Climate change is the problem of our generation, but the world is not stopping. We already have the technology to fight climate change. It’s just a matter of making it cheaper, and many companies are succeeding at this task and making profits on the way.

Some of the companies we’ll review here have almost doubled their stock price this year.

The shares of these companies are called Tesla killer stocks for the real threat they represent to the monopoly of Tesla over environment-friendly vehicles. Identifying the potential opportunities in the early stages of this technology could signify huge earnings for those who invest in these companies.

Let’s learn of the best options to profit from this market in the following article.

What are blue gas stocks?

Blue gas stocks are the shares of companies working in the field of blue gas, but what is blue gas?

Blue gases are fuels created from a carbon-neutral process. So they represent a threat to electric vehicles. On the other hand, blue gas is an excellent option to fight climate change. Still, it also outperforms the lithium batteries of Tesla cars in many vital fields for the consumer, such as autonomy, and even in environmental issues, since getting the lithium for the Electric vehicle’s batteries is not as “green” as we wish.

So, in the scenario, blue gas stocks are the shares of companies involved somewhere in the market of blue gas production. This year, blue gas stocks have had an essential rise in their price because of the market’s expectations.

The most known types of blue gas are natural gas and hydrogen. They both have been around for a while, but the vehicles genuinely changing the game are hydrogen fuel-cell vehicles. However, they face a significant challenge. Even when hydrogen vehicles have been around for a while, they are not very popular due to the infrastructure needed. Therefore, building those hydrogen stations is a challenge for the industry.

How to buy blue gas stocks?

Step 1. Compare share trading platforms

There are many online options out there to operate your trading account. However, finding the right platform for you, your expertise, and your investment level can differ between profitable or bankrupt.

In addition to studying which stocks you will buy and which you will not, you also need to think about which platform would be best for you. Again, the cost, incentives, and learning opportunities should be at the center of your decision-making process.

Step 2. Open your brokerage account

Once you choose your broker, the process it’s pretty simple, and in most cases, it doesn’t take more than 15 or 20 minutes. This process’s mostly intended to verify your identity and its routine procedure. After you finish the process, you will have to fund your account. You can do this in several ways depending on the options your broker offers you, but basically, you need to link your bank account to your trading account. Once done, you are ready to start trading.

Step 3. Search for your blue gas company

As mentioned above, you should study carefully which stocks you want to invest in. This article provides some reviews about what we consider some of the best options right now, but you may do a little more research on your own. Then, after you have made your mind, find your company by writing its ticker in the search bar and buy.

Step 4. Decide on how many to buy

How many options to buy should be closely linked to your budget. A good investor should always keep in mind that the key to profit in the long-term is what matters, and to do that, lowering your losses may be more important than increasing your profit. Therefore, we recommend that no stocks should weigh more than 4 or 5% of your portfolio.

Step 5. Check-in on your investment

The stock market is constantly changing, and prices go up and down all day long. Due to many factors, prices vary 24 hours a day, and it is impossible to sit at a computer all day. However, you should periodically check your investment and do technical and fundamental analysis to ensure your money is in a good place.

Best blue gas stocks to buy today

As you can imagine, putting money in this type of company is a long-term investment, and they all involve certain risks. However, some companies are doing better than others. Let’s see the three recommendations to invest in blue gas stocks.

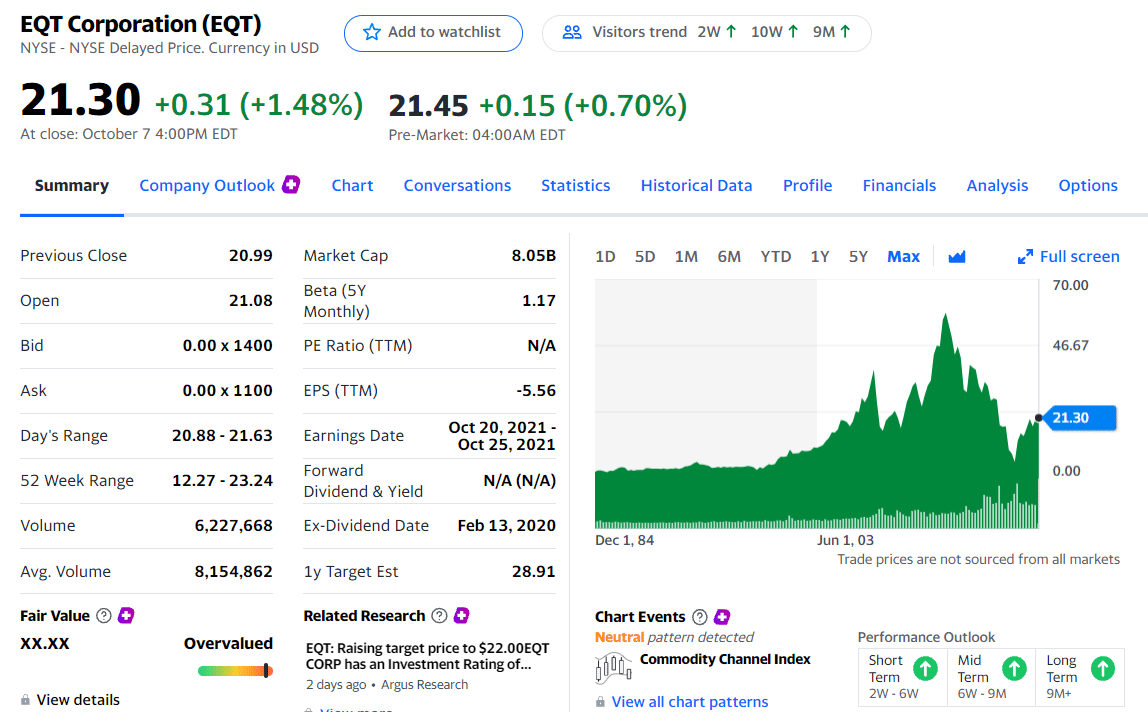

EQT Corporation (EQT)

Price: $21.30

EPS: $-5.56

Market capitalization: 7.933B

EQT corporation was founded in 1888. The company is the largest natural gas producer in the US. It operates in the Appalachian area, and its headquarters are in Pittsburgh.

EQT Corporation is the largest LNG producer in the US

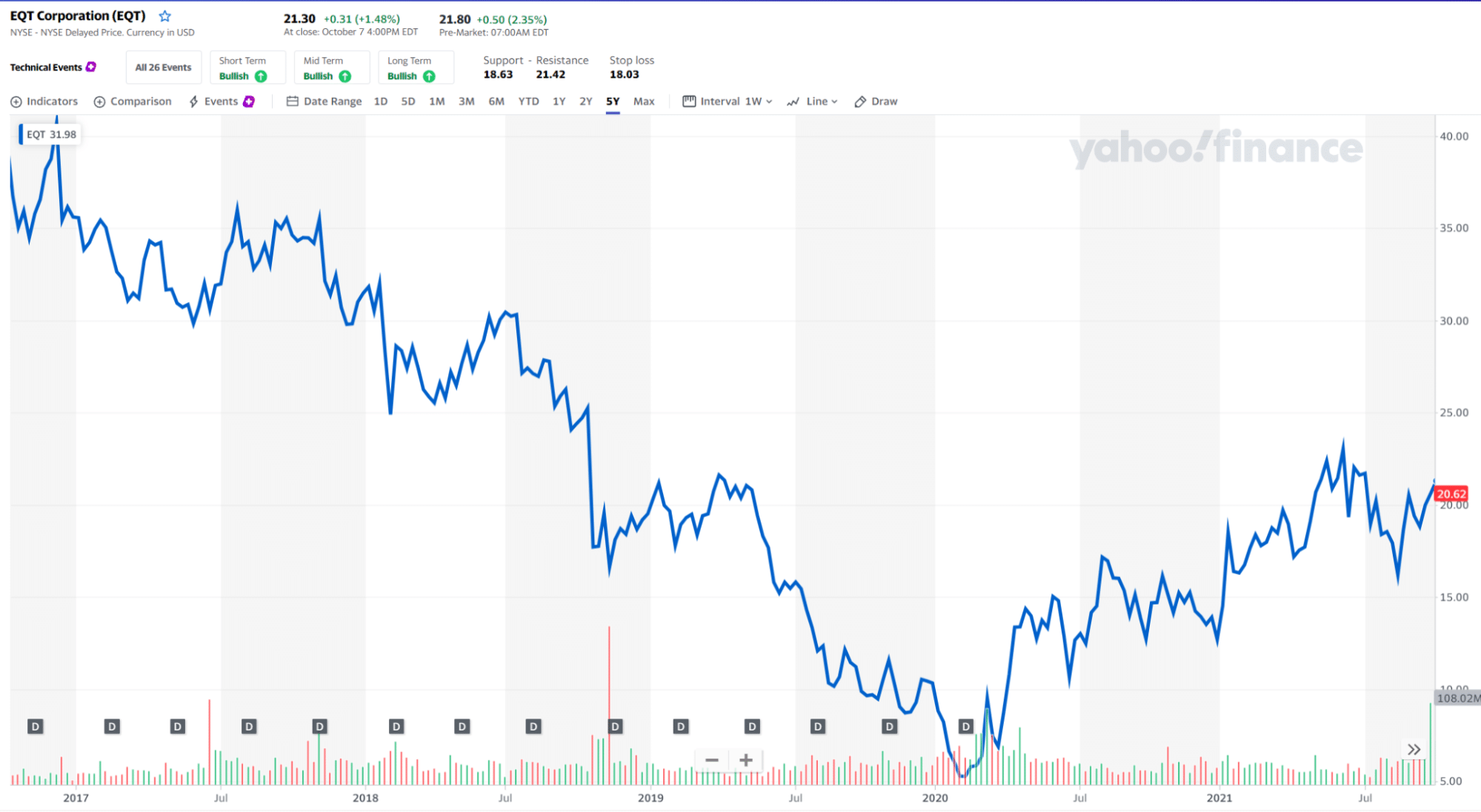

EQT, like many other companies in the gas sector, is taking advantage of the rise in the gas price, and today the stock price is on the rise and recovering from the 2020 minimum. The company held a low debt level, and by 2026 the company expects to generate more than $7 billion in free cash flow with which it will be able to pay the debt.

EQT price chart

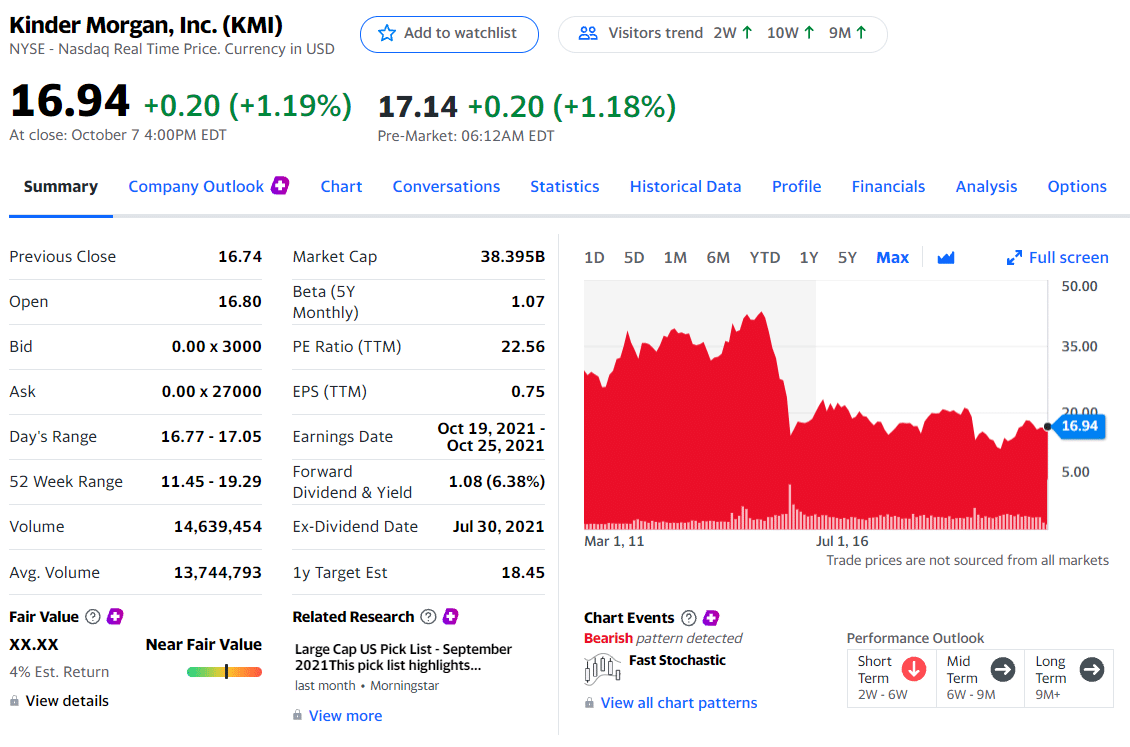

Kinder Morgan, Inc. (KMI)

Price: $16.94

EPS: $0.75

Market capitalization: $37.986 B

Kinder Morgan is the US’ largest energy infrastructure company with the largest network of natural gas transmission. The firm operates businesses that involve natural gas, gasoline, crude oil, carbon dioxide (CO2), and other products.

Kinder Morgan’s stocks are expected to rise

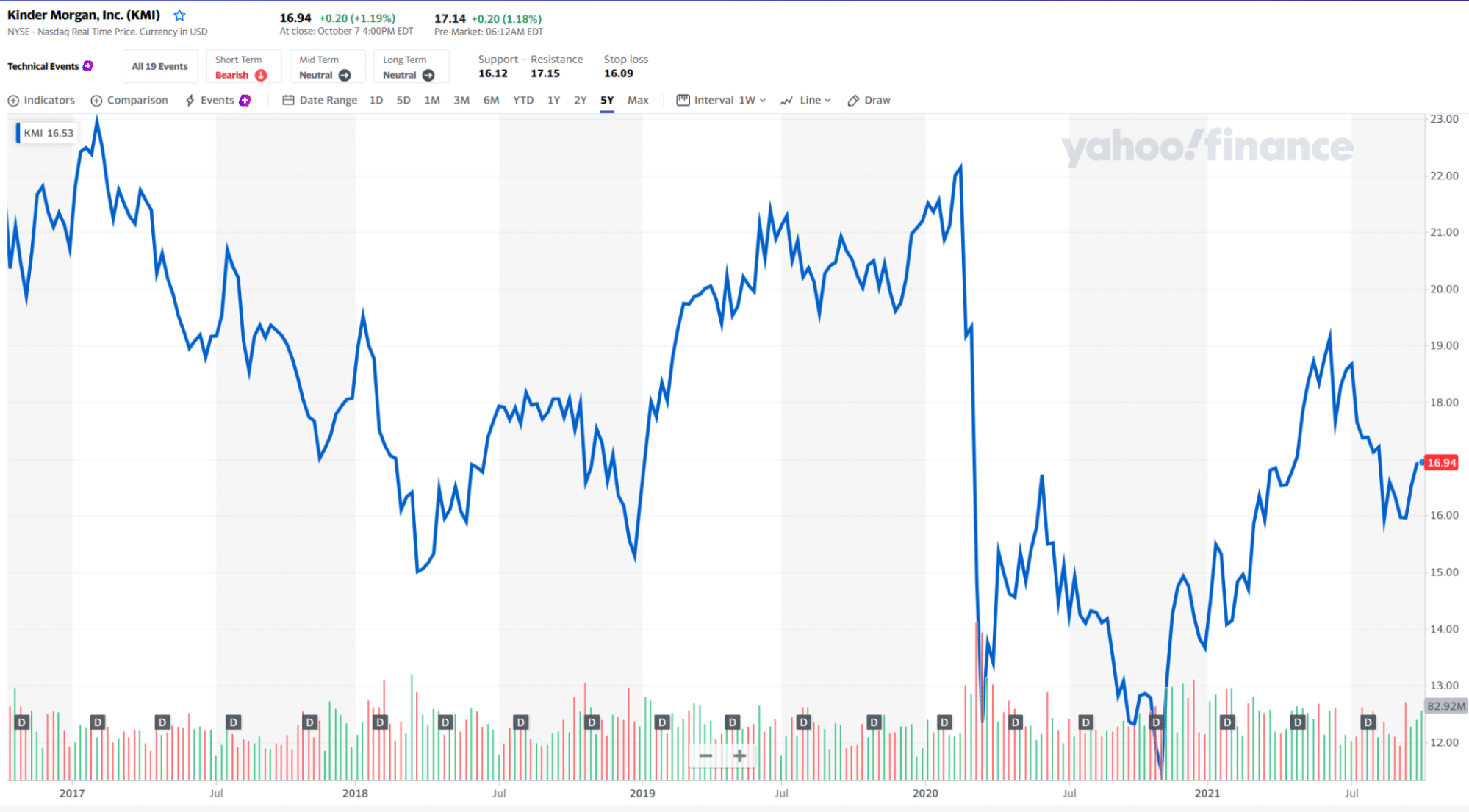

Kinder Morgan has a 6.1% yield, which is among the highest in the sector. The current stock price is around $16.92, and it seems to be recovering from the downtrend that started in June. Experts advise holding the stocks to take advantage of the good moment of the sector.

KMI price chart

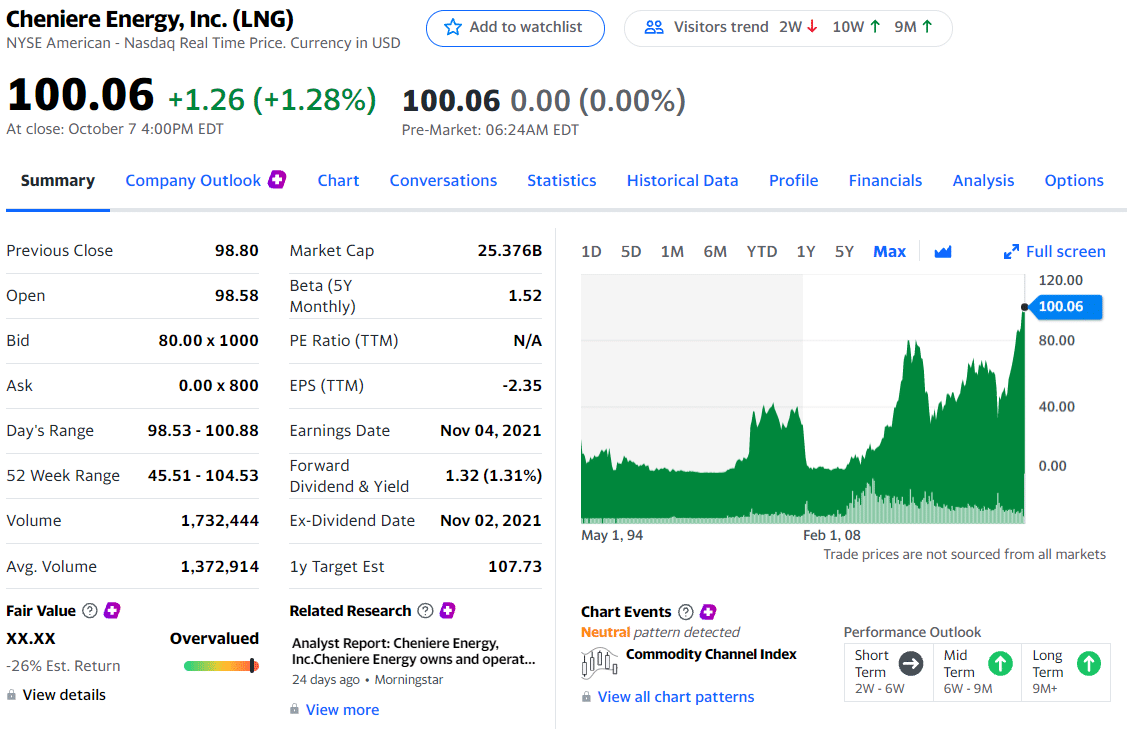

Cheniere Energy (LNG)

Price: $100.06

EPS: $-2.35

Market capitalization: $25.52 B

Cheniere Energy is the second-largest natural gas operator worldwide and the biggest producer in the United States. This company, based in Houston, Texas and founded in 1983, owns and operates two LNG terminals:

- The Corpus Christi LNG Terminal, located in Texas

- The Sabine Pass LNG Terminal, located in Louisiana

LNG Fixed long-term contracts give the company predictable cash flow

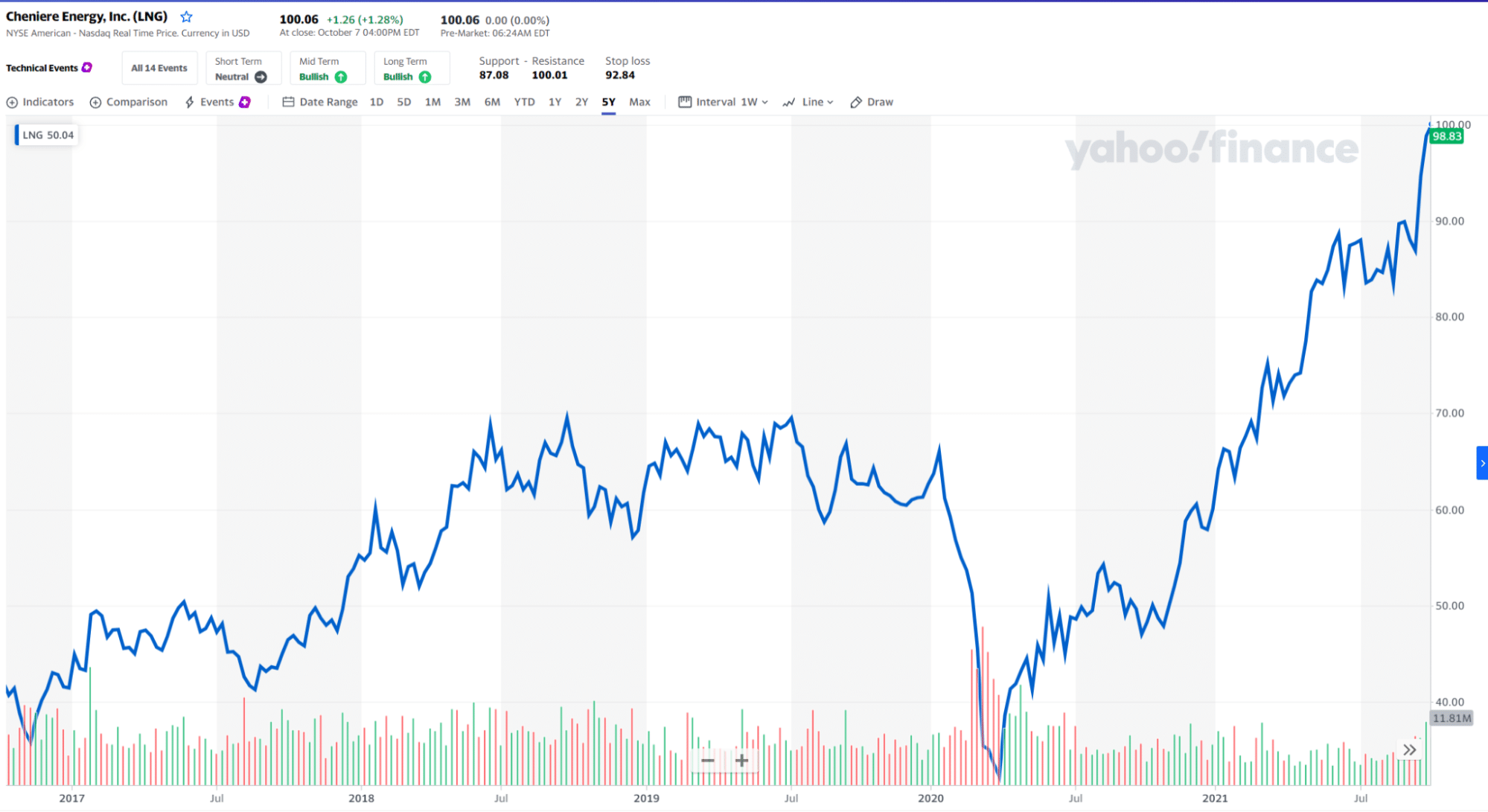

Cheniere Energy sells long-term fixed contracts that allow the company to have predictable cash flow. The company expects to generate $10 billion in cash flow by 2024. Today Cheniere Energy’s stock price is around $100.44. The stock price has been rising since early 2020, and it is expected to keep rising due to the high prices of natural gas.

LNG price chart

Comments