Whether a novice or experienced, investors all live with the fear of a stock market crash impacting their investments, economic instability is bound to happen. Thus the past has shown us how detrimental it can be towards the stock markets.

It affects all markets, and if you do not act in time to prevent the consequences, you can have your hard-earned disappearing before your eyes.

History has taught us to be well prepared, and luckily there are precautions that every investor can take to safeguard their assets from going down the drain in the event of a stock market crash. Without mincing words, preparation and diversification have repeatedly proven to be solid defensive strategies in the face of global economic depression or stock market crash.

Before we explore how to safeguard your investment, let us review past market crashes and their impact on stocks.

Overview on the historic stock market crash

A stock market crash occurs when an unexpected and sudden drop in the prices of stocks. Usually, a decline of more than 10% in the value of stock indices qualifies as a crash.

The predecessors to a crash could be political unrest or a major economic meltdown, and this can occur within a few hours and can last for days or even years. In effect, investors start selling off many of their shares, which results in the value of the particular stock declining rapidly. If you hold your positions during such times, your investment depreciates and can run into high losses.

These are some of the significant market crashes which stand out in history.

The crash of 1929

On 29 October 1929, the trading of approximately $16 million shares in one day caused a major stock market meltdown, and it was known as “Black Tuesday.”

Simultaneously, the high unemployment rate and a rapidly expanding stock market were the leading causes of the stock market crash. With production decreasing, stocks were in excess. Further reasons were increased debt, low wages, and a struggling agricultural sector. Investors lost billions, and the result of the crash was the Great Depression which lasted for ten years.

S&P 500 chart in 1929-1938

S&P 500 chart showing the sharp decline of the stock market from 1929-1933. The market lost 13% in one day and continued to decline for years to follow.

The crash of 1987

During this period, the political tensions between the US and Iran were high; in addition, oil prices declining-this resulted in a highly pessimistic market. Furthermore, the new computer-based trading programs resulted in brokers placing large orders at quick execution rates. When the prices started to fall, they couldn’t keep up with the volumes. The Nasdaq dropped 11%, Dow Jones and S&P 500 more than 20%. It had a detrimental effect on global stock exchanges as well.

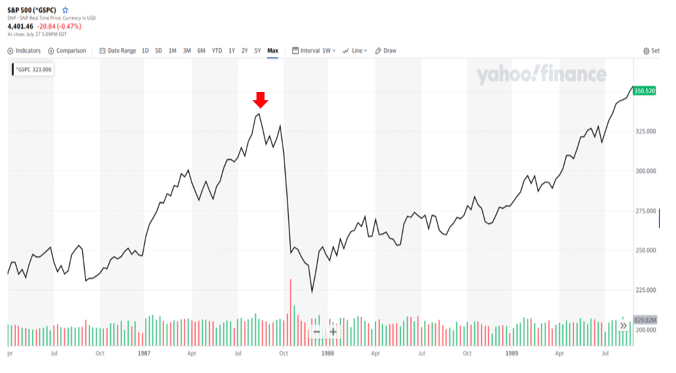

S&P 500 chart in 1987-1989

S&P 500 chart showing the crash of 1987 – the index lost 20% in value, and it lasted until 1988.

The crash of 2007-2008

The property market was booming at the start of the 21st century, and many investors found real-estate securities an attractive option. In addition, banks were eagerly granting mortgage loans to newbie home buyers.

Eventually, debt increased, and borrowers were defaulting, the prices of properties started to fall. Securities based on the real estate began to decrease in value as well. It led to the decline in the stock market in 2008, losing almost 20% in value, the Dow Jones dropping to nearly 500 points. This Great Recession continued until 2009.

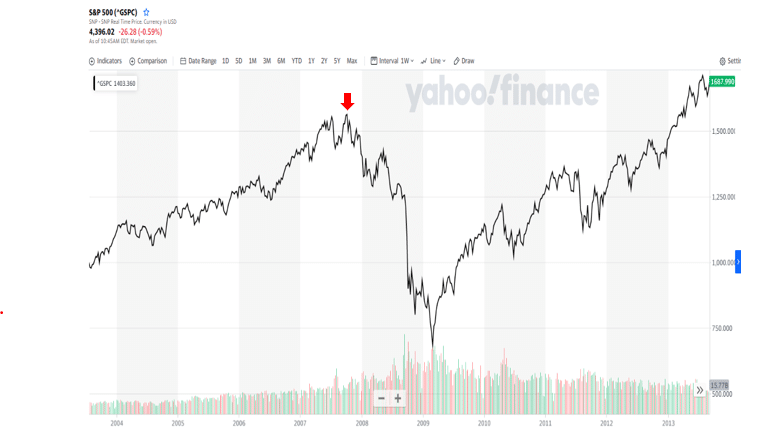

S&P 500 chart in 2007-2008

S&P 500 chart showing the market crash from 2007 to 2008 during which the market lost 20% in value.

Covid-19 crash of 2020

The Covid-19 pandemic hit China first and soon spread to the rest of the world. Around March of 2020, the whole world was in lockdown. Non-essential businesses were closed, and millions were unemployed.

Investors realized the impact of the pandemic and the impact on the economy. In the US, mandatory lockdowns from 16 March resulted in the Dow Jones and S&P 500 losing 13% and 12 % in value, respectively.

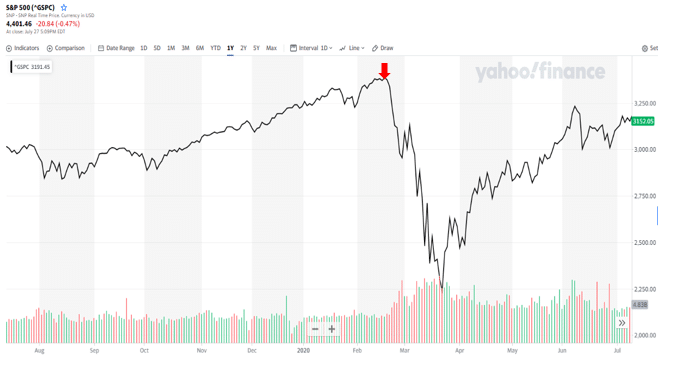

S&P 500 chart in 2019-2020

Stock market crash during the Covid-19 pandemic started from Mid-February 2020 until March 2020. The S&P 500 lost almost 12% in value.

Top five ways to safeguard your investments

No one could have foreseen these stock market crashes, and investors would not have been ready for such a blow. However, as investors, we have learned valuable lessons on protecting our investments, even amid some of the worst crashes. Therefore, we came up with five ways by which you can protect your investments.

-

Pay off your debts

When your investments are at risk, the last thing you want is to have high amounts of accrued debt. You can pay off debts like credit cards and non-essential loans to increase your cash flow. In addition, paying off your mortgage or a significant portion of it can ease the burden as well. Reduce your spending and revise your budget so that you keep money aside in an emergency fund.

-

Hedge your positions

Hedging is an excellent way to manage risk in your portfolio so that the aftermath is not as severe; we can think of hedging as a kind of insurance. A strategy that works is to short sell your holdings in stock by buying put options. If the stock should plummet, you offset your losses from the profits you make off the put options.

-

Diversify

Diversifying is one of the most important ways to safeguard your investments. It means you are moving your funds to safer investments with less risk. You might have to be satisfied with lower yields at times, but the upside is that your money is safer. You can diversify in stocks, commodities, bonds, retirement funds, real estate, and even cash.

-

Cash-out

Another safe option when you detect market uncertainty is to close out your positions and take your cash. Instead of HODLing and hoping the market will not drop further, you instead buy again in the dip. You might even increase your yields if you buy again at lower prices because the stock market inevitably has to recover.

-

Tax-loss harvesting

To offset capital gains taxes, you can sell some of your low-yield assets. In this way, you limit short-term gains since tax is higher on these than long-term gains. Tax-loss harvesting can reduce your losses significantly by reducing the number of occasions you have to pay taxes.

Pros and cons of stock market investments

Pros

- Low investment required

You don’t require millions of dollars to invest in stocks; the market has advanced that the average individual can invest a few thousand dollars in stocks and still benefit.

- Many stocks to choose

The stock market has hundreds of stocks to choose from; there is no limit to what you can buy. As long as you have conducted your research, you can benefit from the most stable and low-risk investment.

- Beat inflation

Investing in stocks allows you to stay ahead of inflation. Stocks listed on the major exchanges like the NYSE have grown on average 10%, which is higher than inflation, resulting in higher returns vs. a savings account or bonds, which has returned lower than inflation at times.

Cons

- Emotionally daunting

The stock market is an emotional rollercoaster since the market moves up and down constantly. If you are monitoring stocks regularly, the constant up and down will cause emotional distress. This can result in you making poor decisions that can be detrimental to your investments. It is advisable not to check the charts too often.

- It requires knowledge

If you are a novice investor, you will require proper knowledge and research of the markets. In addition, you need to understand the earnings reports and performance of the particular stock that you intend to purchase. A lack of knowledge can result in buying the wrong stocks.

- High risk

Stock investments, though profitable, come with high risk. The stock market is highly volatile, and it is affected by the broader economic condition. Therefore, you need to have a good appetite for risk combined with a proper investment plan, keeping in mind that you can lose it all.

Final thoughts

We all like to be optimistic about our investments, but the bearish market will always be upon us. Stock market crashes are bound to happen again. To always be on the safe side, it’s an excellent move to prepare yourself and protect your portfolio from sudden market crashes.

As we’ve mentioned, there are many ways to safeguard your investments; it also builds resilience and expertise to manage your portfolio wisely in the future.

Comments