If you are interested in leading a life with financial freedom, you should find a market where making enormous profits is possible. A large number of billionaires made their fortune through trading in the forex (FX) market. The unique feature of this marketplace is that you can make money from both types of uptrend or downtrend price movements.

However, this journey to becoming a professional trader is not as easy as people think. Individuals must follow some guidelines to get success from the FX industry.

A large number of the newcomers lose their first deposit as they have tendencies not to follow proper procedures. Some of them may don’t know the appropriate way to approach. This article will be a guideline for all beginners in the FX market.

How to create your trading routine?

The trading routine is an essential factor for any trader. It will help if you start to act like professionals to become a professional trader in the forex market. In other industries, most professionals such as singers, teachers, or doctors have basic routines to follow that help them reach a certain level of a successful career.

Anyway, creating a trading routine is easy that allows you to increase profitability and decrease losing trades. The main factors of creating a trading routine are that it suits your everyday life and trading style.

To create a trading routine like professionals, you need to follow:

- Achieve sufficient knowledge about participants in the market and its working procedure.

- Define an end goal for yourself in your trading career and keep that in mind.

- Recognize what factors are affecting your trading life. Eliminate the pessimistic facts that cause you loss and embrace positive attributes that are better for your trading.

- Make proper trade management and money management methods (risk management, profit ratio, losing trades, stop loss, profit-taking, etc.) and follow them.

- Make sure that your trading method can change with the market fluctuation.

- Develop positive and master winning habits. Don’t lose yourself over some winning trades as well as losing trades. Learn to recover from the stress from losing trades.

- Make a habit of learning, improve the trading style and practice more.

How much trading capital should you start?

Nowadays, individuals can start trading with a small capital such as $50-$100. When it is a question of making a living through trading in the FX market, that is too small as trading capital.

Moreover, newcomers have to deal with unavoidable factors such as overtrading, emotional trading, revenge trading, etc., to meet their return expectations.

If you want to be a professional trader, then you have to follow:

- First, set an amount of yearly return from your capital that will meet your expectation.

- You must consider a reasonable amount of return when you set your return expectations. Professionals may expect a 15-25% yearly return from their trading capital.

- The equation is desired income / return % = capital. So if you desire to get a return of $5000 by the end of every year. Meanwhile, the return expectation is 20% of your capital; then, you have to start with a deposit of $25,000 in your trading account ($5000/0.2=25000).

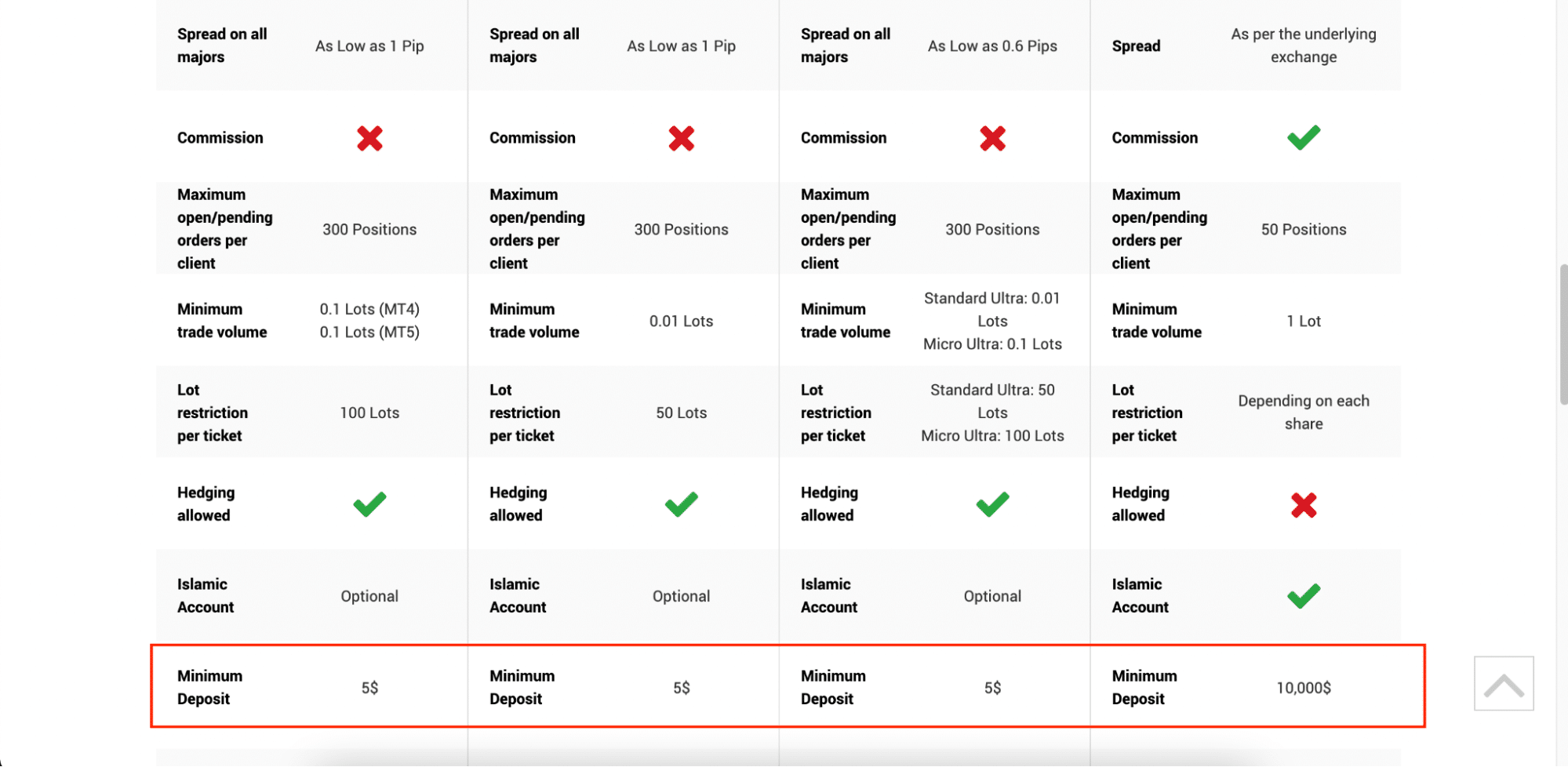

Most forex brokers provide flexibility in deposit amounts, while a well-regulated broker requires a higher initial deposit amount to start trading.

Deposit requirement from a forex broker

How to determine the right approach for you?

The next part is determining the suitable approaches for the individuals to the forex market. Identifying proper procedures that suit you will help you to be involved in costly trading mistakes. It will be best if you learn some facts before deciding the suitable approaches, such as:

- You have to know your availability on trading.

- You must know which types of analysis you are following. It might be based on an indicator, price action, swing trading, or the combination of technical and other analysis methods.

- You have to learn if you will follow automatic trading, copy trading, etc., as your trading approach or not.

When you seek these factors for yourself, you will learn that the tools, support, and analysis provided by your broker aren’t enough to meet your desire. You may need some additional tools, software, and resources to increase your profitability.

When you can sort out how much learning and understanding you need to be a professional trader, you will need additional tools to get a handful of returns from your trading capital. Checking on the risk factors will help you decide on taking risks per trade.

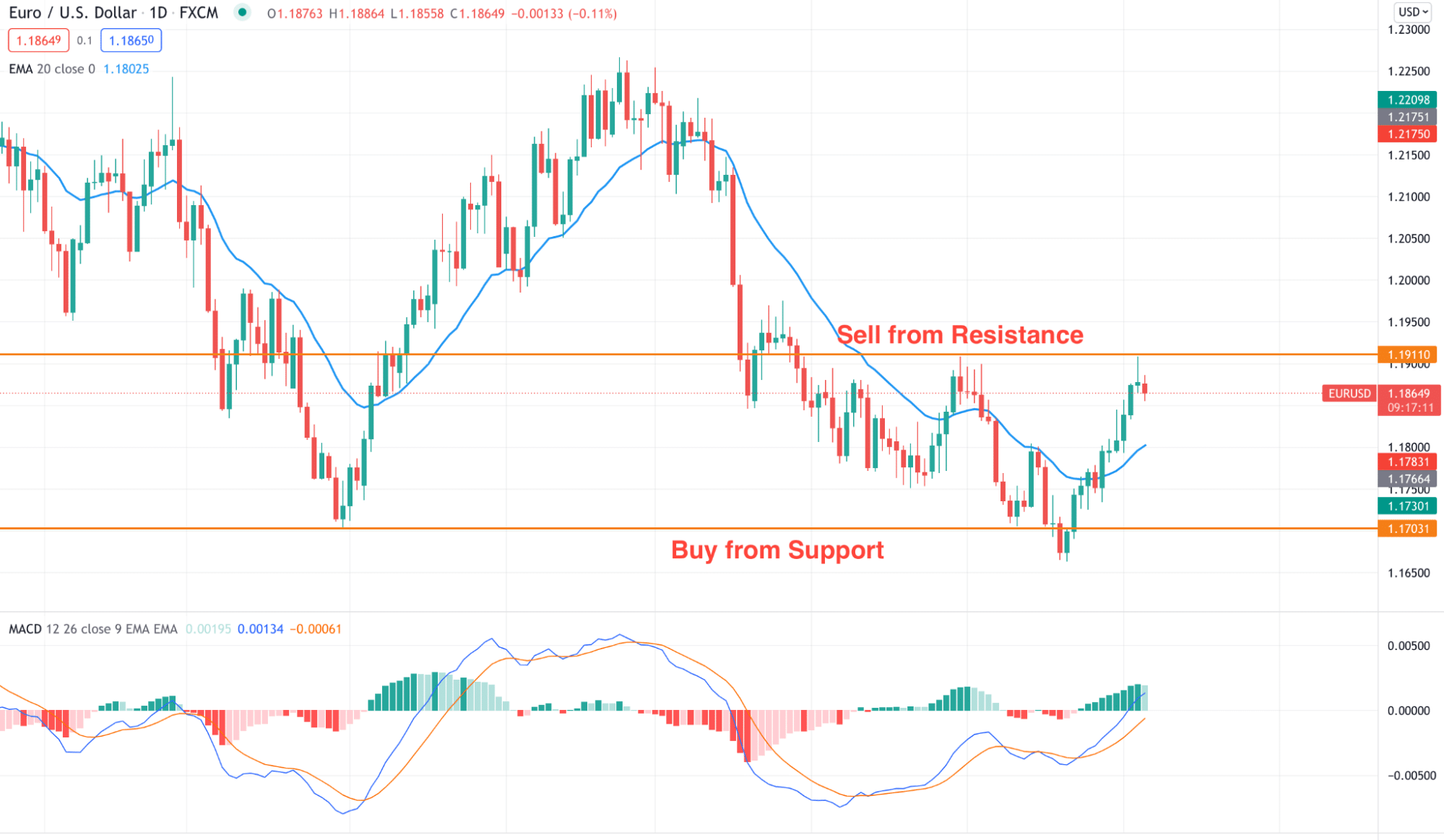

Anyways, indicator-based systems or naked charts both are profitable in this industry. You need to understand the market context, especially what the big players and institutional traders are doing. Let’s look at the easy example of the naked trading.

Simple EUR/USD naked chart analysis

How much money do Forex traders make?

You already know that the FX market is a vast marketplace to trade for individuals with a few thousand on the trading account. It is mainly a marketplace for banks and financial institutions. So there is a huge opportunity to have enormous profitability in this marketplace.

You may see a lot of self-made millionaires story in this market which may influence you, but in expectation of profit, you have to check on some facts such as:

- Your trading account size.

- The number of trades you are going to make per year.

- How much are you willing to risk to get every dollar profit?

- What percentages of your trading capital are you risking per trade?

- Will you reinvest your profits or withdraw? If you withdraw, then what will be the duration and amount? Is it weekly, monthly, quarterly or yearly.

Don’t fall for getting rich. Most newcomers dream of becoming a millionaire, but they lose capital for unrealistic profit expectations and a lack of trading plans. When you are a trader, you will have both winning and losing trades.

Avoid revenge trading, emotional trading, strict trading plans. Learn to recover from trading stresses, practice more and keep learning. You will get a satisfactory return from your investment, as all professional traders do.

Final thoughts

You know all the facts you may not underestimate to be a successful trader from the FX market. You need to have sufficient patience and spend enough time developing your skills. If you want to make a sustainable account growth, you have to build a winning mindset. Moreover, you must identify the lacking factors and eliminate them.

Comments