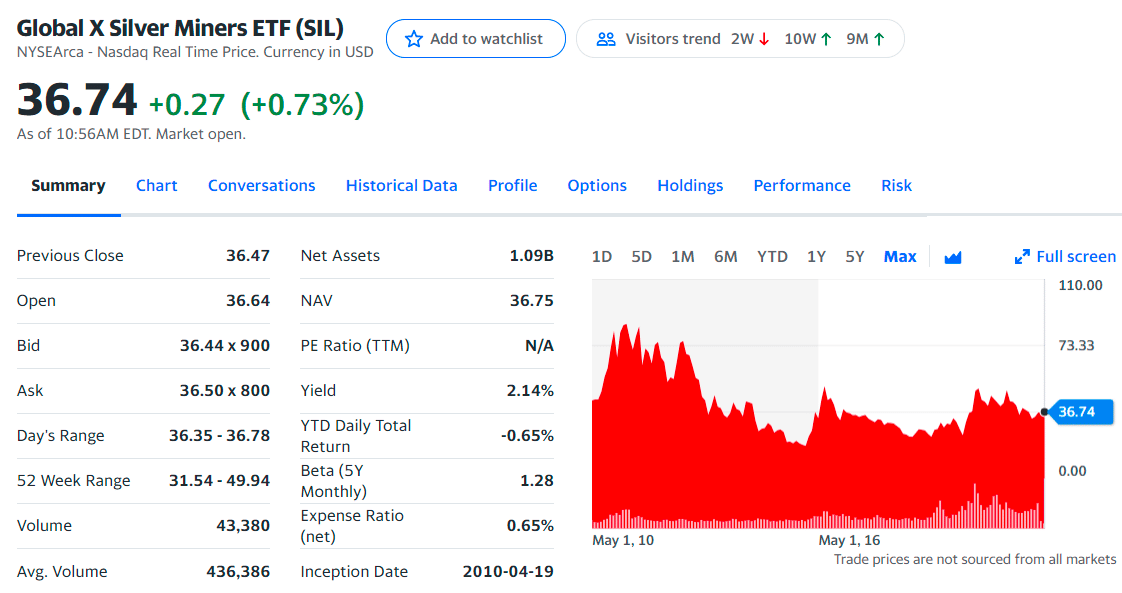

SIL ETF summary

This fund seeks to track the performance of the Solactive Global Silver Miners Total Return Index, which invests in international companies involved in exploration, mining, and the refining of silver. The index will own between 20 and 40 stocks at any given time and primarily uses a market cap to weigh the companies in the index.

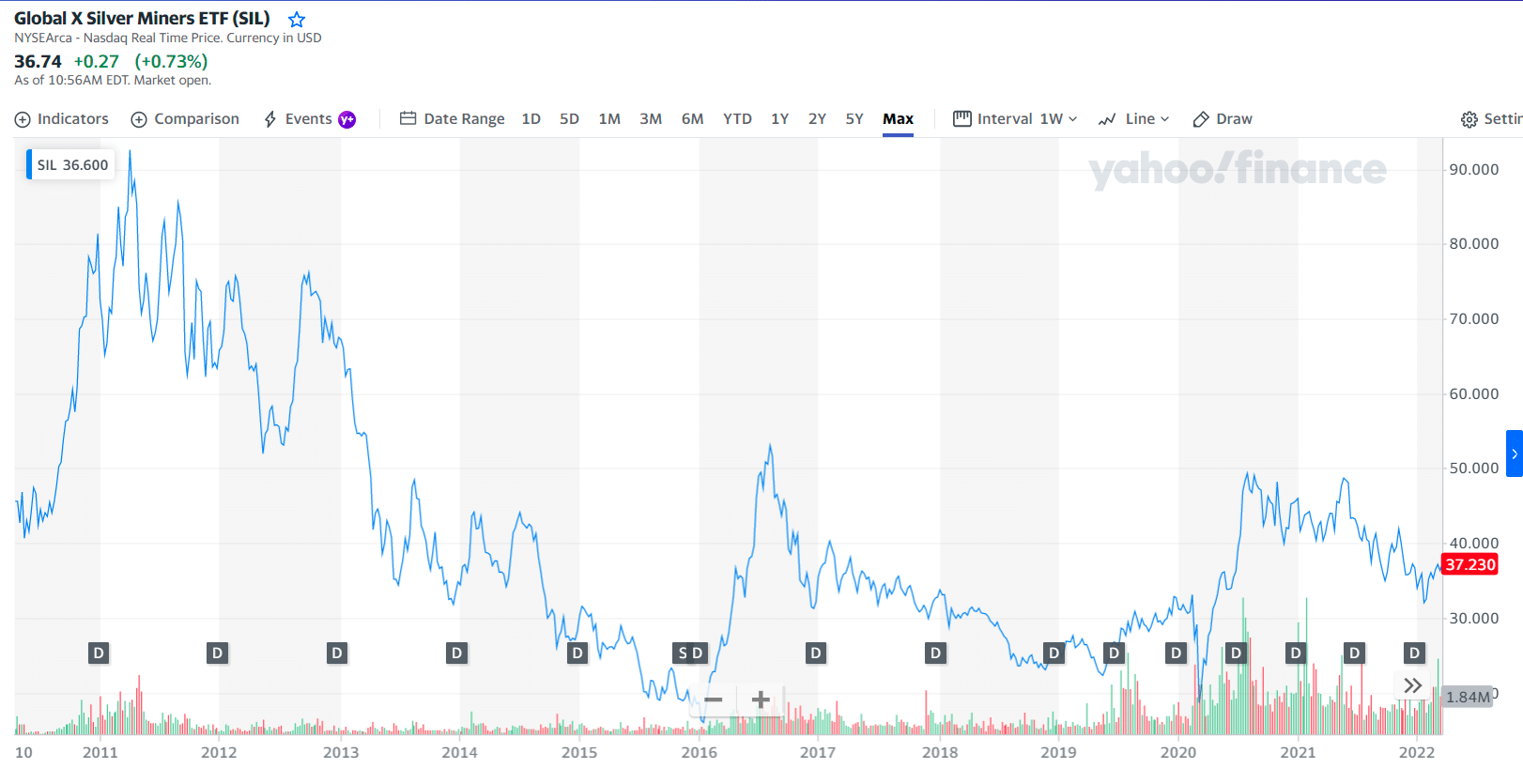

SIL price chart

This fund subjects investors to less currency risk than the iShares fund. Approximately 42% of its investments were US dollar-denominated. The Canadian dollar, Great British pound, and Mexican peso-denominated assets comprised 35%, 18%, and 5% of its assets.

It holds just 23 different companies. The five most prominent positions made up more than half of the fund. Fewer holdings result in a significantly higher average market cap for stocks in its portfolio, with the average company being 50% larger than the constituents of the iShares MSCI Global Silver Miners. The fund carries an annual expense ratio of 0.65%.

The first three holdings with their asset percentage are:

- Wheaton Precious Metals Corp. — 26.94%

- Pan American Silver Corp. — 9.79%

- SSR Mining Inc. — 6.59%

Final thoughts

Rising demand for metals tends to drive up prices, providing investors with the opportunity to make money on the metals market. One broad way to invest in the thesis that metals prices will rise is through metals ETFs, an essential tool for bullish investors on the metals market.

Comments