The electric vehicle industry has seen a lot of growth lately. Seeing this trend, many investors want to get involved, and one way to engage is through lithium stocks. Lithium is an earth mineral that is crucial to producing batteries that drive electric vehicles. You might not be aware of it, but lithium-ion batteries power gadgets you love to use, such as laptops and smartphones.

Grandview Research estimated that the global lithium market was around $2.7 billion in 2020 and is expected to increase by 14.8 percent yearly for eight years from 2021 to 2028.

Because of the rising demand for electric cars, auto manufacturers invest a lot of capital on systems that facilitate the mass production of such cars. This growing demand naturally results in escalating demand for lithium, a critical element of batteries. This is all the more accentuated by the growing concern by governments and companies worldwide about CO2 emissions.

All these developments indicate that lithium stocks could see a lot of growth in the years to come. How can you invest in lithium stocks? You will find out in this article. Plus, you will get to know three potential lithium stocks to invest in 2022.

What are lithium stocks?

Lithium stocks are companies that either mine or process lithium. You can find two companies in our list below that mine lithium. As an earth mineral, lithium is obtained through mining. Compared to other valuable minerals such as gold and silver, you cannot directly invest in lithium. You can buy lithium stocks that engage in the production of lithium products in one way or another.

As pointed out earlier, lithium demand mainly comes from car manufacturers producing electric cars, paramount to Tesla. Without lithium-ion batteries, these cars would not run. While this strong demand in lithium could lead to volatile lithium stocks, it can offer you an excellent chance to make huge returns on your investment in a short period.

Lithium Stocks to Buy

How to buy lithium stocks?

There are generally two ways to go about investing in lithium stocks. Either you can buy individual lithium stocks or go for a lithium ETF. The good thing about ETFs is that buying one immediately diversifies your holdings in a given sector. However, if you are an investor who is conversant with the lithium industry, owning individual lithium stocks might work for you.

When thinking about individual stocks, select renowned lithium companies that produce large volumes of lithium using less costly mining processes. You may also choose startups with access to low-cost lithium supply. Investing in startup companies poses a medium risk, but they offer a huge upside potential, justifying the risk.

Top three lithium stocks to invest in 2022

Below, you can find our pick of the best lithium stocks to invest in. Include them in your list of prospective stocks in 2022 and put them in monitor status.

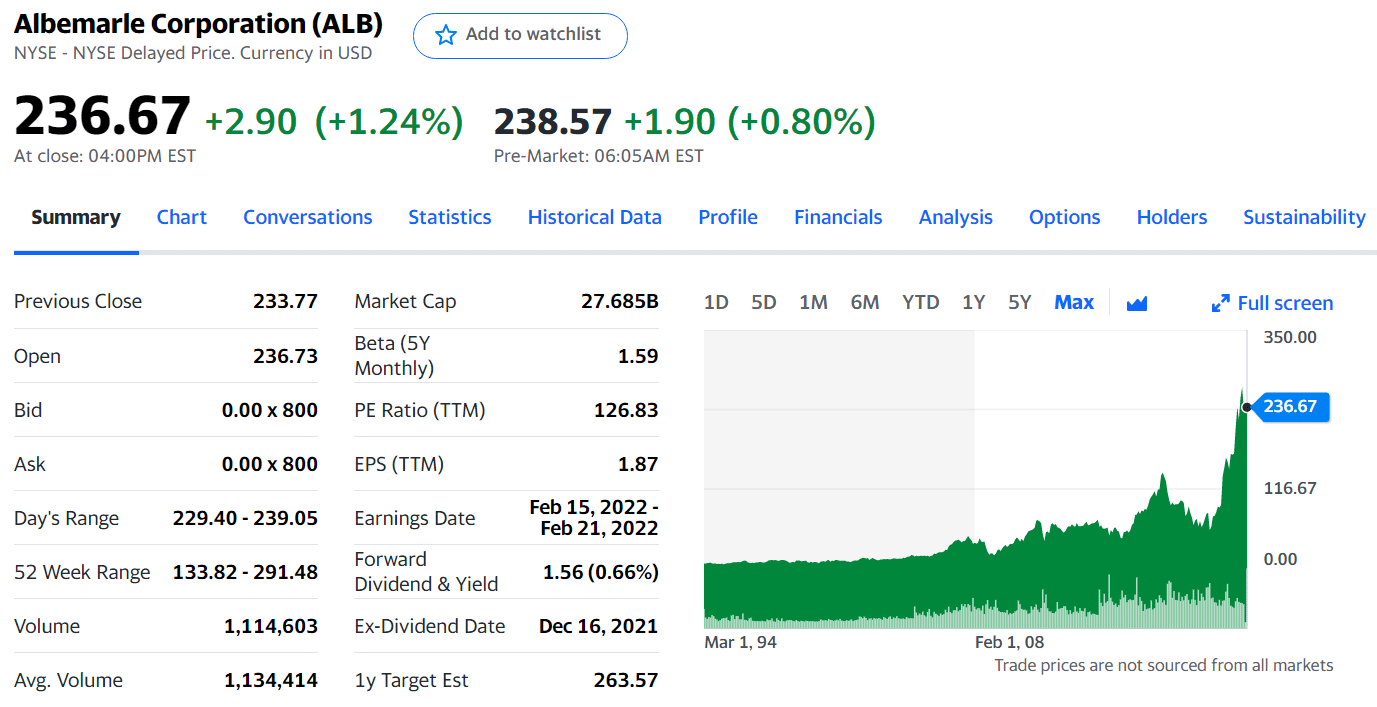

No. 1. Albemarle (ALB)

Price: $236.67

EPS: 1.87

Market capitalization: $27.685 billion

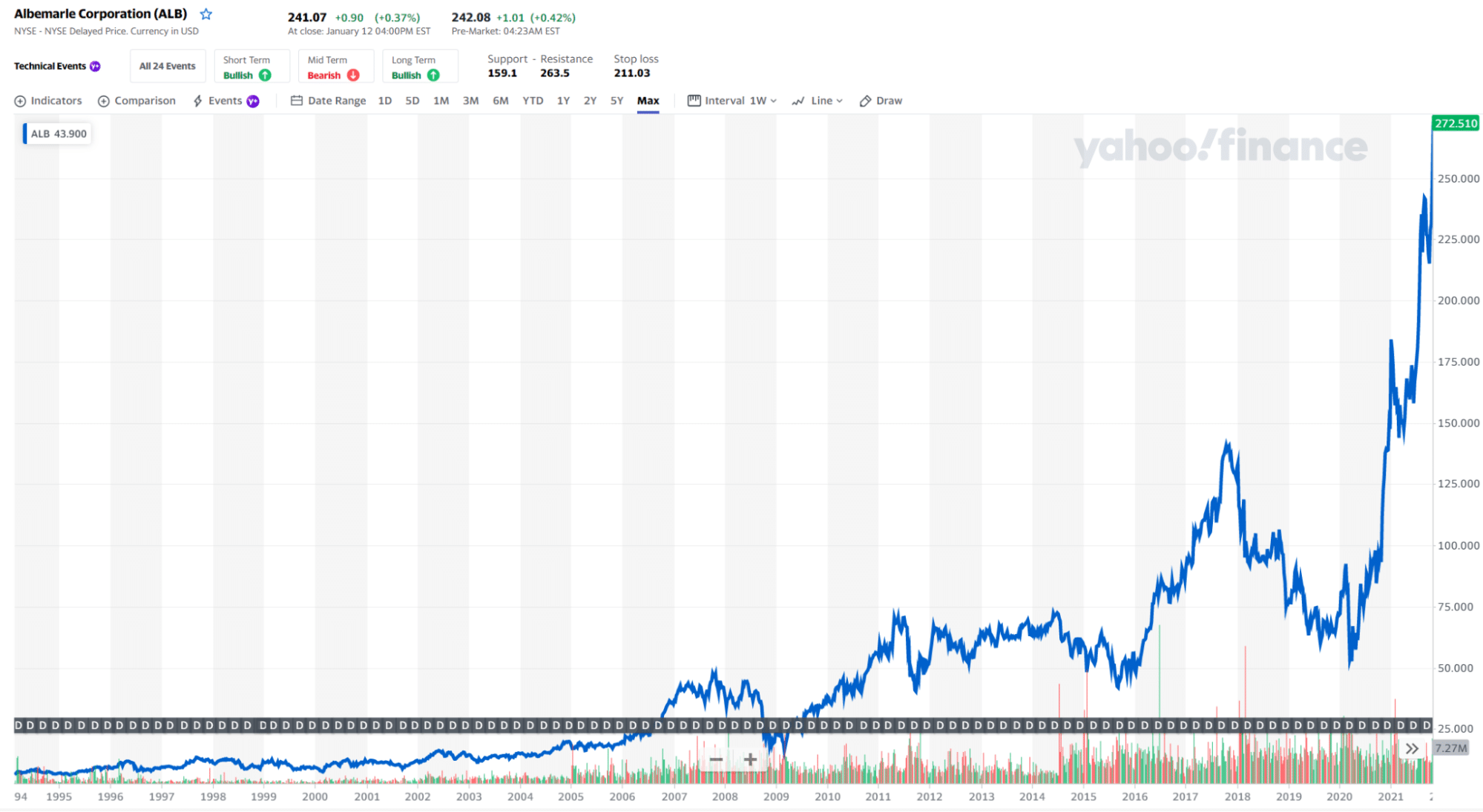

ALB stock price chart 1995-2022

Based in Charlotte, North Carolina, Albemarle is a chemical manufacturing company that produces the largest volumes of lithium in the world. The company utilizes thermal evaporators to recycle wastewater from its wastewater treatment facilities in Nevada, Silver Peak, Chile, and Salar de Atacama to produce lithium. The purified water is then fed to its processing plant, producing high-quality lithium carbonate.

ALB stock summary

Albemarle went public in February 1994. Since then, the company has continually given out dividend payments to stockholders yearly. The monthly chart of ALB stock below shows that the stock has made four explosive runs since its inception. It means that the stock grew exponentially in value over the years. At this point, the price looks expensive, though. Consider investing when the price has rotated to an area of support. Alternatively, you can use dollar-cost averaging if you strongly believe in this stock.

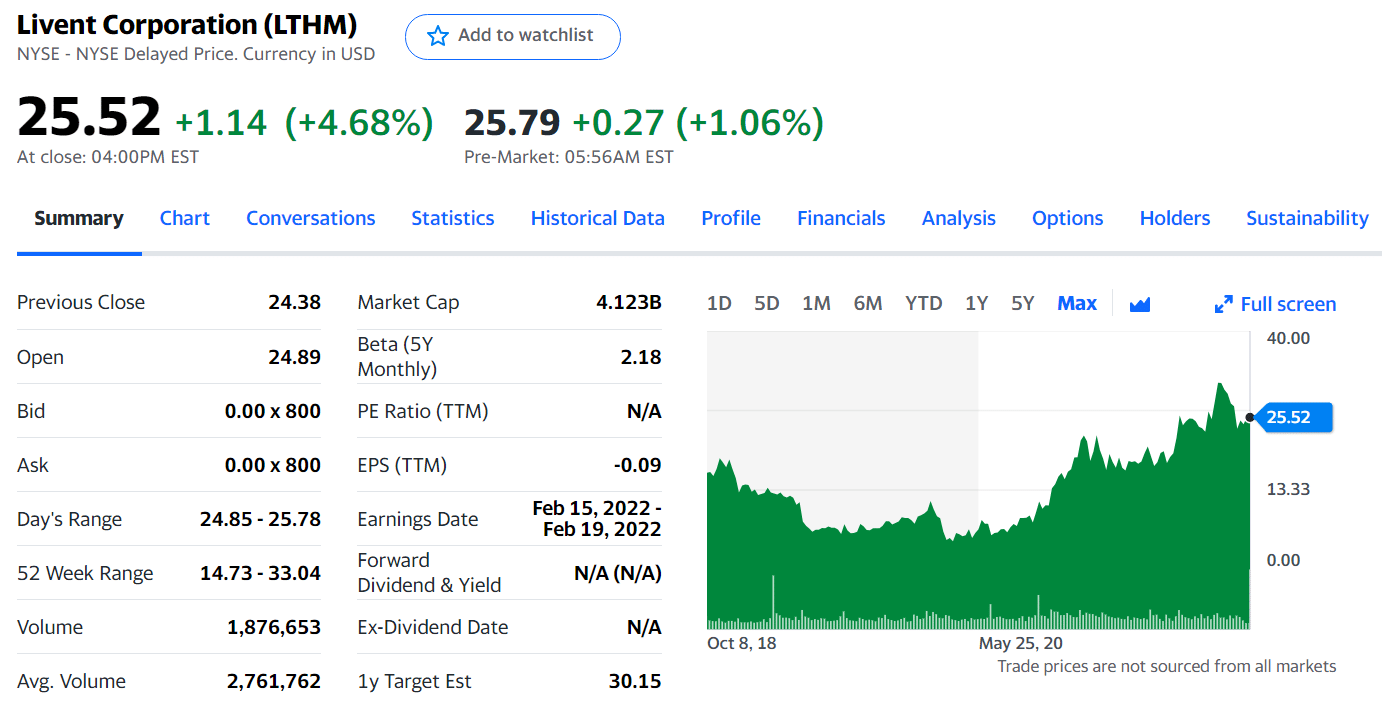

No. 2. Livent (LTHM)

Price: $25.52

EPS: -0.09

Market capitalization: $4.123 billion

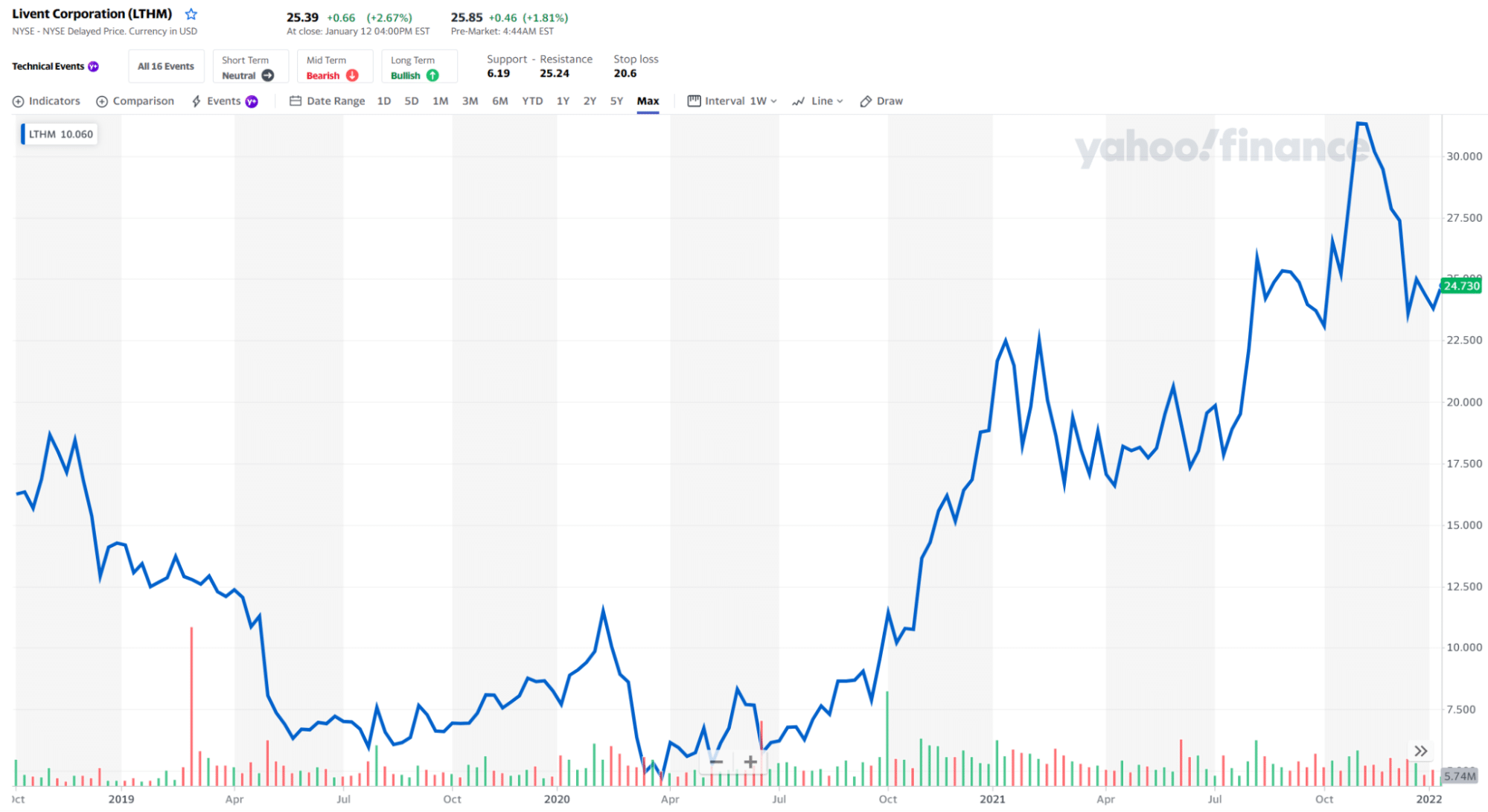

LTHM stock price chart 2019-2022

A company that has easy access to lithium sources is worth considering. One such company is Livent, a pure-play lithium supplier. The two main advantages of Livent over its competitors are its access to Lithium carbonate in Argentina and its Lithium plants in China and America. Although this market player is relatively new, it seems to have a sound footing right from the start. It is absolutely one stock you must look into.

LTHM stock summary

Compared to Albemarle, Livent is a relatively newcomer to the lithium industry. It began its public journey in October 2018. After losing almost 68 percent of its value in March 2020, the stock began its ascent in earnest and printed a massive step-up ladder structure in the weekly chart. At this time, the price is barely above support at 23.276 after a mild correction. Buying the stock right now can be your best entry into this market.

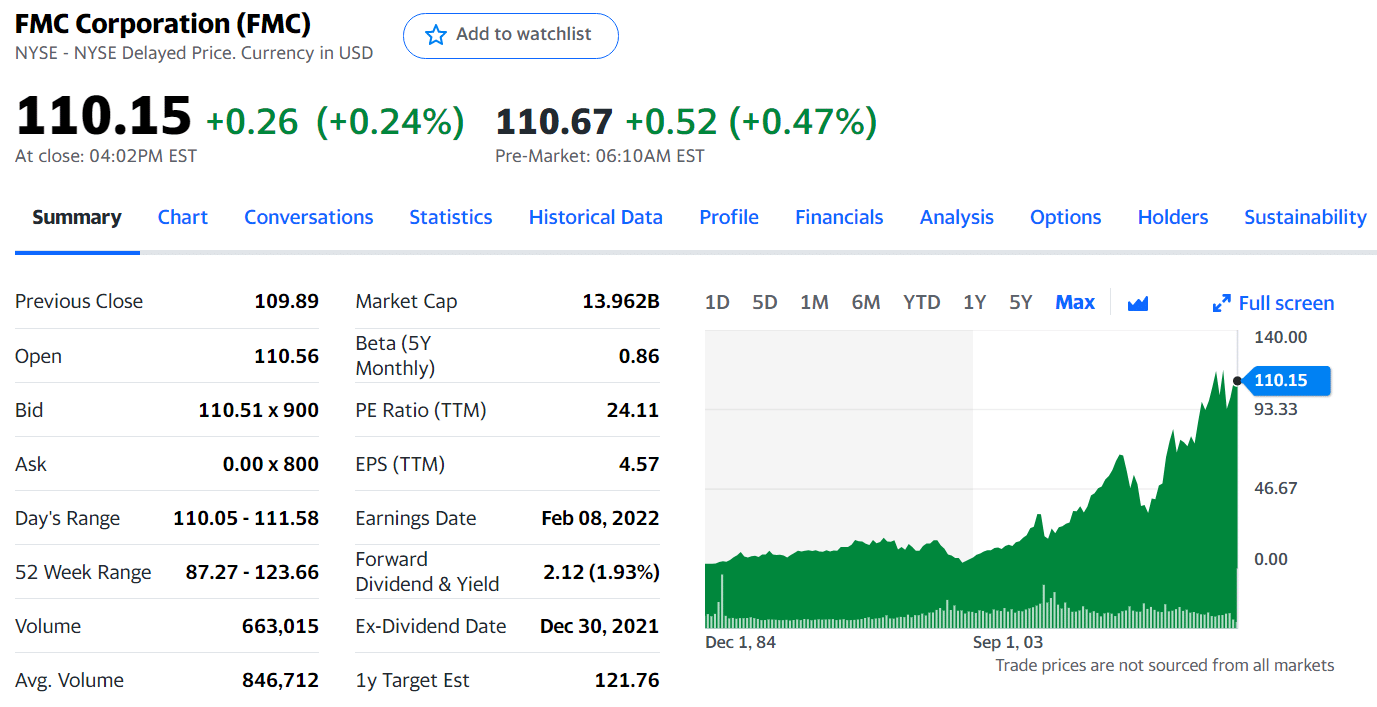

No. 3. FMC Corporation (FMC)

Price: $110.15

EPS: 4.57

Market capitalization: $13.962 billion

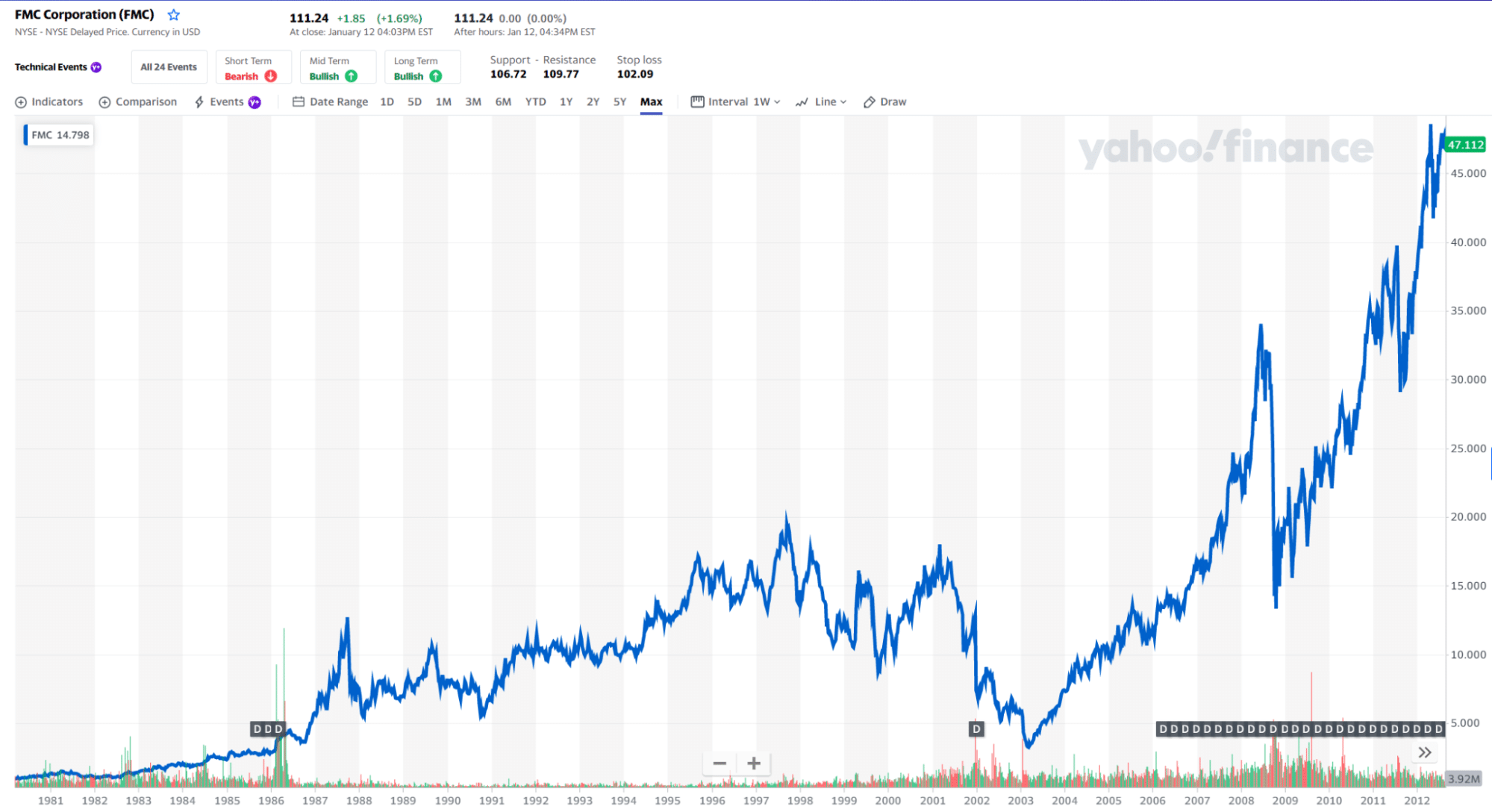

FMC stock price chart 1981-2022

Based in Philadelphia, FMC is a chemical manufacturer that produces and markets lithium worldwide. The main business of FMC is the production and marketing of crop management solutions. It made embarkation in the lithium sector in 1985 when it acquired Lithium Corporation of America. Around 30 years later, in 2018, the company decided to make the lithium segment a separate business.

FMC stock summary

Compared to the two stocks presented above, FMC is the longest-running stock in this list. It made its NYSE debut in March 1980. After more than 20 years of slow progress, the stock began a strong ascent in 2003. Since then, the stock underwent massive rallies at least three times. See the chart below.

At this point, the price is near the recent peak in March 2020 and is struggling to break above it. Overall, the long-term trend is bullish, but the near-term momentum is unclear. Buying the stock now might not be best as the possibility of a rotation is high.

Final thoughts

As more and more countries are getting involved in the clean energy movement, lithium stocks are likely to benefit. Lithium stocks are popular nowadays due to the high demand for lithium. This demand is fueled by the rise of companies producing electric vehicles, one of which is Tesla. Get yourself a handful of these stocks and enjoy the ride to take advantage of this trend. Limiting your exposure and diversifying your portfolio across various sectors to reduce the risk.

Comments