Wind energy is a safe, renewable source of power that doesn’t emit any carbon. According to the IEA, wind and solar power will be required to generate 70% of the world’s electricity in 2050 to achieve net-zero carbon emissions.

Wind power already generates 7% of total electricity globally and should double its share by 2030, as reported by IHS Markit. In addition, the cost of installing wind capacity is dropping as the technology of wind turbines becomes more efficient and more extensive. Compared to onshore wind, offshore wind is also much cheaper. Onshore wind costs have fallen by over 45% over the past decade.

Wind stock prices declined in 2022 due to supply chain challenges and cost inflation. However, there will be a need for wind energy stocks in the future, and these three stocks could be a good fit.

What are wind energy stocks?

Wind energy is a critical component of the rapidly expanding renewable energy industry, aiming to produce energy with lower emissions and less pollution. The Global Wind Energy Council reported that the global wind industry recently experienced rapid growth.

A variety of aspects of the industry exist, such as the creation and management of wind farms, the production and distribution of the electricity generated by wind power, and the manufacturing, distribution, and maintenance of machinery. As a result, there are a variety of competitors, from small companies and multinationals to large, domestic companies which run their wind business as a division or subsidiary. For example, General Electric Co. (GE) has a division for Renewable Energy.

As measured by the First Trust Global Wind Energy ETF (FAN), the wind energy sector underperformed over the past year. In the last 12 months, FAN has provided a total return of -21.4%, which is far below the Russell 1000’s total return of 24.4%2.

How to buy wind energy stocks?

If you wish to have a position in the wind power industry, you have two options: you can either buy shares directly from the company or use financial derivatives such as spread bets and CFDs.

Shareholders with voting rights could join the share dealing platform to become shareholders in wind energy stocks. You will benefit from selling at a higher price and any company’s dividends when you purchase physical shares. But if you sell your shares at a lower price than when you bought them, you will lose money.

In theory, stock prices can continue to rise, giving you unlimited potential profits. However, your potential losses are limited to the initial investment, excluding additional fees. It is also possible to trade CFDs and spread bets on the price of wind power stocks without investing in the underlying stocks.

Utilizing leverage, you’re able to gain total exposure while committing only to an initial deposit, called margin. Remember, however, that leverage magnifies both your potential profits and losses so that you could lose more than your original investment. Therefore, it is crucial to manage your risk appropriately.

Top three wind energy stocks to buy in 2022

Listed below are the top three wind energy stocks with the most momentum, the best value, and the fastest growth.

No. 1. China Longyuan Power Group Corporation Limited (CLPXY)

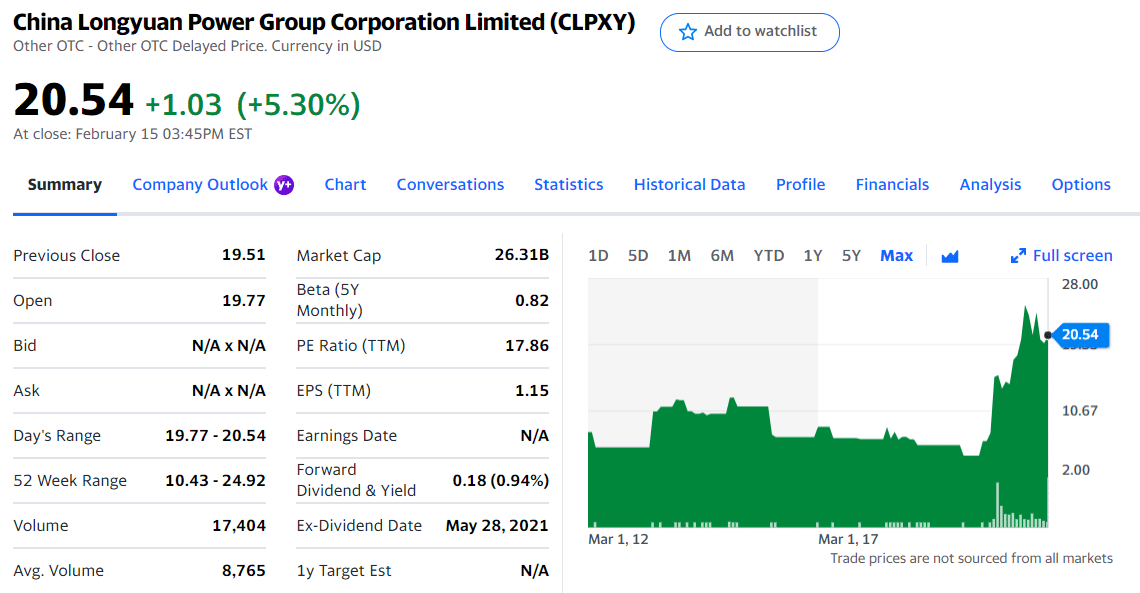

Price: $20.54

EPS: $1.15

Market capitalization: 24.87 B

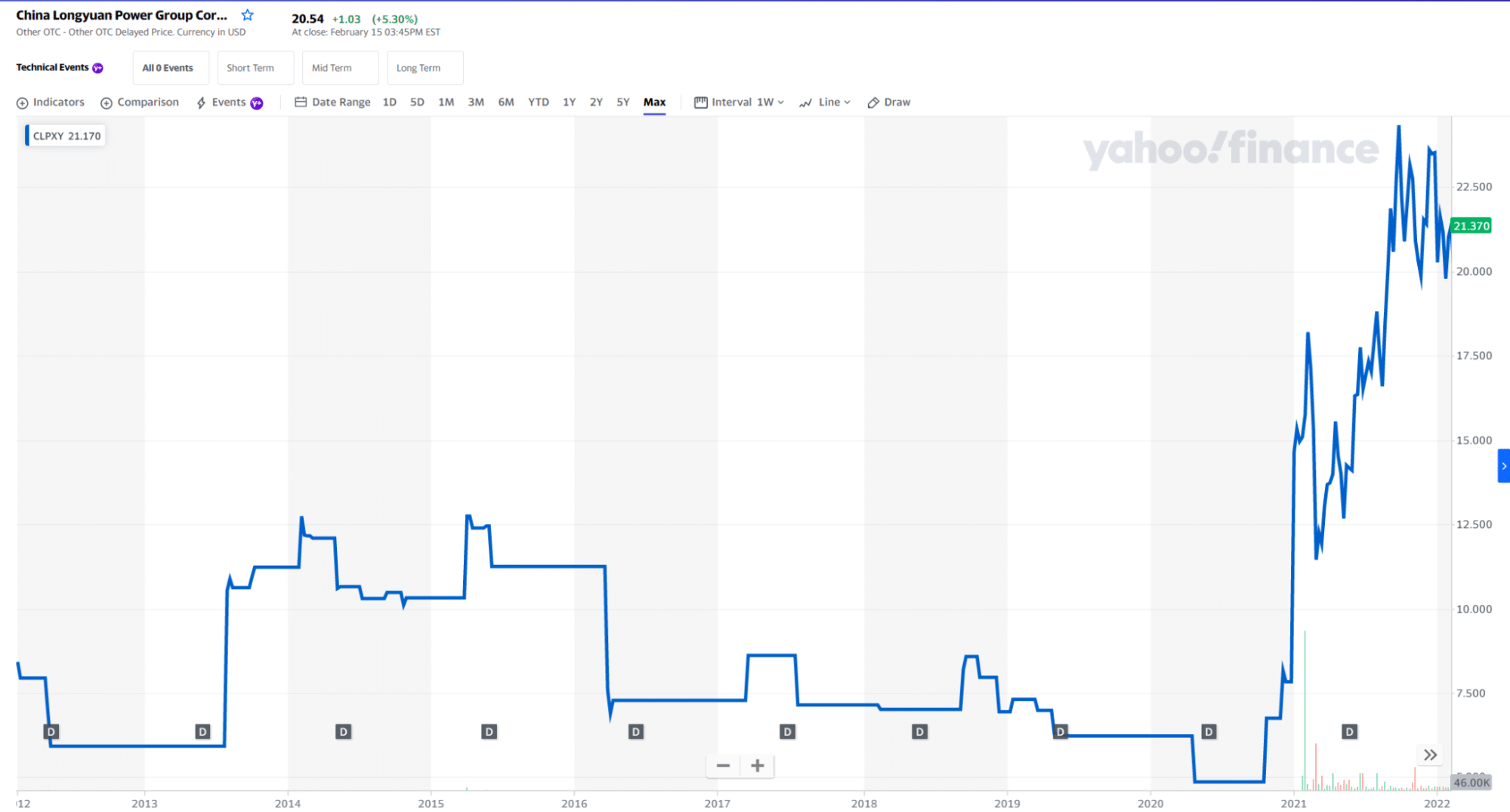

CLPXY price chart 2012-2022

Chinese onshore wind power stocks are attractive because the country has the largest onshore wind market globally. China Longyuan Power generates wind power and sells it for a profit. China’s largest wind energy producer, with over 20 GW of capacity.

In the late 1980s, China Longyuan became a pioneer in wind energy in China. Today, its portfolio includes wind farms around the country. Although the company falls in the Hong Kong stock exchange, it also operates in the coal industry, making it less attractive to investors looking for ethical, social, and governance investments.

CLPXY stock summary

Top three holdings:

- Handelsbanken Hallbar Energi

- Vanguard Emerging Markets Stock

- Lazard International Strategic Equity

No. 2. NextEra Energy (NEE)

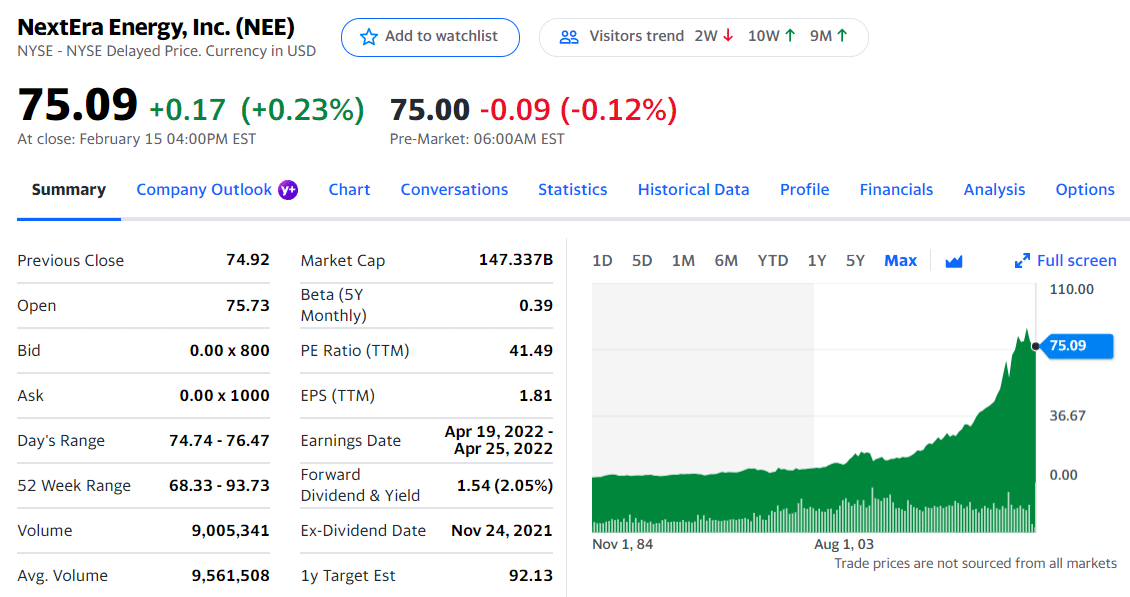

Price: $75.09

EPS: $1.81

Market capitalization: 147.082B

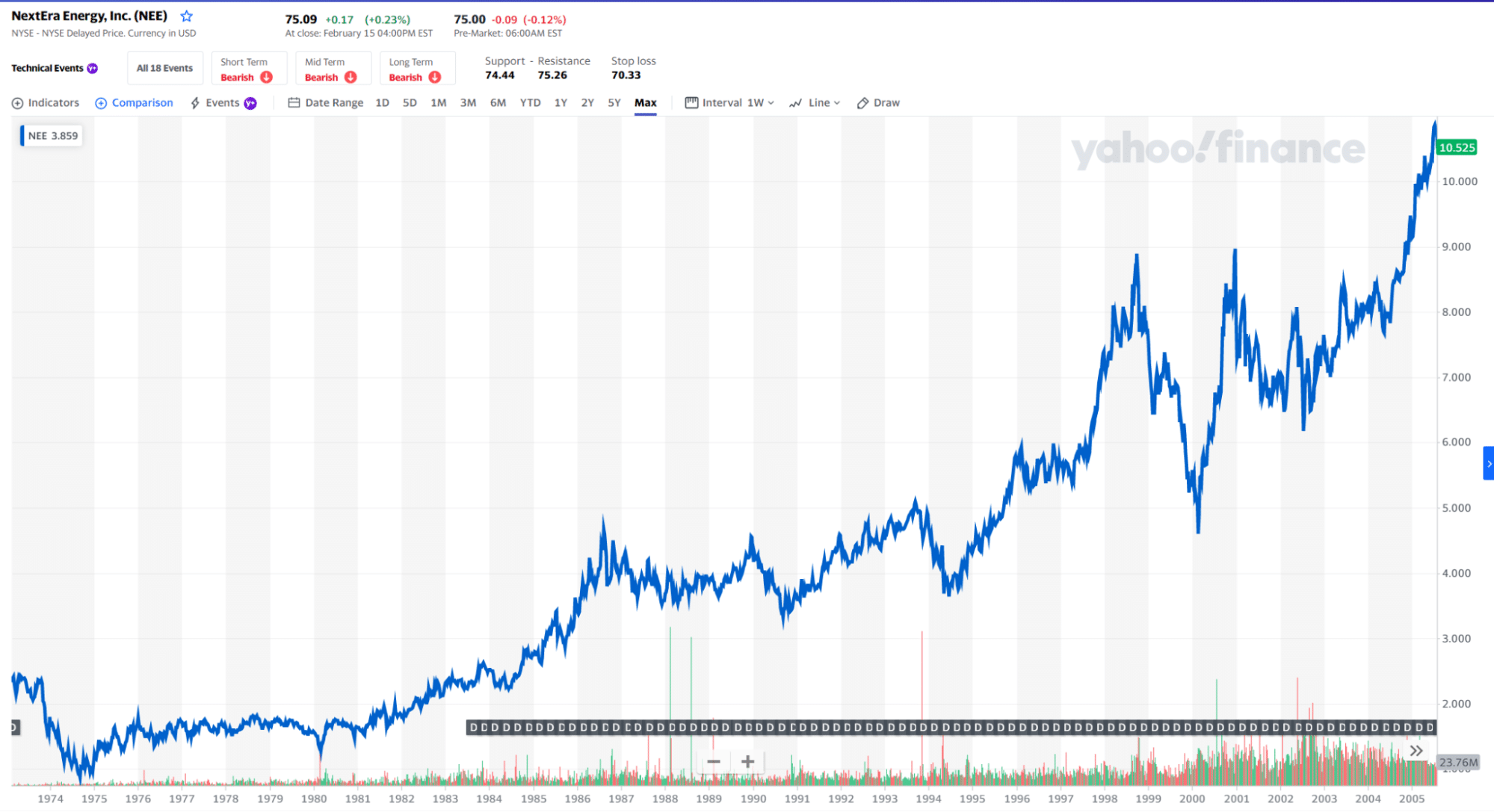

NextEra price chart 1974-2022

Onshore wind power, the United States is the world’s second-largest market, and NextEra Energy, based in Florida, is the largest US generator. NextEra produces more than 16 GW of wind energy, placing it among the top wind power producers globally. Beyond developing renewable energy projects, NextEra still owns Florida Power & Light Company, the country’s largest regulated electric utility, a battery storage division, and seven commercial nuclear power plants. Its market capitalization exceeds $170 billion, and the company boasts over $18 billion in revenue.

NextEra’s method of generating electricity differs from those of the other companies on this list in that it uses a combination of wind, solar, natural gas, and nuclear energy. However, the diversification of power generation sources shouldn’t be harmful, as several utility companies source energy from different sources to ensure energy security.

Although NextEra has a diverse portfolio of energy resources, it has almost tripled its wind energy capacity in the past decade. Under the NEE ticker, NextEra is available on the New York Stock Exchange (NYSE).

NEE stock summary

Top three holdings:

- The Vanguard Group, Inc.

- BlackRock Fund Advisors

- Norges Bank Investment Management

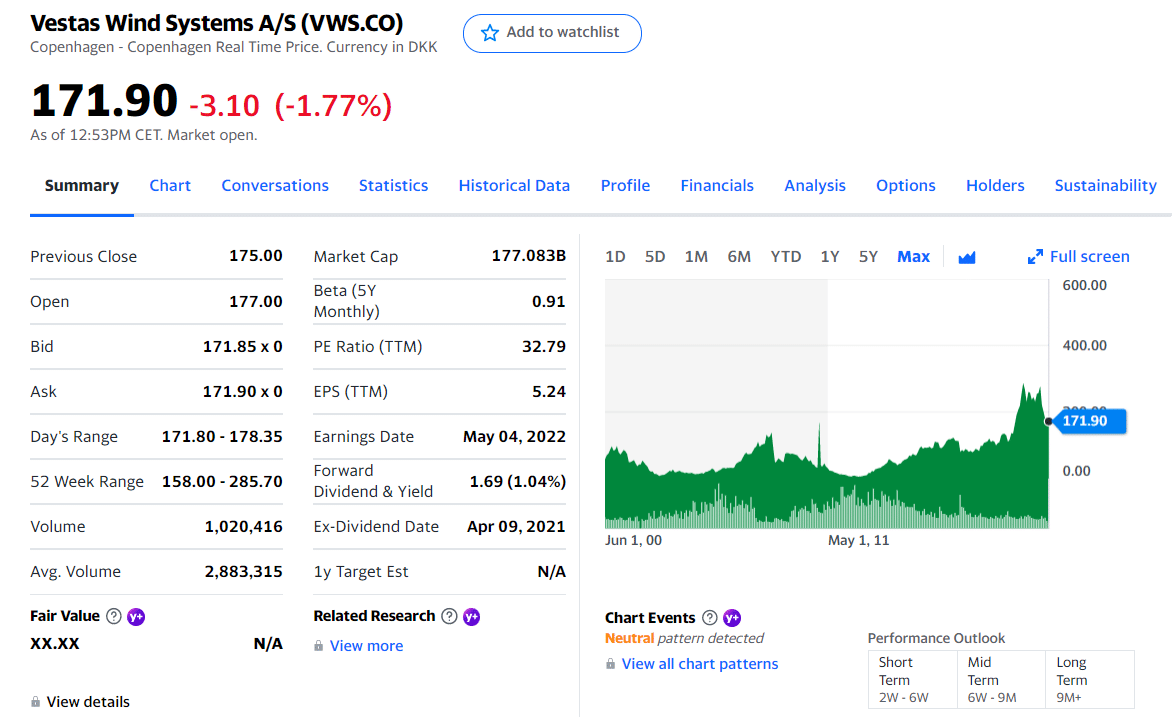

No. 3. Vestas Wind Systems (VWS.CO)

Price: $171.90

EPS: $5.23

Market capitalization: 165.745B

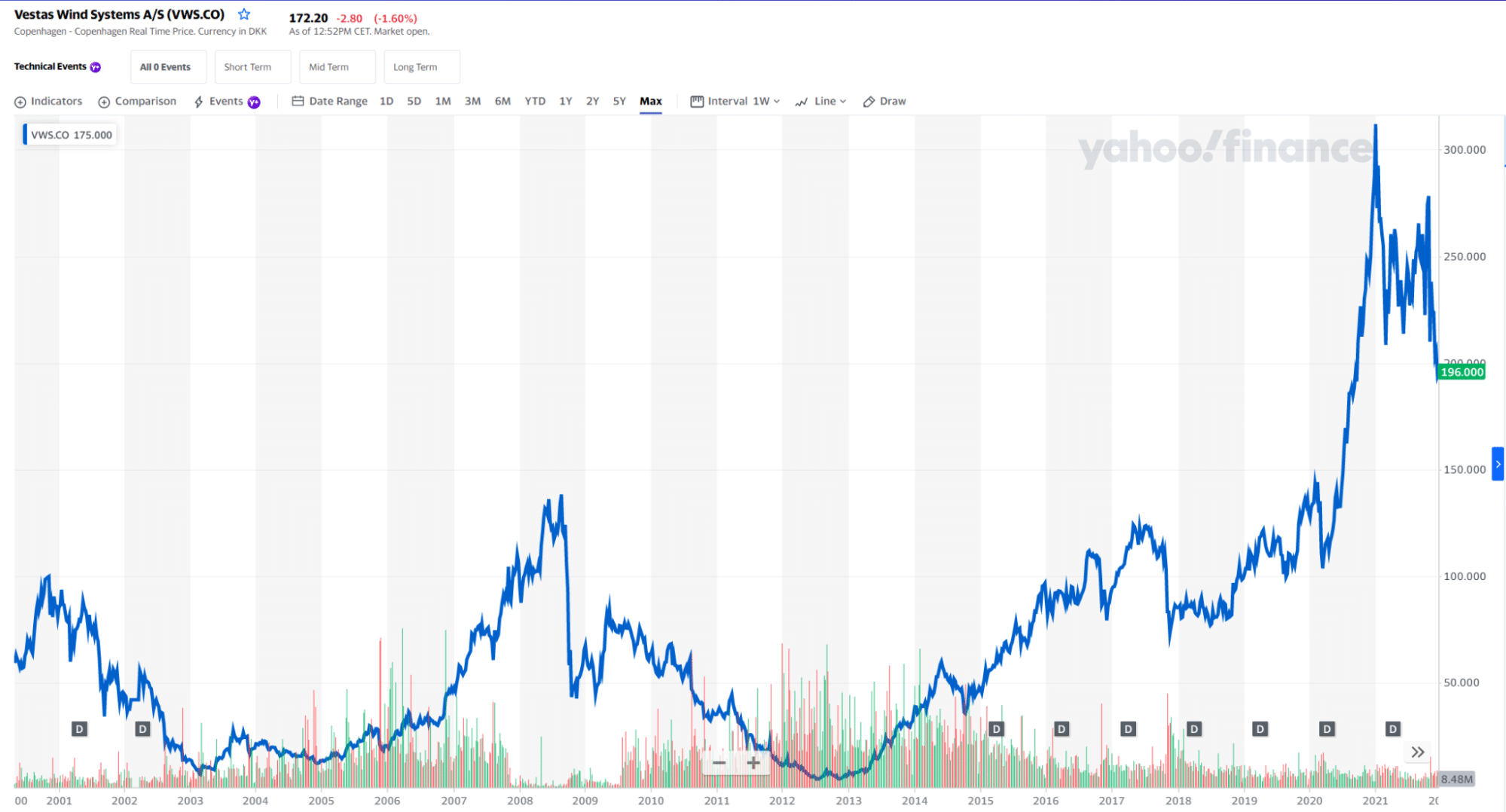

VWS.CO price chart 2001-2022

Wind turbines manufactured by Danish company Vestas Wind Systems are the most popular onshore wind turbines. Onshore wind is a more stable market than offshore wind because it has been around longer.

Currently, Vestas is the only company that has installed more wind turbines than any other. Additionally, it has 40 GW of installed capacity in North America. Wind power is still a critical component of the energy mix, and the turbine-maker expects double-digit growth in 2022, despite supply chain disruptions and cost inflation.

VWS.CO stock summary

Top three holdings:

- AllianceBernstein LP

- Green Alpha Advisors LLC

- Cacti Asset Management LLC

Final thoughts

Compared to oil and nuclear industries that have been around for a long time, wind energy is a relatively new sector. To maintain its upward trajectory, constant development and consumer interest are crucial.

Investors and traders will likely diversify their portfolios with wind stocks in the coming years because of the increased public awareness of climate change and fossil fuels’ environmental impact.

Comments