The green economy needs more copper used in electric cars, wind turbines, and solar panels. Copper prices have doubled since the pandemic lows, and many industry experts believe that supply and demand dynamics will continue to be favorable.

Copper funds are designed to track the price of copper, an industrial metal used in a wide variety of applications in manufacturing, electronics, and construction. Investment strategists at Goldman Sachs said that its prices could reach $15,000 per ton in 2025, driven by the metal’s use in green technologies.

Should you invest in copper assets? Let’s take a closer look below.

What are copper ETFs?

Copper is considered a cyclical commodity whose price fluctuates with economic cycles, rising when the economy grows and falling when the economy slows. The highly sought-after metal might not be as precious as gold or silver. Still, it is a precious commodity you should consider gaining exposure to in your portfolio.

Suppose you are looking to capitalize on the booming copper industry. In that case, this article will provide you with a list of some of the best assets in this sector.

How to buy copper ETFs?

If you want broad exposure to the copper industry through several stocks, you could consider funds. Thus, you can generally trade in a range of copper-related companies or trade the copper industry with a single position.

The buying and selling of such shares are the same as for stock shares, placing orders through your brokerage account.

Step 1. Purchase shares of your selected fund by placing a buy order with the stock ticker and number of shares.

Step 2. These shares trade on the stock exchange; thus, your order will be filled almost immediately during market hours.

Step 3. Confirm that the order was filled by checking your account summary page, which should list the fund shares and the purchase price.

Top 3 copper ETFs & ETN to buy in 2022

Here are three funds to consider for diversifying your portfolio.

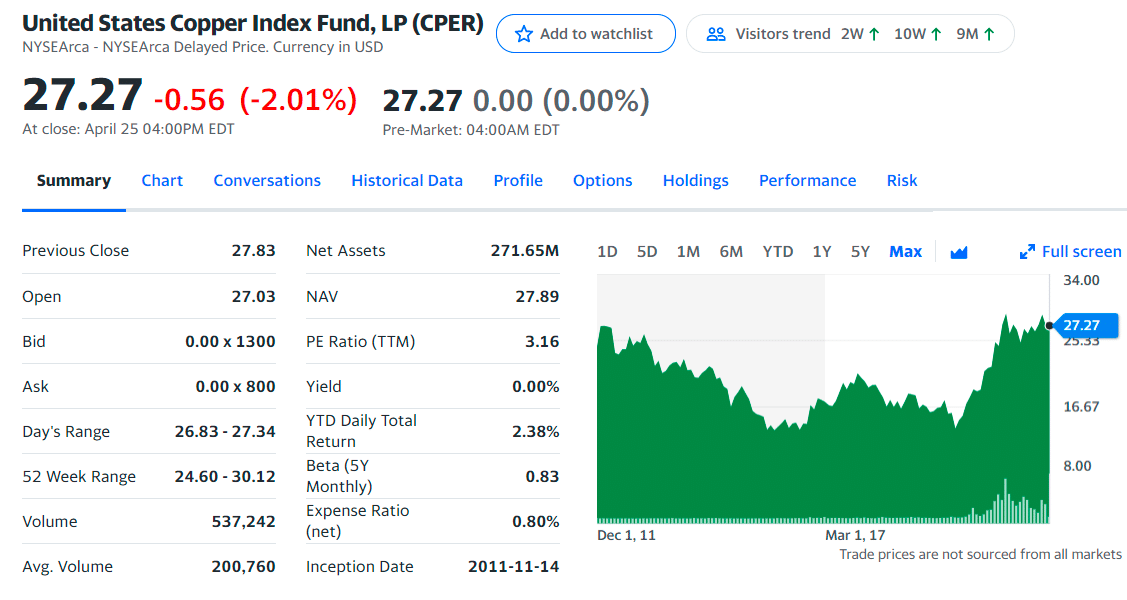

№ 1. United States Copper Index Fund (CPER)

Top Copper ETF & ETN

It is a private commodity pool investment design that tracks the SummerHaven Copper Index Total Return, reflecting its futures portfolio performance. Investor contributions are utilized for trading commodity futures contracts to maximize profits through leveraged trading. US treasury bills back the futures contracts with three-month durations. The contracts maintain exclusivity in copper futures.

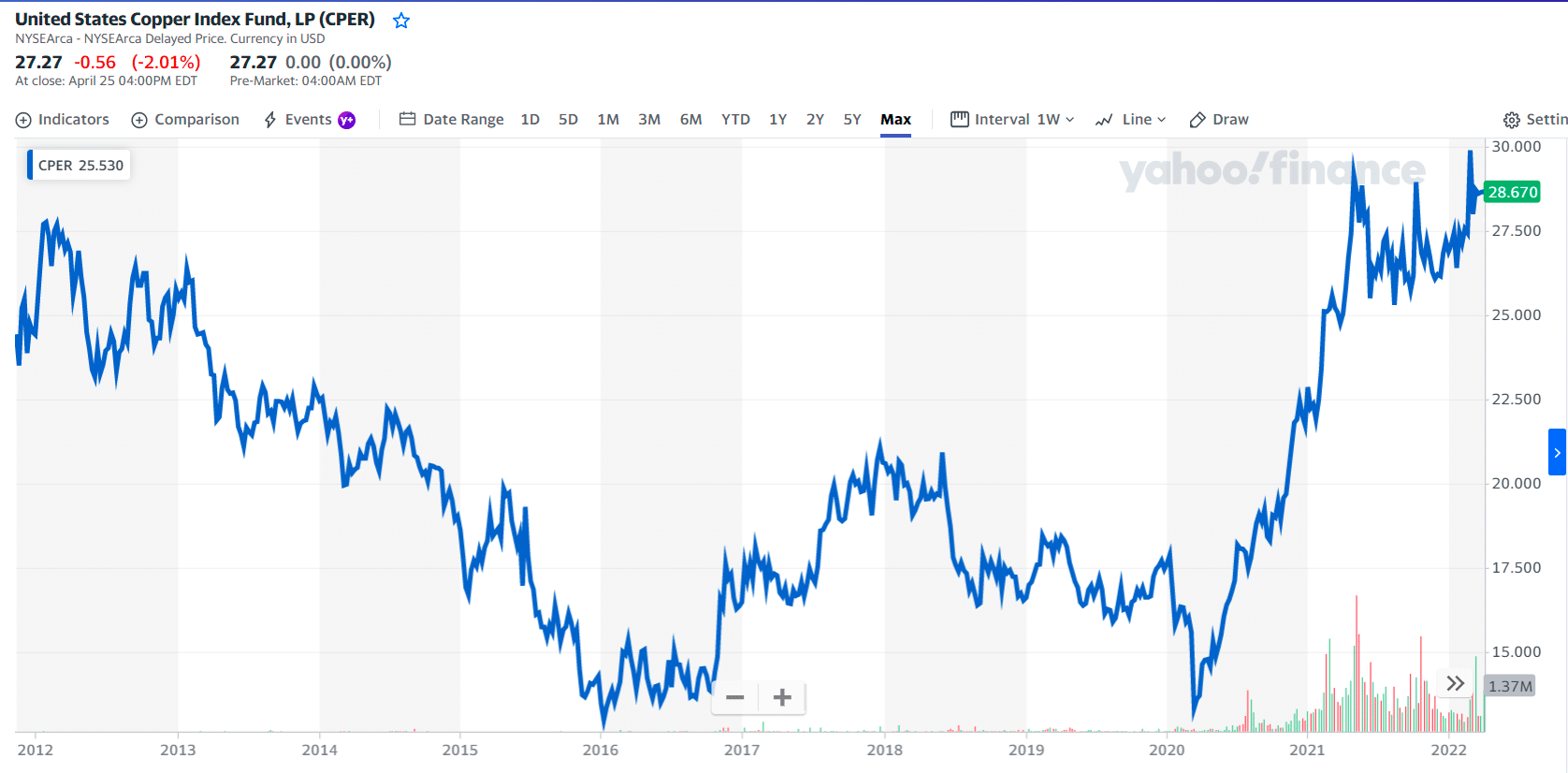

CPER price chart

Like other copper funds, this one lags the broad basket commodity index and the S&P 500 index for the 1-year return ending February 28, 2022. However, it leads the commodity index for more extended periods yet still lags the S&P for three years or more extended returns.

The first holdings with their asset percentage are:

- Copper Future May 20 — 45.36%

- The United States Treasury Bills — 2.79%

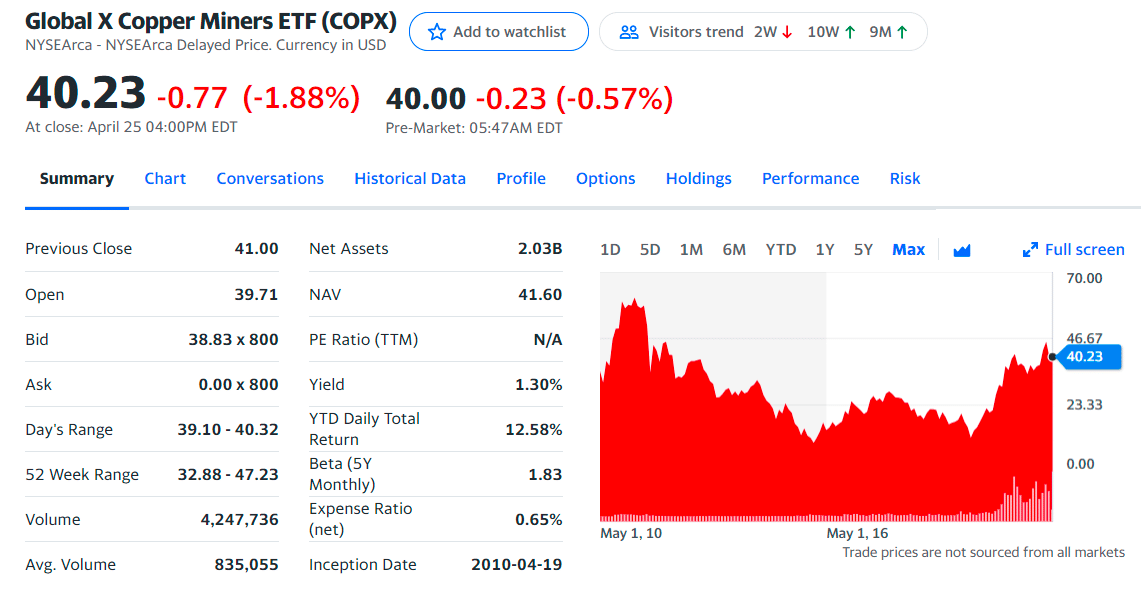

№ 2. Global X Copper Miners ETF (COPX)

COPX ETF summary

It is an equity-based ETF that seeks to provide investment results that generally correspond to the price and yield performance of the Solactive Global Copper Miners Total Return Index.

This fund significantly underperforms the broad basket commodity index and falls just shy of the US equity index, S&P 500, for the 1-year return. However, it strongly outperforms commodities for more extended period returns. At the same time, results are mixed compared to the S&P 500 for three years and beyond.

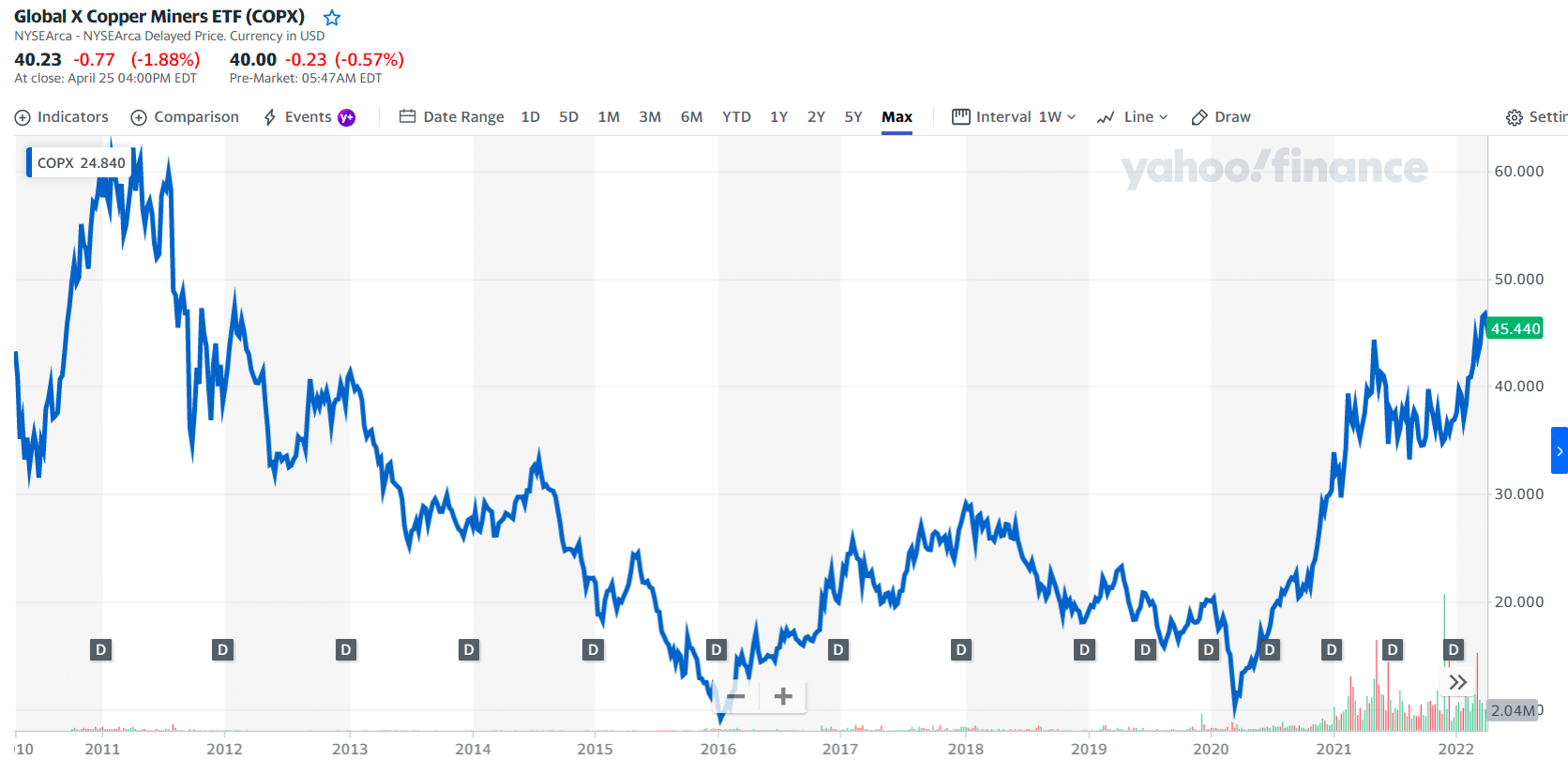

COPX price chart

This fund significantly underperforms the broad basket commodity index and falls just shy of the US equity index, S&P 500, for the 1-year return. However, it is strongly outperforms commodities for more extended period returns. At the same time, results are mixed compared to the S&P 500 for three years and beyond.

The first three holdings with their asset percentage are:

- Zijin Mining Group Co Ltd Class H — 4.98%

- Freeport-McMoRan Inc. — 4.89%

- Boliden AB — 4.85%

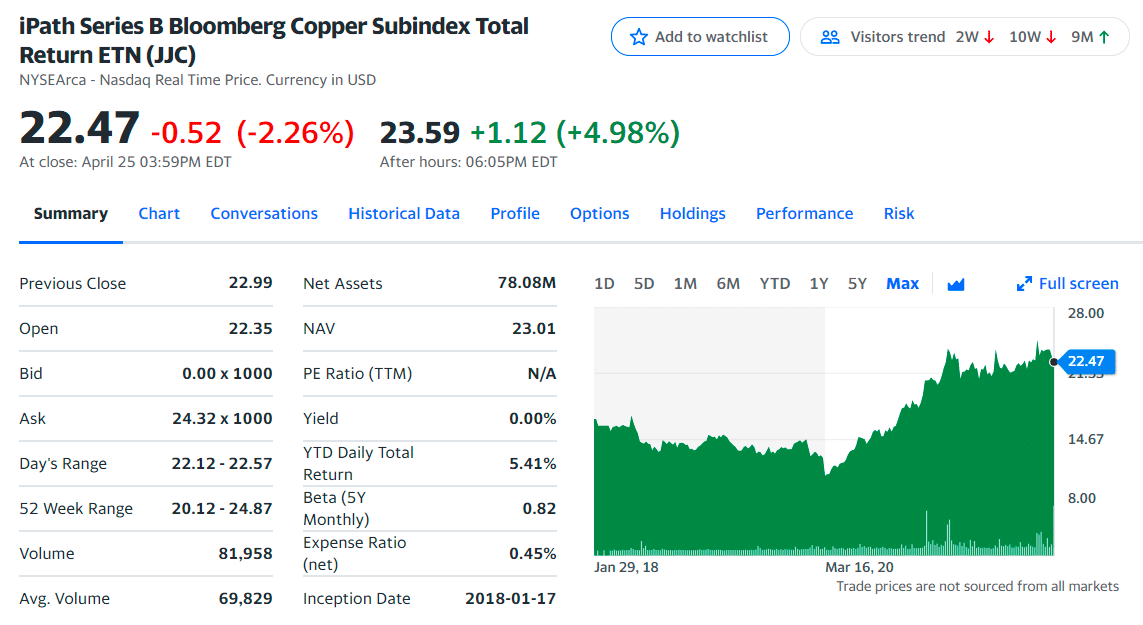

№ 3. iPath Bloomberg Copper Subindex Total Return ETN (JJC)

JJC ETF summary

The smallest fund on the list, it tracks the Bloomberg Copper Subindex Total Return, giving you exposure to copper futures contracts. It costs 0.45%, has $105 million in assets, and returned 7% in 2022 year-to-date.

However, it is not an ETF but an ETN, which is a form of debt issued by a bank, in this case, Barclays. Unlike an ETF, which buys and holds the underlying securities, an ETN doesn’t own anything.

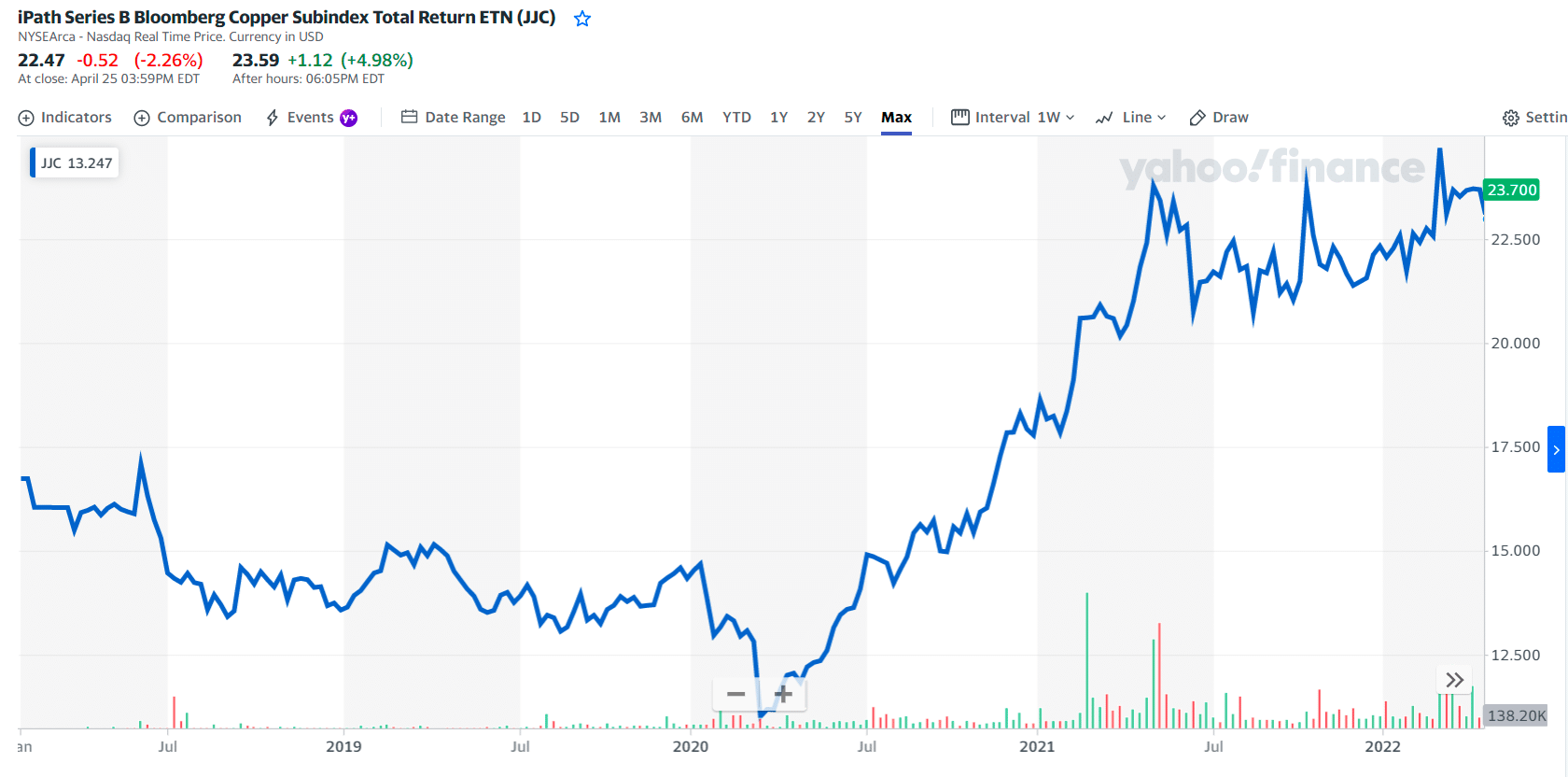

The fund underperforms the broad basket commodity index and the S&P 500 index for the 1-year return ending February 28, 2022. It beats commodities for the 3-year while under-performing the S&P. It does not have a performance record for five years or beyond.

JJC price chart

The ETN offers exposure to futures contracts and not direct exposure to the physical commodities. The index is composed of one or more futures contracts on the relevant commodity and is intended to reflect the returns that are potentially available through:

- An unleveraged investment in those contracts.

- The rate of interest that could be earned on cash collateral invested in specified Treasury Bills.

Final thoughts

Copper is used extensively in many processes that keep our modern world running smoothly, from electricity generation to infrastructure. This means the demand for the metal is relatively stable.

There are two copper ETFs and one copper ETN traded on US markets. An ETF may hold copper futures or stocks of copper mining companies, while an ETN is an uncollateralized debt instrument that may hold copper futures. Investors should study the benefits and risks of these funds before considering an investment.

Comments