When it comes to FX trading, it’s not enough to be right about the behavior of the market in the future. You also should choose when to be correct.

Volatility makes you profit, and volatility is a result of market volume. Market participants capitalize from the market movement. So as a trader, you can yield whether the price goes up or down, but it’s harder to make money if the price doesn’t move. You can trade less and make more money by choosing when to trade.

Learn how to apply the principles of effective trading with these five tips on FX market hours.

Tip 1. Check the active market

It is clear to make money. It would help if you saw a difference between the price level at which you enter the trade and the price level at which you exit it. The difference between those two levels is your profit or loss. So, the more significant the difference, the better. That difference defines volatility.

How does this happen?

FX is a speculative market. Thus supply and demand define the price. So, for the price to change, one of those factors needs to change. An active market is one in which most traders are operating. High activity moves the prices and in this situation is when you get your chance to make money. Many traders waste hours trading in inactive markets, making marginal profits and wasting their days.

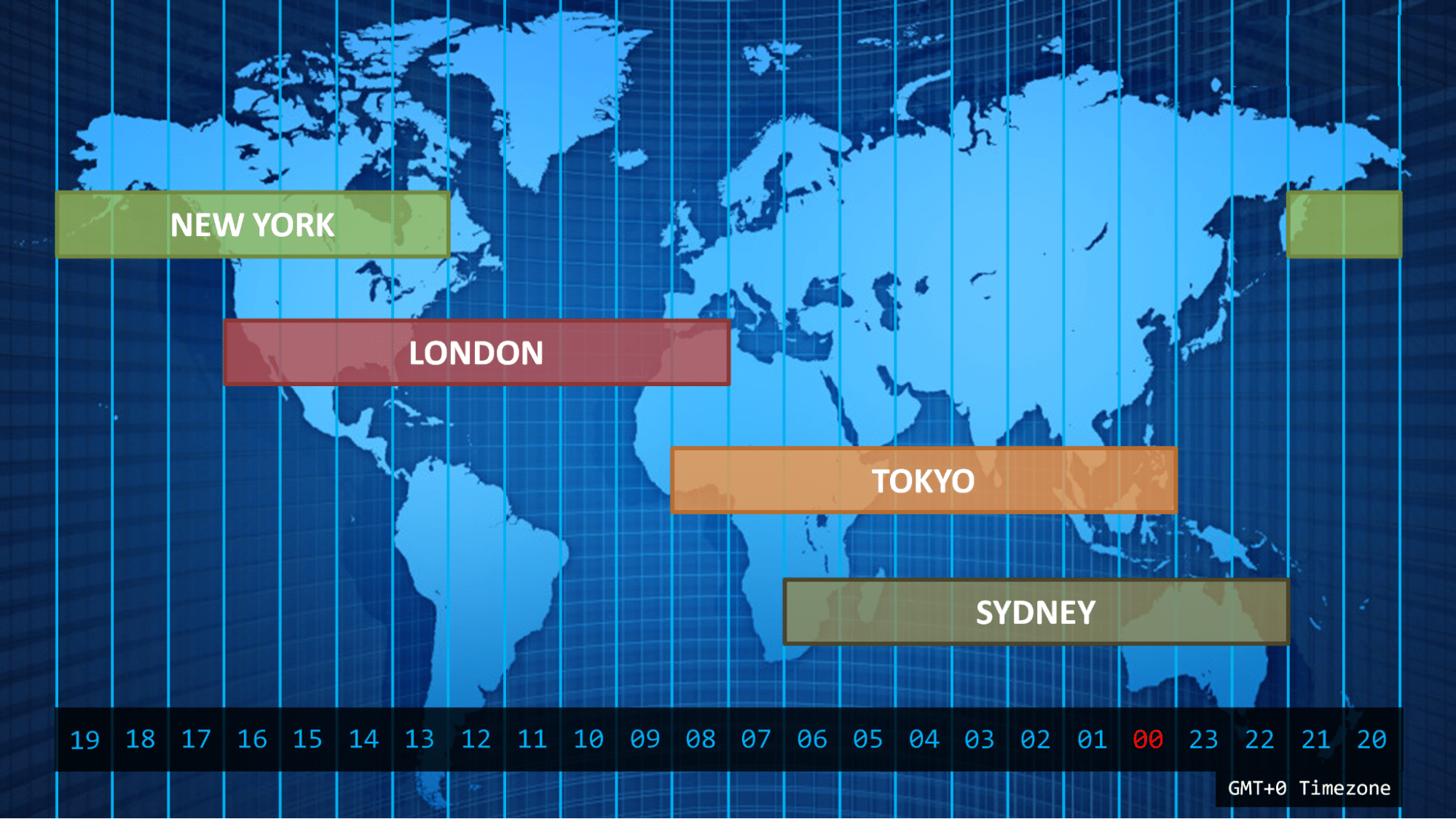

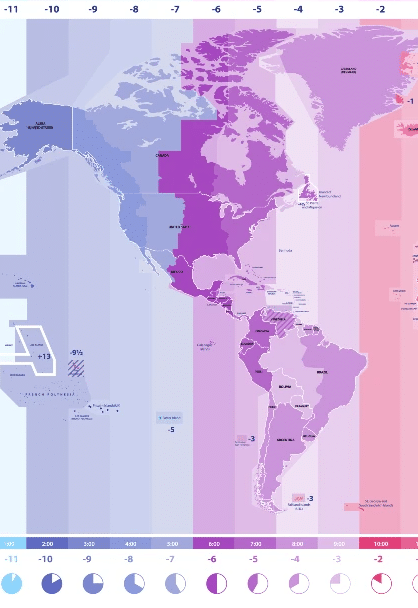

The trading session working hours varies depending on the country

How to prevent the fault?

Choose the most active market for the currencies you trade and avoid trading during inactive hours. Try to trade in hours when two sessions overlap. In those hours, the market is more volatile.

Tip 2. Choose the best time to trade

We know that there are better moments to trade, but how can we choose the best time to operate? The answer is linked to the first tip. The right moment is when the market is more active. As a rule of thumb, try to trade when two sessions overlap, but also, you should trade during the session of the country from which you trade your currency.

How does this happen?

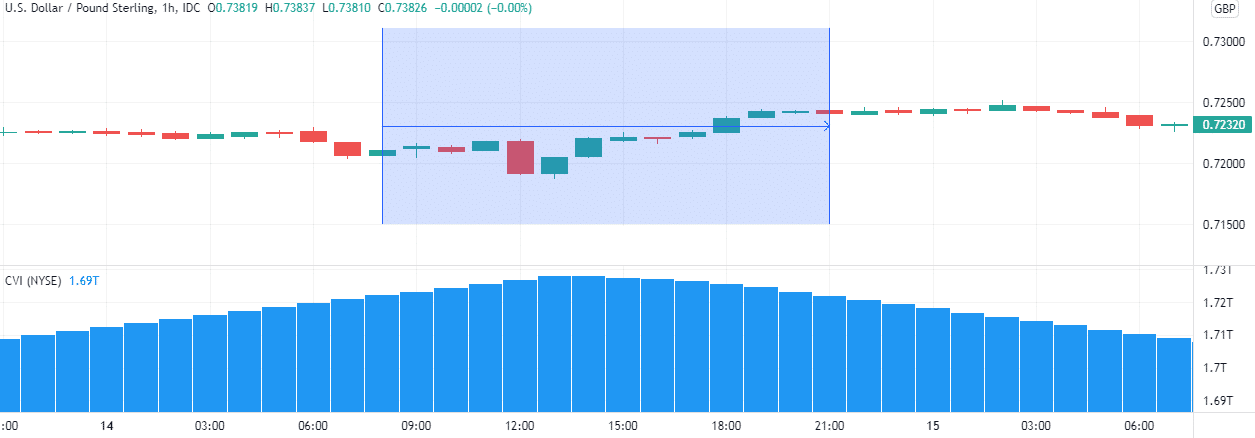

During sessions, most market participants, and most institutional traders, operate. So, because of the high volume they put into the market, volatility increases, and the earnings also increase.

The volume peaks during the trading session

How to prevent the fault?

Avoid trading on hours where the market is less active. During this time, not only you’ll see lower profits, but also the costs of your operation will increase due to the lower liquidity. In addition, the spread between the bid and ask price will be higher.

Tip 3. Use the forex market zone converter

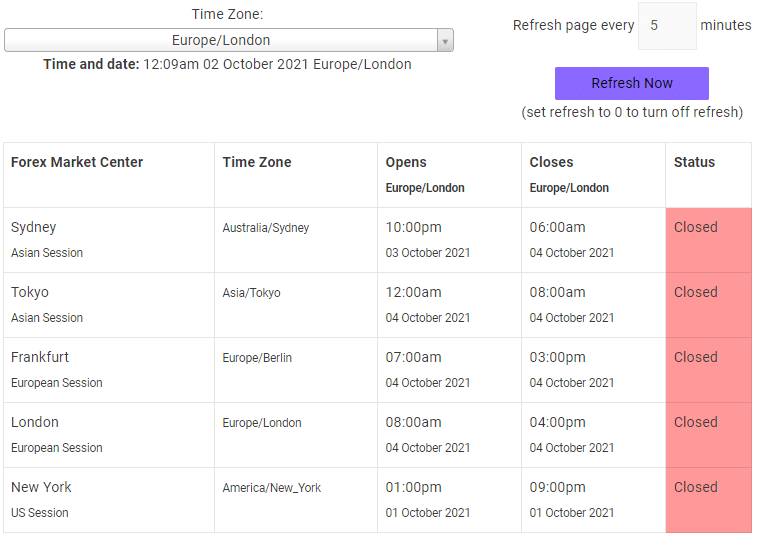

If you look at a chart, you can notice that most of them use UTC on the horizontal axis. This makes it easier for every trader around the world to analyze the market. However, it is not convenient to see UTC unless you live in England when trying to set your trading time. So instead, you can use FX market converters to figure out each session’s opening and closing times in your time zone.

How does this happen?

Due to the different time zones, you may be confused about when a certain market fluctuation occurs. For example, imagine the price of the AUD/USD rises 100 pips, at 9:00 am in Australia, then in New York, it would be 7:00 pm the previous day.

You can find many forex time zone converters online

How to prevent the fault?

Using a forex market converter, once you set your time zone, the tools will automatically tell you when each market will open and close in your time zone. Thus you don’t miss any opportunity and can choose the perfect time to trade.

Tip 4. Check the high trading volume

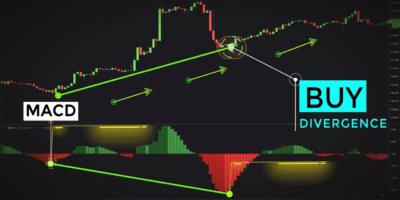

For the price to move, you need strong forces pushing it up or down. So, if you buy a pair, you want bulls to push the price higher and higher. On the other hand, for the price to go down, the bears must beat the bulls. So, depending on the volume of each force, the strength of bulls and bears moves the price.

How does this happen?

High volume doesn’t guarantee big trends. If the market’s sentiment is neutral, the price will stay about the same level. On the other hand, a bearish sentiment with high volume is like a snowball. The fast rate at which trades are made lowers the price quickly. So you will have second waves of traders that weren’t initially willing to sell, selling at even lower prices, which makes the price go even deeper.

In contrast, the same bearish sentiment with low liquidity could refrain from the trend because there won’t be many offers in the market. So, it is less likely that, for instance, a seller finds a buyer willing to pay the price he asks for the pair, this way, the price takes more time to go down, and the sentiment will dissipate. The same thing happens with bullish trends.

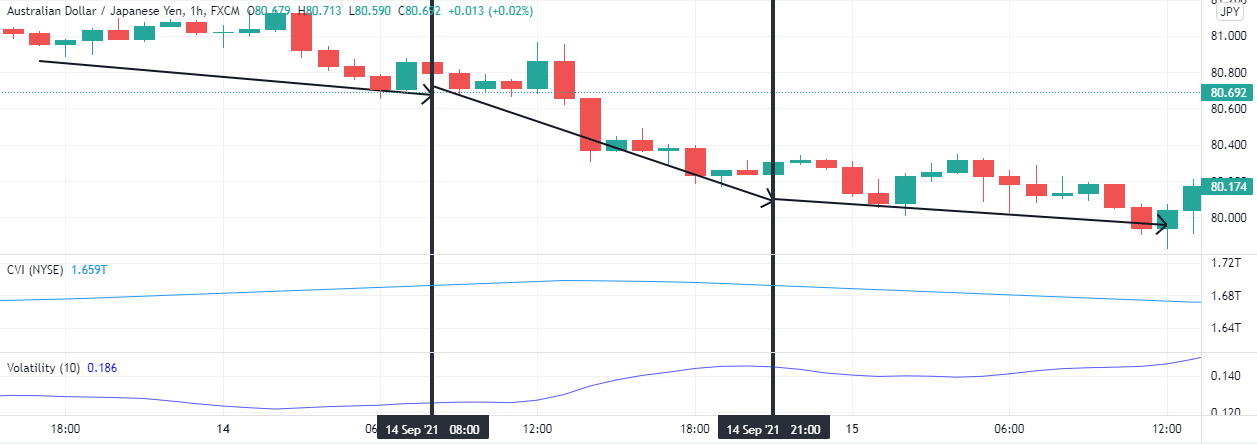

Volatility is usually highest during times of maximum volume. This leads to bigger trends.

How to prevent the fault?

If you are trading, let’s say the AUD/JPY pair, you want to trade when the institutional traders from both Japan and Australia are operating. So, you don’t have to work all day to make a few pips. Instead, you can make the same pips you used to make in one day in just a few hours by trading at the same time as the market makers.

Tip 5. Trade at the beginning of the session

At the beginning of every session, it is more likely to get the movements that set the market sentiment during the day. Therefore, trading at the beginning of the session can save you hours of your day and still yield the same or more than you would in other hours.

How does this happen?

More than a 12-hour gap separates the end of one session and the beginning of the next one. That’s half of the day. In this fast-changing world, many things can happen in twelve hours. For example, while someone is sleeping in Frankfurt, the Bank of Japan could adjust the interest rates. Those events shape the market sentiment, and particularly the market makers will adjust their operations accordingly in the session’s opening. So, the beginning of the session is often very volatile.

For most people in Latin America, the time difference with New York is three hours maximum

How to prevent the fault?

Trading foreign currencies sometimes requires waking up at 2:00 am to make some trades and then have the rest of your day by yourself. If you are unwilling to make these sacrifices, choose to trade currencies from a country whose opening session coincides with your working hours. For example, trading the USD/CAD is a good option if you live in Latin America.

Final thoughts

The FX market runs 24 hours a day, but you do not have to stay awake and stay in front of your computer screen forever. Instead, be a smart trader, learn the most active trading hours, choose the right currency pairs, and you are done.

Comments