Why did the last crypto market crash?

The 21st of January 2022 is considered by investors and analysts as a black Friday due to the across-the-board crypto market crash. As a result, up to $136 billion worth of investment was wiped out within 24 hours. There are at least three reasons why this had happened. One main reason is the market liquidation led by Bitcoin. About $880 million was liquidated in a single day, $175 million of which involved Bitcoin.

Another reason cited for the crash is the proposed ban of crypto use and mining in Russia, the third biggest Bitcoin miner in the world. The third reason has something to do with the correlation with the stock market. Note that BTC is about 59 percent correlated with the S&P 500 index. A sell-off in the stock market is likely to be felt in the crypto market.

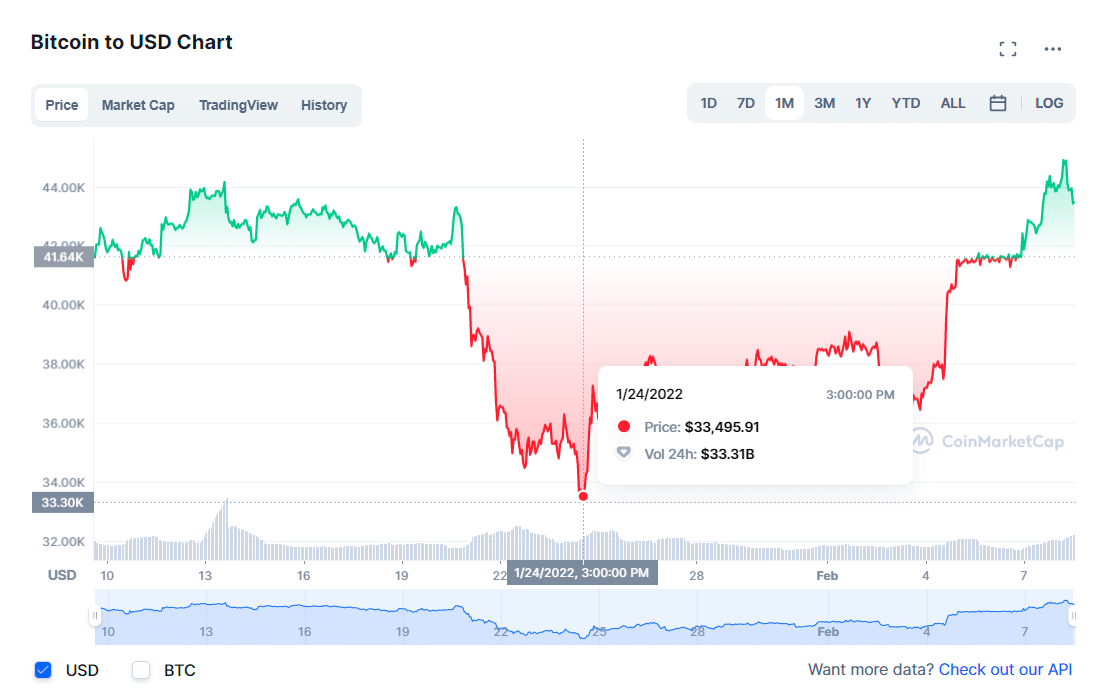

What price did Bitcoin drop to?

The biggest digital currency, Bitcoin, lost over 12% in a single day during the January 2022 crypto market crash. The lowest price during that fateful day was about $33,500. This breakdown was critical because it disrespected a long-term support on the daily chart (i.e., $40,000).

21st of January 2022 BTC crash

When and will the crypto market recover?

Several analysts predict that the current bear market will persist in a while. What offers consolation is that many crypto assets are still bullish overall when you look at higher time frames such as the weekly chart. Bitcoin, for instance, is way below the high reached in November 2021. However, the current BTC price is still above the year 2021’s open price of around $28,994.

Although not all market analysts concur, some experts say there is still a chance for crypto in general and Bitcoin in particular to see a recovery in 2022. They are seeing a $75,000 price for Bitcoin as a possibility if the current bear market finds a bottom and turns around. The last line of support for Bitcoin is the $30,000 level.

Which five cryptos are better to buy during the 2022 crash?

The crypto market has been beaten down by various fundamental factors during the last month of 2021 and during the first month of 2022. It might look risky to buy crypto now as the daily price changes are in red and many crypto assets are swinging down. For crypto believers, this could be a great buying opportunity as they are given discount prices. If you belong to this camp, here are five cryptos to buy after the 2022 crash.

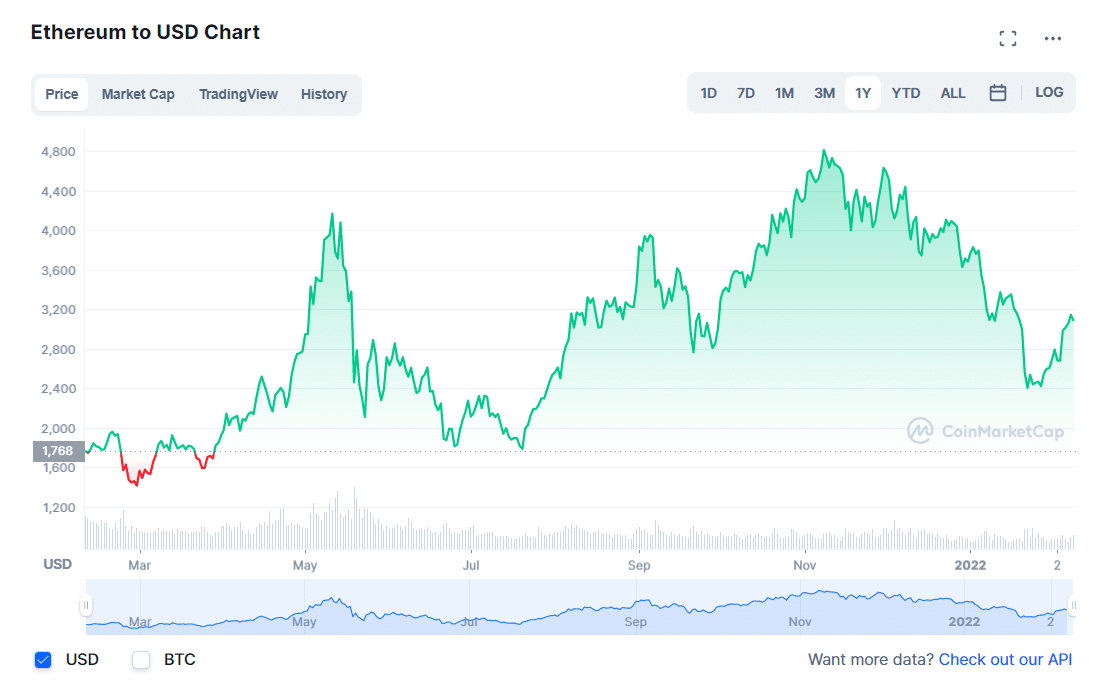

What is Ethereum (ETH)?

Ether is the native coin of Ethereum and is the second-biggest crypto in terms of market share. At the time of writing, Ether has a market cap of about $360 billion. The January crash led to a crushing loss of over 50 percent for Ether as measured from its 10 November 2021 all-time high of $4,867. Ethereum is instrumental to the development of blockchain technologies such as NFTs, smart contracts, decentralized finance, and others.

ETH/USD daily chart (1Y data)

What is Solana (SOL)?

Solana is the biggest competitor of Ethereum, offering faster transaction processing and boasting an increasing number of decentralized applications. The other features that make Solana attractive as a blockchain are lower transaction costs compared to Ethereum and harmony with the easy-to-use rust programming language.

SOL/USD daily chart (1Y data)

What is Avalanche (AVAX)?

Crypto exchange FTX founder Sam Bankman-Fried believes that Avalanche has the potential to make explosive gains in 2022. He makes his assertion on the basis of such factors as low fees and support for smart contracts. Without the much-needed Ethereum 2.0 upgrade, ETH might lose some of its market share to Avalanche.

Technically, AVAX holds a lot of promise. Refer to the daily chart below. The market is obviously sitting above obvious support and completes a bullish harmonic pattern. The confluence of these two factors gives a strong narrative for a possible trend continuation.

AVAX/USD daily chart (1Y data)

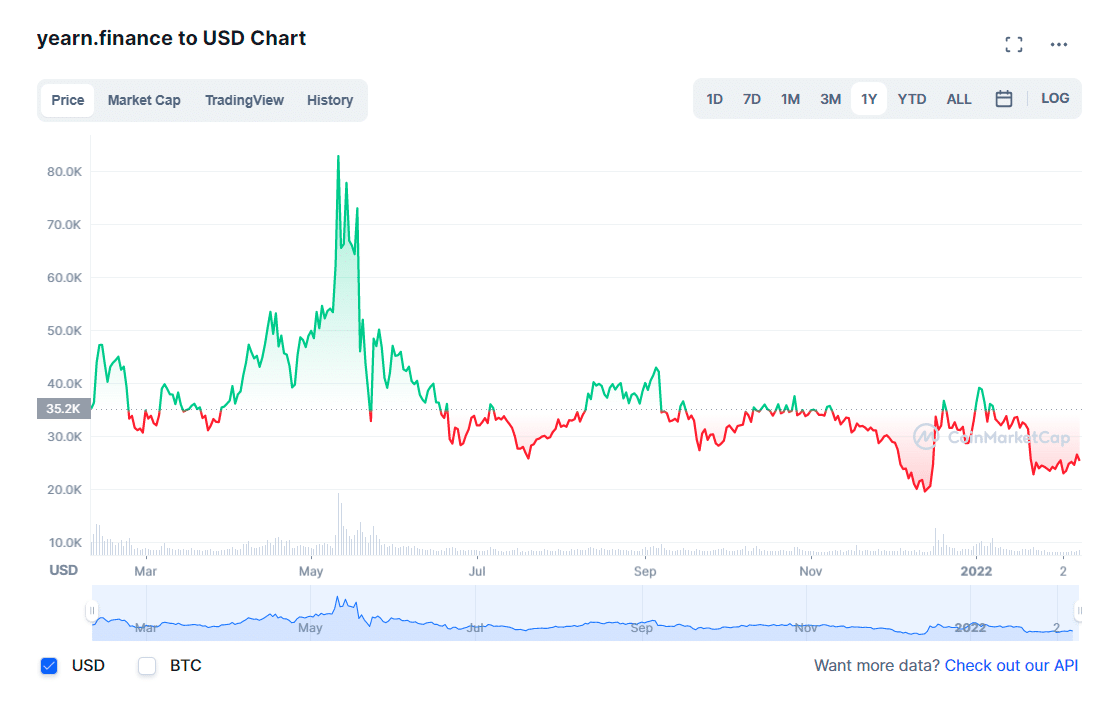

What is Yearn.Finance (YFI)?

Yearn.finance is one of the few digital assets with a high price tag. Trading at a price of $23,627 at present, YFI occupies the 24th spot out of the 17,336 cryptos in existence in terms of valuation. With a market cap of about $865 million, YFI sits on the 90th place. Like BTC, one great attraction of YFI is scarcity. There are only 36,666 YFI coins in existence now and into the future. This could be one of the main reasons why this token has reached its current price. Regardless, YFI experiences volatility like all other cryptocurrencies.

YFI/USD daily chart (1Y data)

What is Polygon (MATIC)?

At the time of posting, Polygon has a market cap of $11.77 billion, allowing it to occupy the 14th spot in terms of market value. Obviously, MATIC is bigger than YFI, but the two have a common goal. Polygon is vying for mass adoption of digital currencies by expanding Ethereum’s scalability.

Polygon uses a technology that seeks to run an unlimited number of dApps in the Ethereum network to push the network’s use cases. Trading below 40 percent of its 27 December 2021 peak, MATIC has a lot of room for the upside to run. While the market structure on the daily chart below is compromised, the overall trend is bullish and the price is resting a little above support. As you can see below, the price is showing a rejection of this support and might be printing a higher low before continuing upward.

MATIC/USD daily chart (1Y data)

Final thoughts

Cryptocurrency is a highly volatile market, making it a risky investment. If you are comfortable with a fluctuating account balance, this asset class might be suitable for you. Because of the huge risk, you should not expose a large portion of your investment in crypto. Allocate no more than five percent of your portfolio to crypto. If you dabble a small amount of investment in crypto, you may need to stay the course longer than usual and become less worried with temporary drawdowns.

Comments