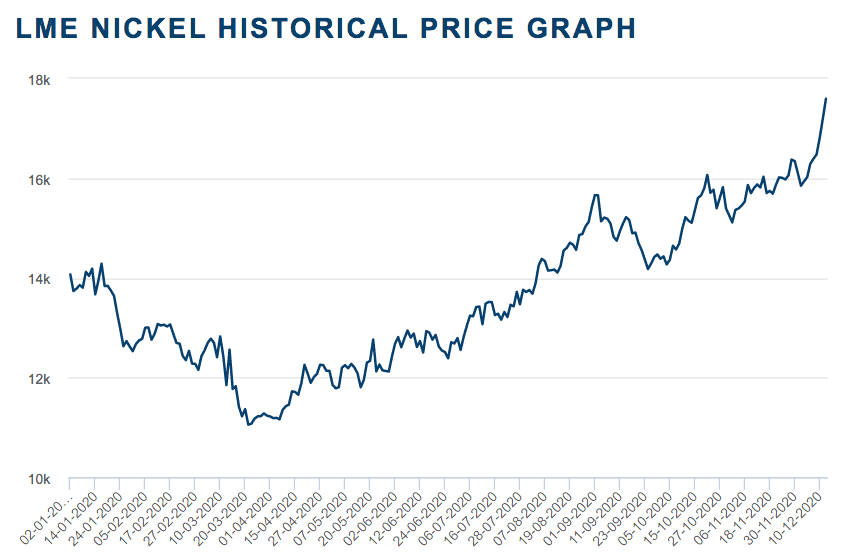

The post-pandemic era will offer many investment opportunities, and the mining sector is one of the most important. Nickel mining will have a key role in the upcoming years. The price rose from $8.000 in 2016 to $19.000 in 202, and this is not just for the reactivation of the economy.

Even though most Nickel goes to corrosion-resistant materials, its price rises due to the demand for electric car batteries. Tesla’s CEO publicly offered a huge contract to any company that can provide Tesla with enough Nickel for the next decades if the extraction meets Tesla’s environmental standards.

There is no doubt about the importance of this metal for industry, and this is the right time to ride the Nickel’s boom. Read on to learn how to do it and the best companies to invest in during 2021/2022.

What are Nickel stocks?

Nickel stocks are shares of companies engaging in the business of extraction or commercialization of Nickel. Today these stocks are experiencing a huge up-trend due to the demand for Nickel to produce electric car batteries.

Nickel is a key component for the production of lithium-ion batteries since manufacturers have decided to replace the cobalt from their batteries with Nickel, which is cheaper and holds more energy.

Today, there are about 7,2 million electric cars, but for 2030 there will be about 245 million.

However, today, most Nickel is sent to stainless steel producers, so the weight of the demand is on their side by far. Nevertheless, the reactivation of the economy is also making that sector grow. However, the sector is facing severe difficulties due to the incapacity of suppliers to cover the demand.

This paints a scenario where the demand for Nickel will remain high in the short term and the long term, which means that the price will keep increasing, benefiting the investors.

How to buy Nickel stocks?

Nickel outlook 2021

After all this, you may be in a rush to enter the market, and even maybe you could experience a little FOMO while choosing the right way to go. However, it is better to wait and make sure that you won’t lose money than to bet on making huge profits without any research.

Nickel companies will experience good years, but if you pay attention, some of them will make it better than others, especially those capable of adapting to the environmental requirements of the times. To avoid making the wrong investments, here are some steps to invest in the right Nickel stocks.

Step 1. Select the broker for you

As important as the market and the company, it is to select the right broker for you. You are probably not familiar with the stock market and its risks. If you still don’t have a broker’s account, you still have homework to do.

Selecting the right broker will help you with all of that. Make sure you take plenty of time to see which broker gives you the best experience. Ideally, this is a long-term relationship in which your capital is involved. You do not want to change constantly from one broker to another because you learned too late that your broker has high fees or does not give you all the info you want.

Step 2. Understand the market

There are too big sectors behind the price increase of the Nickel. Ordinary stainless-steel market and the electric vehicle market. You may think that it doesn’t matter where the Nickel goes. What does matter is the total demand? But you’re mistaken.

Since Tesla is a major market maker, its requirements change the game, and not all Nickel companies will extract the ore as Elon Musk wants. So, you can see two different markets there; the one Tesla is building and the traditional Nickel market. You need to understand which market your company is aiming for.

Step 3. Suppliers

Not every company has the same conditions. Many factors come into play when talking about the future of a company and its profitability. With minerals, since these are strategic resources, it is not strange that populist governments want to put their hands in the business. When you invest in a company, you need to ensure that its legal environment is safe enough to put your money in, especially for companies with projects in underdeveloped countries.

Step 4. Company or ETF

After considering all the previous steps, you are ready to choose the company or companies you want to invest in. Naturally, the company that aligns better to the market you think will grow the most, with a safer legal environment and more sustainable projects, should have the advantage. However, if you do not want to risk your capital in just a few companies, you can always look for an ETF that invests in nickel companies. That way, experts will make the call for you.

Step 5. Follow

Whether you choose individual companies or an ETF, you should always keep track of your investments. Many things can change over the years, and you need to keep a close look at your money. Check constantly how the market is behaving and where it is going.

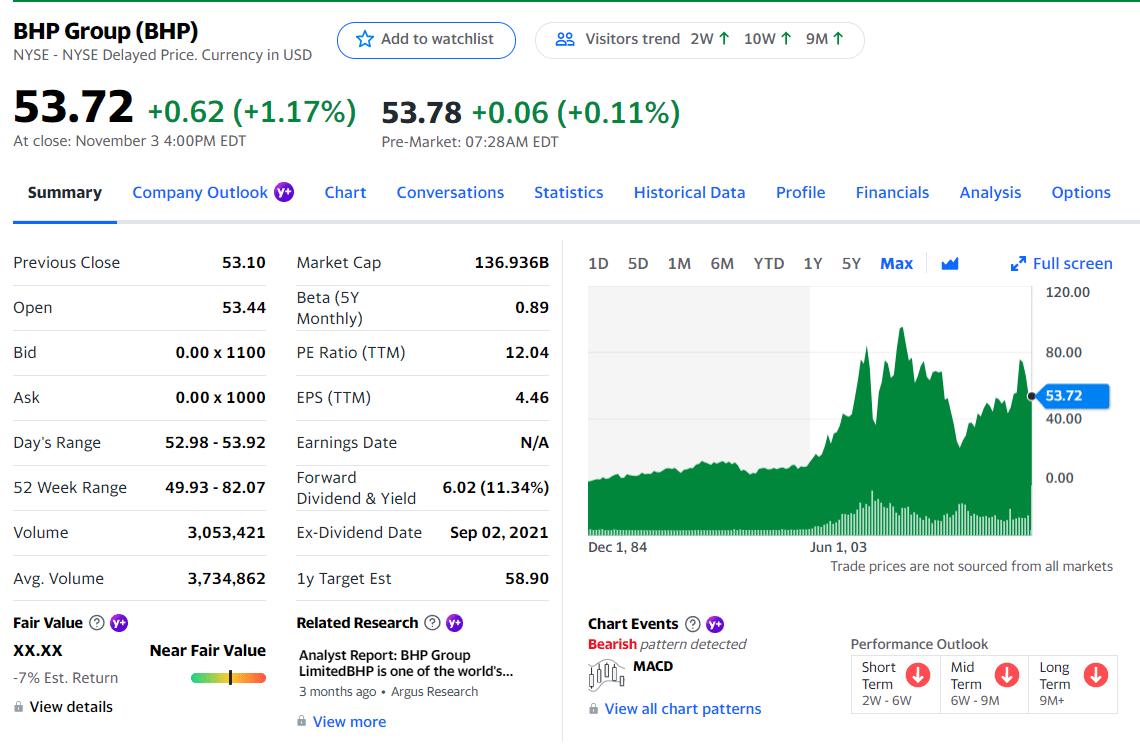

№ 1. BHP Group (BHP)

Price: $53.72

EPS: 4.46

Market capitalization: $ 138.785B

BHP Group is a giant in the Nickel industry. Currently, 75% of its production goes to the electric cars sector, and the company’s projects match the expectation that by 2050 50% of all cars will be electric.

BHP Group reached its resistance level three times in the past few months

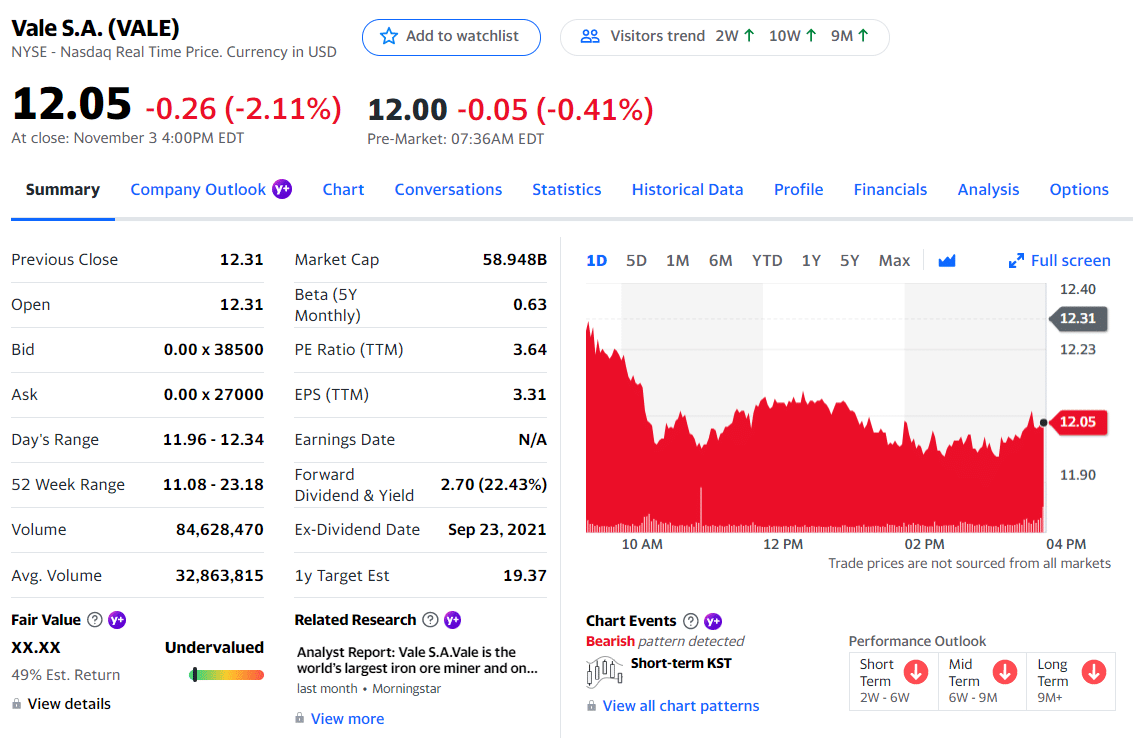

№ 2. Vale S.A. (VALE)

Price: $12.05

EPS: 3.21

Market capitalization: $65.545B

The company is the world leader in Nickel extraction. It also engages in the production of iron ore, pellets, manganese, and iron alloys. Vale S.A holds operations in Brazil, Canada, Indonesia, and New Caledonia. It began its operation in 1942, and its headquarters are in Rio de Janeiro, Brazil.

Vale S.A. stocks price has been decreasing since August

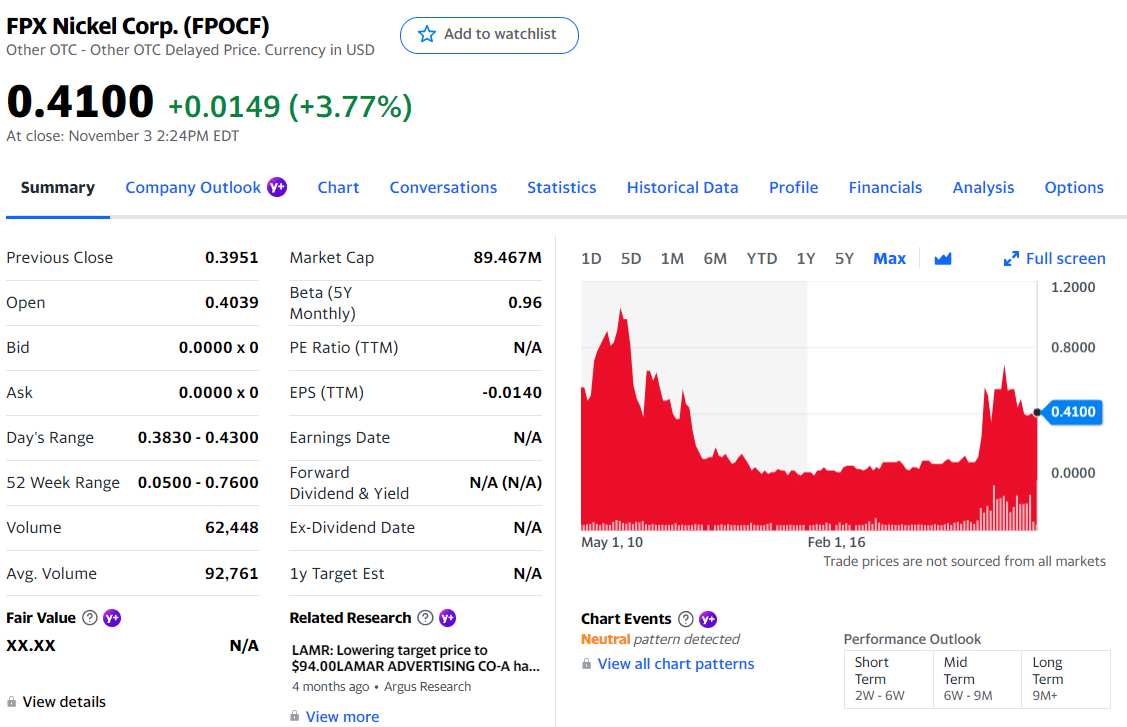

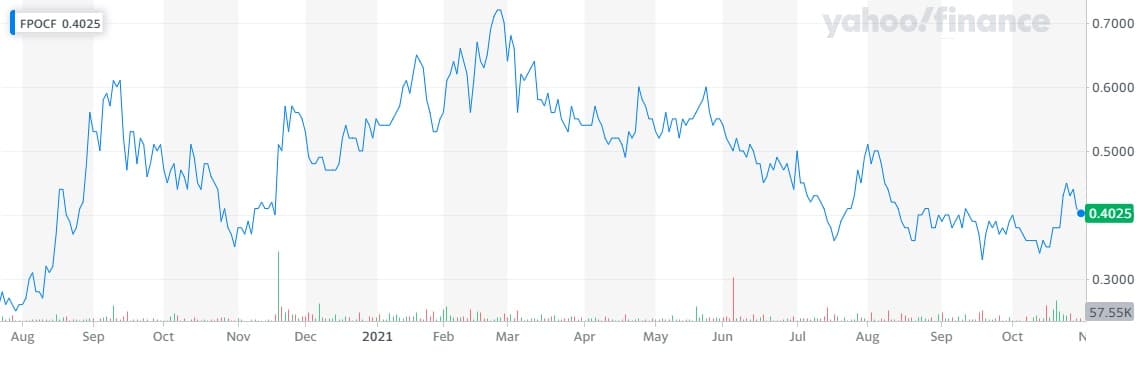

№ 3. FPX Nickel (FPOCF)

Price: $ 0.41

EPS: N/A

Market capitalization: $ 85.957M

FPX Nickel is a Canadian company dedicated to the exploration of Nickel deposits. It is considered a junior company but with great chances of becoming an important player in the next few years.

FPX Nickel is a promissory penny stock

Final thoughts

The Nickel sector can’t do anything but grow. Today the demand is bigger than the sector can supply, and there is no sign of decelerating. So unless a breakthrough in the development of batteries occurs in the next few years, Nickel will still be a key component of the batteries. And even if that happens, the traditional use of Nickel will still support the market.

Comments