Metals such as cobalt have become a favorite of investors. As the electric car market grows, its price is skyrocketing. Yet what about the long-term fundamentals, and what should investors consider when choosing cobalt stocks?

Throughout history, metal has played an essential role in a wide range of applications, from magnets to paint to chemical catalysts. However, the metal’s importance in batteries for electric appliances and automobiles has caused demand to rise sharply. Battery chemicals account for almost half of the metal’s production. In addition, most metal goes into superalloys used in high-end products, such as aircraft engines. Recently, cobalt, a rare metal element, has become more expensive and famous.

This article will cover the global cobalt market and show you which three cobalt stocks are worth adding to your portfolio.

What are cobalt stocks?

In copper mining, cobalt is a byproduct. Cobalt mining interests also exist in South America and Indonesia. Copper, gold, molybdenum, silver, and other rare metals are among the minerals Freeport-McMoRan mines, along with oil and gas. The company operates over 150 wells worldwide, most of them in California.

How to buy cobalt stocks?

It is possible to invest in cobalt in two ways: cobalt futures and cobalt stocks.

A futures contract for cobalt trades on the London Metal Exchange is under CO. The tonne-based futures were introduced in early 2010 and traded in US dollars. The arrangements are typically for 15 months, allowing investors to bet on the metal over a range of periods.

The cobalt mining sector is another option for gaining exposure to critical metals. However, the smaller companies must concentrate on value-added products downstream rather than simply producing concentrates, such as cobalt sulfate, targeting the battery market.

In our year-to-date overview of cobalt companies that have seen gains, we include several larger companies with exposure to cobalt, as well as some smaller firms entering the space. This is an excellent place to start if you are new to the industry.

Top 3 cobalt stocks to buy in 2022

This industry context is the basis for this list of the ten best cobalt stocks to buy in 2022. As the shadow of the Coronavirus recedes, the aviation market starts to grow, more electric vehicles hit the road, and record numbers of electronics come out of factories around the world.

No. 1. Wheaton Precious Metals (WPM)

Price: $48.10

EPS: $1.38

Market cap: 22.293B

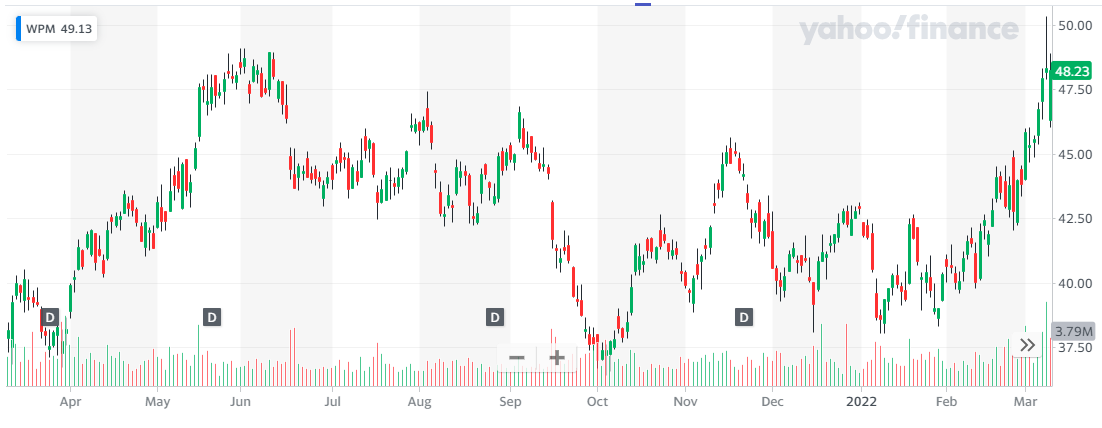

Wheaton Precious Metals price chart

Wheaton Precious Metals, based in Vancouver, Canada, is another cobalt stock that isn’t direct. Instead, the company offers gold and silver bullion. Silver and gold production amounted to 30.4 million ounces and 357,300 ounces, respectively, in 2016.

Despite Wheaton’s lack of cobalt production, the company has recently acquired Vale’s cobalt production. Thus, it will own 42.4% of Canadian cobalt production at Voisey’s Bay. Continuation of this will occur until 31 million pounds of cobalt are produced, and after that, they will receive 21.2% of the production.

In 2020, Wheaton generated $248 million in revenue with a net income of $105.8 million. It can produce various metals through its 14 “streams.” Eight of its development projects are already underway, and 24 of its mines are currently operating.

WMP summary

The first three holdings:

- Capital World Investors (U.S.) — 4.18

- First Eagle Investment Management, LLC — 3.68

- BlackRock Investment Management (U.K.), LTD — 3.40

No. 2. Glencore (GLEN.L)

Price: $511.30

EPS: $27.70

Market cap: 65.649B

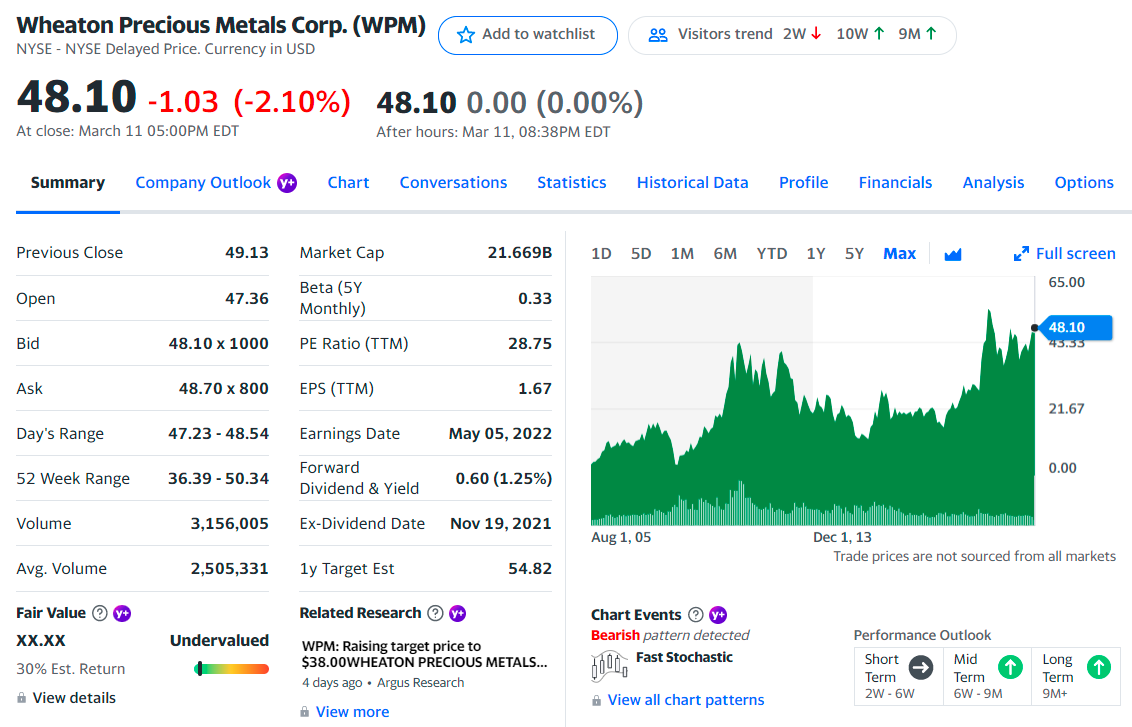

GLEN-core price chart

Glencore (GLEN.L) is a Swiss multinational corporation with mines in the Democratic Republic of the Congo and operations in Australia, Canada, and Norway. It is one of the largest producers of cobalt in the world. Its repertoire of assets consists of copper, cobalt, nickel, zinc, lead, chrome ore, ferrochrome, vanadium, alumina, aluminum, tin, and iron ore. It is also a global provider of coal, crude oil, and natural gas and oil exploration, production, distribution, storage, and bunkering.

According to December 2020 financial reports, the company had $140 billion in revenue and a market capitalization of $53 billion.

Last month, Tony Hayward, chairman of the firm, announced that he would step down next year. The company has been under Hayward’s leadership for the past nine years. Copper and battery metal demand has boosted the firm’s shares over the past few months, fueling its steady rise. As a result, the company ranks 9th in our list of the top 10 best cobalt stocks of 2021.

GLEN.L summary

The first three holdings:

- Thomas White International Ltd — 0.01%

- Harris Associates LP — 0.01%

- Windsor Creek Advisors LLC — 0.00%

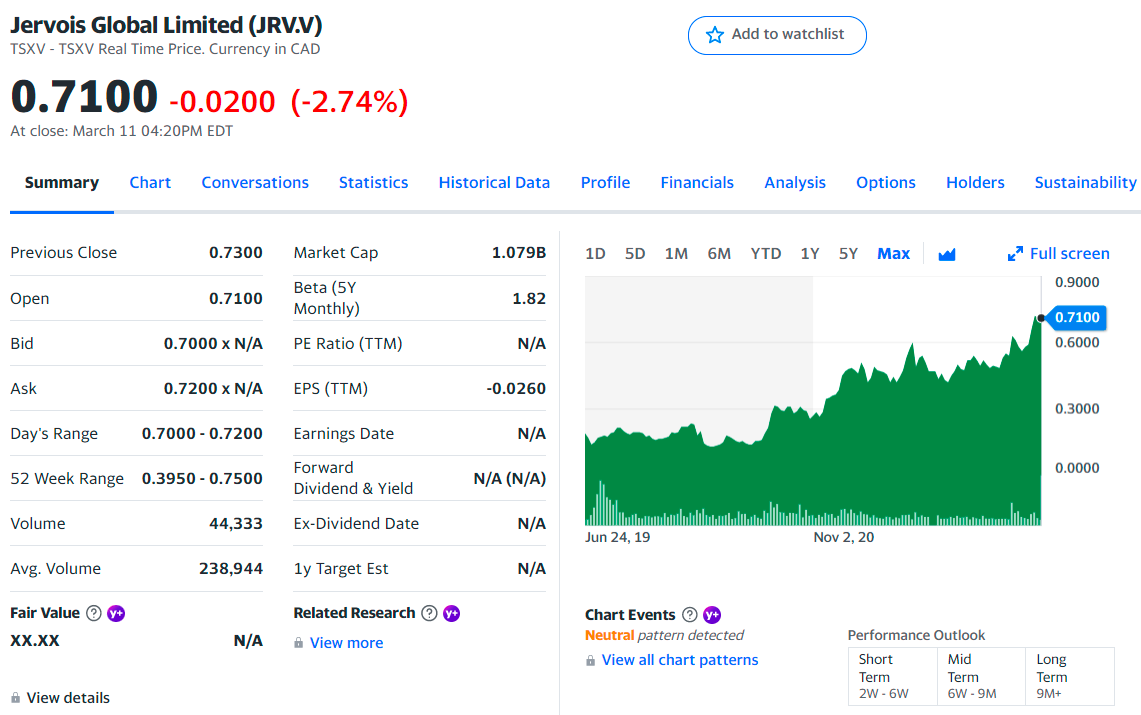

No. 3. Jervois Global Limited (JRV)

Price: $0.71

EPS: $-0.0710

Market cap 1.155B

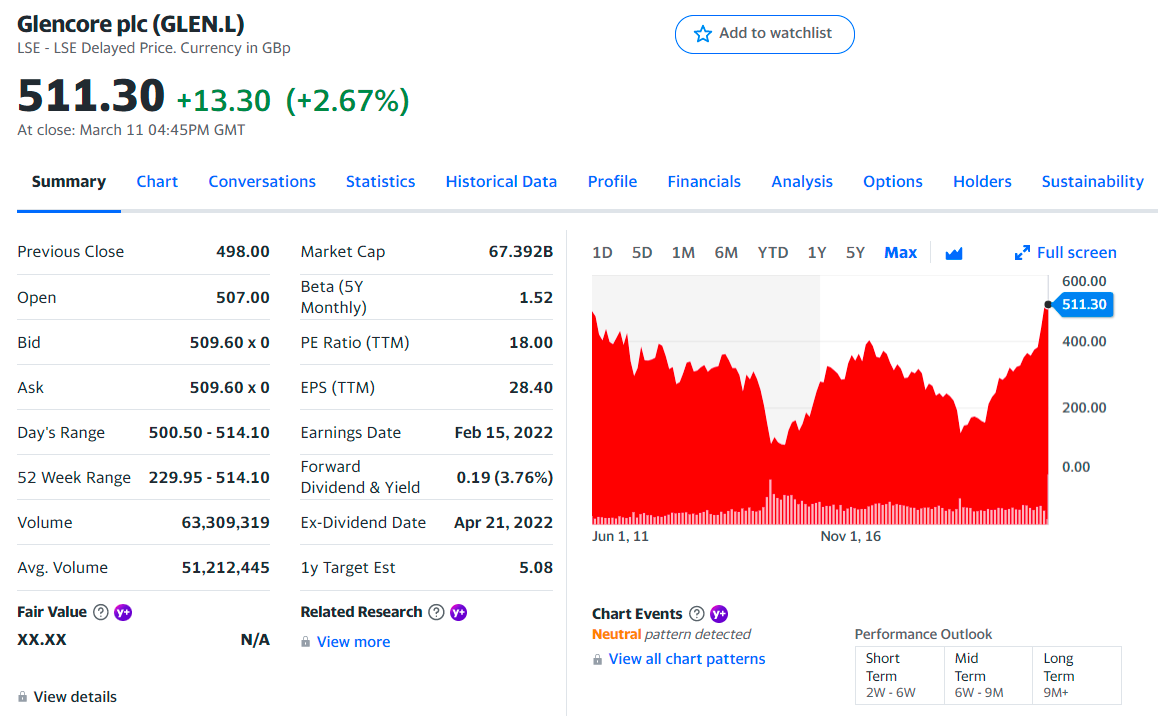

Jervois price chart

The company is a battery metal developer with a portfolio that includes a cobalt-copper mine in Idaho, USA, a nickel-cobalt refinery in Sao Paulo, Brazil, a nickel-cobalt resource in NSW, and is conducting exploration in Uganda.

As part of its Bankable Feasibility Study (BFS), the San Miguel Paulista (SMP) Nickel Cobalt Refinery in Brazil will increase the capacity of its pressure oxygen (POX) leach circuit.

Using the knowledge gained from the acquisition of Jervois Finland, JRV says the BFS will be able to produce nickel sulfate crystals with a dedicated crystallizer circuit. This product can supply both the plating and battery industries.

The mine, Idaho Cobalt Operations, will be commissioned in 2022 after Jervois spends more than $30 million on equipment, materials, and labor costs.

JRV summary

The first three holdings:

- McCusker Holdings Pty Ltd. — 0.97%

- Invesco Advisers, Inc — 0.70%

- Brian Anthony Kennedy — 0.60%

Final thoughts

The demand for cobalt will double by 2030, making the future look bright. In many countries, governments have set ambitious targets to reduce sales of internal combustion engines or phase them out entirely. Because cobalt is a rare metal, those who own the means of producing it now will be in a good position for the future.

It does not mean there are no risks associated with cobalt. An increase in production has raised concerns due to its toxic properties and source in central Africa. There are ongoing research efforts to reduce or even eliminate cobalt from batteries, even though the metal is key to battery production today. Cobalt production will likely continue to increase for several more years, but it is uncertain if it will continue to grow forever.

Comments