Very few consumer products stand the test of time. One of them is coffee. Legend believes that coffee was discovered around 850 AD by an Ethiopian goatherd named Khalid. He observed that his goats became restless and energetic after feeding on the fruits of a certain tree, which we now know as the coffee plant. In this day and age, about one billion people worldwide drink coffee daily. This makes coffee the number one drink globally in terms of popularity.

People cannot get over their love for drinking coffee because of its taste, aroma, and addictive properties. Despite the addictive effect of coffee, research after research provides that regular coffee drinking has no negative effect on your well-being. Since coffee is a timeless product, investing in coffee stocks can be rewarding.

If you want to take part in the coffee industry as an investor, navigating the field can be challenging due to its vast scope. To help you get started with your coffee stock search, we list down three of the top-of-the-line coffee stocks in this article.

What are coffee stocks?

Coffee stocks are public companies operating in the big coffee market. This industry is somewhat complex and is made up of multiple sectors. A coffee stock may specialize in producing, distributing, processing, wholesaling, or retailing coffee products.

You can find many stocks exposed to the coffee market in the consumer essentials and consumer discretionary fields. Generally, retailers and coffee shops belong to the consumer discretionary sector, while companies that produce coffee and packed coffee products belong to the consumer essentials sector.

How to buy coffee stocks?

Investing in coffee stocks follows the same process as buying stocks from other sectors. Naturally, it would help if you connected to a brokerage firm that offers the coffee stocks of your choice. The main challenge lies in your selection of stocks due to many players. The best thing you can do is start your search from the most familiar brands and begin to spread out.

You can find companies focusing mainly on coffee products, but many companies are operating in multiple segments besides coffee. This is one criterion you can use. Are you going for pure-play coffee stocks or a conglomerate? Selecting stocks operating in various segments or sectors can make performance monitoring challenging. Growth in the coffee business might be overwhelmed by a decline in other fronts of the operations.

Top three coffee stocks to buy in 2022

Below are three of the most popular and long-running coffee stocks of today. Consider them in your coffee stock selection and investment in 2022.

No. 1. Starbucks (SBUX)

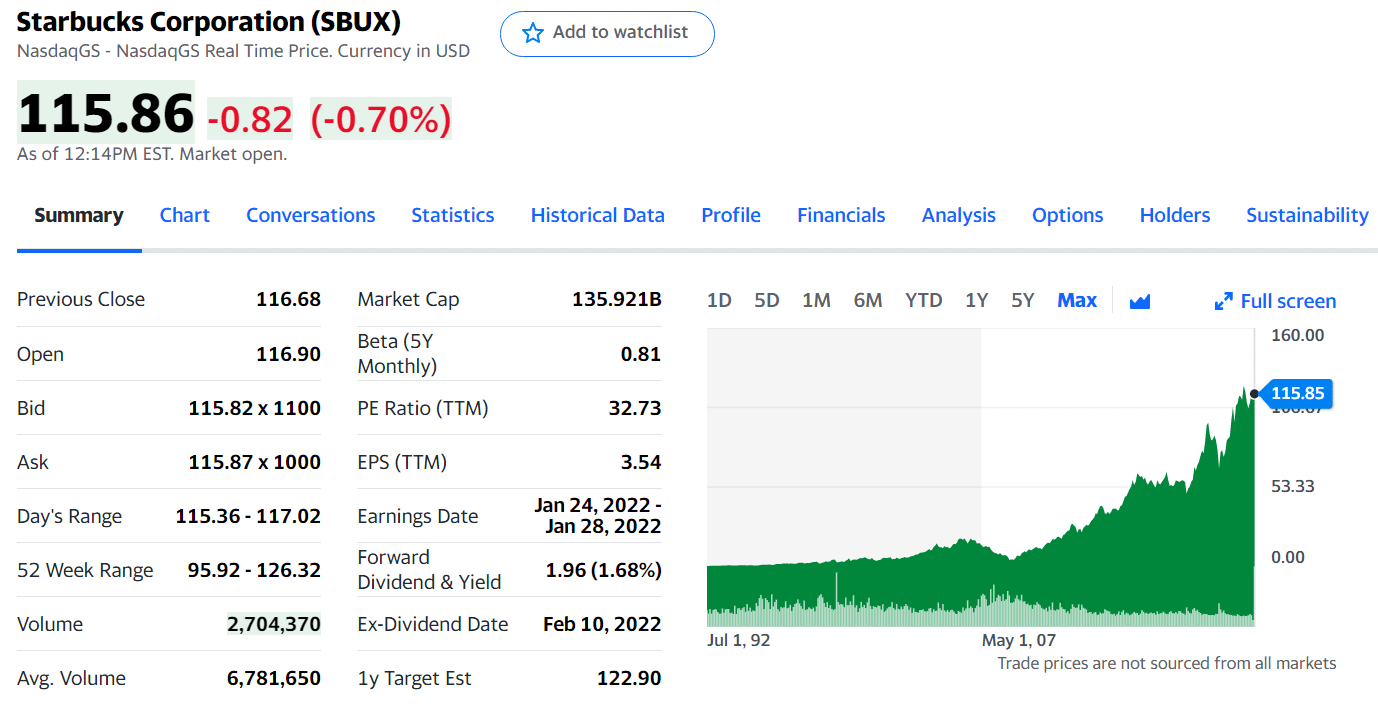

Price: $115.86

EPS: 3.54

Market capitalization: $135.921 billion

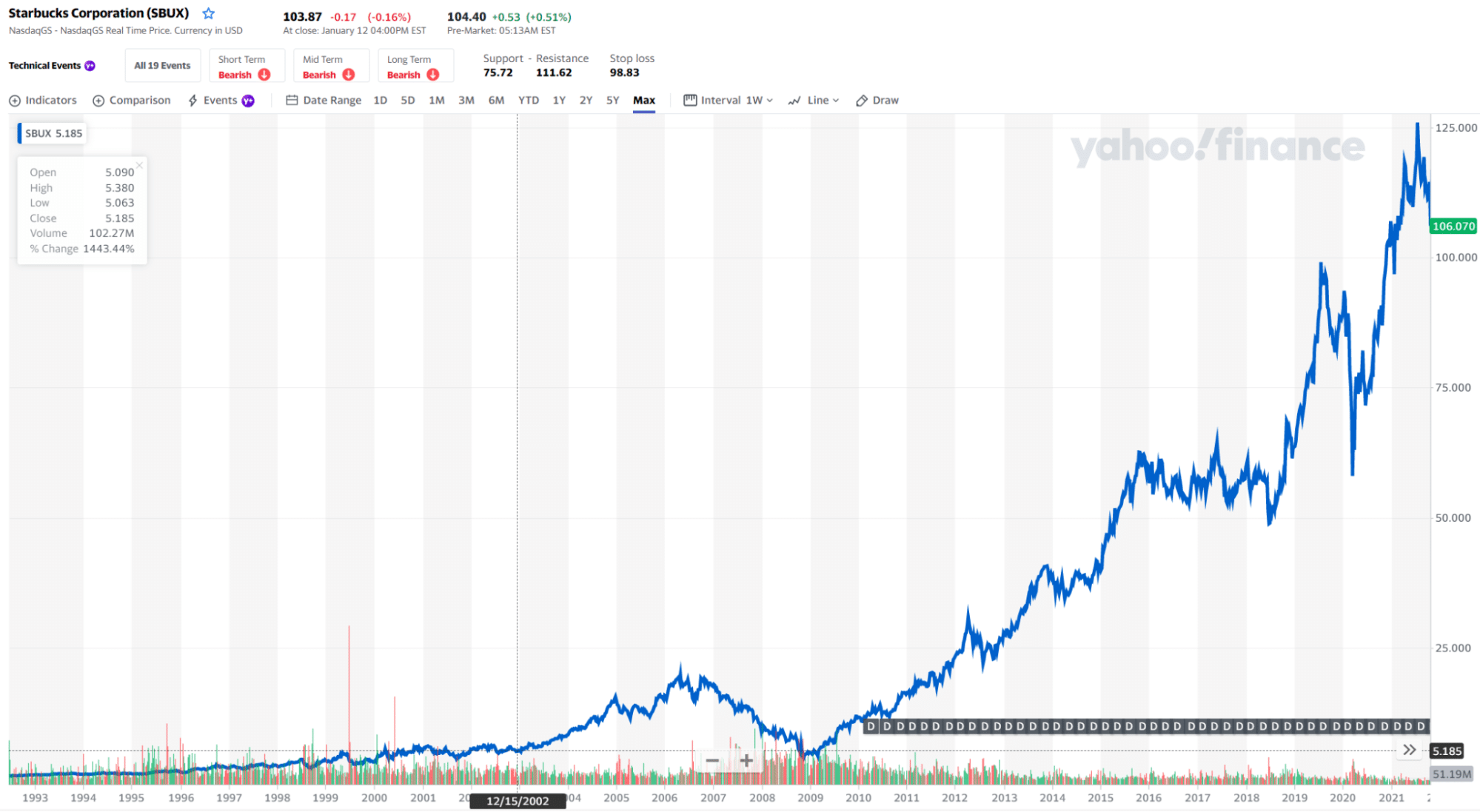

SBUX stock price chart 1993-2022

If you want to engage in pure-play coffee stocks, Starbucks is a good choice. This company is a dominant force in the café industry worldwide. You can hardly find cities without a Starbucks shop in any country. You can see it inside and outside big shopping malls. Starbucks sets itself as another location apart from home and workplace where people chat with friends or unwind. Today, Starbucks runs over 30,000 shops all over the world.

SBUX stock price chart 1993-2022

Starbucks as a stock has been around for 29 years. When it got listed in NASDAQ, the stock slowly climbed in value until 2005. From 2006 to 2008, the company faced a sell-off during a recession. After this, the company has continually released dividends to its stockholders year after year. In accordance, the share price has kept on rising since then up to this day. See the monthly chart below. While the stock is poised for further growth, the timing might not be optimal if you buy it now. As you can see, the stock looks expensive.

No. 2. Nestle (NSRGY)

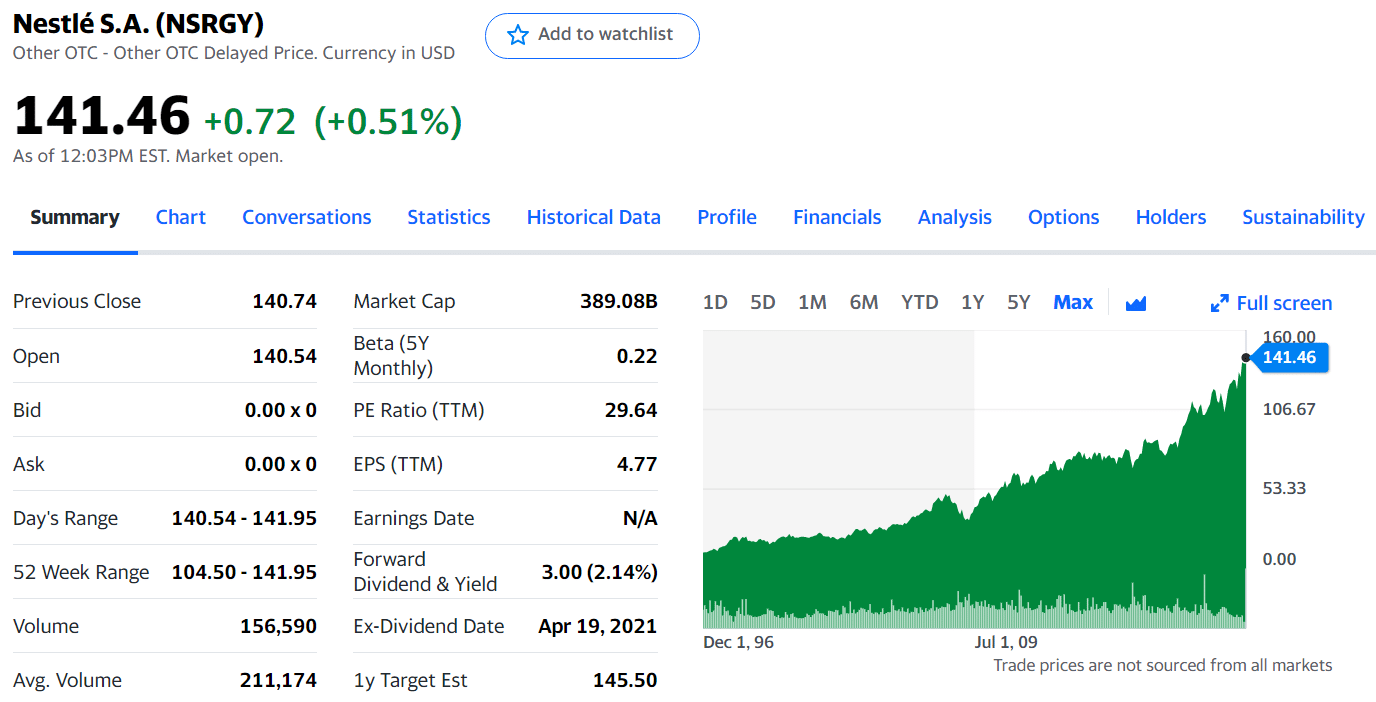

Price: $141.46

EPS: 4.77

Market capitalization: $389.08 billion

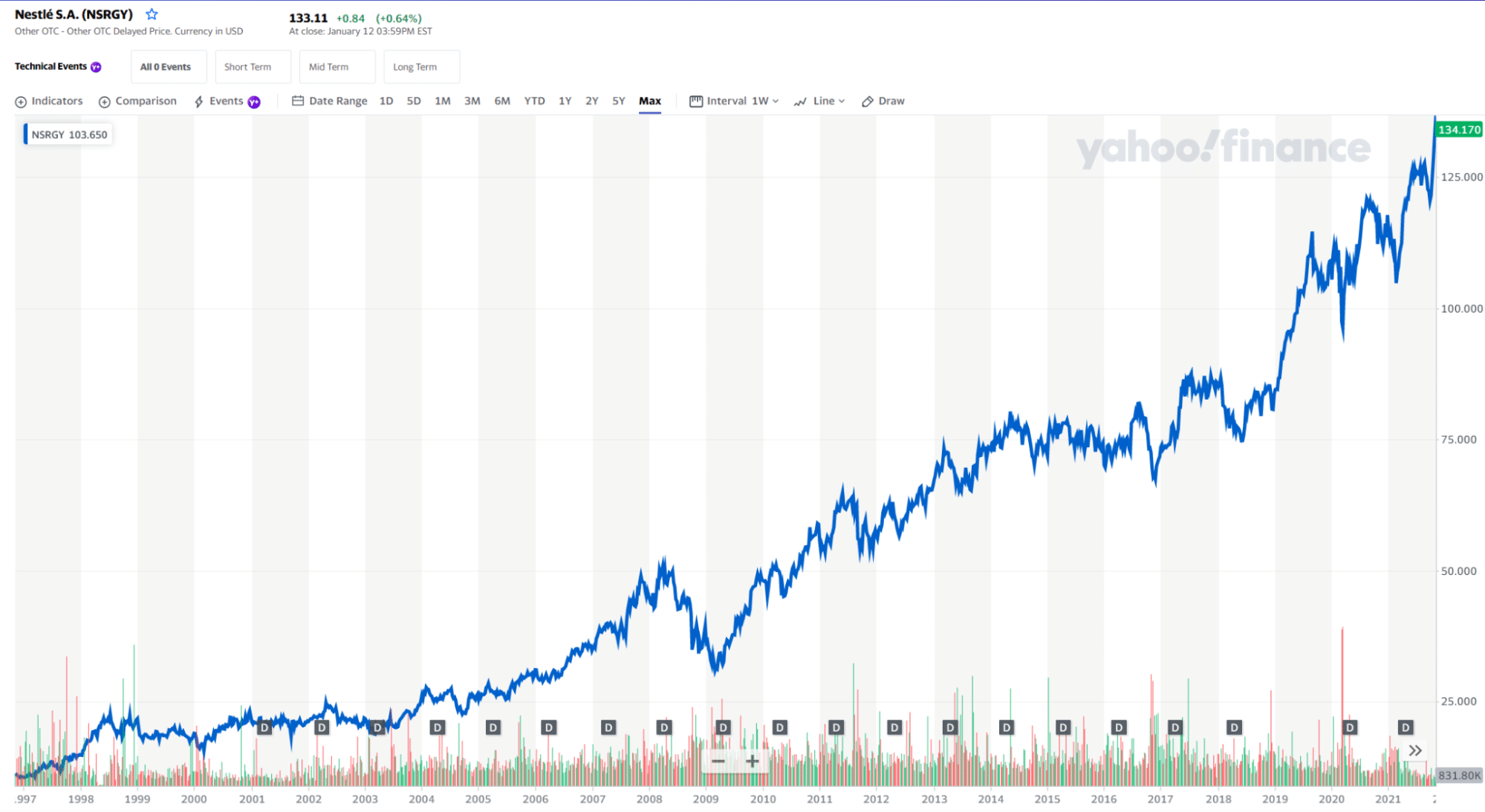

NSRGY stock price chart 1998-2022

Nestle is the biggest food manufacturer in the world. It has over 2,000 well-known brands in numerous sectors that cover products such as bottled water, tea, soup, pet food, candy and sweets, condiments, and, of course, coffee. Nestle has coffee as its major profit-generating segment despite being a highly diversified business.

Nestle stock summary

Nestle is one of a few stocks that have made steady growth over the years since its IPO day. While the company encountered losing years, massive gains overwhelmed those years. If you look at the monthly chart below, the stock is predominantly bullish and seems to be gaining steam as it moves over time.

The stock registered a new high in December 2021, which was broken when January 2022 came in. Currently, the price is too high and might be risky if you go all-in with one shot. The better approach is to wait for rotation to value areas or open your position in tranches as price moves down.

No. 3: JM Smucker (SJM)

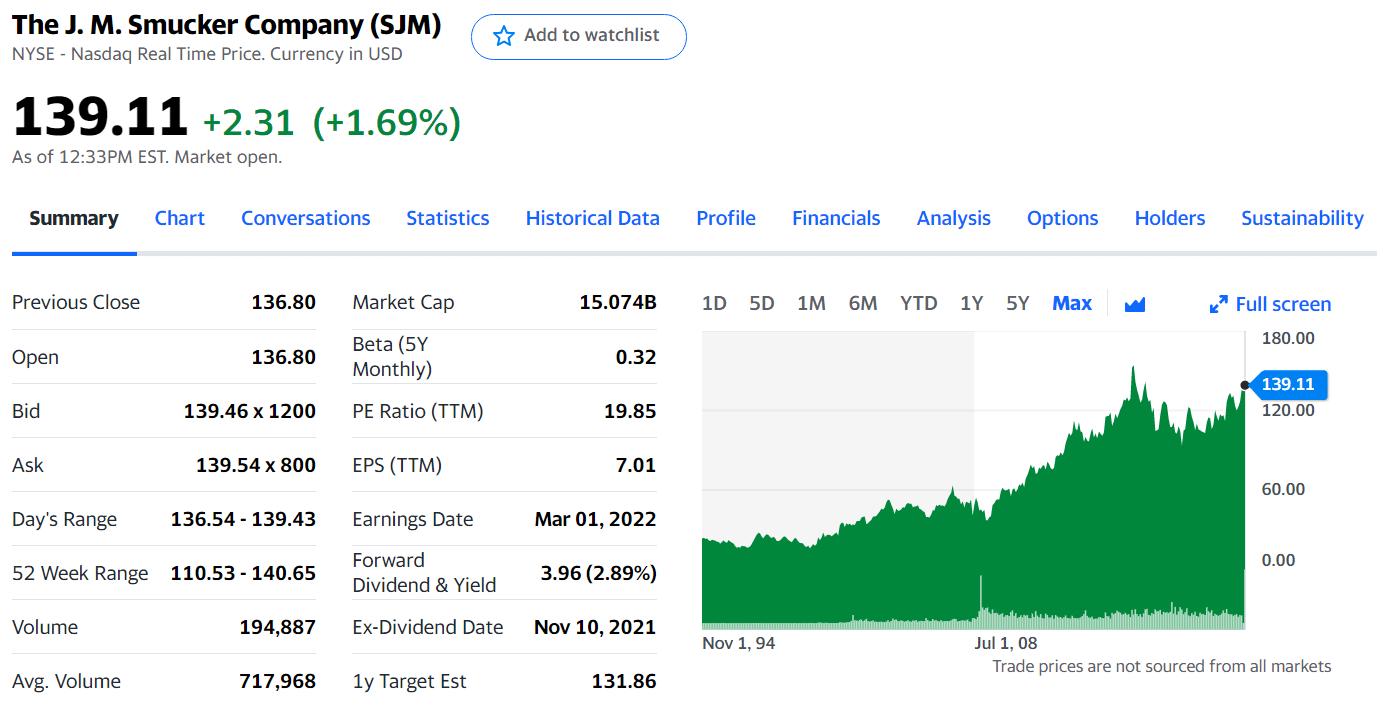

Price: $139.11

EPS: 7.01

Market capitalization: $15.074 billion

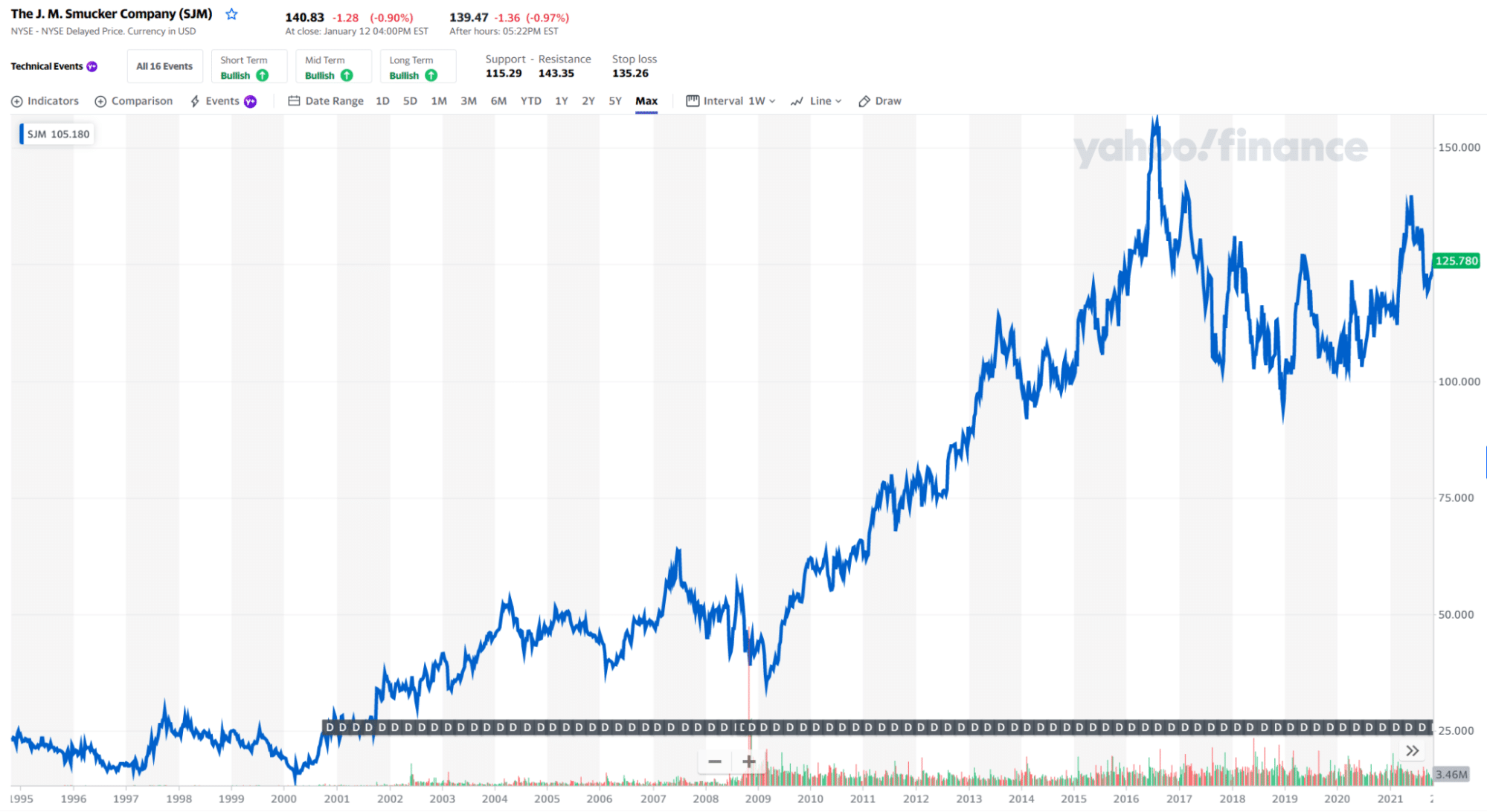

SJM stock price chart 1995-2022

JM Smucker produces and markets food products all over the world. Packaged coffee is a primary product of the company and accounts for the major portion of its profits. In 2021, Smucker generated 42 percent of its profits from its coffee business, which is 10 percent higher than its 2020 profits.

Smucker stock summary

Smucker is an interesting stock as it has given out dividends continuously for around 20 years since 2000. This is true even if the company encountered some losing years. Overall, the stock looks bullish on the monthly chart below. It made a strong rally after the 2008 recession and registered a top in August 2016.

After that, the price was corrected and consolidated above the $100 level. Price has been in this range for five years already, and it looks like an upside breakout is coming soon. Smucker is a better buy from a technical perspective than the two stocks above.

Final thoughts

Because the coffee industry is vast and competitive, you have plenty of investing opportunities at your disposal. You can choose either a dividend stock or a growth stock. In terms of risk, the coffee sector looks stable in the face of environmental challenges worldwide. It is worth looking at as an investment option.

Comments