Naragot Portfolio is based on the principles of volatility breakout and follows seven strategies that the developer claims to use on their live account. The robot uses a fixed stop loss and take profit on each position, and does not trade frequently. To cover all the pros and cons of the system, we will look at the MQL 5 page and make a detailed list of all its characteristics.

The developers state that the robot is a professional system that trades on multiple currencies using selected strategies. It does not rely on any indicator and uses risk management to maintain the drawdown. To verify all the statements, we had to review the product.

What is behind the Naragot Portfolio?

Alexander Mordashov is the author of the product who resides in Russia. He has a total rating of 5 for 33 reviews. The developer has ten products published on the MQL 5 marketplace and has 1 subscriber for his services. He has one year of experience according to the website.

How to set up the robot?

The robot works on the MT4 and MT 5 platforms:

- Traders have to purchase the robot from the MQL 5 website

- After that login to your MQL 5 on the MetaTrader platform

- Download the robot from the market section

- Place it on the charts to start trading

How it works

The system generates income by scanning the market on auto mode. It executes trades when there is an appropriate signal and manages it until closed. Traders do not have to interfere with the positions.

Key features

The robot has the following key features:

- It has risk management settings

- Traders can use it on multiple currencies

- There are no indicators underuse

- The robot does not use any risky strategies such as grid or martingale

Trading strategy

The developer states that the robot trades on EURUSD, GBPUSD, XAUUSD, and USDJPY and uses price action to analyze the markets. It has a fixed stop loss and take profit for each position, and does not use risky grid and martingale strategies. The history on the Myfxbook records is locked, so we cannot analyze the methodology ourselves. We can see that the average trade duration is 10 hours and 41 minutes, conforming to a day trading approach.

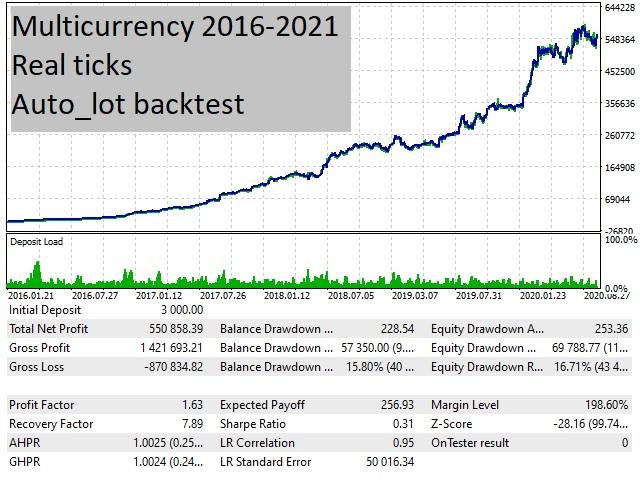

Backtesting results are available for multiple currencies with unknown testing quality. The relative drawdown was around 16.71%. The robot had a profit factor of 1.63 and an expected payoff of 256.93.

The algorithm had a total net profit of $550858.39 with an initial deposit of $3000. Most of the records are hidden as the image is cropped.

Backtesting records

Pricing

The algorithm is only available for an asking price of $333 with no money-back guarantee. There are no renting options present.

The pricing model of the robot

Trading performance of Naragot Portfolio

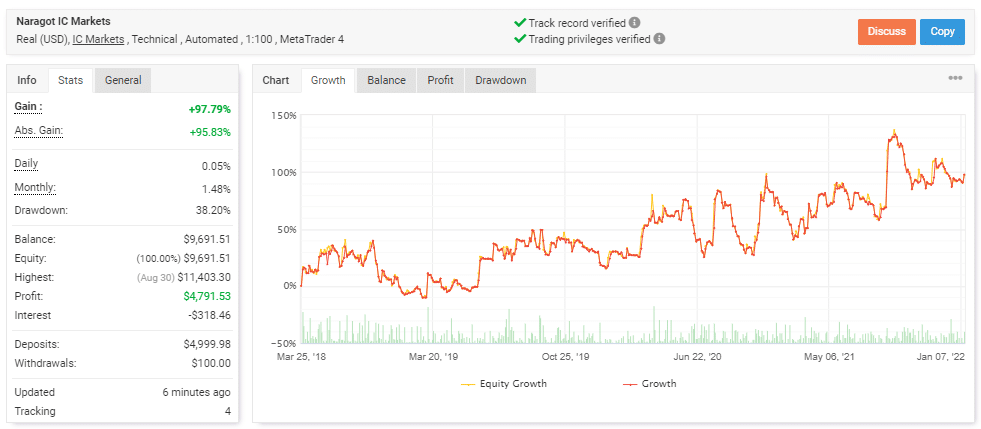

Live trading results are available on Myfxbook. We have a performance from March 25, 2018, till the current date. The system made an average monthly gain of 1.48%, with a drawdown of 38.2%.

The winning rate stood at 40%, with a profit factor of 1.11. The best trade was $267.62, while the worst was -$178.6 within 6330 trades.

The developer trades with a real account with a deposit of $4999.98. The current balance of the system is $9691.51, with a total gain of 97.79%.

Live trading records on FXBlue

Customer support

Customer support is only available by contacting the developer through the MQL 5 marketplace. There is no information on the availability hours.

People feedback

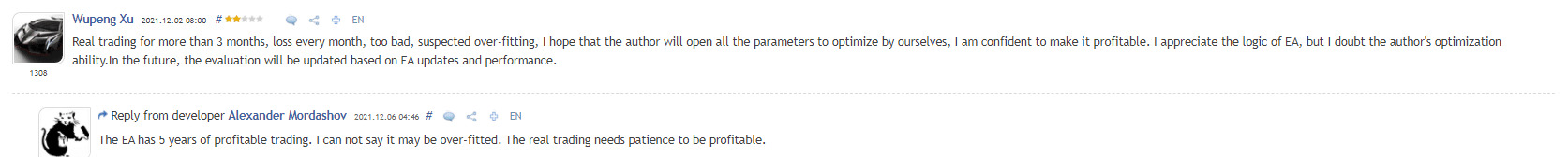

The company has a total rating of 3.95 for 22 reviews on MQL 5. One of the traders states that the robot is over-optimized and that he is facing losses after three months of trading.

The customer review at FPA

Comments