Many businesses like merchants, carmakers, and internet corporations influence how much they may charge for their products. Energy stocks, which trade in commodities like crude oil and natural gas, tend to be at the mercy of the market since their prices are so apparent and set.

In 2020, the Covid-19 epidemic slashed demand for oil and gas, and prices plunged as a consequence. That was an unfavorable scenario for energy company investors.

Even predicting short-term energy market developments is challenging. Renewable energy initiatives, manufacturing, and installation were all put on hold due to the financial crisis. Renewable and fossil fuel energy markets have become even more uncertain as a result of the Coronavirus.

However, it is impossible to forecast what will happen in the oil industry when oil prices drop to -$37.63/barrel in April. This article gives a lot of information on carbon capture stocks to watch, buy and hold in 2021/2022.

Carbon capture stocks to watch, buy and hold in 2021/2022

Following are some vital carbon capture stocks.

1. FuelCell Energy (FCEL)

A worldwide pioneer in developing, producing, installing, operating, and maintaining ecologically friendly fuel cell power systems, FuelCell Energy (FCEL) FuelCell Energy (FCEL) Natural gas and biogas Direct Fuel Cell power facilities are designed, manufactured, operated, and serviced by the company.

Price

The current price is $8.05, FuelCell Energy has a PE of -42 and a price target of US$9.15, which is a 13% increase over the current price.

EPS

Two months ago, its EPS was -0.03 USD. Now it is -0.04 USD.

Market capitalisation

Its market cap is approximately $3.27B but may change in the future depending on market conditions.

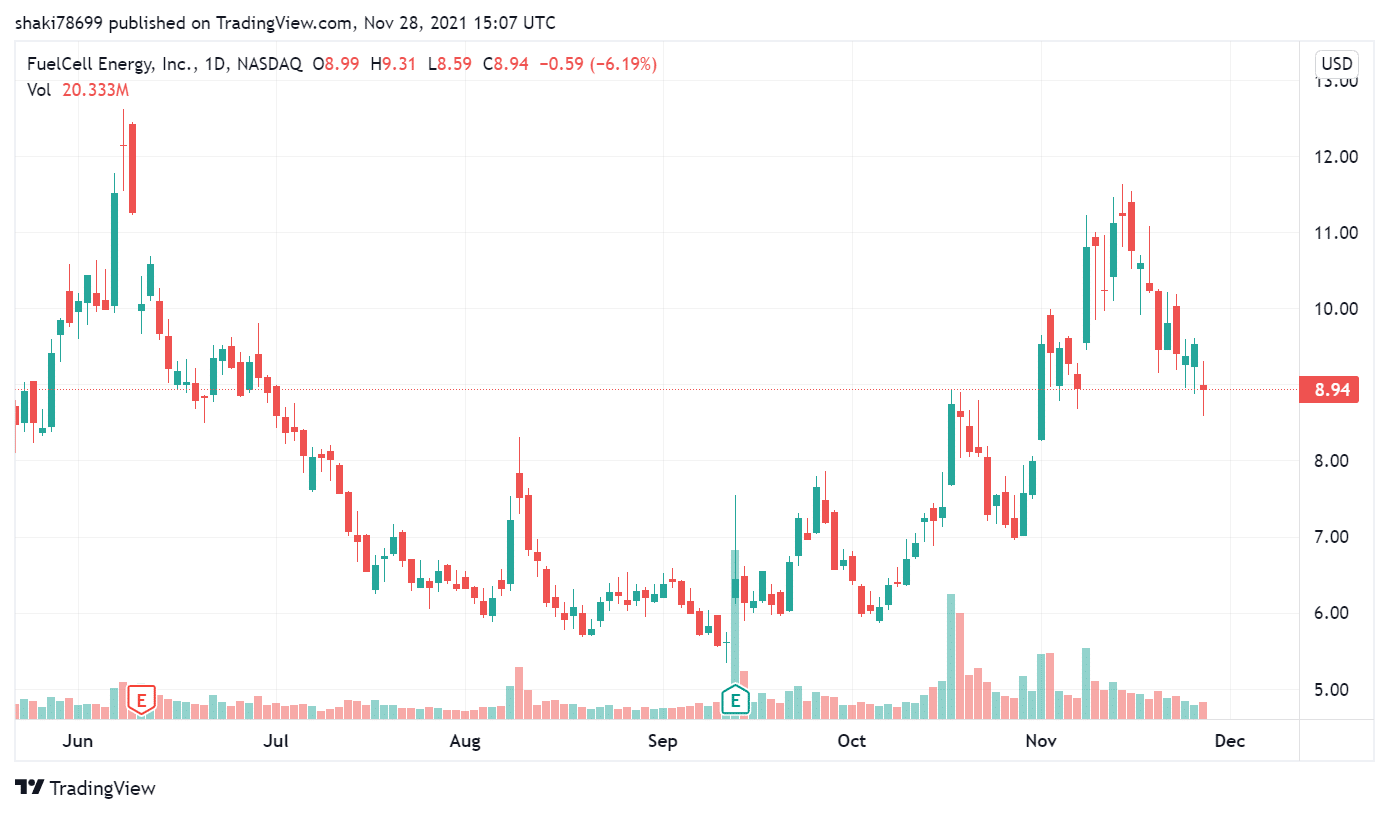

FuelCell Energy (FCEL) stock market trend

2. Consol Energy (CEIX)

Consol Energy (CEIX) isn’t exactly the most forward-thinking capitalization energy company. After all, the company’s principal product is thermal coal and the export services that go along with it.

Price

Its price is 23.13 USD having 52 weeks range of 5.11-36.23 USD

EPS

EPS for Consol Energy’s third quarter of 2021 is $0.74.

Market capitalisation

Its market cap is roughly $797M but may change in the future depending on the market.

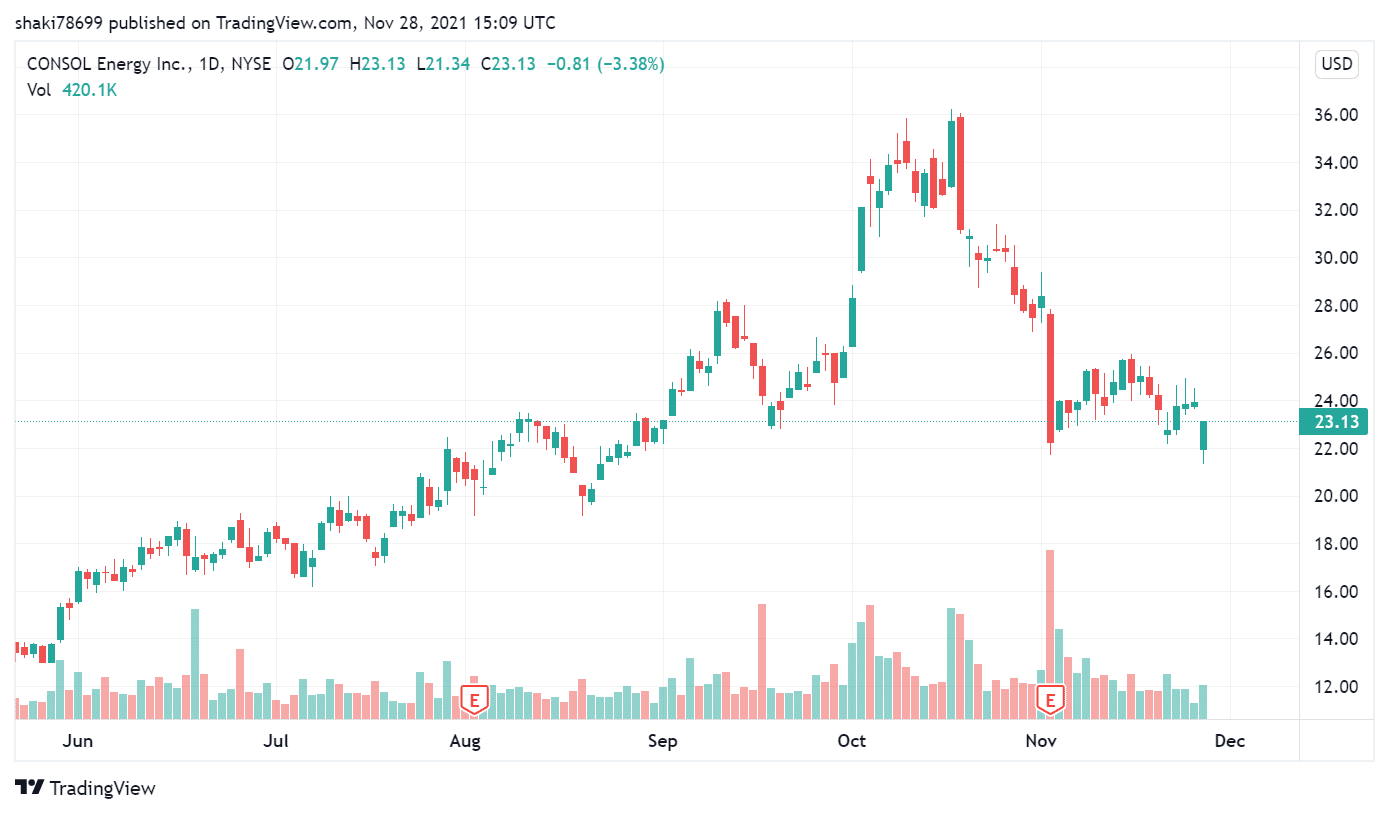

Market position of Consol Energy (CEIX) stock

3. Devon Energy (DVN)

Oil and gas exploration, development, and production are the primary activities of Devon Energy (DVN), an independent energy corporation. Over 4,000 wells are operated by the Oklahoma-based energy company, which was founded in 1971.

Price

Its current price is 42.5 USD having 52 weeks high of 45.57 USD.

EPS

The current EPS of DVN on November 2021 is $1.67

Market capitalisation

A market cap of $28.9B may increase due to climate change and energy demands soon.

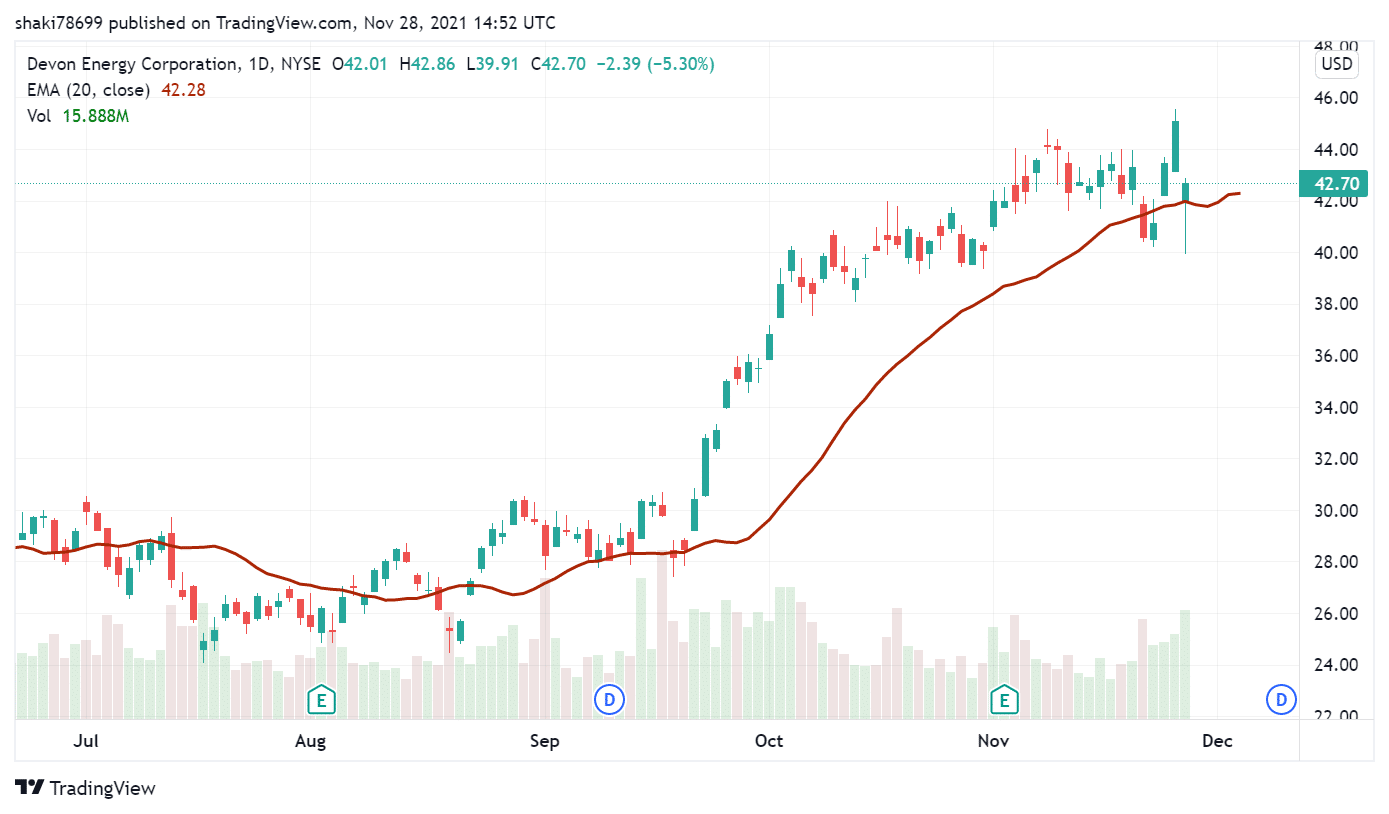

DVN stock price

How to buy carbon capture stocks?

When buying stocks in the market, you should follow the steps below.

Step 1. Choose a broker

You may buy and sell stocks via a broker, and the broker earns dividends. However, if you want to open a bank account, you’ll need to submit your bank account number.

Start by searching online for a broker. Most brokers often waive stock trading fees and minimum deposit requirements. In addition, you may use a trading app if you want to trade less often.

Step 2. Analyze your return on investment

Decide how much stock you can currently afford before proceeding. Several brokers provide the ability for novice investors to buy and sell fractional shares. That means that you may acquire a small portion of the most expensive stocks. Begin with a modest project. You may save a lot of money by using no-commission online brokers.

You should acquire numerous stocks if you plan on investing more than a few thousand dollars. However, to invest a substantial amount of money, diversify your portfolio by purchasing many different equities.

Step 3. Market evaluation

Whether you want to know if you should invest in a company, you need to research. But, unfortunately, it takes a long time and a lot of effort to achieve.

You must know the firm, its goods, finances, and industry to invest intelligently. The SEC filings of the corporation will be necessary for this purpose (SEC). This is the best place to learn about what you’re investing in and its long-term prospects. There are several ways you might profit from expert techniques like studying.

Step 4. Make trade and follow the signals

For now, you may either buy or sell. The trade price is beyond your control. Using a limit order, you may buy or sell at a predetermined price point. Without a better deal, the order will not go through. Depending on the broker, a limit order may continue for up to three months.

There are a few shares, or the stock is liquid; thus, market orders are preferable. On the other hand, limiting orders is the best option for smaller companies and those who don’t want to influence the price.

Step 5. Monitor your investment

When you buy stock, your investments don’t end. Keep an eye on your new job’s quarterly or yearly profits and market trends. You may be able to raise your compensation if the firm is doing well. In the future, you may choose to increase your stock holdings by purchasing more shares.

Even if it’s just for a short time, your stock price will fall. However, if you have additional information about the firm, you may determine whether or not to buy more shares at a discount or sell your current ones.

Final thoughts

Energy stocks are among the most volatile on the stock market. It’s a good thing that the global economy is starting to recover in 2021. Many producers have reduced operations and limited supply in the recent year, which has created positive winds for many oil and gas companies.

As a result, these fossil fuels are more in demand. It has been a rough year, with Covid-19 impacting lives and businesses across the world. We are approaching the conclusion of the year. The pandemic has a significant impact on the energy sector, and lockdowns may have to continue through 2022.

Comments