There will be a double-digit increase in copper demand by 2030. Copper plays a crucial role in electrifying the transportation sector and generating renewable energy, fueling the energy transition. Traders expect that copper prices will significantly increase shortly.

A widening gap between supply and demand leads to copper becoming the new gold. Within the next three years, copper could rise to $20,000 per metric ton, according to a Bank of America prediction.

Copper industry prospects look promising. Below are some copper stocks to consider for investors.

What are copper stocks?

Copper, one of the most widely used metals, is explored, extracted, developed, and produced by companies in the copper industry. Copper consumption is closely linked to economic cycles, as it is instrumental in numerous industries, including construction, electronics, industrial machinery, transportation, power generation, and transmission.

Several large companies are operating in this sector, including Freeport-McMoRan Inc. (FCX), Australia’s OZ Minerals Ltd. (OZL), and China’s Zijin Mining Group Co. Ltd. (2899. HK).

Global X Copper Miners ETF (COPX) represents copper stocks that have outperformed the market as a whole. The performance of COPX over the past 12 months has exceeded that of the iShares Russell 1000 ETF (IWB), which returned 35.7%.

How to buy copper stocks?

A company that trades on the US stock exchanges and is heavily involved in copper might be a good place to purchase stock. You can buy shares online with your broker or through your brokerage account.

Copper is mined in Indonesia and North and South America by Freeport-McMoran Copper and Gold, traded under the symbol FCX. In addition, Southern Copper Corporation (SCCO) operates a copper mine in Mexico and Peru. Other US-based mining and exploration firms with copper assets include Tech Resources (TCK) and BHP Billiton (BHP).

Buy mutual funds, ETFs, and other investments that deal with minerals and metals, specifically copper. Investments in copper mining and other metals mining operations around the globe are found, for example, in the Sentry Mining Opportunities Class Fund: an investment fund that focuses primarily on copper futures.

To invest in copper companies outside the United States, you should contact a broker specializing in trading shares on foreign exchanges. These companies include Xstrata, Jiangxi Copper Company, and Ivanhoe Mines, all listed on the Toronto Stock Exchange.

Top three copper stocks to buy in 2022

According to the US Geological Survey, copper ranks third among industrial metals. Many mining companies operate copper mines because copper is an essential economic component. Even though many companies generate copper, only a few plan to expand production due to available reserves and realistic expansion plans.

No. 1. Turquoise Hill Resources (TRQ)

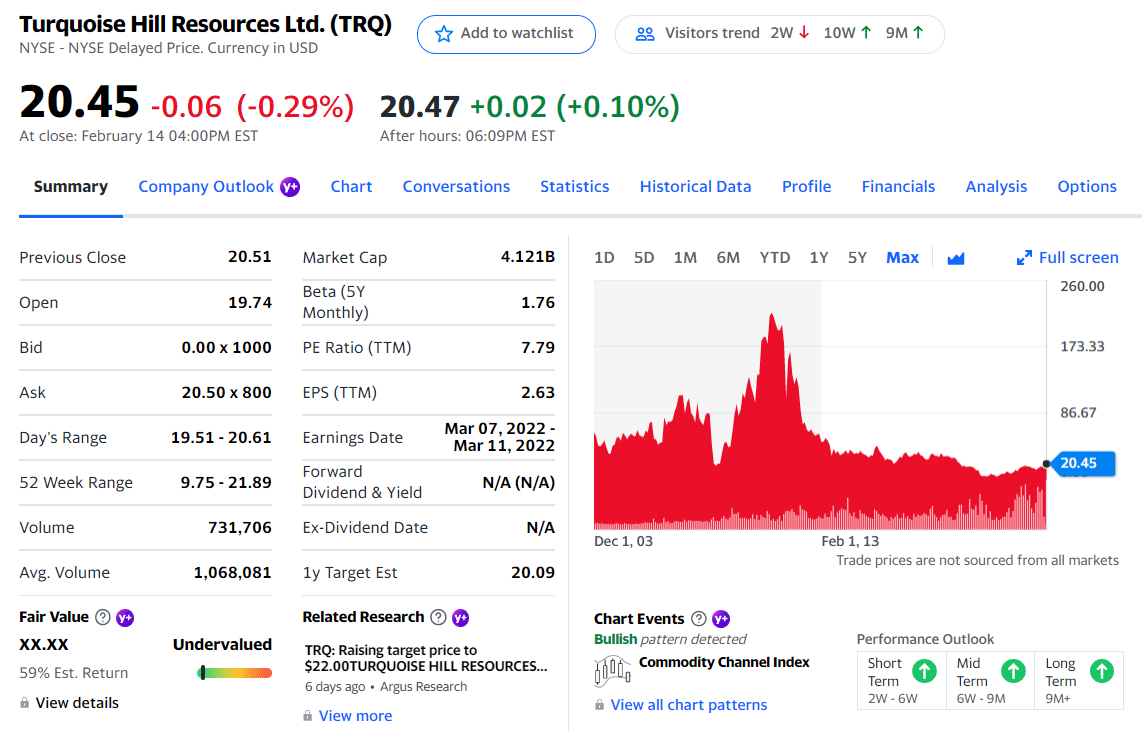

Price: $20.45

EPS: $4.133

Market capitalization: $4.12 billion

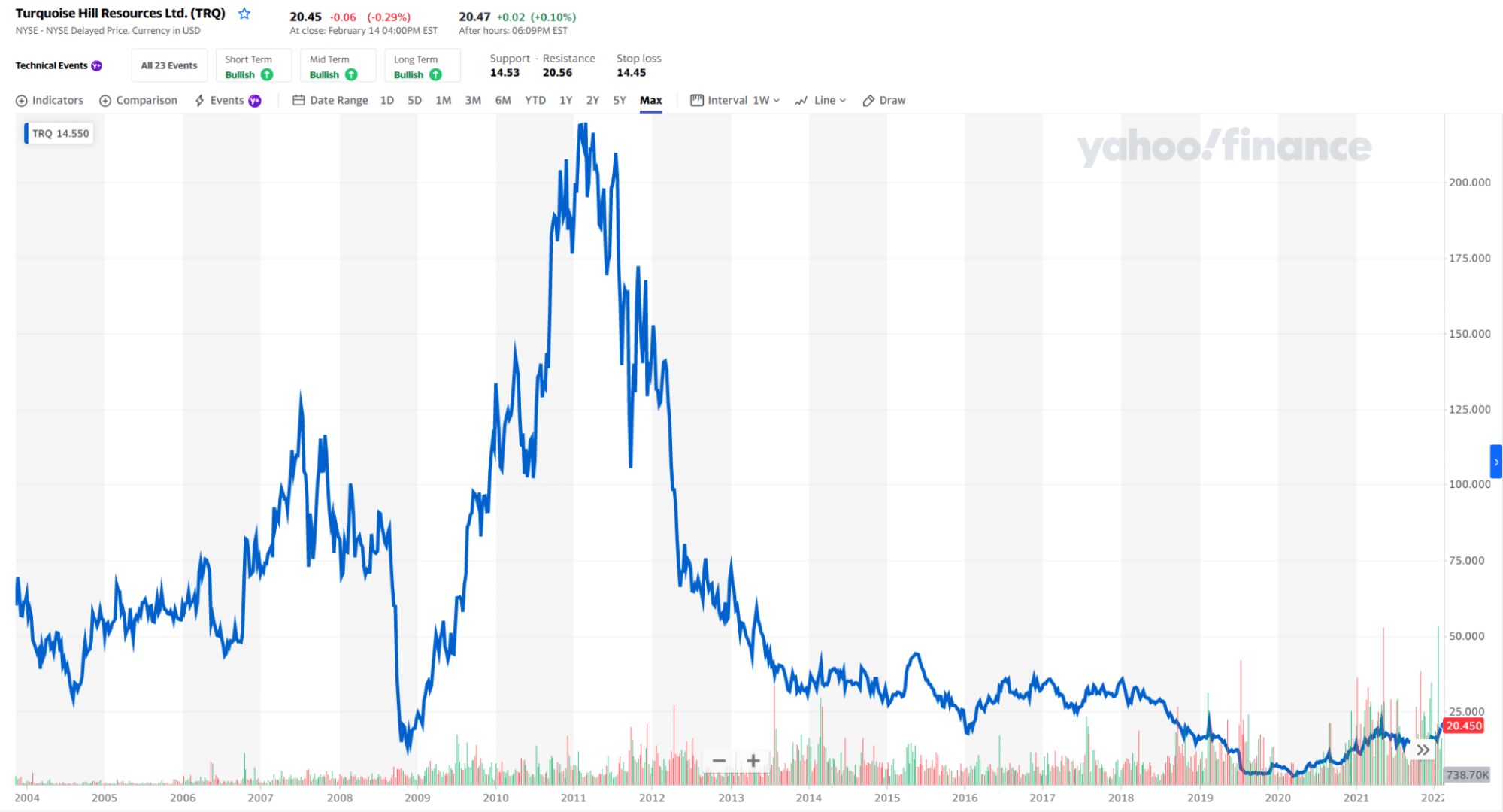

TRQ stock price chart 2004-2022

Turquoise Hill Resources Ltd., a Rio Tinto subsidiary, is listed on the New York Stock Exchange. It has a 66% stake in the Mongolian Oyu Tolgoi copper mine. The Mongolian government owns 34% of the mine. The Turquoise Hill mine is currently expanding into one of the world’s largest copper mines, although relations with Mongolia have not always been cordial. As of 2022, Oyu Tolgoi will produce 150 thousand tons of copper, but it can produce 500,000 tons after expansion completion.

TRQ stock summary

Top three holdings:

- Pentwater Capital Management Lp

- Kopernik Global Investors, LLC

- Credit Suisse AG

No. 2. Teck Resources (TECK)

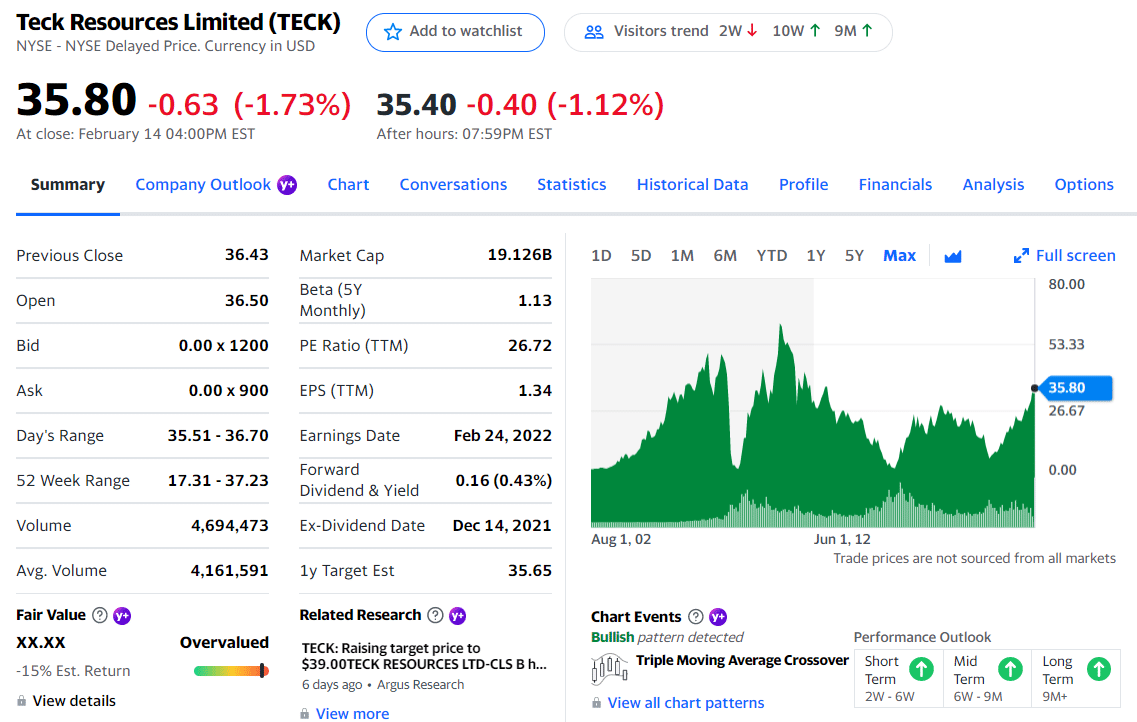

Price: $35.80

EPS: $1.34

Market capitalisation: 19.13 B

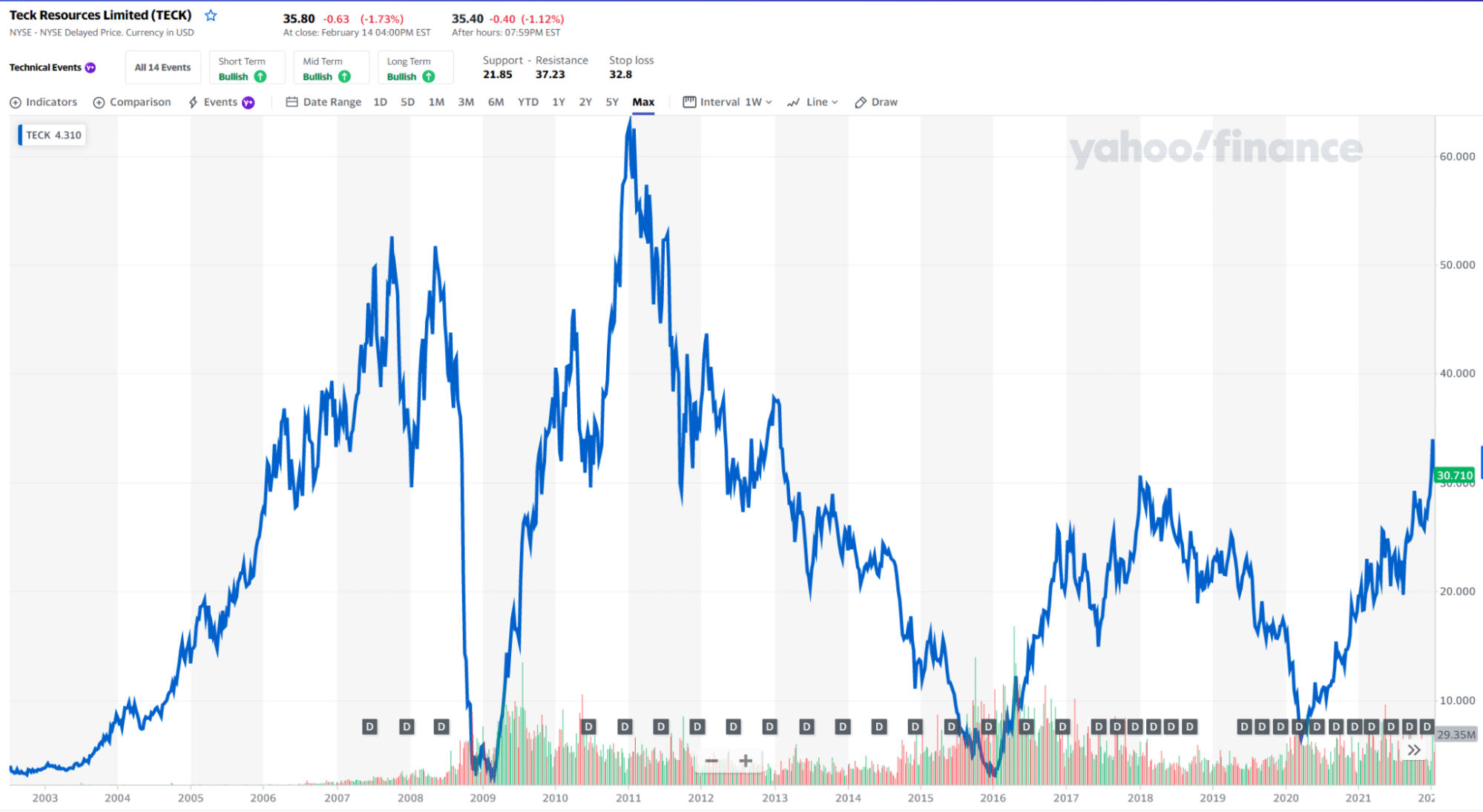

TECK stock price chart 2003-2022

Copper, zinc, steelmaking coal, and oil are produced by Teck Resources, a major mining company in Canada. The company mined 276,000 tons of copper in 2020 at four mines in Canada, Peru, and Chile. Copper contributed 27% of revenue and 44% of profit to the company in 2021. According to the company, it has 33 million tons of known and probable copper reserves. Nevertheless, the company’s coal and Canadian oil sands operations make the stock unattractive to sustainable or ESG investors.

By controlling 66.48% of the outstanding shares of TECK, institutional investors hold a majority stake in the company. Additionally, the interest in this department is much higher than that of most other companies in the other metals/miners sector. As a result, this large group of investors purchased nearly $39.5 million worth of shares for the quarter ended June 2021.

TECK stock summary

Top three holdings:

- The Vanguard Group, Inc.

- Janus Capital Management LLC

- Davis Selected Advisers LP

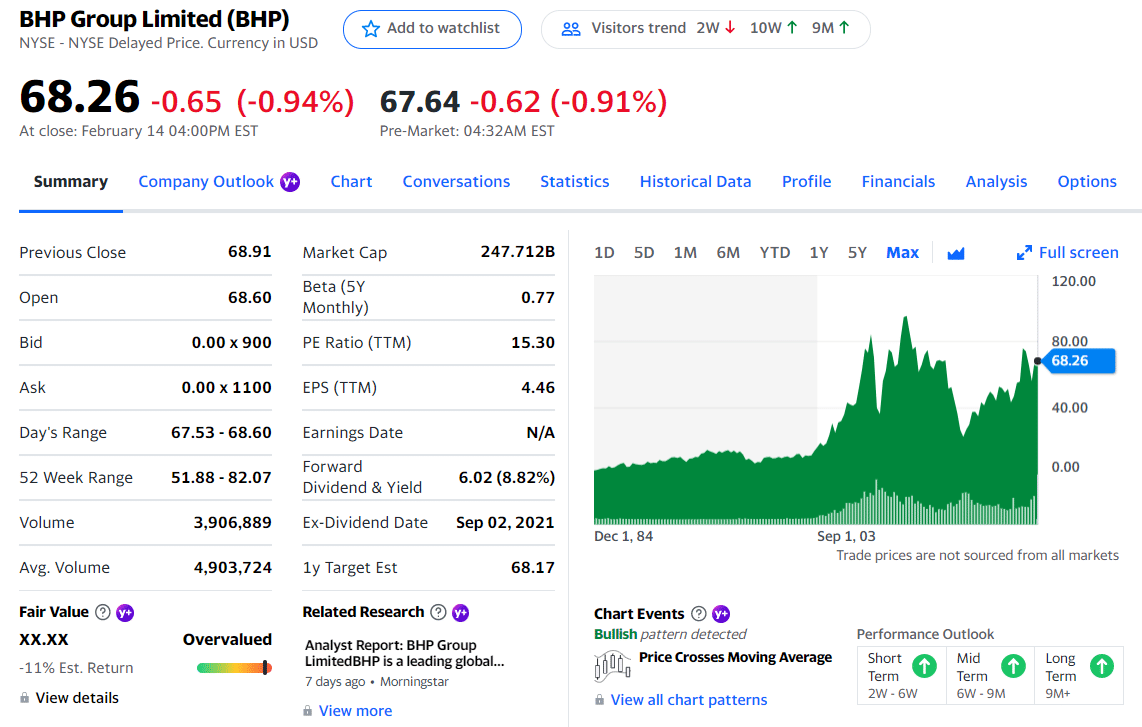

No. 2. BHP Group (BHP)

Price: $68.26

EPS: $4.46

Market capitalisation: 865.62 B

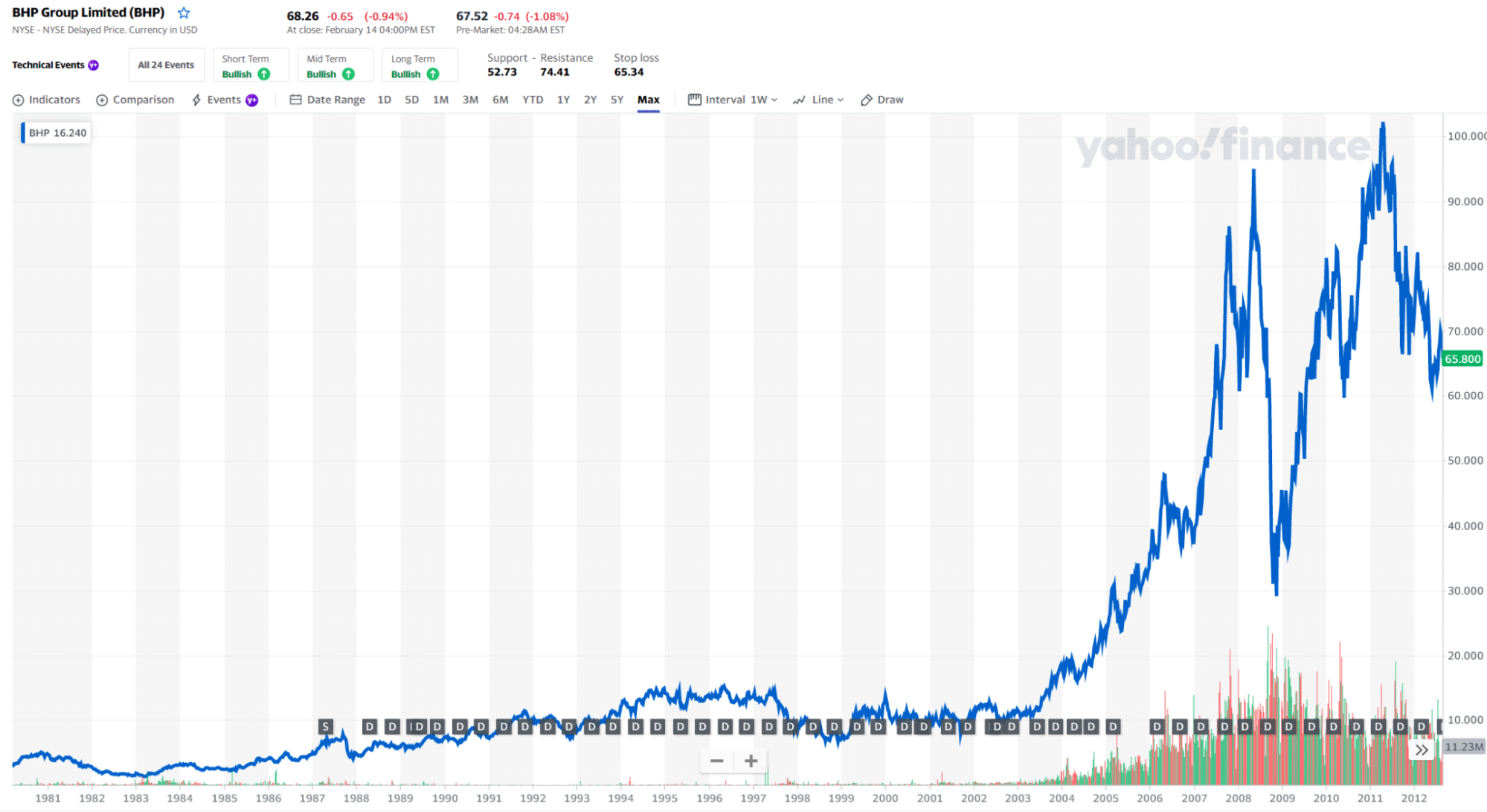

BHP stock price chart 1981-2022

Mining giant BHP Group, which produces 1.7 million tons of copper in 2020, is one of the world’s biggest copper producers. This mining company operates a copper mine in Chile’s Atacama Desert, the world’s largest.

BHP also owns 45% of a large copper project in Arizona, several mines in Chile, and one in Australia. Rio Tinto is the owner of the remaining 55%. This Australian company also mines iron ore, nickel, and other metals. BHP is diversified, but copper represents a quarter of its sales — behind iron ore as the second biggest revenue and profitability driver. BHP does, however, have a coal business, rendering it less attractive for investors focused on sustainability.

In the quarter ended December 2021, institutional investors acquired 3.2 million shares of BHP and now hold 6.49% of the company’s outstanding stock. Considering that this figure is significantly higher than is typical for companies in the other metals/minerals industry, this shows that the smart money thinks this stock to be a substantial holding.

BHP stock summary

Top three holdings:

- Fisher Asset Management LLC

- Goldman Sachs & Co. LLC

- Fisher Asset Management LLC

Final thoughts

Copper is needed to help the world move to lower-carbon energy sources. As a result, the demand for copper will rise considerably over the next few years. The increased demand will encourage mining companies to add capacity for copper, allowing them to boost production and reap the benefits of higher prices.

Those factors should provide more cash to pay dividends and boost the stock price, allowing these companies to increase their cash flow. Therefore, investors should consider the copper industry due to its upside.

Investments come with risks, so you must be aware of them. For example, the copper price can fluctuate widely within short periods, so a portfolio’s value can swing dramatically.

A copper investment may be appealing to investors who would like to begin trading commodities like metals. However, index mutual funds and other passive investments are good for those who prefer a set-and-forget approach.

Comments