In recent years, the demand for electric vehicles has been among the market’s most volatile and top performers. Investors are snapping up shares of EV initial public offerings and early market leaders as they see EV technology as a massive, long-term growth market. As e-bikes become more popular, battery manufacturers have become increasingly competitive for market share. In 2020, there were 2.5 million EVs sales, which then rose to 11.25 million by 2025. Deloitte estimates that by 2030 there will be 31.1 million EVs on the road.

The forecasts predict that the global EV market will reach $1.3 trillion by 2028 at a growth rate of 24.3% annually. Unfortunately, as of 2022, many EV investments have suffered from a rotation out of high-growth tech stocks. In this guide, you will find 3 of the best battery companies and e-vehicle stocks to buy.

What are electric battery stocks?

In the automotive industry, electric vehicles are becoming more common. As a result, automakers are focusing on EVs and are actively developing or selling them. Tesla is a leader in the market. Several carmakers, including General Motors, Ford, Volkswagen, Daimler, and others, are planning to take advantage of the growing demand for e-cars.

GM will sell a million EVs by 2025. At the same time, Ford expects to have 40% EVs on its lot by the end of the decade. EV sales are even higher at Volkswagen. In 2030, the company plans to sell 70% of its EVs in Europe and 50% in the U.S. and China. Daimler, which makes Mercedes Benz cars, will invest 40 billion euros in e-vehicles over the next decade and switch entirely to electric vehicles by 2025.

The mass transition to e-vehicles offers the possibility of profiting directly from the investment in e-vehicle stocks. The third way is investing in battery companies, which are among e-bikes’ most expensive and vital components. The demand for EV batteries will also increase significantly if the number of electric automobiles produced over the next decade rises significantly.

Efforts by governments to reduce emissions from fleets support the abrupt shift towards e-mobility in global economies. Moreover, as the fossil-fuel economy transitions into a green economy, the demand for EV batteries will continue to grow. Based on these factors, Fortune Business Insights predicts that the global EV battery market will grow 28.1% from $27.3 billion in 2021 to $154.9 billion in 2028.

Companies that produce batteries invest heavily to meet the rising EV battery demand. At the same time, startups are developing new technologies that will revolutionize the battery industry. Electric vehicle battery stocks are therefore a significant investment right now.

How to buy electric battery stocks?

As a general rule, CAN SLIM guidelines recommend stocks to buy and watch that demonstrate two essential characteristics. They must, first of all, demonstrate high earnings growth. The chart should display bullish patterns and show evidence of market outperformance.

On the other hand, most new EV stocks have neither. The list includes Fisker (FSR), Canoo (GOEV), Faraday Future (FFIE), Lordstown (RIDE), and Xos (XOS). Some of these EV startups haven’t even started manufacturing yet.

The revenue from sales of e-bikes has begun to flow into two startups.

Deliveries of Lucid Motors’ Lucid Air, an electric sedan, started on October 30. In addition, the R1T electric pickup from Rivian Automotive (RIVN) and the R1S crossover SUV have begun deliveries.

Top three electric battery stocks to buy in 2022

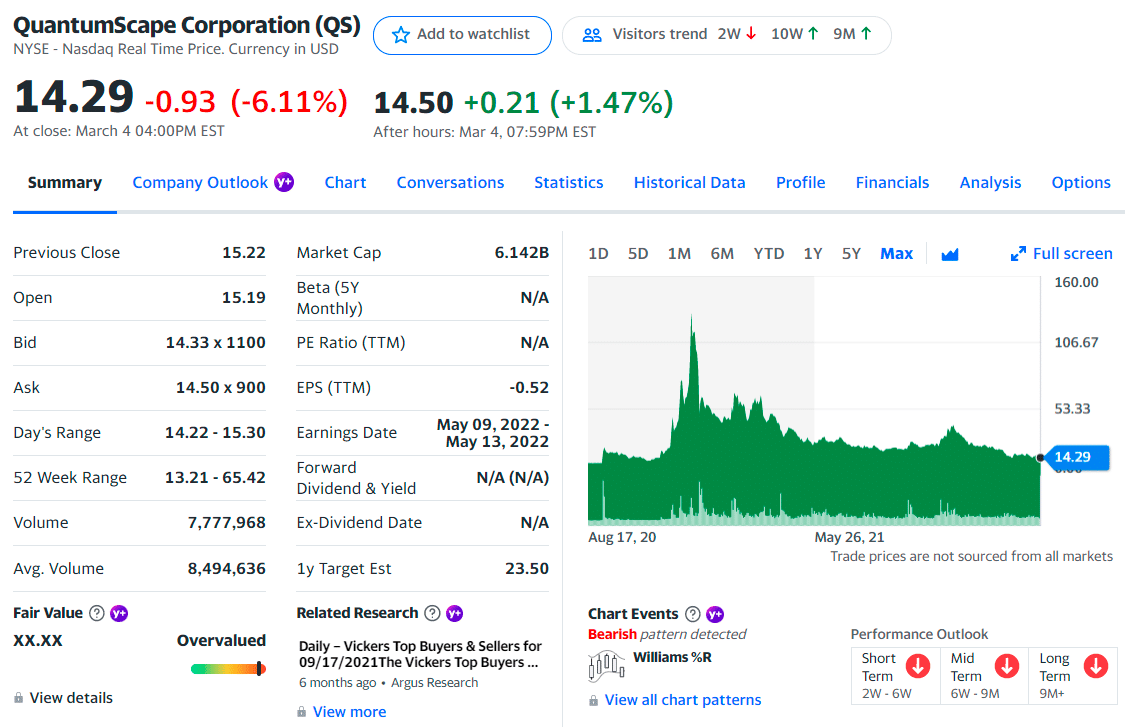

No. 1. QuantumScape (QS)

Price: $14.29

EPS: $-0.52

Market cap: 6.913B

QuantumScape price chart

Battery technology by the U.S. company is only just beginning to expand on a large scale. For electric vehicles to have a more extended range and recharge more rapidly, QuantumScape is developing solid-state batteries. The company will produce two hundred thousand batteries annually shortly.

A significant amount of money has been put into QuantumScape to bring its technology to market. Battery prototypes should reach automakers in 2022, test cars will arrive with batteries in 2023, and commercial batteries will be produced by 2024 or 2025, according to the company. According to the company, capital expenditures will be between $135 million and $165 million in 2021. Even so, it would still have access to more than $1.3 billion in liquidity to make future commercial investments.

QS summary

The top three holdings:

- The Vanguard Group, Inc. — 5.08%

- BlackRock Fund Advisors — 2.45%

- Norges Bank Investment Management — 1.93%

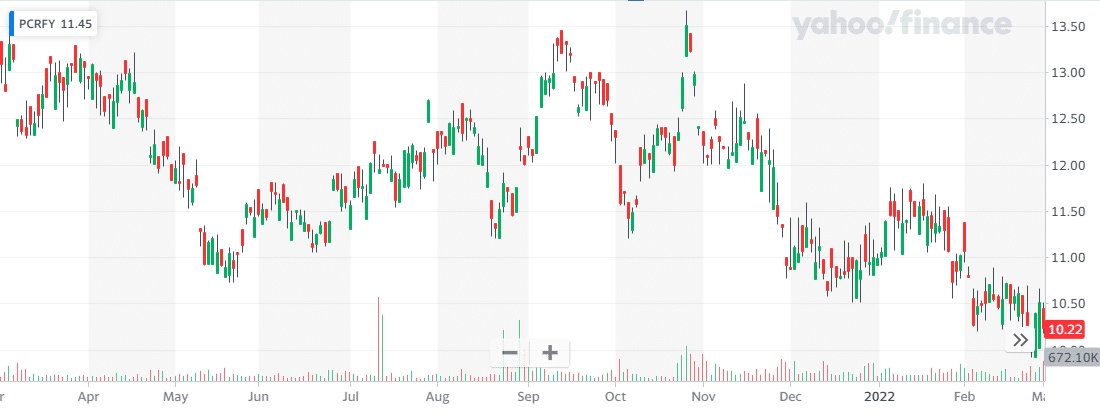

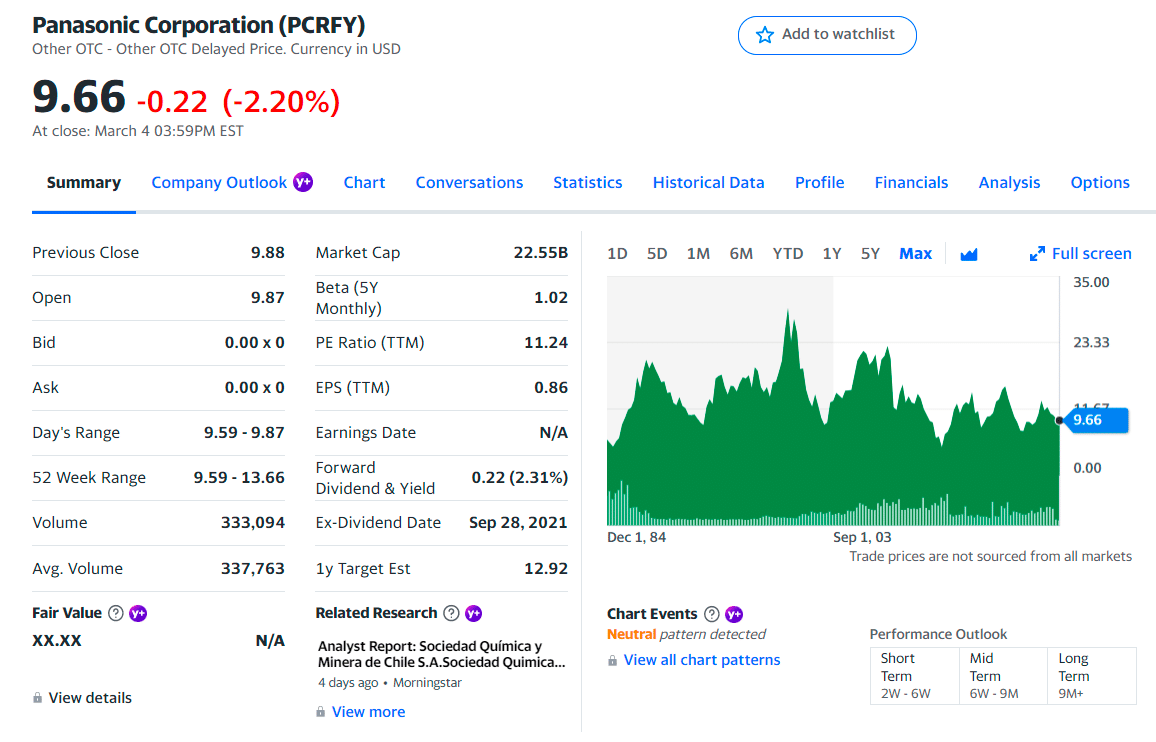

No. 2. Panasonic Corporation (PCRFY)

Price: $9.66

EPS: $0.86

Market cap: 24.526B

Panasonic Corporation price chart

A world leader in EV batteries, Panasonic Corporation (PCRFY) is one of the largest electronics companies in Japan.

For years, the company has produced and supplied high-performance e-vehicle batteries to American e-vehicle behemoth Tesla, Inc. (TSLA).

Panasonic Corporation is also a 49% joint venture owner developing lithium-ion prismatic batteries with Toyota Motor Corporation (TM). Tesla, Inc. recently announced a new massive prototype battery by Panasonic Corporation (PCRFY).

The new battery model from the battery manufacturer could reduce Tesla, Inc.’s (TSLA) e-bikes production costs.

The second quarter of fiscal 2022 saw Panasonic Corporation (PCRFY) increase its automotive segment revenue by 28% year-over-year, driven by a recovery in automotive products and heightened sales of automotive batteries. As a result, as of December 31, Panasonic Corporation (PCRFY) reported 731 billion in automotive revenue.

PCRFY summary

The top three holdings:

- Fisher Asset Management LLC — 0.26%

- Accrued Equities, Inc. — 0.01%

- BlackRock Advisors LLC — 0.01%

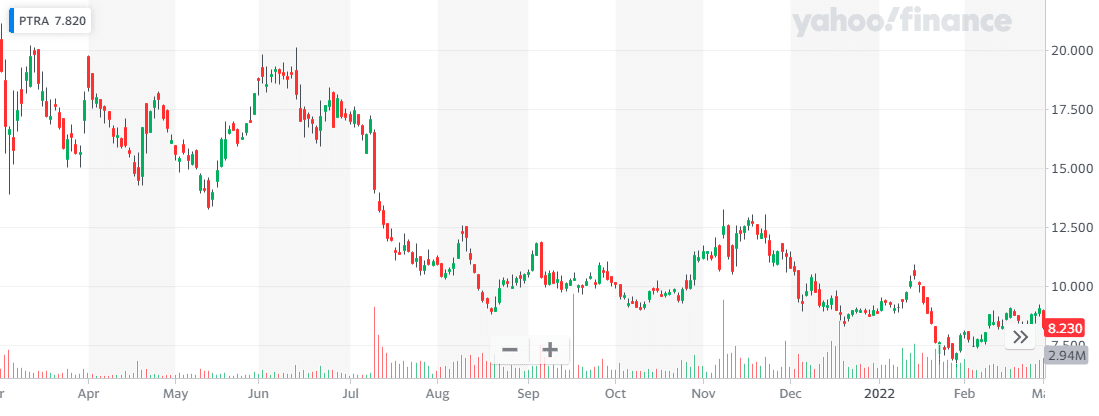

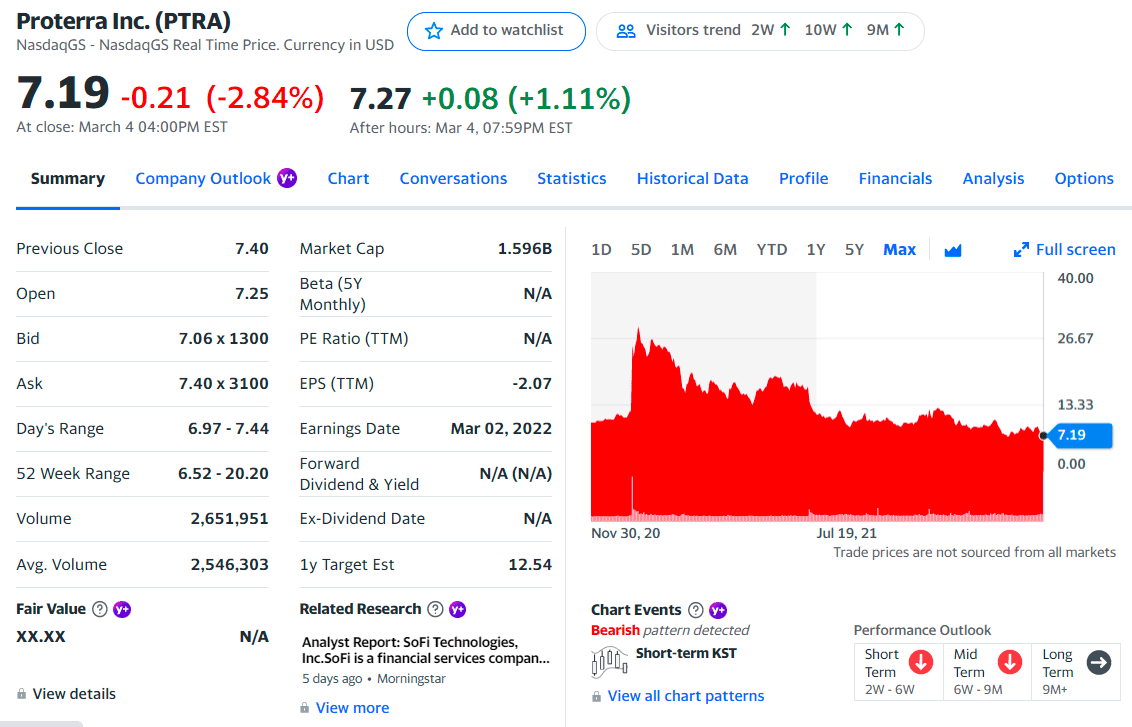

No. 3. Proterra Inc. (PTRA)

Price: $7.19

EPS: $-3.46

Market cap: 1.973B

Proterra Inc. price chart

Proterra produces e-bikes for commercial use. Proterra management recently met with Sherif El-Sabbahy, and he says that the company has a focused, grounded business strategy to compete in the retail vehicle market. Proterra also offers fully electric transit buses and e-battery powertrain systems in addition to its battery packs for commercial EVs. Furthermore, the company provides fleet charging solutions. Approximately 24.7% of Proterra’s revenue growth will be achieved in 2021, followed by 73% in 2022 and 95.3% in 2023.

Bank of America has given PTRA a “buy” stock rating and price target. PTRA closed on February 24 at $8.79.

PTRA summary

The top three holdings:

- Franklin Advisers, Inc. — 11.05%

- Soros Fund Management — LLC 3.65%

- The Vanguard Group, Inc. — 2.27%

Final thoughts

Batteries are an essential component of e-vehicles. With the growth of EV sales, battery sales will rise, benefiting companies who make them. Therefore, investing in a battery maker is something forward-looking investors should consider potentially profiting from this trend.

Comments