When talking about alcohol investments, the first option you hear about is stocks, bonds, ETFs, or mutual funds. But is this the best strategy for investing in spirits and wine? Are you guaranteed consistent growth in times of economic downturn? There’s a lot more to investing in alcohol stocks than just picking up a favorite beverage.

The purpose of this article is to highlight three of the best performing alcohol and wine stocks you can invest in and to outline the pros and cons of investing in alcohol stocks. Plus, you’ll learn a more convenient way to make money by investing in the lucrative wine market.

What are alcohol stocks?

Alcohol generates a great deal of revenue. Water is necessary for the alcohol distilling process, so some overlap with the water services’ economic sector.

While general consumer spending may take a hit elsewhere, alcohol sales remain stable throughout slow but steady beverage businesses.

During times of economic instability, alcohol sales may even rise, as they did during the Covid-19 pandemic.

Beer-making also overlaps with these activities. For example, Budweiser parent AB InBev (BUD) owns the Corona and Modelo brands and Boston Beer Company (SAM), making Samuel Adams. Both of these companies are manufacturers of brands outside of their core operations.

How to buy alcohol stocks?

A stock in an alcohol company might be the perfect choice for those who wish to diversify their portfolio or dabble in some adventurous territory. Stock within the alcohol sector is a company that manufactures or distributes liquor, such as wine, beer, and whiskey. This product falls under a ‘sin stock,’ which refers to unethical products. Drugs and war equipment also belong to the sin stock category. Alcohol, however, offers traders an appealing option. Alcohol consumption occurs worldwide and throughout the year, so you stand to gain high dividends.

Many platforms overcomplicate the process of buying stocks, alienating investors, especially beginners, in the process. Therefore, we have created a simple guide to make buying your first alcohol stock as easy and convenient as possible.

Step 1

Create an account on any platform that offers it. To purchase your first stock in alcohol, you need to open an account on a brokerage site. The process of registering is as simple as typing in the platform name into your internet browser and clicking on ‘join now’ to complete the registration.

Step 2

Fill out the KYC form. After creating your account, the first step is to identify yourself, as these platforms require strict identification. A photo ID and proof of address will suffice to verify your identity.

Step 3

Deposit money. The final step before purchasing alcohol stocks is to deposit money for the purchase into your account. By clicking ‘deposit funds,’ entering $100 as your deposit amount, then click ‘deposit,’ that’s it. Again, you can use a credit card, debit card, bank transfer, or eWallet such as PayPal for the transaction.

Step 4

Purchase alcohol stocks. Now that you know how to invest in alcohol stocks, you are ready to buy. To find a company on the alcohol market, you need to type its name into the search bar. For example, the company name may be Boston Beer (SAM). Next, you will need to select the trade, fill in the amount you would like to purchase, and click on ‘open trade’ again.

Top 3 alcohol stocks to buy in 2022

Following are the top three stocks that you can add to your portfolio for making money.

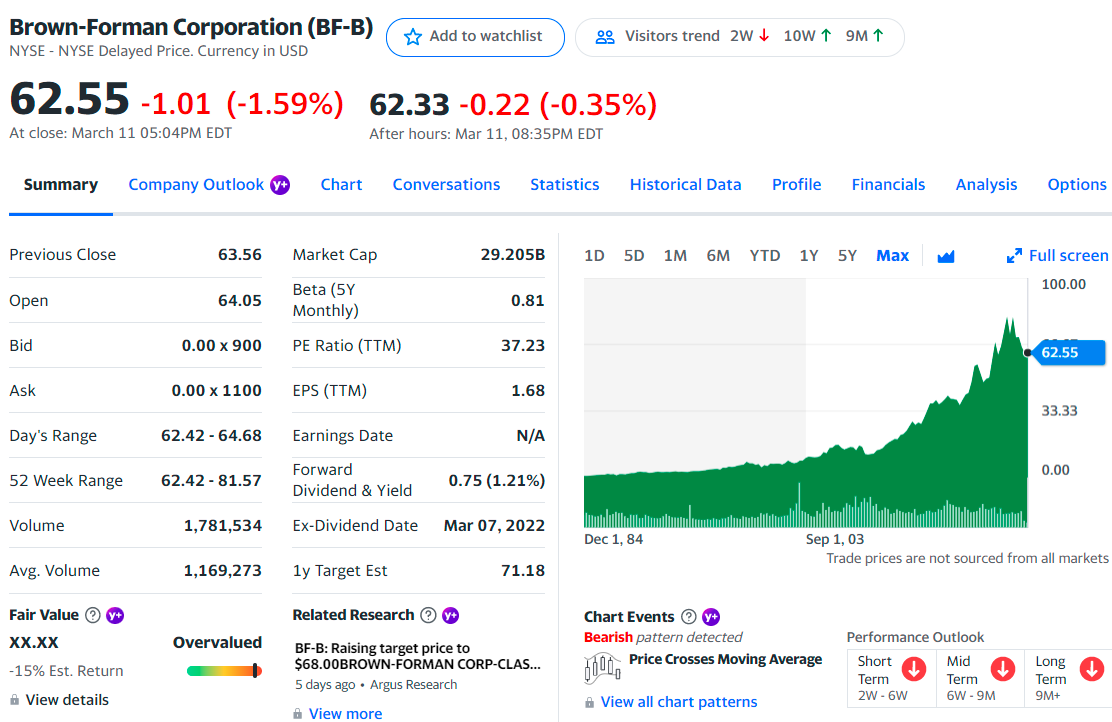

No. 1. Brown-Forman (BF.B)

Price: $62.55

EPS: $1.68

Market cap: 29.607B

Brown-Forman price chart

Historically, Brown-Forman has increased its dividends consistently. With 38 consecutive years of dividend increases, it is a Dividend, Aristocrat.

A strong brand portfolio and recession resilience have led to Brown-Forman’s long dividend growth history. The company has a wide range of products, mainly whiskey, vodka, and tequila. Historically, Jack Daniel’s has been their most famous brand. In addition to these brands, Herradura, Woodford Reserve, El Jimador, and Finlandia are also popular choices.

We anticipate Brown-Forman’s earnings to grow by approximately 7% in the next five years. Additionally, Brown-Forman’s stock yields 1.1%.

Although Brown-Forman’s P/E of 39 appears significantly overvalued, our fair value multiple of 24 suggests it is undervalued.

BF-B summary

The first three holdings:

- The Vanguard Group, Inc. — 6.54%

- Fundsmith LLP — 4.99%

- SSgA Funds Management, Inc. — 3.37%

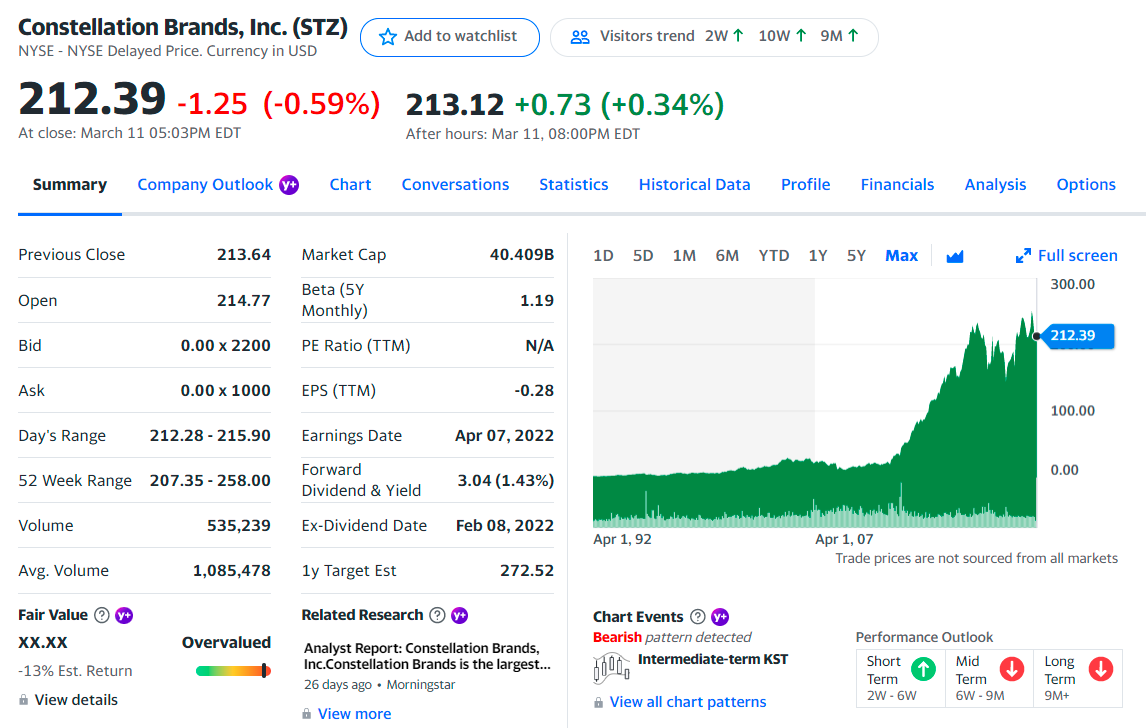

No. 2. Constellation Brands (STZ)

Price: $212.39

EPS: $-0.28

Market cap: 40.598B

Constellation Brands price chart

The New York-based corporation Constellation Brands makes beer, wine, and spirits. With over 100 brands in its portfolio, this company is home to Robert Mondavi, Wild Horse Winery, Opus One, Ravenswood Winery, and Clos du Bois.

Corona, Modelo Especial, and Pacifico are other beer brands owned by Constellation Brands Inc and popular alcoholic beverages brands like Svedka Vodka, Casa Noble Tequila, and High West Whiskey.

Also, the company owns 38.6% of cannabis company Canopy Growth. The company’s revenue has increased by 1.24% since 2020, and its operating free cash flow has increased by 7.25% from the previous quarter.

STZ summary

The first three holdings:

- The Vanguard Group, Inc. — 7.09%

- Capital Research & Management Co — 5.36%

- SSgA Funds Management, Inc. — 4.31%

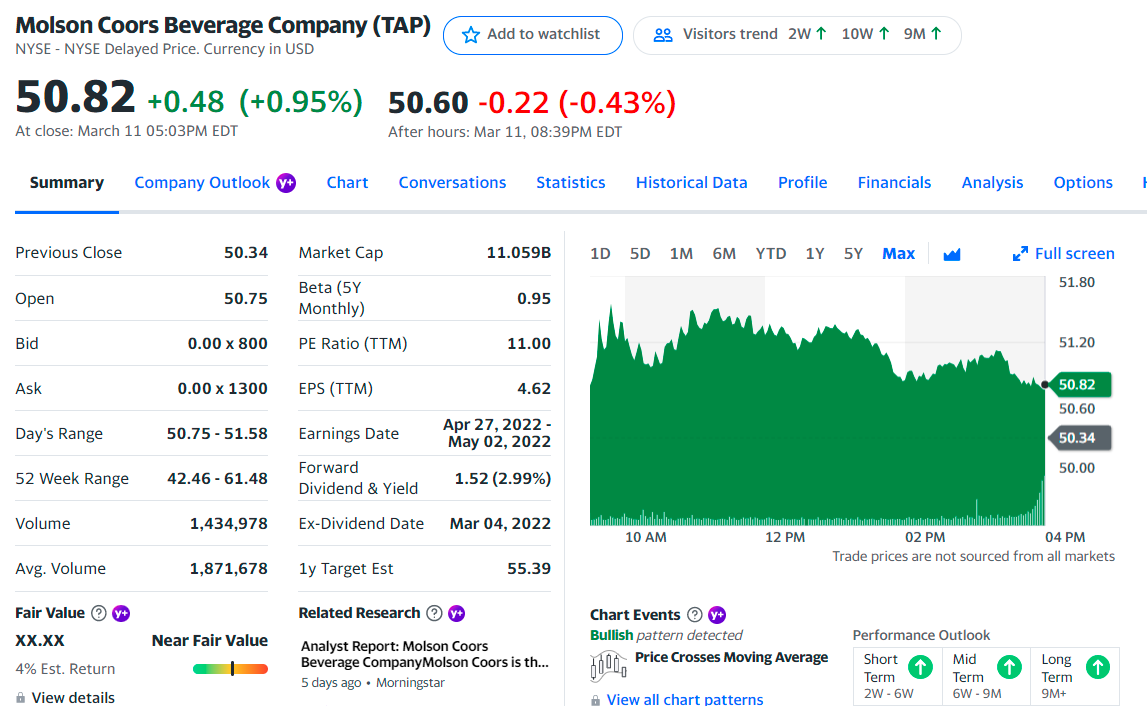

No. 3. Molson Coors Beverage (TAP)

Price: $50.82

EPS: $4.62

Market cap: 10.941B

Molson Coors Beverage price chart

Molson Coors Beverage Company was established in Chicago in 2005 following the merger of Molson, based in Canada (founded in 1786), and Coors, based in the United States (1873).

According to alcoholic beverage sales volume, it is the second-largest brewer in the United States and fifth-largest on the planet.

As a company, Molson Coors owns various brands such as Molson Light, Molson Canadian, Coors Banquet, Carling, Hop Valley, Blue Moon, and Crispin.

Compared to smaller breweries in the United States, it has a relatively small portfolio of craft beers. Nevertheless, Molson Coors’ top brands will give it strong pricing power to help its margins grow.

TAP summary

The first three holdings:

- Dodge & Cox — 15.26%

- The Vanguard Group, Inc. — 9.64%

- BlackRock Fund Advisors — 5.52%

Final thoughts

There is a long history behind alcohol production, and the alcohol industry is far from the fastest-growing sector on the stock market. A few giants control most of the investible portion of the industry. The alcohol stocks, as well as their beer stock cousins, are worth taking a look at if you’re trying to generate some income and enjoy some stable returns over the long term.

Comments