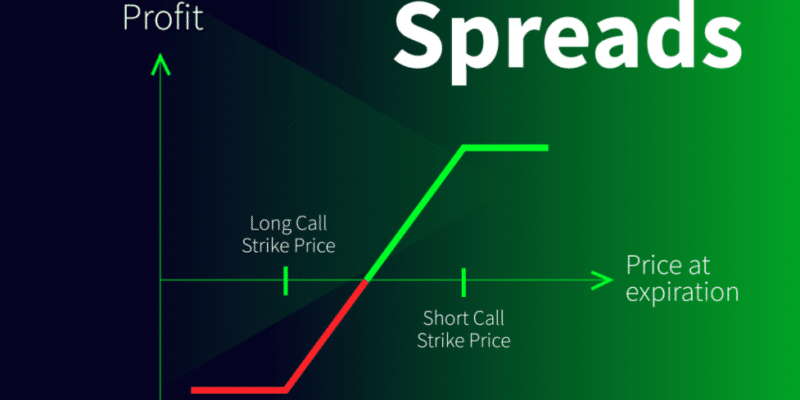

If you are trading as an options trader, then you’ve probably heard of vertical spreads. They are like a building block of multiple compound options strategies. We’ll go more into what vertical spreads are and how you may profit from them in this writeup.

What are vertical spreads?

The vertical spread is a trading technique that includes simultaneously trading two alternatives. These choices entail trading simultaneously but at separate price levels with the same expiry date.

You can purchase and sell contracts just at market price. That is a derivative. The phrase “vertical” refers to the strike price’s location.

It’s important to remember that you may sell chances to get premiums. It’s because if an option has not been exercised before the expiry date, it is no longer valuable.

When is a vertical spread used?

When you expect a significant change in the value of the underlying security, these spreads are generally oriented bets adjusted to reflect the trader’s bullish and bearish position on the asset.

Depending on the sort of such spread, customers may credit or debit their accounts. Because a vertical spread incorporates both sellers and buyers, the gains from creating an option would partially, if not entirely, pay the premium you’ll need to acquire its other portion.

As a consequence, the transaction is frequently less costly and riskier than trading bare options. Let’s look at the different forms of these spreads, which are divided into four categories:

- Bull call

- Bear call

- Bull put

- Bear put

We’ll go through two different sorts of calls: bull calls & bear calls.

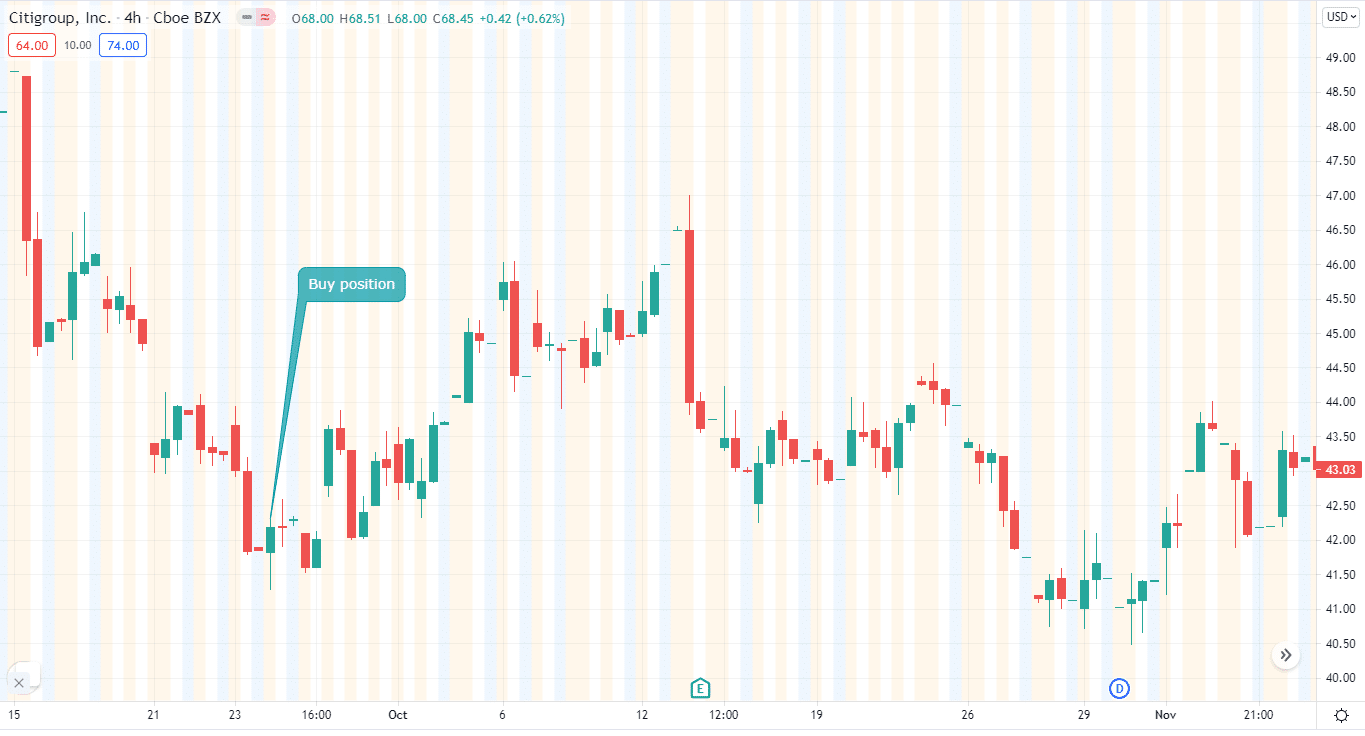

Bull call in vertical spreads

The bull call split is a bullish vertical spread created with call options, as the name suggests. Long call spreads, call debit spreads, and simply purchasing call spreads are almost all used to describe bull call spreads.

So to produce a range with a lower and upper strike price, the approach uses two call options. As a result, the bullish call spread helps to limit both stock losses and profits.

A bull call spread reduces the cost of a call option, but still, it comes with a price.

Gains on the assets’ prices are similarly restricted, resulting in a tight profit range for the investor. The bull call spread should be used if you believe the value of an asset will rise substantially. During moments of severe volatility, this approach is most often utilized.

The bull call spread risks and returns are restricted due to the lower and upper price levels. You do not execute the option at expiry if the asset price falls below the lower strike price from the first purchased call option.

You lose the original net premium paid when the option strategy expires. You may charge a larger strike price for an asset within loss if you exercise the option.

Let’s have a look at an example.

You sell a call at the $30 strike price and get $1 per contract at the same time. So your net cost to spread is $2 per contract, or $200 because you spent $3 and got $1.

This is a straightforward calculation:

2*100 = $200 is the result of multiplying your contract size by 100. Thus you lose $2 for each contract. The price of $30 will increase to $10 unless the stock rises above $40. These options expire useless if the stock goes below $30.

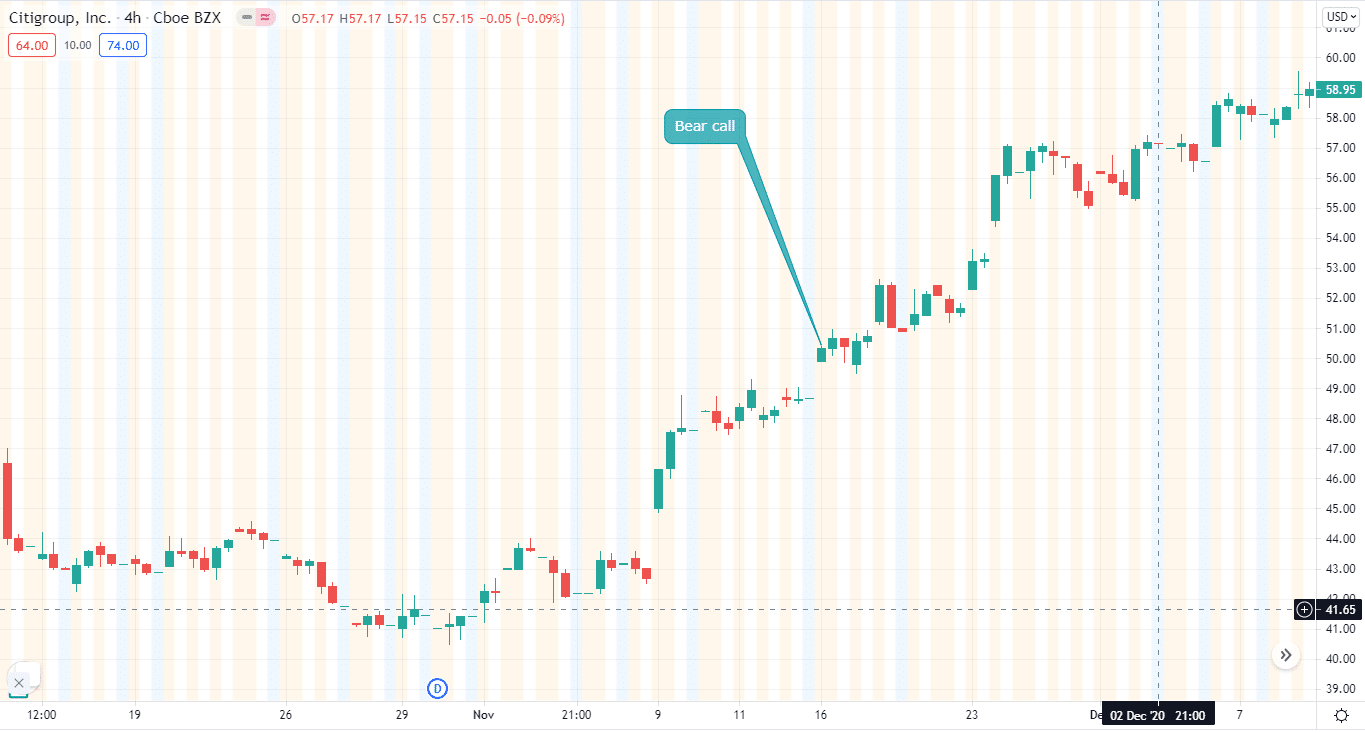

Bear call in vertical spreads

It is a bearish method that employs two call options with the same expiration period. The short call spread, call credit spread, and simply selling a call spread are used to describe this strategy.

A bear call spread is made by purchasing call options with a certain strike price to sell the same amount of calls of the same expiry date but at a lower strike price. With this approach, the maximum profit is equal to the credit obtained at the deal’s start.

A short call spread is another name for a bear call spread. It is thought to be a low-risk, low-reward strategy.

Let’s take another look at the Citigroup, Inc. stock as an example.

Breakeven and profit potential in vertical spreads

We know your head must be spinning. So to give your brain a rest, let’s examine in what way you can sum up breakeven plus profit potential for bull and bear call spreads.

For a bull call spread, the formula for determining breakeven and profit potential is:

- Breakeven price = strike price of the bear call + premium paid

- Profit potential = spread size – premium pay x contract size

- Your risk of losing money is calculated as follows: premium paid x contract size

On the other hand, the formula for calculating breakeven and profit potential for bear call spread is:

- Breakeven price = bull call’s strike price + premium paid

- Your profit potential = premium received x contract size

- Maximum loss potential = spread width – premium received x contract size

You may have noticed bull and bear calls have limited profit potential. Because they have limits, it is considerably more straightforward for you to choose when to take profits.

What about a loss? Should you close vertical spreads at a particular point if they are losing money?

Because all vertical spread techniques have specified risk, lost trades have better risk/reward profiles than winning trades.

Final thoughts

So, there you have it. Next time when you trade options, you can use these spreads to accelerate your trading game.

Comments