It is common knowledge that forex has more losers than winners. This business is not suitable for everyone. You must have a heart of stone to continue the battle and finally get ahead. While determination is essential, a proper trading method is crucial.

If you are a market technician, having a solid trading system is necessary. If you are a fundamental trader, you need to have in-depth knowledge of economic indicators driving the markets. However, upon closer look, it is not the entry strategy that fails many traders. At the core of trading failures is a lack of awareness about trading risk.

No one succeeds in trading without burning a deposit or two. That is a fact. Virtually all professional traders traveled that road at the beginning. However, they learned from their mistakes and employed good trading practices. That is why they were able to reach their current stature and maintain it.

As a newbie trader, you need to learn many things. You can even start your education on learning why many traders lose money. So this is to ensure you do the right things from the get-go. Here are some of the most common mistakes of newbie traders you should not make:

- Trading with insufficient capital

- Not accepting losses

- Overtrading

- Engaging in revenge trading

- Not having a documented trading plan

- Being overly zealous about a trade

From experience, the author realizes that the biggest mistake you can make is risking too much in each trade. This can mean taking too large of a trading volume than your account can handle. This could also mean opening multiple positions in a symbol.

Use a safety risk management strategy. At other times, it could mean using risky money management techniques. Therefore, if you want to succeed as a trader, think of risk first. If you manage risk well, profit will come next.

Fixed lot size vs. fixed percent

When you have found a trading opportunity, you need to decide the risk you are willing to take on the trade. For most traders, a fixed lot size is the norm. If you want to risk a particular portion of your capital on each trade, defining the trade volume is a bit challenging.

If you trade price action strategies such as candlestick trading, you know it is hard to maintain the risk on each trade if you use a fixed lot size. This is because the risk depends on the distance from your entry to your stop. This distance, in turn, is a function of the setup being traded.

For example, if you trade an engulfing pattern, the risk may increase or decrease according to the size of the candle formation. Therefore, the better solution is to use a fixed percent.

Investors suggest one or two percent of risk per trade. With fixed-percent risk management, your lot size may vary per trade, but you will maintain the same amount of dollar loss or dollar gain. That is the beauty of this risk method. There is no need to think about the actual amount of risk in a given trade setup. You can take every trade opportunity that comes your way.

Understanding pip value

Before we can compute the fixed-percentage lot size, we need to understand the pip value. The pip value is a crucial currency trading metric as it allows the trader to understand the potential loss or gain of open trade. Obtaining the pip value is a prerequisite to defining the correct lot size.

Apart from the actual price quote, price movement in forex markets is measured in pips. Due to the introduction of five-digit and three-digit quotes, now we have the term points. However, pips and points have a direct relationship. If you multiply pips by 10, you will get points.

See the example below:

- Price movement in pips = 5 pips

- Price movement in points = 5×10 = 50 points

It would help if you understood how to read price quotes in terms of pips and points. Be aware that price is expressed in two ways depending on the currency type. Each currency pair belongs either to the USD pair or the yen pair. All currency pairs having JPY as the counter currency are yen pairs, while the rest are dollar pairs.

The table below shows where the decimal position of one pip for each type lies.

| Convention | USD pairs | JPY pairs |

| Old | 0.0001 | 0.01 |

| New | 0.00010 | 0.010 |

Pip value means the amount in terms of the deposit currency of a one-pip price movement. However, this value is often not easy to come by. Three factors play into its calculation. These are the specific instrument considered, the trading volume, and the current price quote of the instrument. This means that each symbol has a varying pip value. The only exception is those symbols having USD as the counter currency. For these currency pairs, the pip value is the same.

How to compute a fixed-percent lot size

Here is how you can calculate the pip value for a standard account. Let us use the GBP/USD pair in this example. At the time of this writing, the exchange rate of GBP/USD is 1.41600. This value means that you will need 1.41600 dollars to buy one pound.

If you are using a four-digit account, one pip is equal to 0.0001. For a five-digit broker, one pip is equal to 0.00010. The only difference is the additional zero for the five-digit account, but the value is the same. Let us obtain the pip value of a standard lot (or 1.0 lot), equal to 100,000 units.

You can use the following formula:

(0.0001/1.41600) x 100,000 = 7 pounds

In terms of the counter currency USD, the pip value is:

0.0001 x 100,000 = 10 dollars

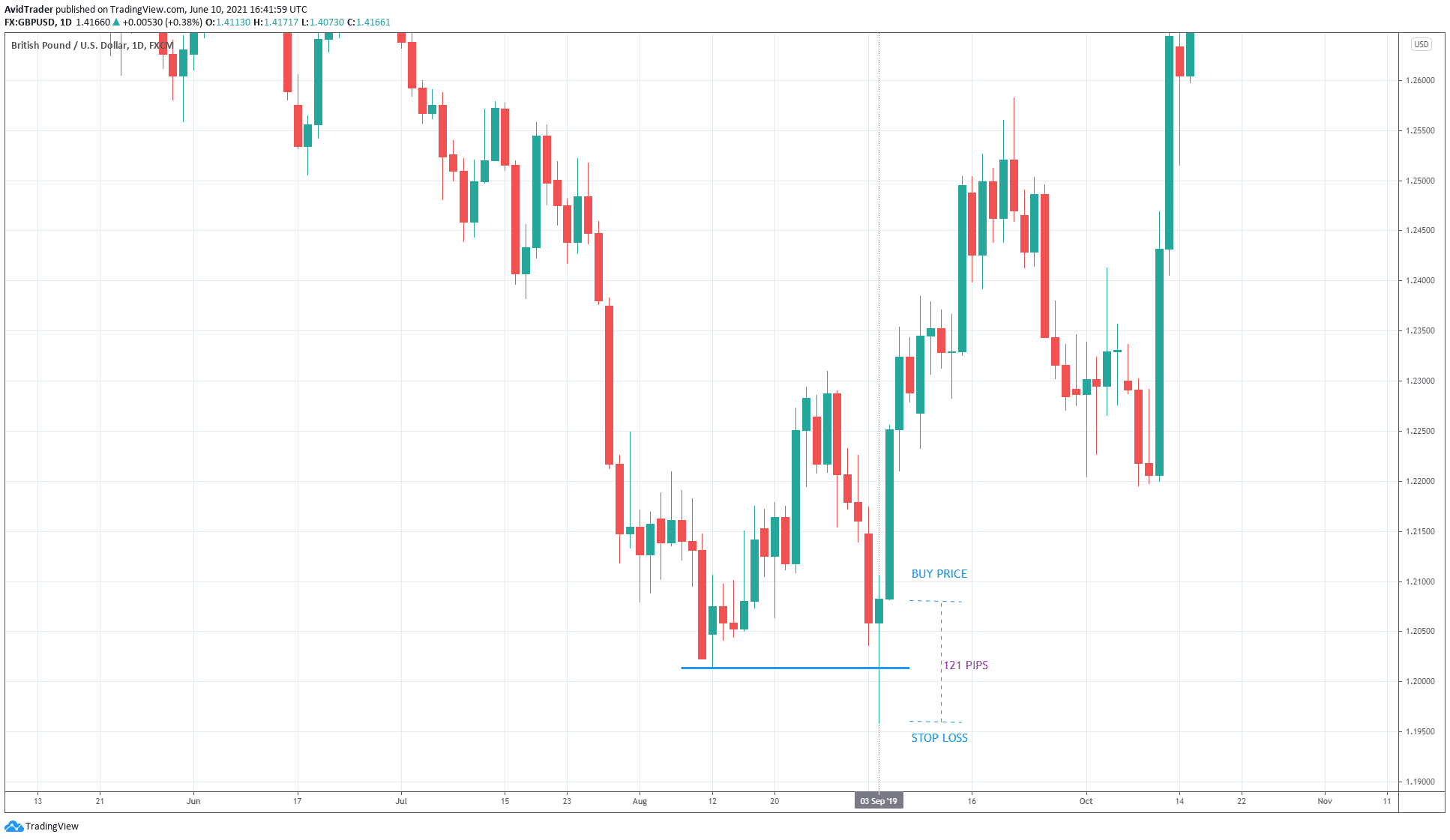

Now we are ready to compute the current trade lot size. Let us use the trade setup above as an example. This type of entry is the price action method using candlesticks and support and resistance levels. You had spotted a buying opportunity on 03 September 2019 in the GBP/USD pair when a bullish pin bar rejected support, as shown above.

Typically, you will initiate the position once the entry candle closes. For this setup, your buy entry is the open price of the new candle, and your stop loss will go to the low of the previous candle. Therefore, the risk in this trade is 121 pips. Next, we will determine what this value is in terms of the dollar amount.

Let us assume you have an account with a capital of $100,000. Then your trading plan requires you to risk one percent per trade.

What would be your lot size in this case?

- Desired trade risk = $100,000 x 0.01 = $1,000

- Pip value for one lot = $10 per pip

- Potential trade risk = $10 x 121 = $1,210

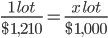

The $1,210 risk is 21 percent greater than the desired trade risk. Therefore, let us use ratio and proportion to get the actual lot size.

x = 0.82 lot

Therefore, instead of one standard lot, you can trade with a 0.82 lot, assuming the trade server accepts this trade volume.

While obtaining the fixed lot is time-consuming and involved, you can use a script to automate the process. It would be best if you run the script in the symbol of your choice. If you are lucky, you can find a free script online. If not, you can ask a friend or hire someone to write it for you.

Final thoughts

We have allotted enough space in this article to get the lot size based on a percentage of the account. This shows the significance of determining the correct lot size for your trades. However, knowing the accurate volume is not enough.

There are other helpful risk-management ideas you must know. This includes not taking multiple positions in one symbol being traded. Trading uncorrelated pairs is also a good idea. This way, your risk is diversified. Be a risk-averse trader. Focus on the risk, not on a reward.

Comments