A 401k plan allows the account holder to live a stress-free life post-retirement. Besides, it prepares the surviving spouse for any eventuality. If the account holder dies, the chosen person can inherit the account. He could make it a source of living. Or use it for any purpose. The case, provided the recipient satisfies the requirements laid down by the IRS.

There are many things that the beneficiary of an inherited 401k plan must know. Among them are rollover rules, tax benefits, withdrawal options. Besides, the beneficiary must go through all the pros and cons of this plan.

You will learn all about this as you read the article. Let’s check what can happen to your 401k money.

Die before retirement: what happens with 401k?

Perhaps you are the spouse of a 401k plan holder who died unexpectedly. Thus, you are the beneficiary. Now you are wondering what will happen to the retirement plan after your partner’s passing.

What will happen with savings?

The money in the 401k plan can be transferred to another account. As the beneficiary, you can move the savings into a different account of your choosing. One of the accounts you can use to roll over the 401k savings is an IRA. See the image below.

That is why the plan holder must select the recipient correctly. In the case of multiple heirs, each one will receive minimum distribution amounts. Of course, at the time of passing of the account owner.

What will happen with credits?

If the person who passed away has debts to settle with, you might worry that creditors may take advantage of the opportunity by going after the 401k plan. The good news is that this is not ordinarily possible. The Internal Revenue Code shields 401k accounts against creditors.

401k and taxes

You might have concerns about paying tax on your partner’s 401k. How might the tax impact the 401k of your deceased partner if you are the beneficiary? One thing could alleviate your concerns. Paying taxes for the 401k is typically out of the window if you are not employed.

Take note that as a beneficiary of a 401k plan of a departed spouse, this benefit forms part of your taxable estate. However, you have recourse available to reduce the burden of paying your spouse’s 401k taxes over time.

The goal is to make tax payments manageable, mainly if you work minimally over the years. Unfortunately, being retired does not mean exemption from tax obligations. Therefore, you have to know what options are available to you.

5 and 10 years rules

The five-year rule allows you to withdraw money from the 401k account you have inherited from your spouse five years after your partner’s death. The ten-year rule follows the same logic. However, each rule has different eligibility requirements. The five-year rule would take effect if your spouse passed away in 2019 or earlier. In contrast, the ten-year rule would take effect if your partner passed away in 2020 or later.

Taking out money from the 401k account this way allows you to distribute the tax obligation for several years. If you inherited the 401k account but are not the deceased’s spouse, your best option is the ten-year rule due to regulations imposed by the federal government.

401k: three main advantages and disadvantages

Although a 401k plan is not perfect, it offers a lot of benefits to the employee. Here are three main advantages of a 401k plan.

Federal legal protection

Retirement plans such as the 401k are protected by a federal law known as ERISA. This law establishes baseline standards for employers providing retirement plans and those responsible for managing them. ERISA aims to protect the interests of plan holders and their beneficiaries.

Matching funds

Although not required by law, many employers providing retirement plans such as 401k give counterpart contributions to boost the retirement account’s value. Depending on the plan designed by your employer, the matching contribution can be:

- A dollar amount regardless of your salary.

- A percentage of your contribution up to a certain percentage.

Free investment advice

After your enrollment to a 401k plan, you must select from a few investment options your employer offers. Most of these plan providers are big brokerage firms. They afford valuable materials, as free financial advisors and financial tools. Considering financial status, risk appetite, and age, choose the best options.

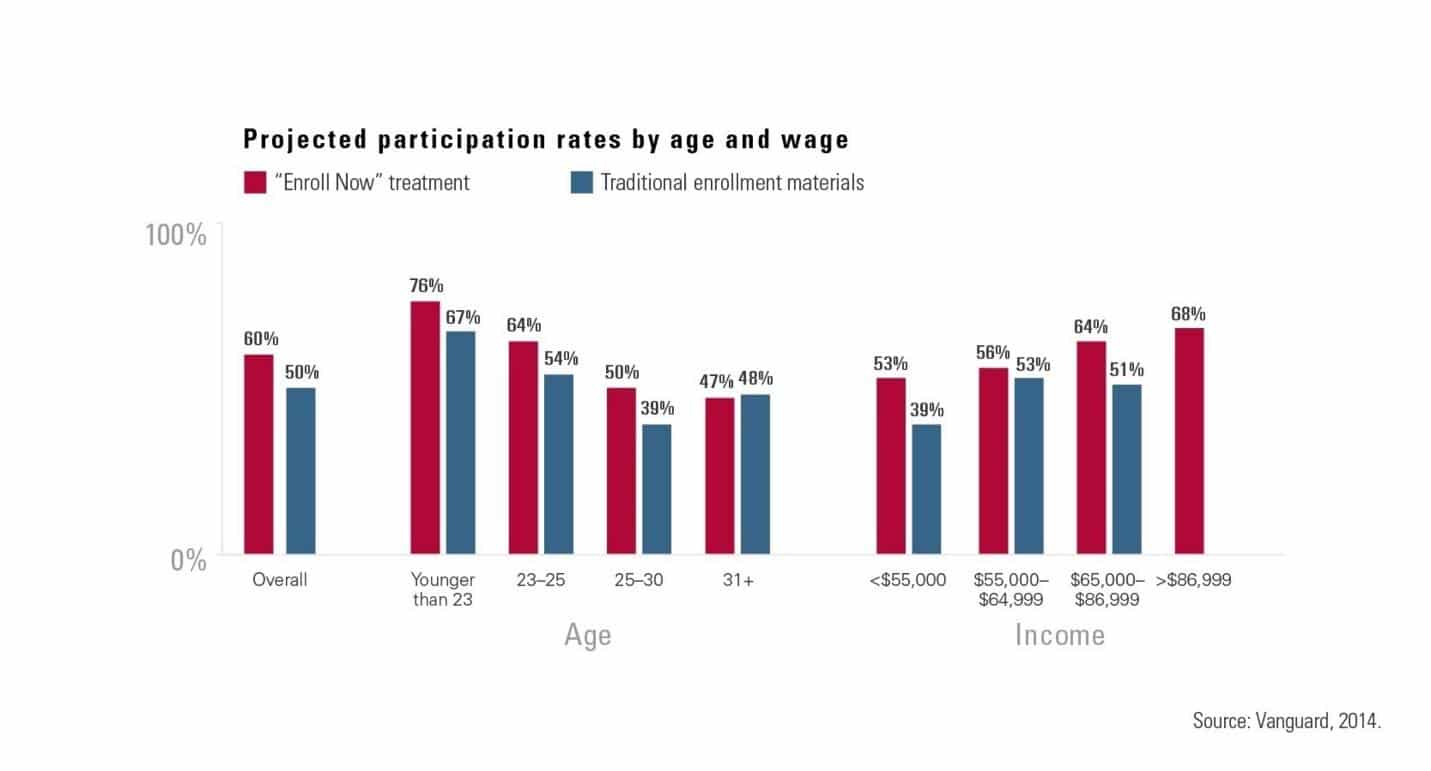

Vanguard is one of the significant providers of 401k plans. The above image shows the projected attendance rates by age and income.

While 401k plans are more beneficial to employees, there are some downsides. Let’s check them.

Limited investment options

In contrast with several other types of retirement plans, you may have limited choices in terms of investments for your 401k plan. Typically, you will have these basic investment options: bond, stock, and cash funds.

Higher account fees

Your 401k plan may charge high fees as it involves administrative responsibilities on the part of your employer. Typically, you have little to no control over these fees. To keep the involved fees low, you must select low-cost investment vehicles such as ETF and index funds.

Fees on early withdrawals

One main downside to putting savings in a retirement plan such as 401k is the 10% fee associated with early withdrawals. This penalty applies when you get money out of your 401k account before retirement.

Final thoughts

Keep in mind that the official retirement age is 59.5 years old. You may not be able to tap into your 401k account unless you experience great hardship, which you must substantiate.

Comments