There is some terminology that every trader must know before starting trading. Without these basics, you can’t understand the world’s largest marketplace. If you want to be a trader, you need to have clear concepts about these terms.

Before participating in the forex market, let’s move to the top ten basic terminologies that every novice trader should know.

Currency pair

In the world of FX, the trading assets are currency pairs. It is quoting for two different currencies:

- The first one is the base currency of any currency pair.

- The other one is the quote currency.

The price movement of any currency pair depends on the strength and weakness of the participating currencies.

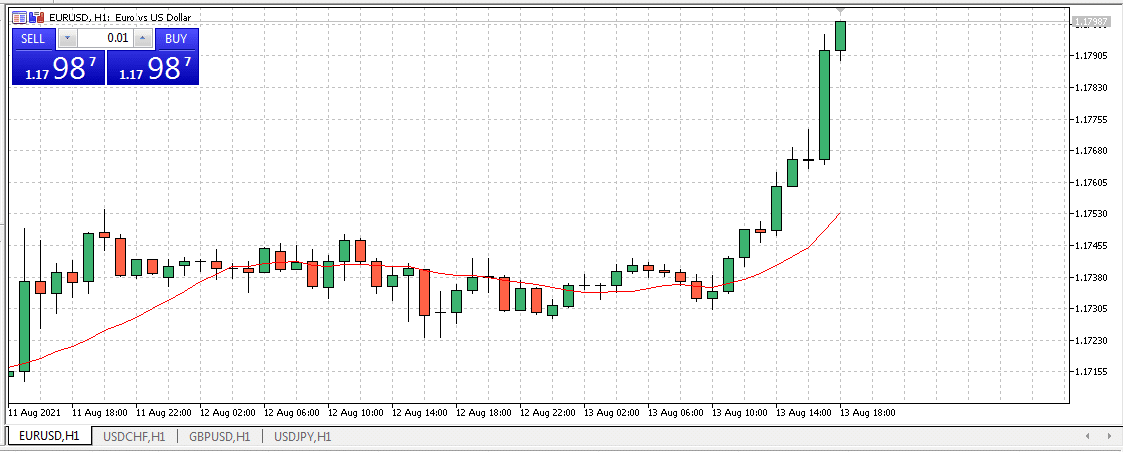

EUR/USD H1 chart

The figure above shows the hourly chart of the EUR/USD pair. Here the base currency is Euro, and the quoted currency is the USD. When the Euro is stronger than the dollar, the EUR/USD pair goes up and vice versa when the USD is stronger than the EUR.

Pips

It stands for a tiny standard measurement of price change of any currency pair in the FX, which is the short form of “percentage in points”. It counts at the price change in any currency pair — usually the fourth number after the point.

The price change is currency pairs measured on pips. For example, suppose the opening price of the EUR/USD is 1.1700, and it closes at 1.1780, then the price change is 80 pips for that day. It means the EUR gains 80 pips against the USD. The brokers and participants count their profits or losses by counting pips.

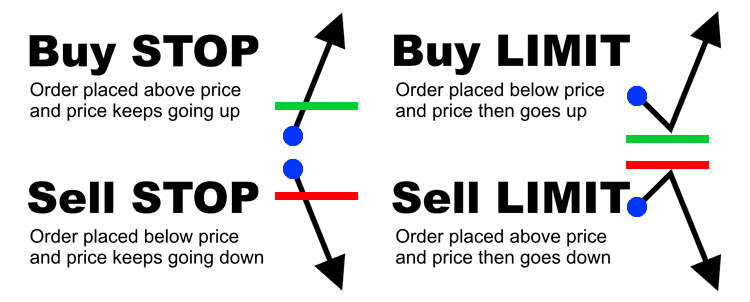

Buy stop sell stop

A ‘stop’ type order you place is above or below the current price.

Suppose the current price of the USD/CAD pair is 1.2511. Your analysis suggests that the price will remain on an uptrend if it crosses above 1.2520. Then you can manually place a buy order when the price crosses 1.2520.

Otherwise, you can place a ‘stop’ entry order at 1.2520. When it gets hit by the price movement, your order will be active. You can modify the order after or before the price movement hits it.

Instant execution

It refers to a quick entry or exit from trades. The FX is a 24 hours marketplace where continuous price changes occur at the currency pairs. Traders observe the price movement and place orders to make profits; that order should process instantly. It is called instant execution.

Generally, market maker brokers offer instant execution. The other type is the market executive type, which is opposite to the instant execution. In instant execution, it doesn’t allow brokers to change the price if any price change occurs when placing an order or during the processing period of that order.

Spreads

It is the difference between the two prices. Generally, brokers offer bid prices and ask prices for their clients slightly different from the actual price. You can check it on your terminal.

- The bid is the price by which you can sell the base currency.

- The ask is the price that a broker offers when you want to buy the base currency.

Brokers usually make money from spreads. Although some brokers offer fixed spreads for their clients, the spread value differs from broker to broker. The difference between them is the spread for the forex pairs.

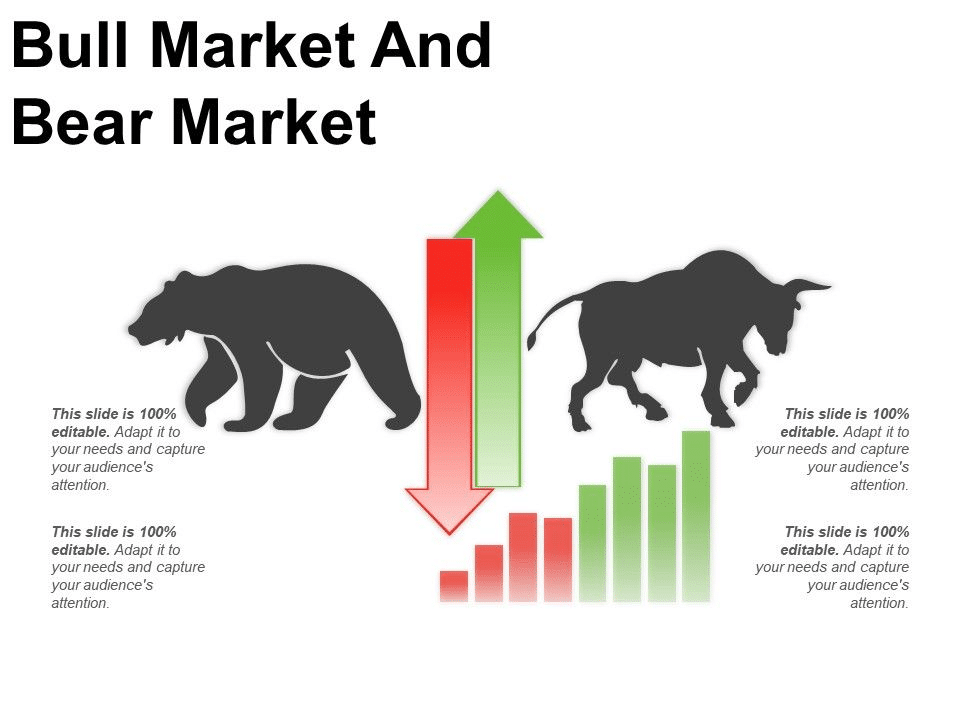

Bulls and bears

- Bulls mean the positive or upward force for any particular asset.

- Bears mean negative or downward pressure for any trading asset.

When bulls attack any specific pair, it means the price of the base currency is increasing. It says bears took over the price. When bears attack any currency pair, the price movement is downward. On the other hand, when the base currency loses, the ground starts to fall.

Swap

It is mainly an agreement between two parties. In forex trading, swap relates to the interest rate between the two participating currencies of a currency pair. The broker will pay if you have the currency in possession with more interest rate and hold the asset for a certain period. Hedge fund managers take advantage of interest rate swaps and use them for speculation.

Commission

It is a relative fee with the volume. The value of commissions changes with the volume. The commission will be higher with the higher trading volume of the asset. Brokers charge the clients for carrying the trades, and that charging amount is the commission, which involves the relation of the broker and the dealer.

Indicators

Traders use indicators to do technical analysis. They represent or calculate the market data or price movement in various ways. The indicator shows you the way of market-moving to predict the future direction for the asset price.

Traders decide to exit or enter the trades using indicators, which are mathematical terms that help define the price movement for trading assets. Brokers allow their clients to customize the parameters of the tools, so the traders can observe the price movement from various angles as they want.

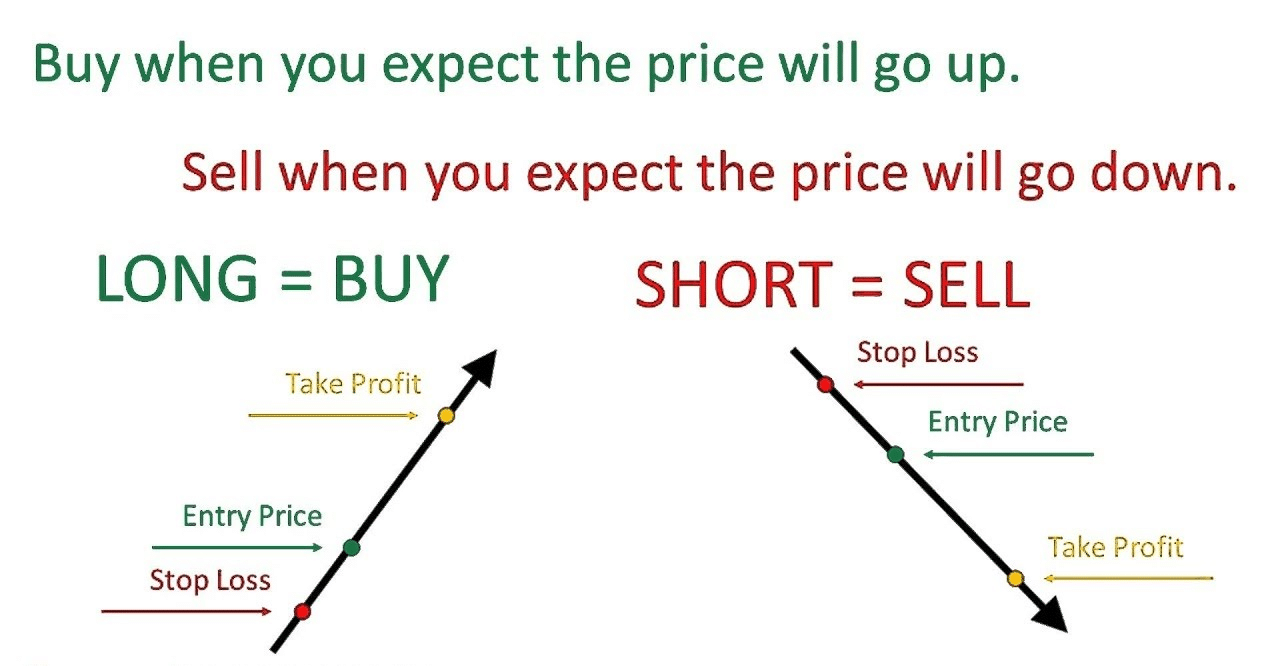

Short and long

Final thoughts

Finally, these are the most basic terms that every trader should know before trading. It isn’t easy to become a successful trader in the FX market, and most newcomers lose their first deposit. It will help if you learn more before you start trading and make continuous profitable trading positions.

Comments