When the term precious metal comes up, most people immediately think of gold and silver, with the informed ones expanding this list to include platinum and palladium. The truth is that to make money on metals, these are not the only options available to investors.

Uranium, a metal primarily used as fuel for nuclear reactors, is currently making waves in the investment world. Why? The era of fossil fuels is at the dying stages, and scientists now agree that nuclear energy will power the next humankind revolution while protecting the earth for future generations.

At present, 10% of the global energy is nuclear energy, with additional applications in the medical field and space exploration. Data from IAEA, International Atomic Energy Agency, shows that demand for nuclear energy will double in the next two decades.

In terms of revenue, the expectation is market growth size from $34.6 billion in 2021 to over $49 billion by 2025. With such an explosion, the uranium market is up for grabs. The uranium equities below are in pole position to benefit if played right.

What are uranium equities, and why invest in them?

With applications in the energy sector, healthcare sector, and space exploration, uranium stocks comprise organizations involved in mining, exploration, and refinement of uranium, organizations engaged in utilizing uranium to manufacture equipment, and all ancillary service organizations in the uranium value chain.

With the world-leading economies looking to nuclear energy for sustainable yet cost-efficient energy sources with minimal greenhouse gas emissions, uranium, as the only metal that powers the nuclear reactors, is on the verge of demand explosion.

This market then is just reaching critical mass, presenting money-making opportunities.

Top five uranium stocks to buy on the dip and hold for profitability in 2021

Since the Fukushima nuclear disaster in 2011, the global community has been skeptical of safe nuclear energy production. However, since then, the world has called for alternative energy sources with minimal carbon footprint while being sustainable, scalable, and cost-efficient. In the same period, scientists have figured ways of stabilizing nuclear reactors using gravity, heat transference, and convention.

With all this in mind and the recent surge in uranium prices, the five uranium equities below have the potential for portfolio profitability if bought on the dip and held as this energy niche stretches its legs and grows.

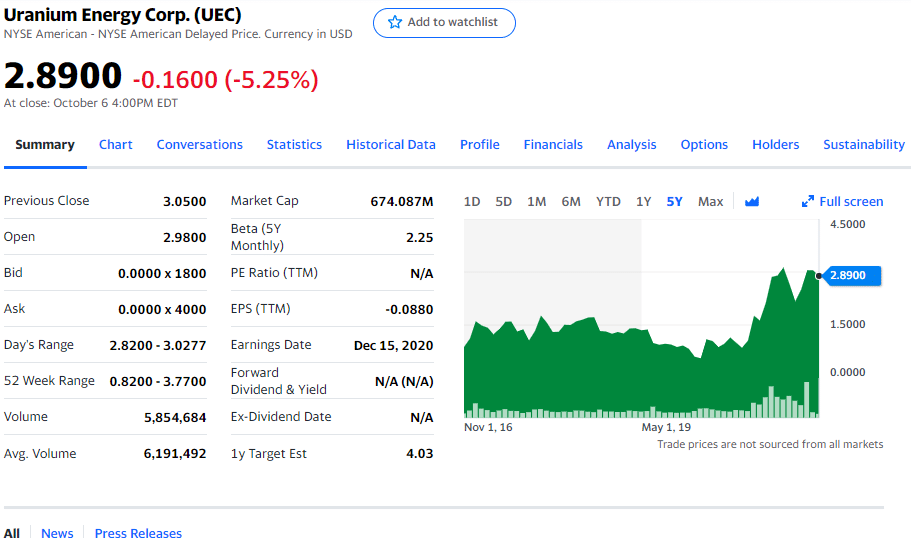

№ 1. Uranium Energy Corp. (UEC)

Price: $2.89

EPS: -$0.02

EPS growth: N/A

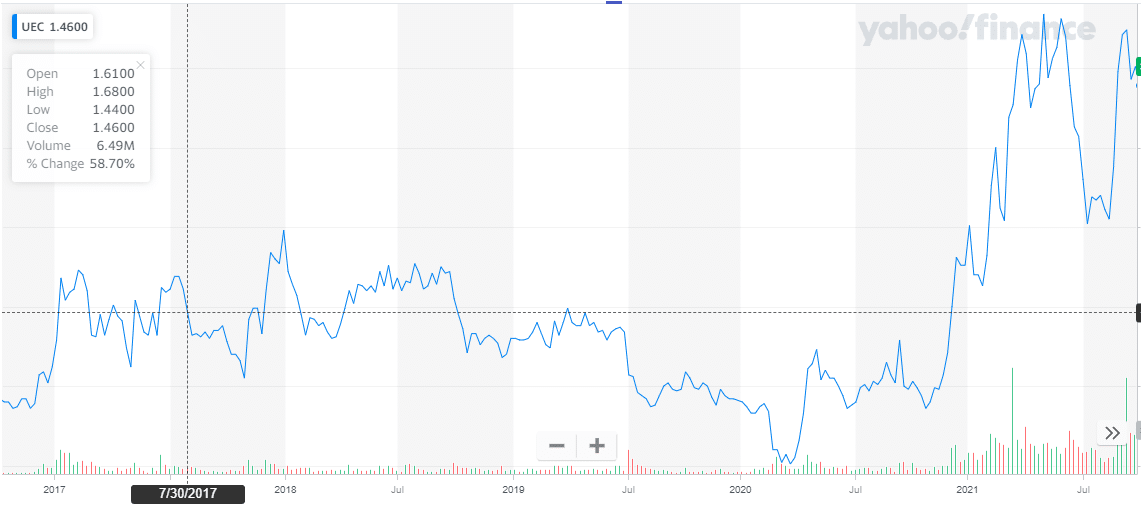

UEC chart

UEC and its subsidiaries have a presence in the US, Paraguay, and Canada, with interests in uranium and titanium exploration, mining, and processing. This Texas holding company changed its name from Carlin Gold Inc. in 2005 to reflect its core business interests.

UEC total returns for the last five years stand at 217.2%, with the one-year returns at 191.2%.

UEC chart

With a market undervaluation reflected in the stock price, the average cost is $4.03 against the current price of $2.89, and the growing appetite for nuclear as clean energy, this uranium stock is worth having the investment crosshairs.

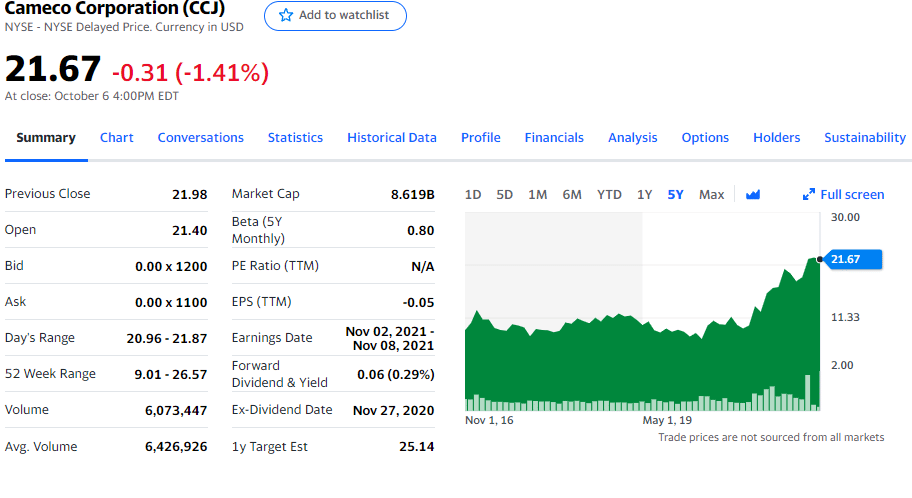

№ 2. Cameco Corp. (CCJ)

Price: $21.67

EPS: $0.02

EPS growth: 22.13%

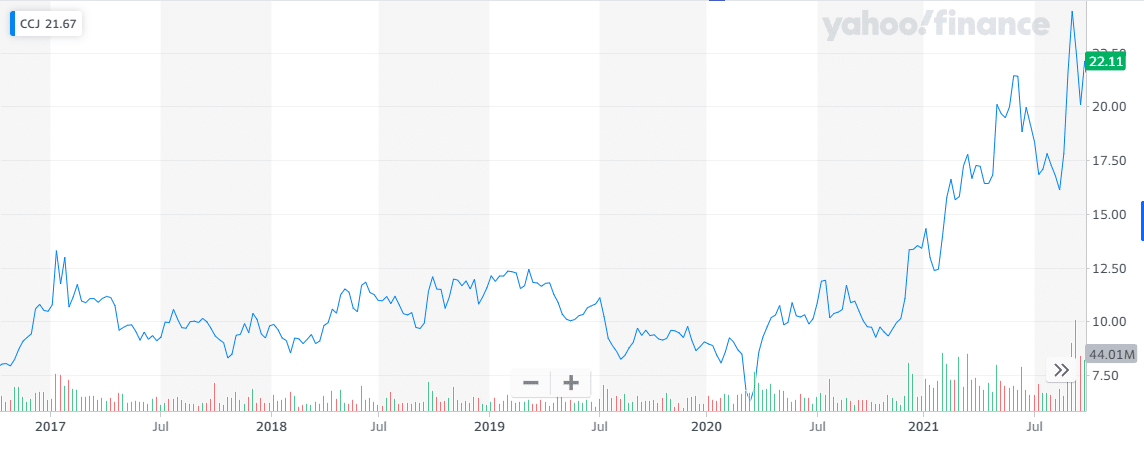

CCJ chart

Cameco Corp. is arguably the largest uranium company globally, with roots in Canada’s second-largest uranium-producing nation. Unlike UEC, CCJ, Cameco, has tentacles in the uranium value chain via two segments, uranium mining, and fuel services.

The uranium mining segment deals with exploration, extraction, milling, selling, and purchasing uranium concentrate. On the other hand, the fuel services segment deals in uranium refinement, conversion, and fabrication, coupled with the sale of uranium-based conversion and fabrication services.

CCJ chart

Compared to some stocks on this list and CCJ’s capitalization, the historical performance is a bit off the mark, with 5-year total returns of 85.17% and 1-year returns of 127.8%.

However, its EPS growth and projected revenue growth of 166.7% in the next year and 88.36% in the next five years mean that CCJ, if played right, can mint money for an investor.

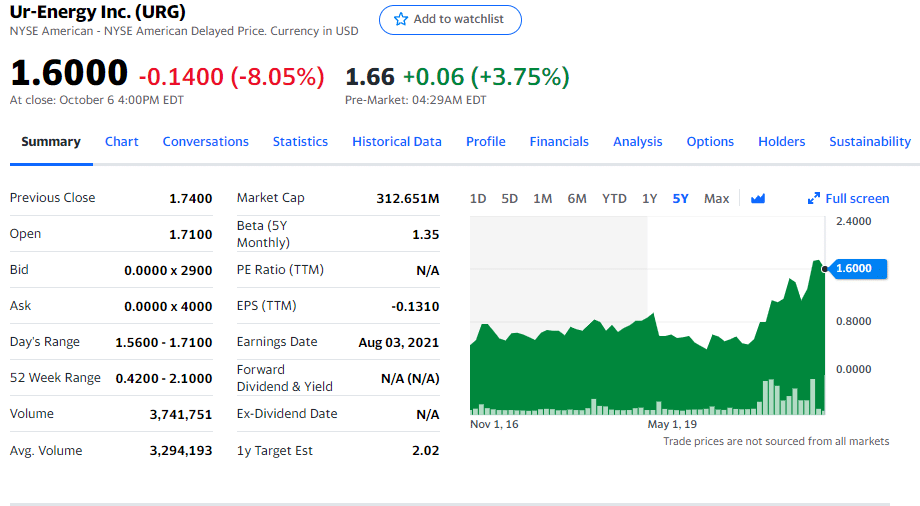

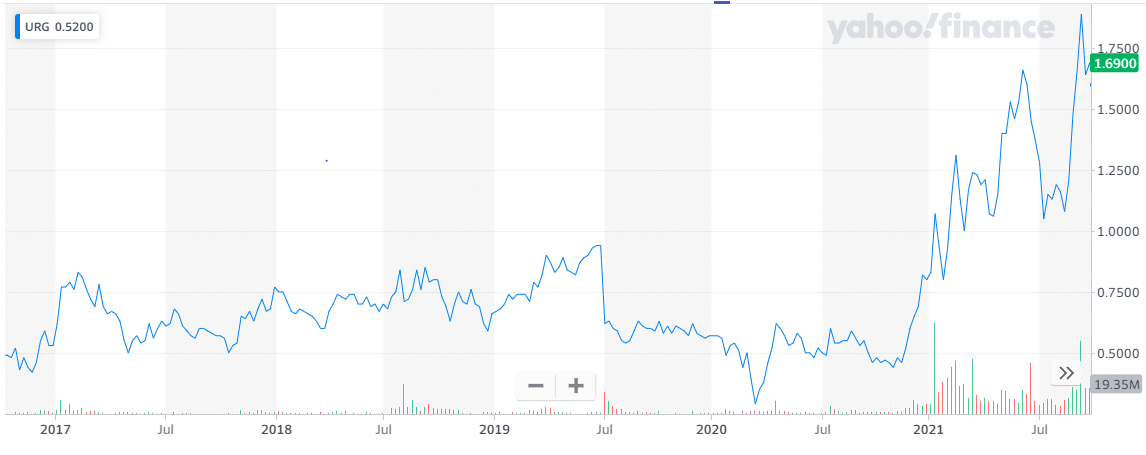

№ 3. Ur-Energy Inc. (URG)

Price: $1.60

EPS: -$0.04

EPS growth: N/A%

URG chart

Diverging from the majority of uranium stocks, Ur-Energy Inc. has no interest beyond the US borders. In addition to the acquisition of uranium mineral properties, the interest of URG includes exploration, development, and management of uranium mineral properties.

URG beats UEC on the five-year total returns, 245.4% against 217.2%, and does the same for one-year returns, 243.3% against 191.2%. With developed nations and emerging markets looking into nuclear energy as a clean energy option, experts tip the earnings and revenues for this uranium equity to go even higher.

URG chart

At less than $2, an investor has the option to buy into this uranium stock that is expected to retail at $3 minimum come 2022. This bullish outlook is coupled with a revenue growth estimate of 183.3% for the next 12 months, necessitating the need for close monitoring.

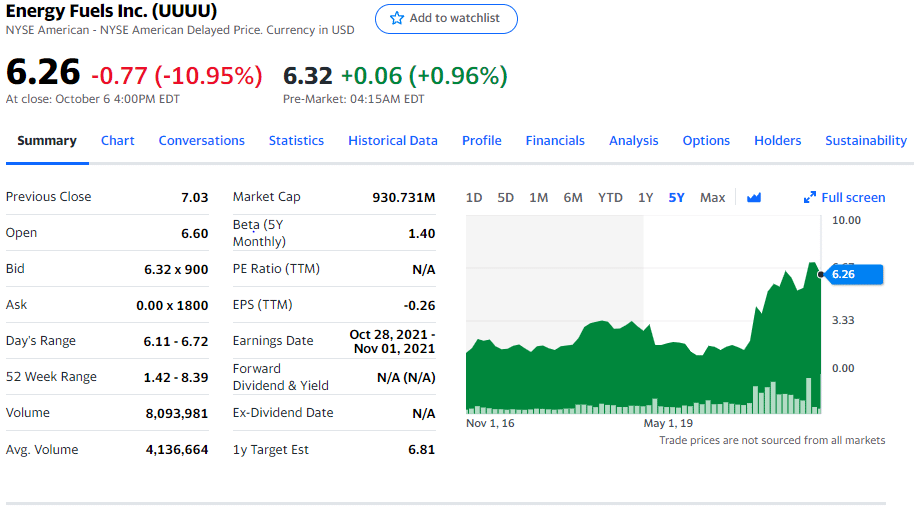

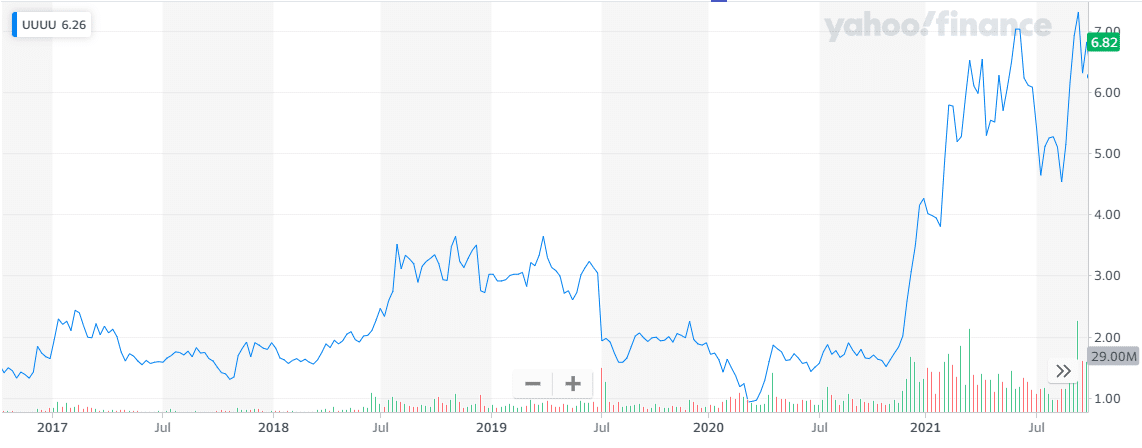

№ 4. Energy Fuels Inc. (UUUU)

Price: $6.26

EPS: -$0.07

EPS growth: 6.62%

UUUU chart

Energy Fuels Inc. is a Colorado mining company with interests in both uranium and vanadium exploration and evaluation. Its projects are all within the US borders, similar to Ur-Energy projects. UUUU is also involved in evaluating and recovering thorium and radium through a strategic alliance with RadTran LLC. These different verticals are attributable to the name change from volcanic metal exploration Inc to Energy Fuels LLC.

UUUU chart

Looking at the historical total returns, UUUU is the best performing uranium equity, with 5-year returns of 317.3% and 1-year returns of 274.9%. The fact that its estimated growth is 18.80 for next year, and so far, the year-to-date total revenue return is 46.95%, means it is highly undervalued and worth a second look.

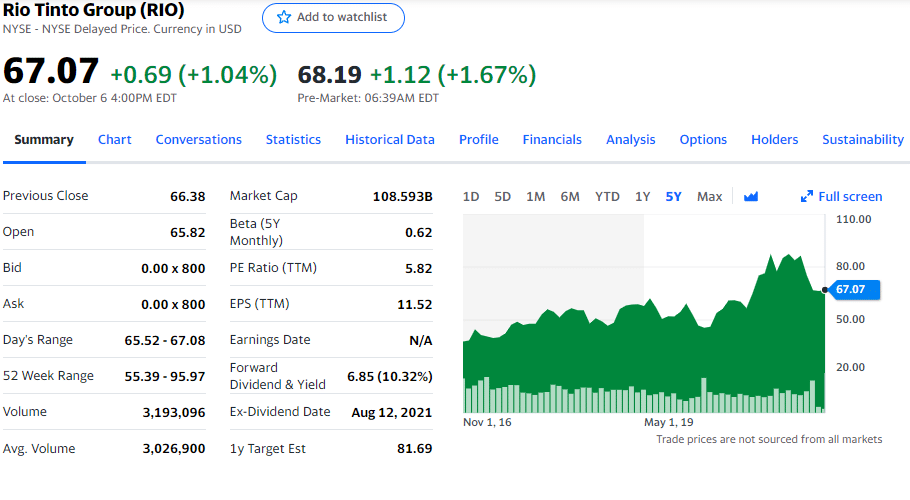

№ 5. Rio Tinto Plc (RIO)

Price: $67.07

EPS: N/A

EPS growth: N/A

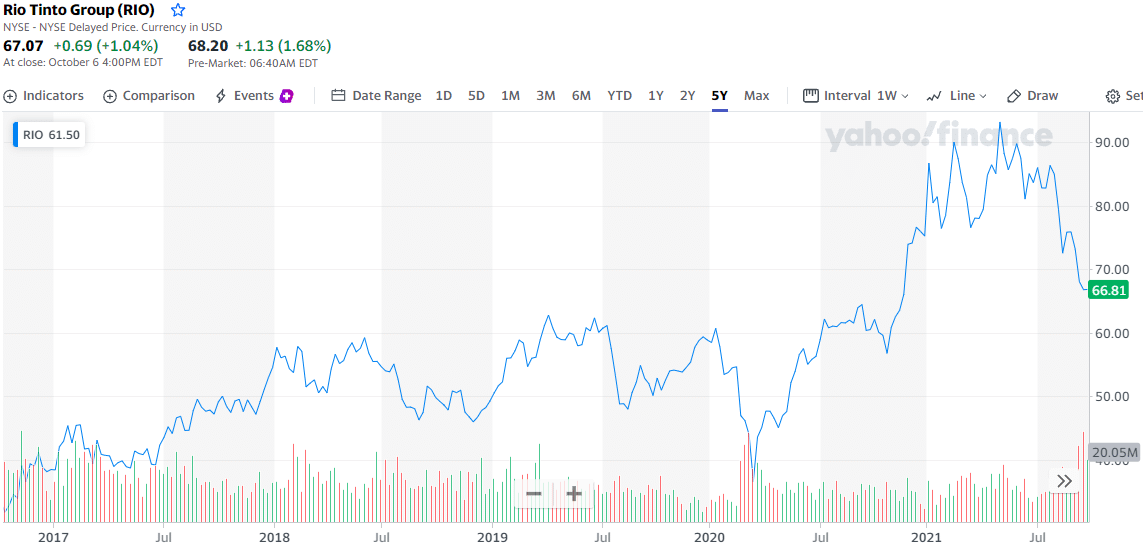

RIO chart

This UK company is not a pure-play uranium organization but a global power player in the mineral resource space. It has interests in the exploration, extraction, and processing of; copper, iron ore, aluminum, bauxite, diamonds, alumina, molybdenum, uranium, gold, borates, silver, titanium dioxide, and coal.

In the minerals’ value chain, it is interested in, it also owns and operates research facilities, power stations, and service facilities.

RIO chart

RIO Tinto’s five-year total returns stand at 206.3%, with pandemic year returns of 26.40%. RIO provides uranium equity with a rare diversification twist that would caution against uranium price volatilities with such diversified income streams.

Final thoughts

The era of shunning nuclear energy due to past horrors is at its end. Advances in tech and science combined with the ever-increasing appetite for clean energy are attributable to the recent resurgence of uranium prices and associated stocks.

As more global economies invest in nuclear power, leading the developed economies and emerging markets, the recent surge is the stepping stone for this energy niche. Stocks inherently come with a lot of risks, but those discussed herein, if played right, have the potential to make profits as the nuclear energy space explodes.

Comments