The stock market has been paying more attention to beer stocks lately, thanks to the announcement from PepsiCo and Boston Beer that they are creating an alcoholic version of Mountain Dew. Additionally, several beer manufacturers are going into the complicated seltzer business.

Some might turn a blind eye to these new alcoholic beverages, but they might also find a way to invest a little bit in an up-and-coming stock. Investing as little as $600 or less can be possible when you find shares at low prices or use fractional percentages.

These beer stocks may be of interest to you if you want to add a bit of liquid courage to your portfolio.

What are beer stocks?

It is common for people to drink beer, but not everyone realizes beer is an excellent investment. It is sometimes challenging to find the best beers. Nowadays, it is even harder to find top-quality beer stocks. We used to view them in a different light than alcohol stocks. However, the lines have blurred as hard seltzer and prepared cocktails have become increasingly popular.

It consists primarily of companies specializing in beer production, but many also produce other alcoholic and non-alcoholic drinks. Leading companies in this business include SABMiller International B.V., based in the Netherlands-which is a part of the Belgium-based Anheuser-Busch InBev S.A./N.V. (BUD) — as well as Japan-based Kirin Holdings Co. Ltd. (KNBWY).

How to buy beer stocks?

A broker online gives you access to thousands of stocks within minutes. These platforms let you trade confidently with pinpoint accuracy.

You can trade online with the help of advanced tools provided by brokers. For instance, by setting up customized filters, you can instantly find stocks under $10 or $5.

As many breweries produce other beverages, including alcoholic and non-alcoholic ones, buying stocks in the beer industry could give you a broader exposure to the food and beverage industry.

In times of economic downturn, these stocks could protect your portfolio. Try these stocks to get a firm grip on the market today.

Top 3 beer stocks to buy in 2022

Listed below are three of the best beer stocks to buy in 2022.

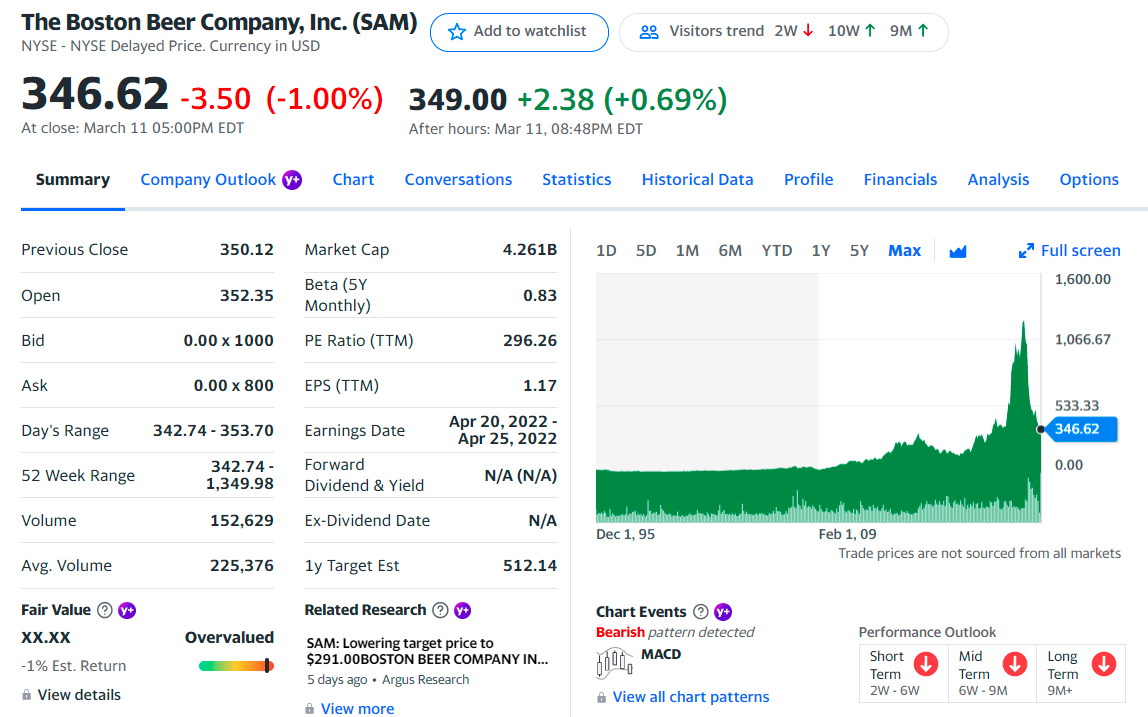

No. 1. Anheuser Busch Inbev SA (BUD)

Price: $55.91

EPS: $2.28

Market cap: 97.856B

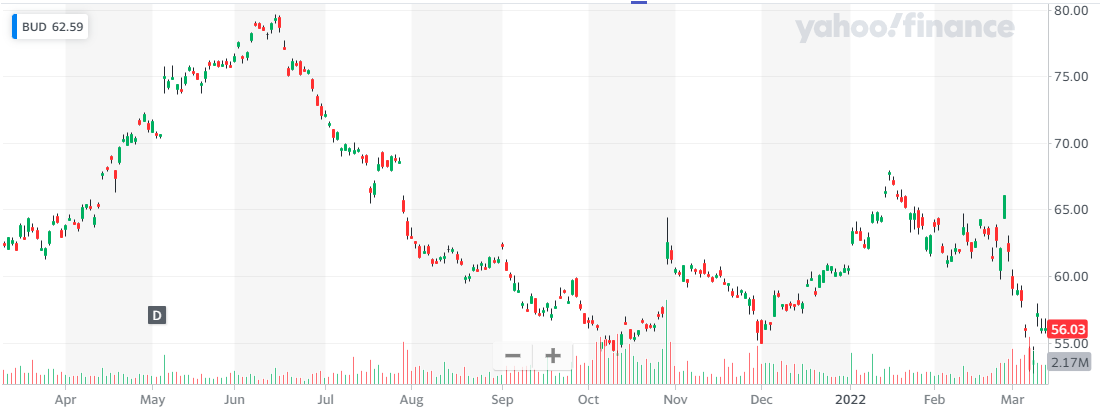

Anheuser Busch Inbev SA price chart

Anheuser Busch Inbev SA is the world’s largest brewer, noteworthy that it was established only in 2008. The company now sells 630 beer brands in 150 countries, and it has regional headquarters on all four continents. Several mergers have led the company to today, mainly due to acquisitions.

It now generates over $50 billion in revenue from selling popular beer brands like Budweiser, Corona, and Becks. It now appears that the company’s share price is on the verge of recovery after struggling for the last five years.

Because of its fundamental value, Anheuser Busch Inbev SA is on our list. Moreover, our analysis suggests the company’s value could increase over the next year as Covid-19 lockdowns end and beer demand surges. Its total assets exceed $200 billion, and its market cap is around $100 billion.

BUD summary

The first three holdings:

- Government Pension Fund — 1.41%

- Dodge & Cox International Stock — 0.64%

- Vanguard Total International Stock — 0.63%

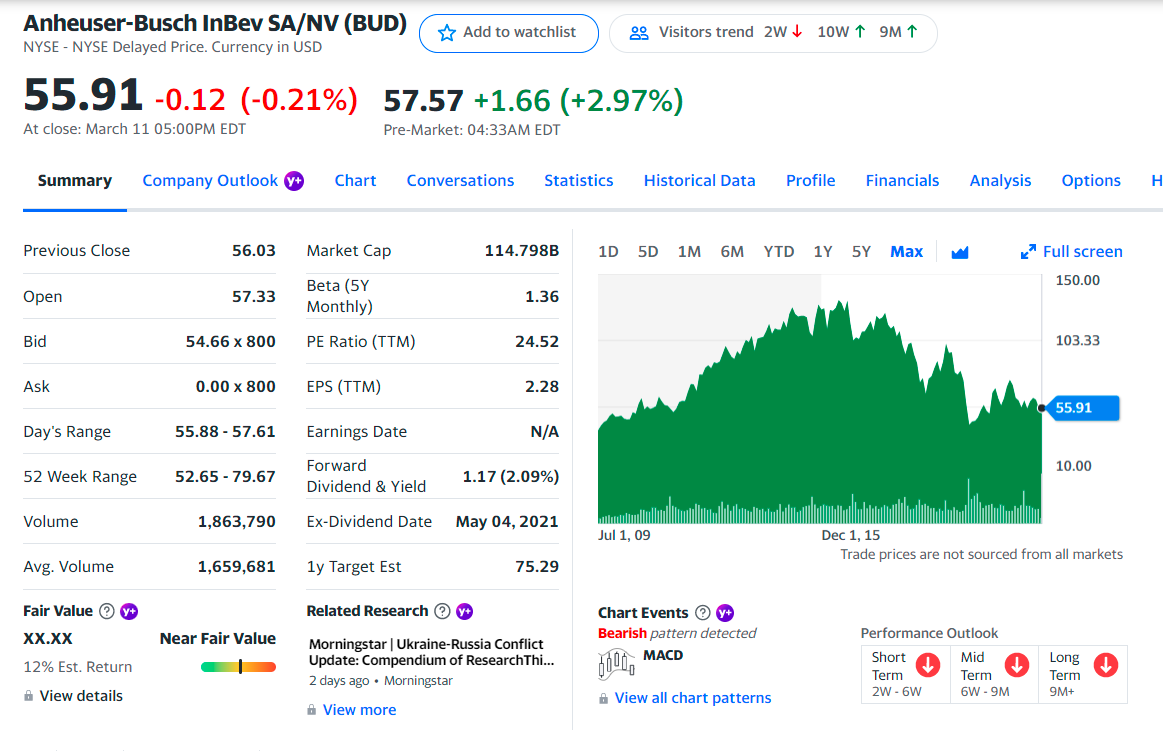

No. 2. Kirin Holdings (KNBWY)

Price: $14.92

EPS: $0.62

Market cap: 12.912B

Kirin price chart

Kirin is one of Japan’s largest consumer staples companies and is next to Asahi Group Holdings (OTC) as the country’s second-largest beer brand. The Kirin business has stagnated for years and isn’t a growing business. However, profitability has resumed since the Covid-19 pandemic and supports this top dividend-paying beer stock.

Kirin has also formed a health science division, leveraging its beverage production expertise to establish a business that produces healthy food and drinks. Kirin could capitalize on the increasing interest in health and well-being of consumers worldwide and their quest for better diets through the application of applied health science to food and drink.

The tiny segment won’t change Kirin’s fortunes overnight, but it provides a new space to sow seeds of expansion in the future. The company is also enhancing its dividend-paying capacity through digital updates to modernize and improve its operations.

KNBWY summary

The first three holdings:

- Mitsubishi UFJ Kokusai Asset Managment — 0.74%

- BlackRock Advisors (UK) Ltd. — 0.20%

- Lindsell Train Ltd. — 0.13%

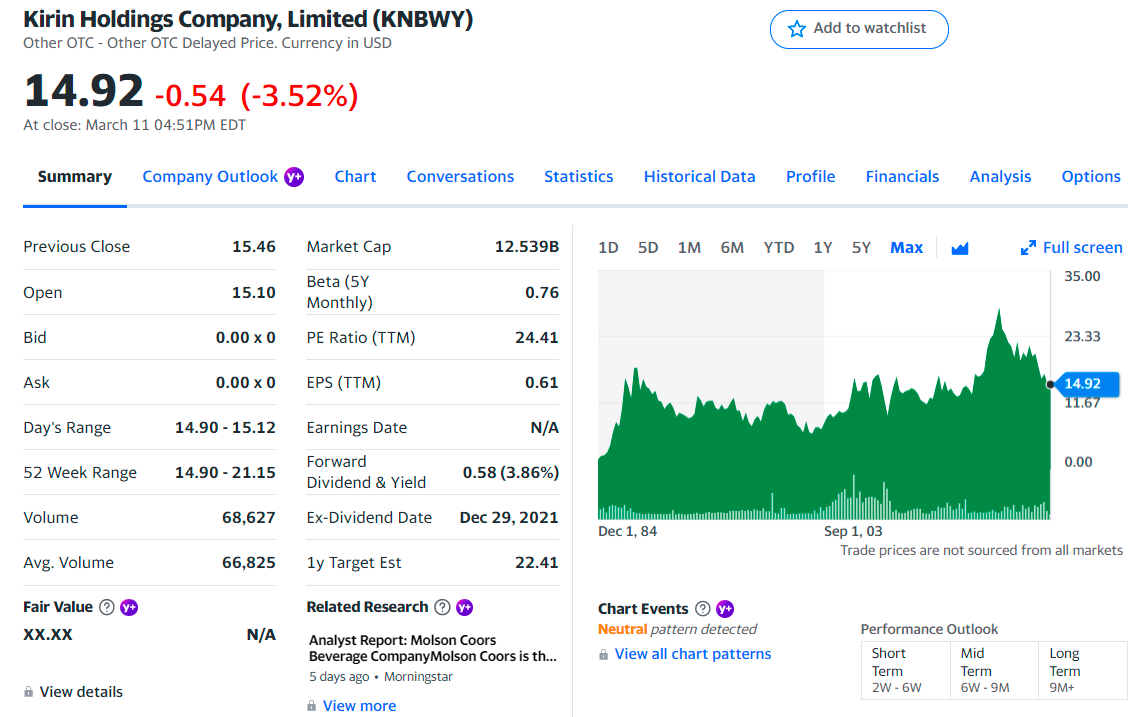

No. 3. Boston Beer Company (SAM)

Price: $346.62

EPS: $1.17

Market cap: 4.304B

Boston Beer price chart

Boston Beer, known for its Samuel Adams craft beer, Truly Hard Seltzers, Angry Orchard hard ciders, and several other small regional breweries, has long been a top advocate for the independent craft beer movement. However, Boston Beer still represents a small share of North American beer consumption, despite no longer being the small business it once was.

Alcohol consumption at home increased dramatically during the pandemic. Thus, Boston Beer experienced sales growth acceleration this year and last year. The continuous change in consumer trends has caused headaches, such as falling demand for spiked seltzer products over summer and autumn. Nevertheless, double-digit percentage growth is excellent, especially in an industry-driven mainly by predictable and slow consumption patterns.

Additionally, Boston Beer’s balance sheet is debt-free, something somewhat unusual among the global beer conglomerates. Boston Beer, therefore, represents a rare growth stock among beer investors. Due to the slowdown in sparkling seltzer sales growth, Samuel Adams’s parent company shares were down by over 50% in 2021. However, in the long run, the company should do well.

SAM summary

The first three holdings:

- Fidelity Management & Research Co. — 4.12%

- Durable Capital Partners LP — 2.88%

- Champlain Investment Partners LLC — 2.45%

Final thoughts

Brewery stocks have historically underperformed the market overall over the past few years. The tail-off in demand may be to blame. In the wake of the Covid-19 crisis, the need for beer is likely to pick up, although some issues facing the industry result from consolidation.

Many people predicted this would be a big win for shareholders when the large beer companies began to swallow up the smaller ones around a decade ago. However, while big beer businesses have seen their market share decline, it appears that pricing power no longer plays a significant role.

Comments