Let’s be honest; ethics is not the first word that springs to mind when investing. The primary goal of doing business is profit, and some corporations have come under heavy fire over their less-than-ideally-moral business practices.

ESG investments attempt to reconcile the desire to make a profit, keep businesses afloat, preserve the environment, ensure that human and work-related rights are protected, and ensure that the investors are provided with the transparency and honesty they deserve.

What are ESG investments?

Let’s start with the basics. ESG stands for environmental, social, and governance. ESG is not, in any case, the only name that this approach to investing carries. Some call it “sustainable” investing, and some refer to it as “ethical” investing, and some dubbed it “socially responsible” investing.

Speaking in simple terms, it is an approach that allows investors to put their money towards companies that meet specific business standards. As society changed, the standards became stricter, as well.

Going back to the ESG, the environmental factors mainly refer to issues regarding pollution and the wellbeing of animals. The investors, in that case, favor companies that prove to be cruelty-free or aim to have a low carbon footprint.

When it comes to the social factor, the companies that do the best job protecting human rights, employee compensation, and pursuing community engagement are chosen over those who make the mentioned issues less of a priority. Therefore the governance factor is meant to tell us more about the diversity in the companies’ decision-making bodies.

How does ESG investment work?

ESG investment is not universally agreed on. At least, there is no one way to do it. In its essence, it comes to combining the three factors that we mentioned and assessing the companies based on how well they do against all three criteria.

The two main approaches include positive screening and negative screening. In the first one, you favor companies that check some of the boxes that you deem essential. For example, you can strive to invest in businesses that deal in renewable energy or pay extra attention to diversity.

On the other hand, there is negative screening or practice of removing the companies whose operations you find subpar. Some investors stay clear of the companies dealing with tobacco, firearms, gambling, and other currently unpopular trends. Others avoid investing in companies that have had fraud-related scandals in the past or were proven to have violated human rights.

Pros of ESG investment:

-

Win-win

If you use ESG as a criterion for investing, you will be doing your part for either the world, its people, or both. At the same time, ESG investments are usually less risky than some other types of “ethical securities.” In the latter case, people typically invest in developing communities, and their money does a lot of good, but it, more often than not, ends up as a donation.

-

It yields results

Persuaded many companies to change their operations and strategies due to their spotlight when the ESG policies began to pick up popularity. While it may not be fault-proof, the ESG has gotten many firms to abandon their unethical practices.

-

Less volatility

ESG is a standard, and we know that any standardizing method will usually directly correlate with less volatility. By making the company’s actions mandatory in certain aspects, an ESG strategy can, as a side-effect, mitigate the risk that you as an investor have to bear.

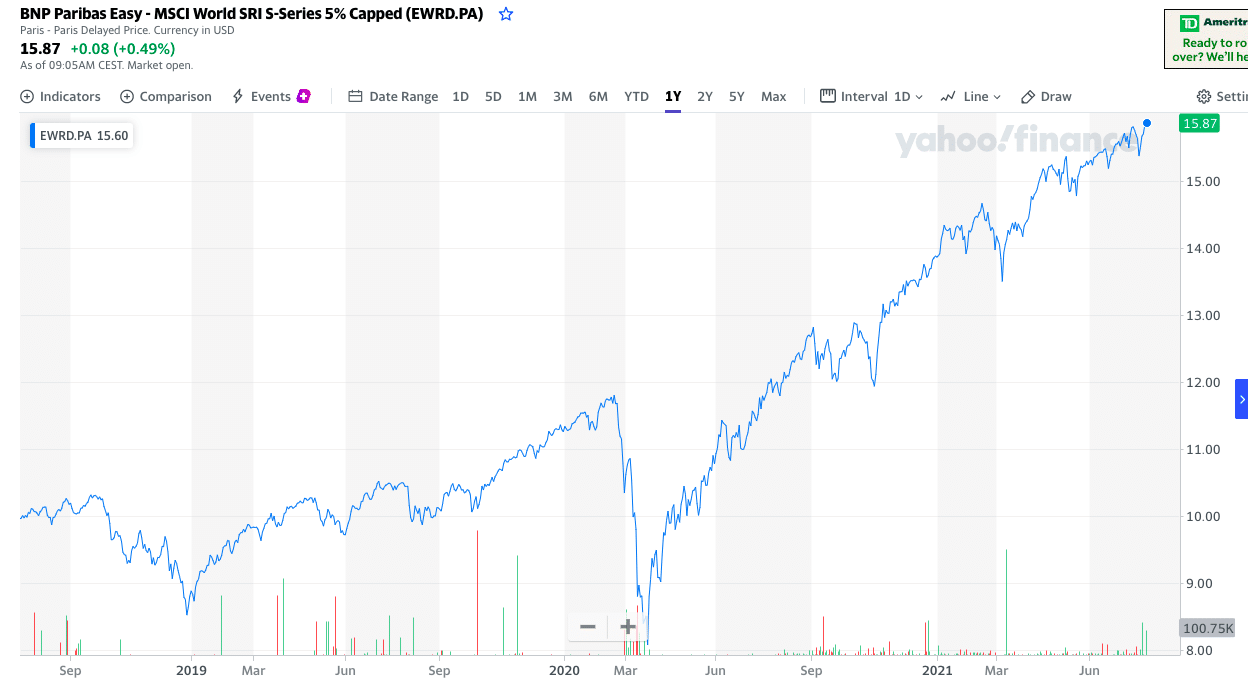

BNP Paribas Easy — MSCI World SRI S-Series 5% Capped ETF

For example, take a look at the BNP Paribas Easy — MSCI World SRI S-Series 5% Capped ETF, one of the most ESG friendly Europe-based exchange-traded funds. Not only does it support ethical business practices, but it also comes with solid yearly returns.

Cons of ESG investment:

-

Standards vary

As we already mentioned, there isn’t a single approach to ESG criteria. Different companies view ethics differently, and they might prioritize an area that doesn’t come at the top of your list of goals.

-

Rating agencies vary

As the standards for ESG investments vary, the agencies tasked with rating the companies differ from each other. As a result, you can find a single fund rated drastically different by just two firms, regardless of how well-established each agency is.

-

Not mandatory worldwide

Tracking the ESG rating is not a must around the world. Even in the United States, companies by law do not need to follow any determined methodology in the process. As a result, we sometimes have to learn about the company’s rating from the company itself.

-

Limited diversification

Having an added filter of which companies you can invest in can hinder your portfolio’s width. The stricter the standards, the more challenging it becomes to diversify your assets and hedge versus losses.

Final thoughts

On the one hand, most of us want to think of ourselves as good people, whatever that may mean to us. That’s why investing in firms with moral standards similar to our own is so appealing. Moreover, the ESG investments are at a lower risk of suffering government penalties due to their nature and meeting regulations to be characterized. This also means less risk for you.

On the other side, one of the cons we failed to mention is the ESG stocks’ higher prices. Due to the significant demand for “ethical” equities, their price can skyrocket, making it more expensive for investors. It can feel not very encouraging to have to pay more to do the right thing.

In the end, the decision needs to be yours. Find out what ESG stocks you like, and research if the company meets your standards of “responsible.” Make sure you analyze different options and find securities that will match your portfolio and your investment goals.

Finally, remember that it is not a black-and-white situation. Investor’s primary goal is to secure their future. Only you get to determine how you do that.

Comments