Crypto staking makes it possible for anyone to earn crypto in a passive manner. The good thing about staking is that you can gain crypto even without using a high-end computer. Plus, this money-making scheme will not push your electricity bill higher. The question that might come to your mind is which coins support staking or offer the best rates? You will learn about it in this article.

What is staking?

Staking involves setting aside coins to support a crypto network and reap the rewards in return. Keep in mind that staking applies only to the proof of stake validation system. In proof of stake (PoS), transactions are verified using coins. Meanwhile, mining applies to the proof of work (PoW) protocol.

Blockchain is a public record of crypto transactions. Anyone with a public key can see how much crypto is being bought or sold. Adding new blocks to the blockchain requires the verification of transactions using an authentication system such as staking and mining. The person or group of persons who participate in the successful verification of a transaction is rewarded with coins.

How does staking works?

You can do staking in two ways, with one option more complicated than the other. The first option is staking through a crypto exchange, which is favored by the majority of users. The staking process involves depositing crypto coins in an exchange and requesting to stake them. This staking method is likened to depositing money in a bank account and earning interest. Three popular crypto exchanges supporting staking are Coinbase, Kraken, and Binance.

The second, more advanced option involves setting up your staking node. To do this, you must be reasonably knowledgeable about computer technology. Plus, you may have to grapple with a minimum requirement for coins allowed to be staked. However, if you do the staking on a big platform, minimum stakes are less of a concern for you.

How to select coins to stake?

While you can find several coins to stake, you must select the best coins. To find the best, weigh each coin on these three criteria:

- Market cap

Select coins with a high market cap. This way, you have good chances of success because you stake in coins with sufficient backing from investors.

- Staking is complexity

Can you access the coin on a central platform? Select the staking option that suits you best, depending on your technical know-how.

- Return rate

Investigate how much each crypto project offers in terms of return. While you can find projects promising as high as 20 percent yearly return, the industry standard is more or less five percent.

Top five crypto for staking in 2022

Below are our top five picks of the best crypto to stake in 2022. These coins are arranged by market cap as provided by coinmarketcap.com.

What is Ethereum?

Ethereum is the second-biggest crypto next to Bitcoin. The platform supports smart contracts, decentralized finance, decentralized apps, and more. With this platform, you can make payments across the globe, buy and sell NFTs, and mint new coins. Ethereum was initially designed to work on the proof of work method, but it is transitioning to proof of stake.

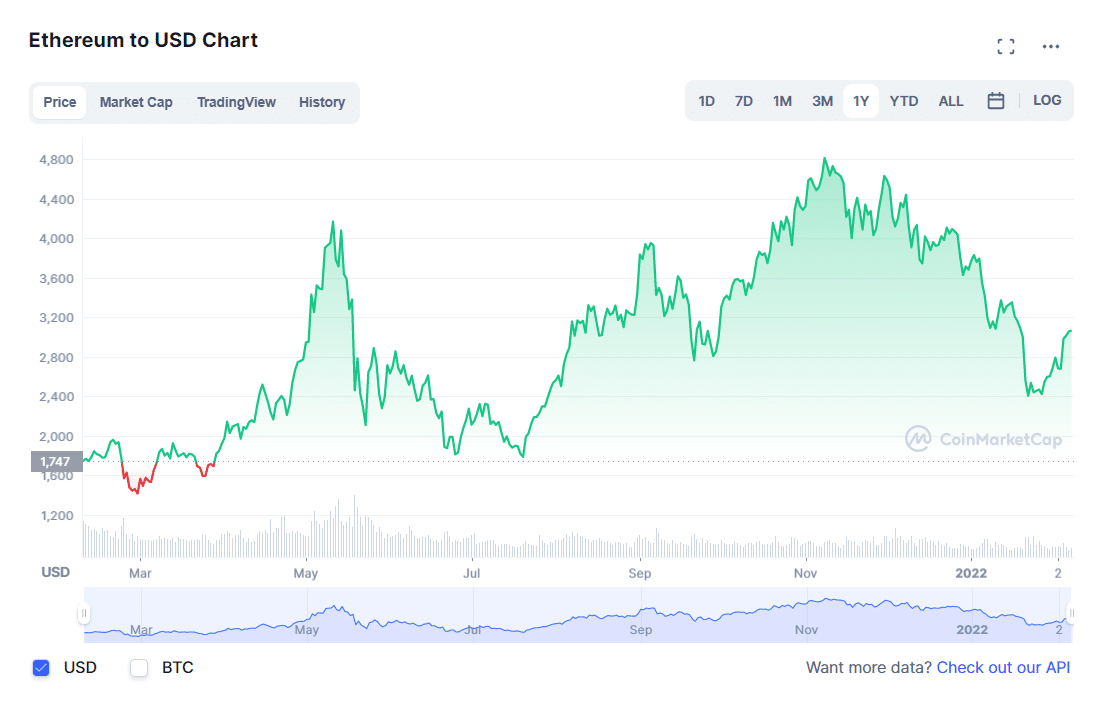

Ethereum daily price chart (1Y data)

Ethereum price prediction 2025

Using a deep learning algorithm, Ethereum is expected to reach more than $7,000 in 2025. This is in spite of the fact that the market encountered a sharp decline since November 2021.

What is BNB?

BNB is the native token of the world-renowned crypto exchange Binance. This token is being used as a medium for paying transaction costs in the platform. On average, you can earn about six to nine percent return yearly when you stake BNB coins. A 30 percent yearly return is possible on some occasions. Be aware that the return rate fluctuates based on the change in transaction fees.

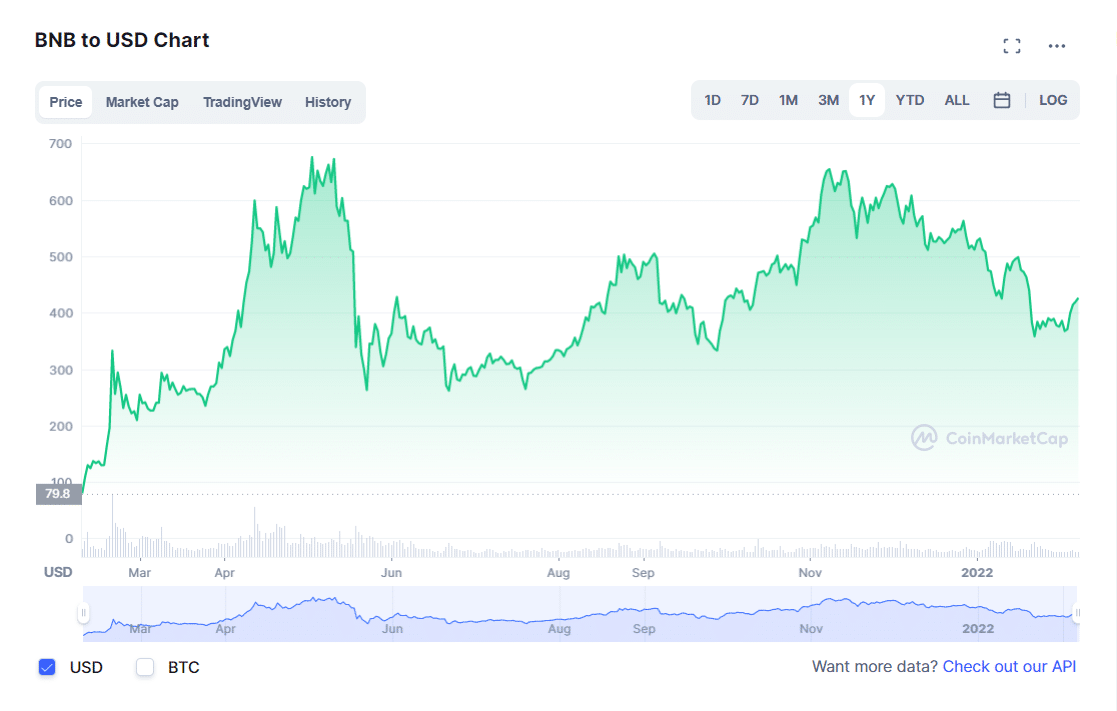

BNB daily price chart (1Y data)

BNB price prediction 2025

One factor that makes BNB primed for mass adoption is tradability. You can use BNB to convert between different crypto assets. If expert predictions come to fruition, you may see BNB hitting about $850 in 2025.

What is USD Coin?

USD Coin belongs to a group of crypto known as stablecoin. As the name suggests, USDC is paired with the US dollar. As a stablecoin, USDC does not fluctuate so much in value, unlike other digital assets. The Ethereum network powers this coin.

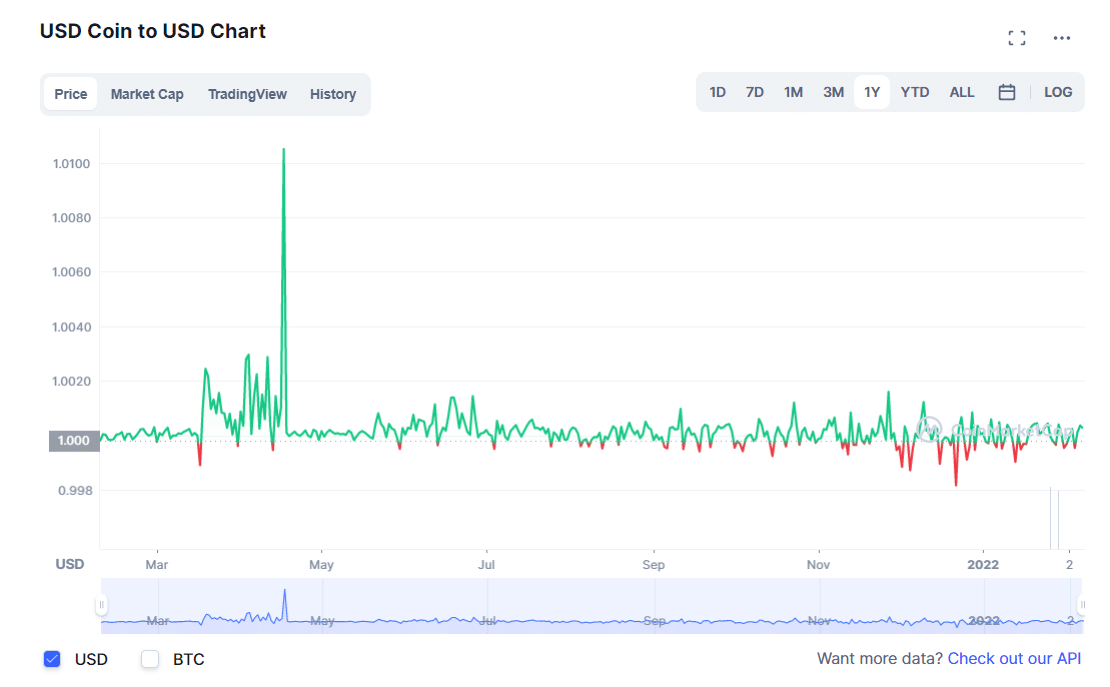

USD coin (1Y data)

USDC price prediction 2025

As a stablecoin, USD Coin will not fluctuate much in valuation. From 2022 until 2025, you can expect the price to stay within a tight range from a minimum of $1.08 to a maximum of $1.598.

What is Cardano?

Cardano is one of the coins introduced to defeat Ethereum by fixing the latter’s failings. This platform offers scalability, sustainability, and flexibility. To process transactions fast, Cardano divided its blockchain into two tiers. One tier keeps an account of transactions and balances, while the other tier runs decentralized applications.

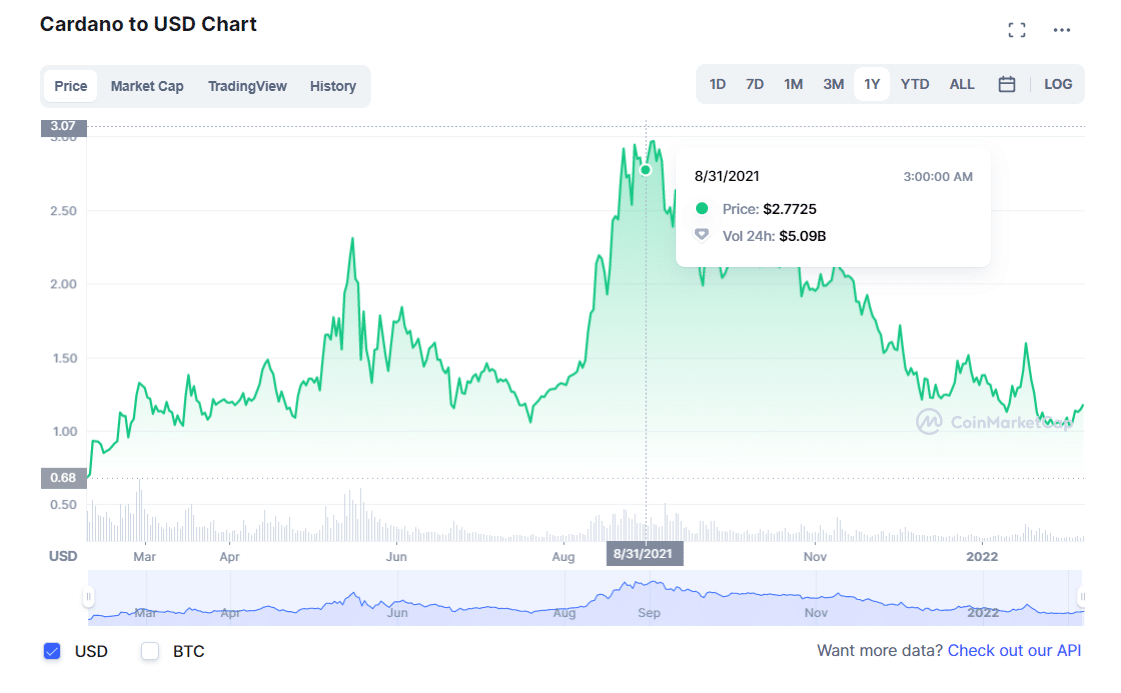

Cardano daily price chart (1Y data)

Cardano price prediction 2025

The price of Cardano is currently sitting around long-term support. Refer to the above chart. If this support holds and the uptrend resumes, Cardano may hit around $12 by the end of 2025.

What is Solana?

Solana is another competitor of Ethereum. It supports much functionality provided by Ethereum, such as DeFi and smart contracts. What makes it superior to Ethereum is its speed in processing transactions. You can use Solana coins to pay gas fees and vote on how to govern the platform.

Solana daily price chart (1Y data)

Solana price prediction 2025

Because the supply of Solana coins is limited, its value is expected to rise. Toward the end of 2025, the price of Solana may play around a minimum of $380 and a maximum of $450.

Final thoughts

Selecting which coins you should stake is very similar to the process of choosing which crypto to invest in. Market cap is one good indicator to consider when making that decision. Coins sitting on the higher end of the market cap listing suggest that investors value them. Market cap is a good starting point when searching for the best crypto coins to stake. Another metric is the rate of return. Although a high return rate is better than a lower one, it is simply one factor in the selection process.

Comments