The Metaverse market size has been forecasted to grow to $828.95B in 2028. It was worth about $48B in 2020.

Metaverse is widely considered the future of the internet, where users will be able to collaborate, play games, socialize, and work in 3D spaces. Even education is expected to enter the Metaverse very soon, and technology firms are actively working toward dominating the virtual world on all fronts.

Let’s look at the top five Metaverse funds in this article to help you pick the best for your portfolio.

What are Metaverse ETFs?

A Metaverse ETF is the easiest way to invest right now. It is an online community where people can meet up, collaborate, and have fun. An actively managed portfolio of companies creating the Metaverse is available to investors via the ETFs. Because funds are diversified, they help limit volatility, minimizing risk exposure in the market.

How to buy Metaverse ETFs?

Buying and selling ETFs is a simple process that can be done the same way as any ordinary stock. Before buying shares in a Metaverse ETF, you will need to sign up with a broker. Getting the most significant value on a futures contract starts with talking to your futures broker.

Top five Metaverse ETFs to buy in 2022

Metaverse ETFs allow us to gain exposure to the Metaverse investing theme without researching individual companies. You can now choose from five Metaverse ETFs.

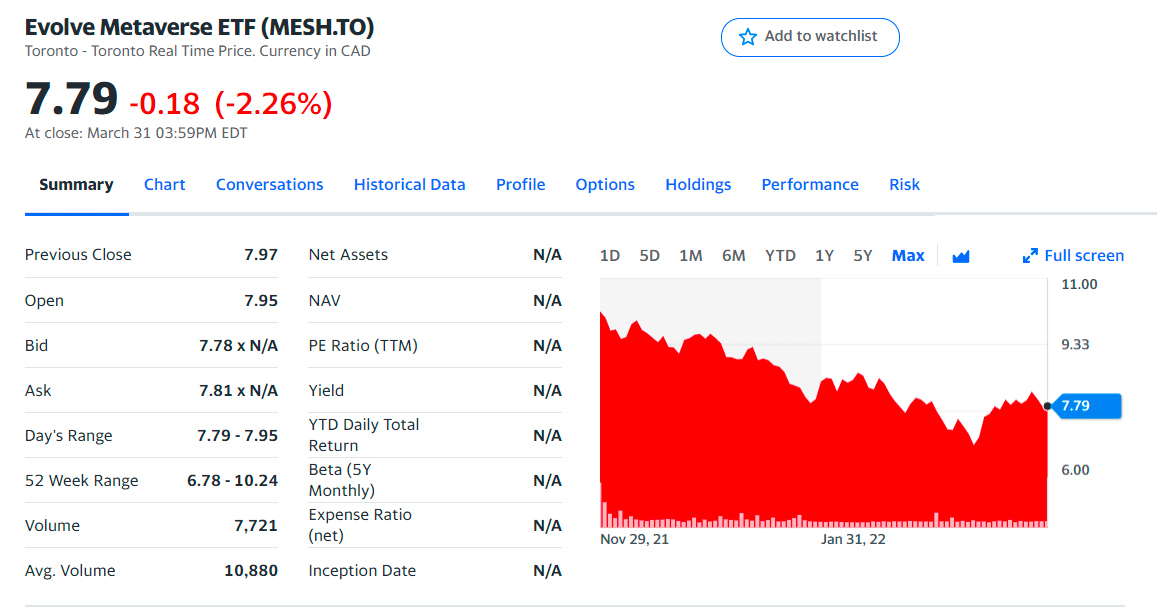

№ 1. Evolve Metaverse ETF (MESH.TO)

MESH ETF summary

This fund seeks to provide holders of Units with long-term capital appreciation by actively investing in a diversified mix of publicly traded equity securities of issuers from North America and other developed markets from around the world that are involved in the development of the Metaverse.

It is Canada’s first Metaverse ETF, which exposes investors to a diversified group of companies actively involved in Metaverse’s expansion. Even though it has 25 stocks, it is now skewed toward companies from the US and Asia.

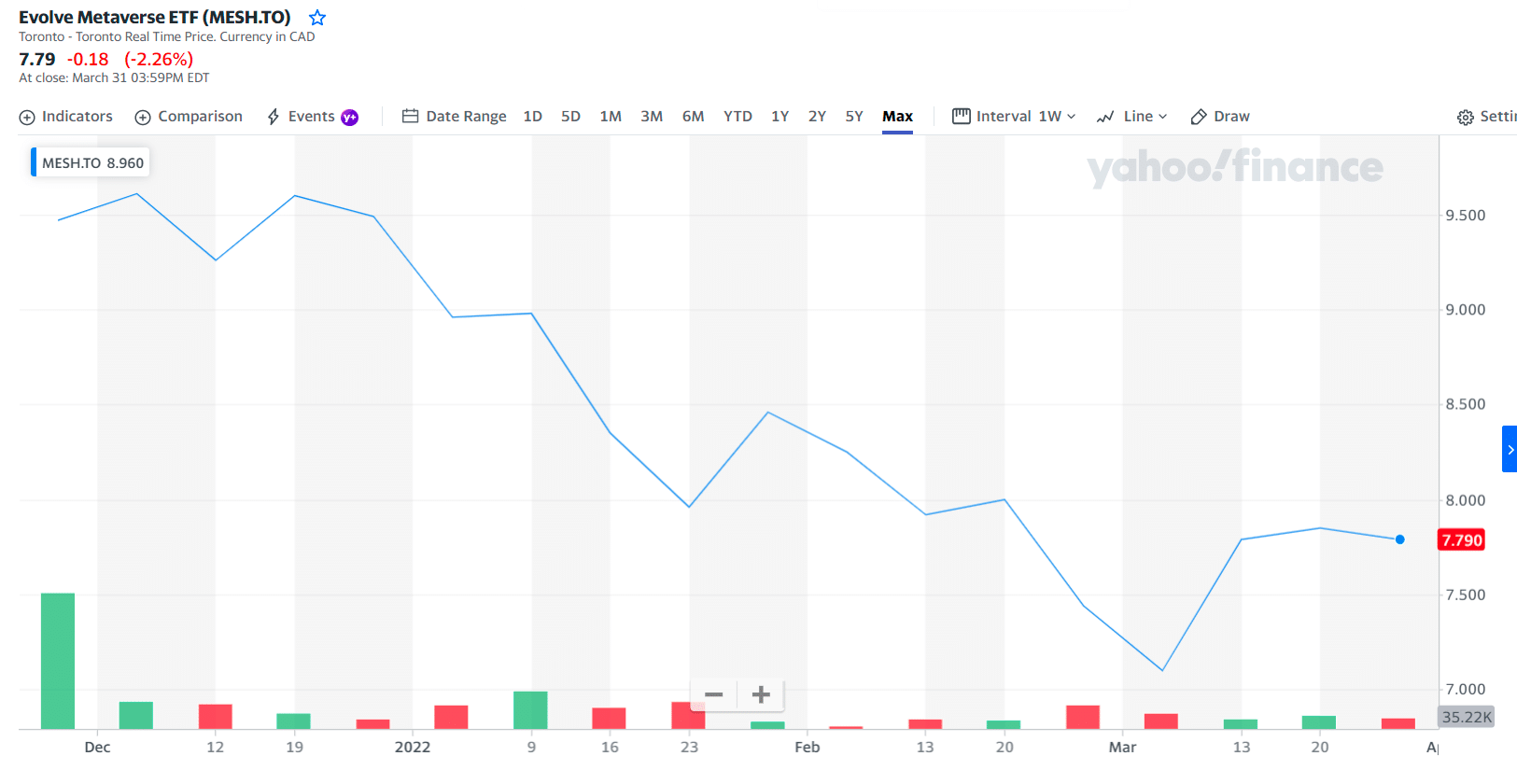

MESH price chart

Around three-quarters of the fund comprises American firms, with the rest coming from Chinese, Japanese, and Singaporean firms. It invests predominantly in the technology sector and includes some of the most well-known big-cap stocks, such as Meta, Autodesk, and Walt Disney, comparable to Roundhill.

Because it’s a new ETF, there is minimal data on its previous performance; however, it does have over $8 million in assets under management. As a result, MESH’s equal weighting is one of its most enticing aspects. It splits its whole money among all of the stocks it invests in, ensuring that no one business has a significant effect on its total performance.

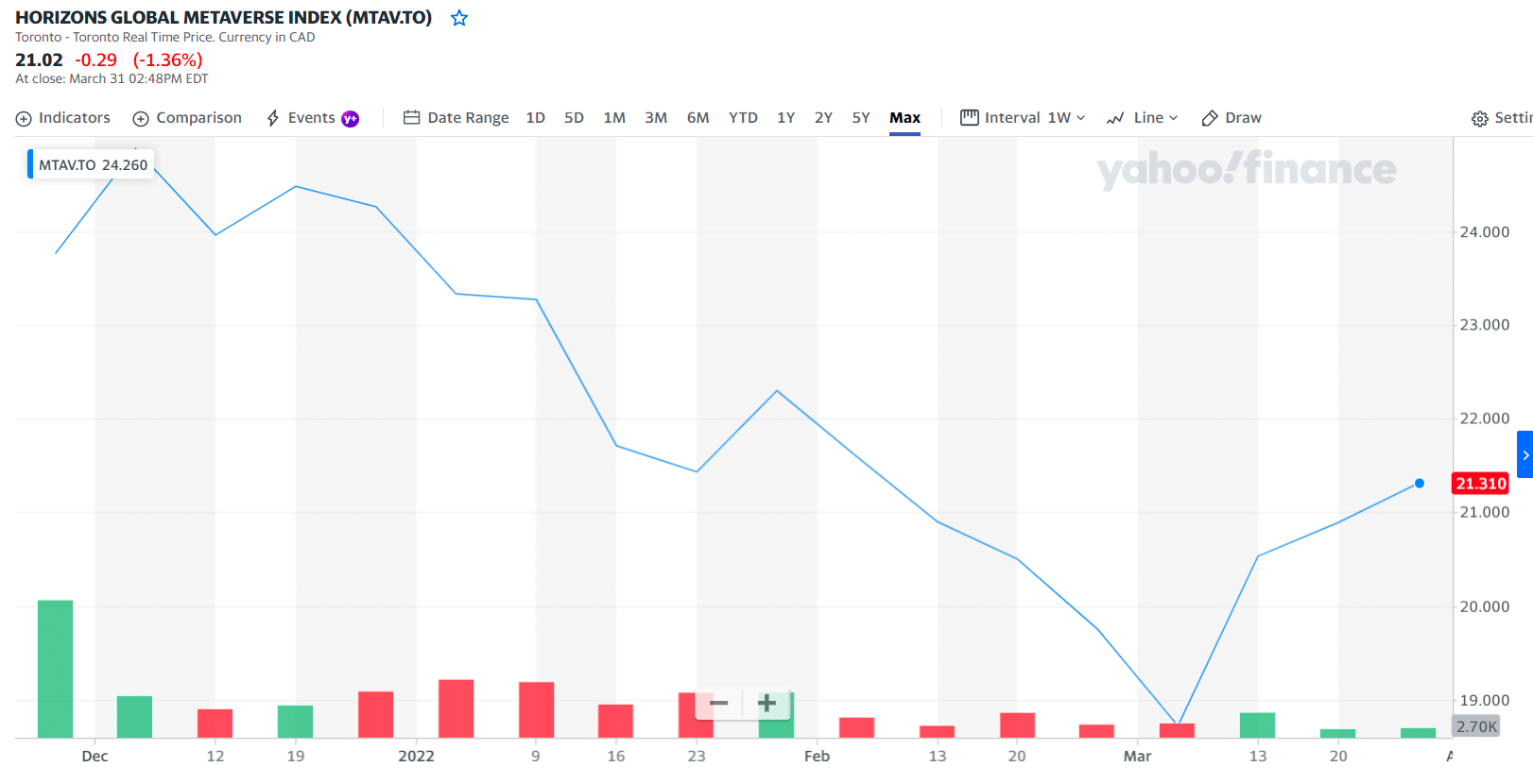

№ 2. Horizons Global Metaverse Index ETF (MTAV.TO)

MTAV ETF summary

Like Evolve, MTAV is a Canadian ETF listed on the Toronto Stock Exchange. It’s simply another new ETF in this market, with little historical price data to depend on.

Horizons stand out for its broad sector allocation compared to the other ETFs on our list. While the technology sector receives around a quarter of the total investment, the rest is spread over a wide range of other businesses. The topics covered are gaming stocks, digital payments, and augmented/virtual reality.

MTAV price chart

MTAV includes stocks from all over the world. Among its most valued holdings are Google, Visa, and Amazon. In addition, it provides each of its holdings a roughly equal weighting. This, along with the fact that it invests in various sectors, makes it a less hazardous option to Metaverse ETFs. However, it gives a slight advantage to those with their headquarters in the US.

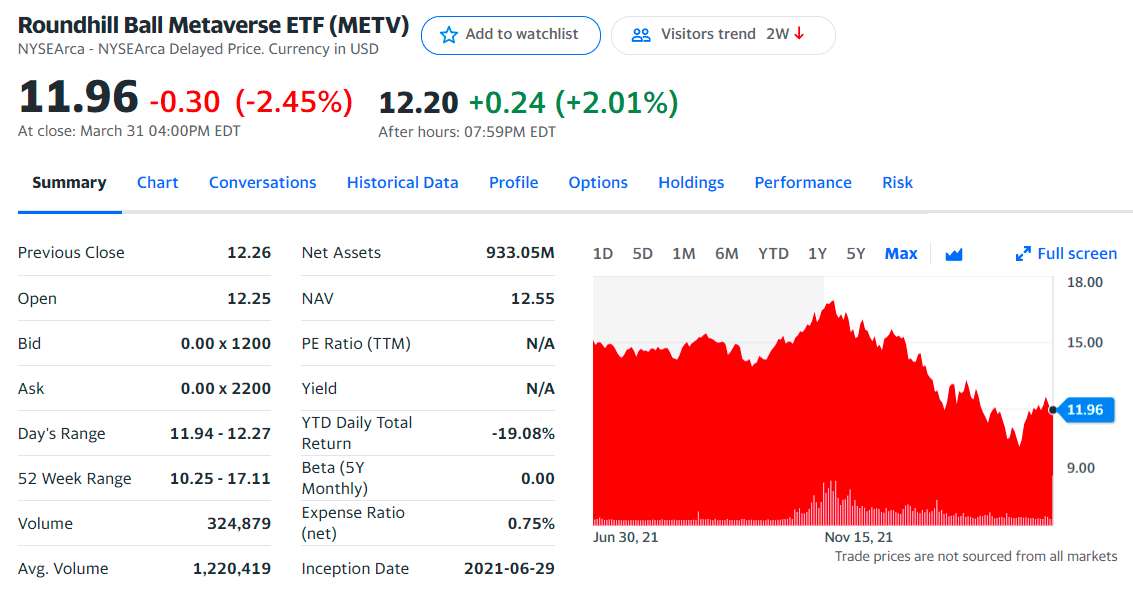

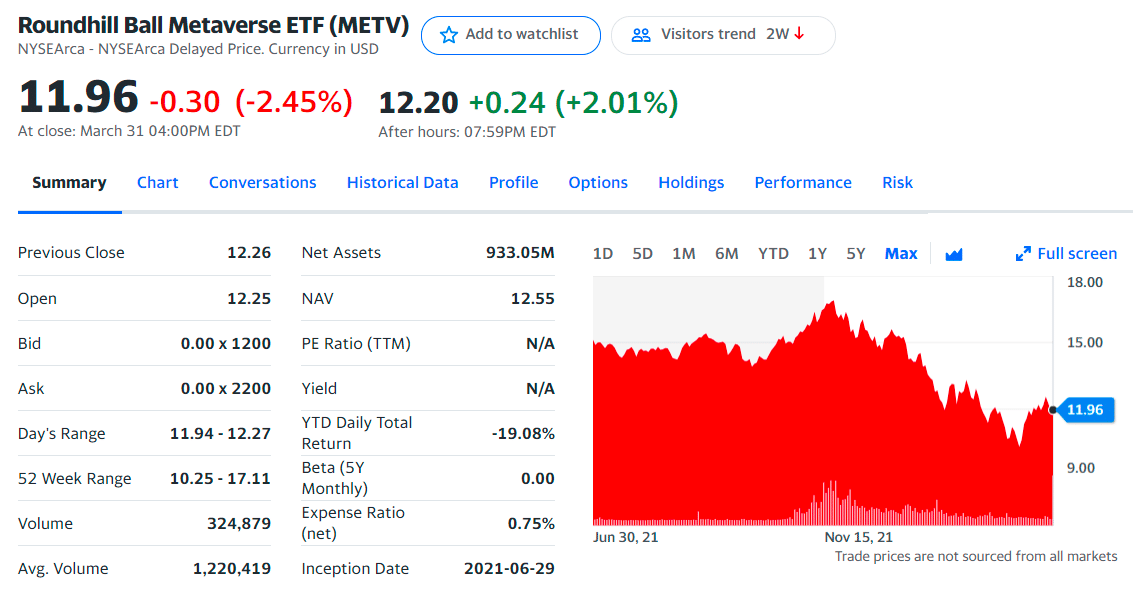

№ 3. Roundhill Ball Metaverse ETF (METV)

METV ETF summary

It is the world’s first Metaverse exchange-traded index, and it seeks to mirror the performance of the Ball Metaverse Index. A portfolio of 40 firms in the Metaverse is available to investors via this fund. Around 80 percent of its holdings are in the US, with 20 percent in Asia.

The fund seeks to track the performance of the Ball Metaverse Index. The Index comprises globally-listed equity securities of companies that engage in activities or provide products, services, technologies, or technological capabilities to enable the Metaverse and benefit from its generated revenues.

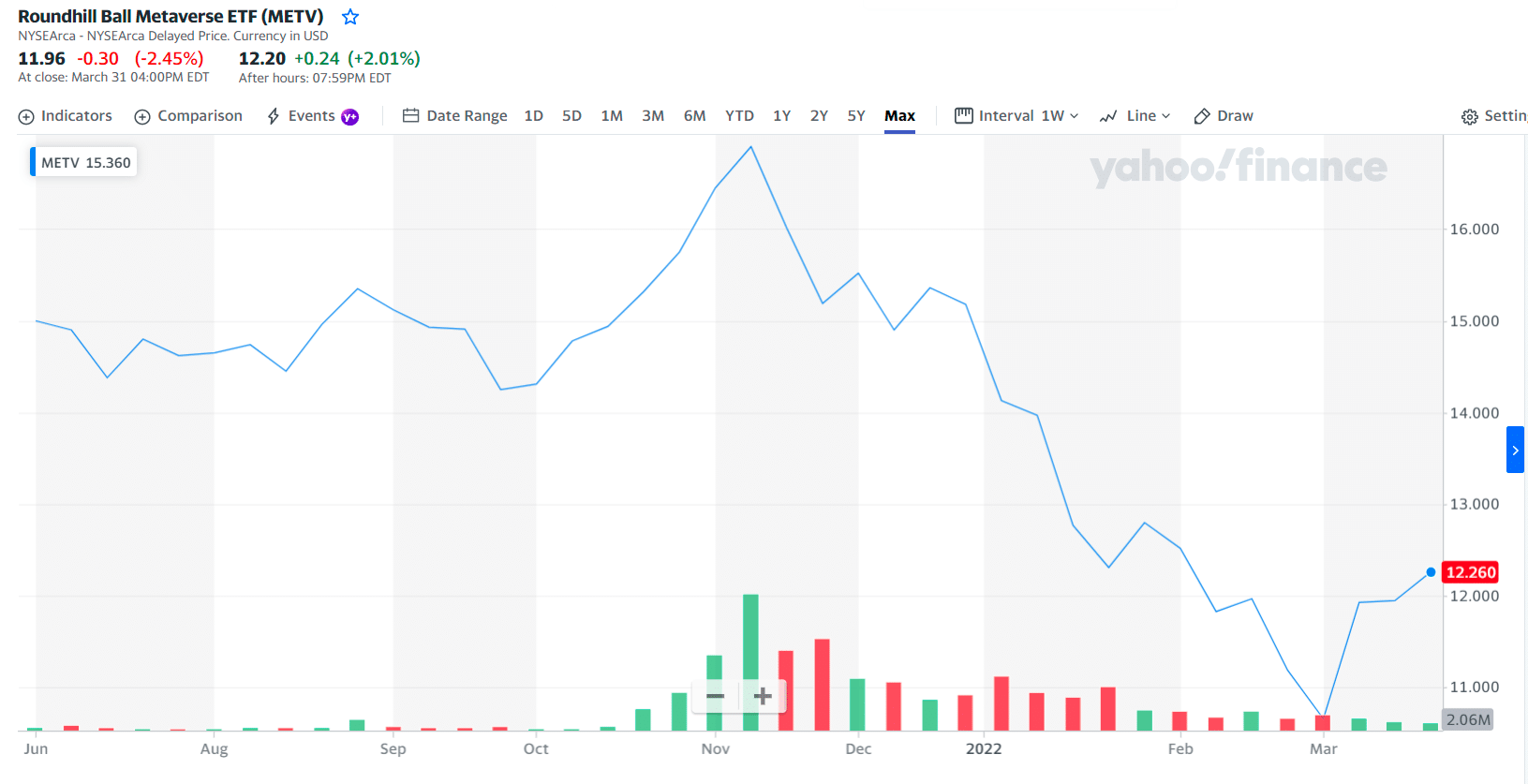

METV price chart

It’s a brand-new ETF that launched in June 2021; hence there’s no historical performance against it.

The first three holdings with their asset percentage are:

- NVIDIA Corp. — 8.72%

- Microsoft Corp. — 7.47%

- Meta Platforms — 6.35%

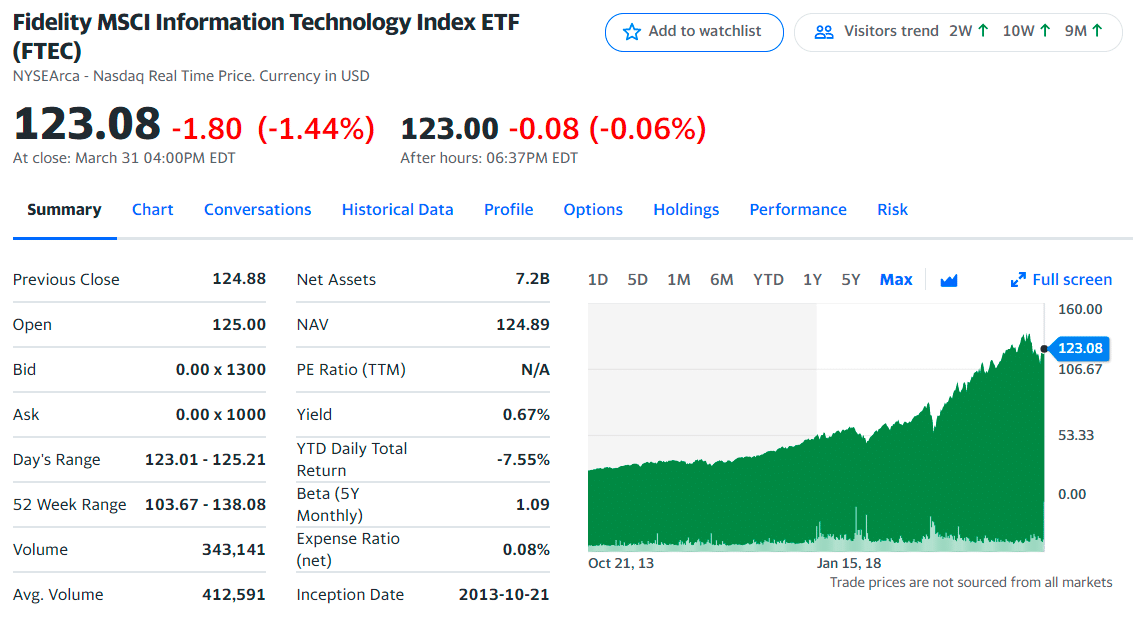

№ 4. Fidelity MSCI Information Technology Index ETF (FTEC)

FTEC ETF summary

Fidelity MSCI Information Technology Index ETF is a technology-focused ETF that tracks the performance of the MSCI USA IMI Information Technology Index, which represents the companies from the IT sector in the US equity market. The top ten holdings of this fund make up almost 65% of its total investments, which comprise 368 securities.

A top holding of FTEC is NVIDIA Corporation (NVDA), a multinational technology company providing products and services to the semiconductor, artificial intelligence, consumer electronics, gaming, and computer hardware industries.

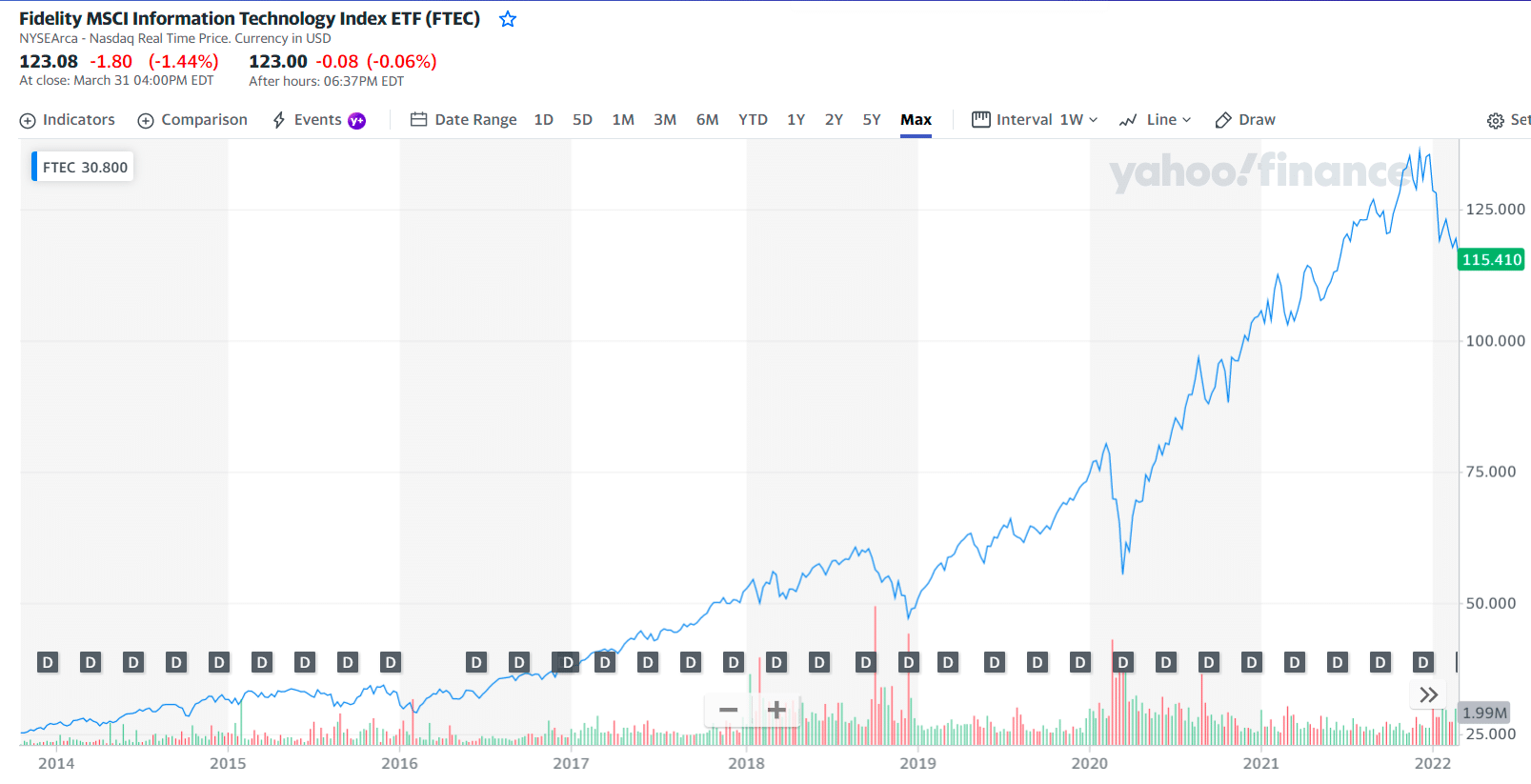

FTEC price chart

The first three holdings with their asset percentage are:

- Apple Inc. — 22.15%

- Microsoft Corp. — 17.67%

- NVIDIA Corp. — 5.00%

The Metaverse depends on graphics computing technology provided by companies like NVDA, which also offers free software to artists and content creators developing virtual worlds for the Metaverse and making technology deals with multiple marketplaces that sell NFTs and 3D content.

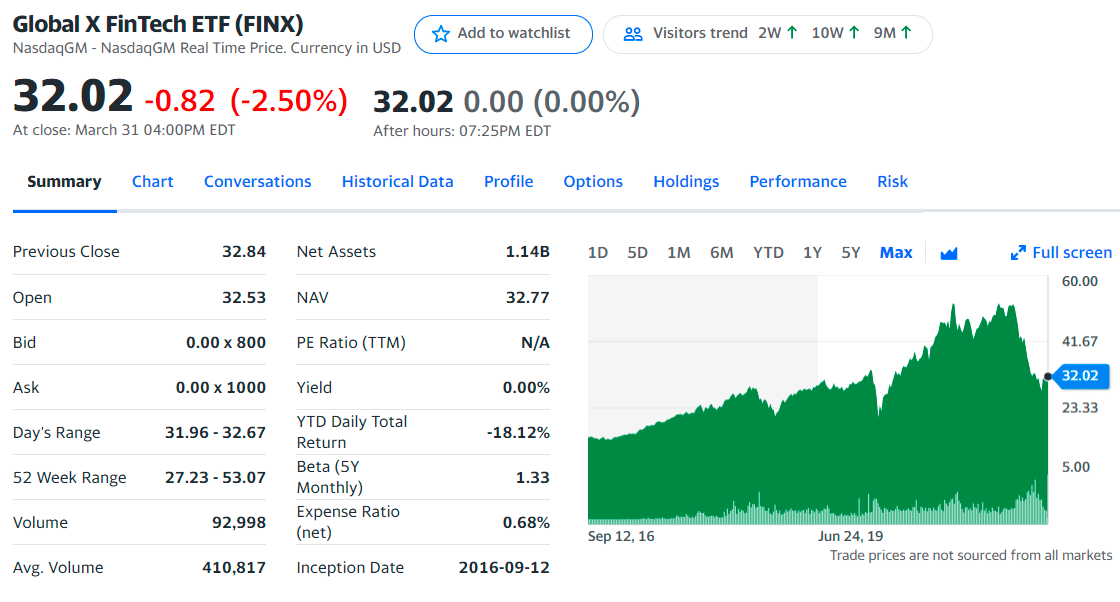

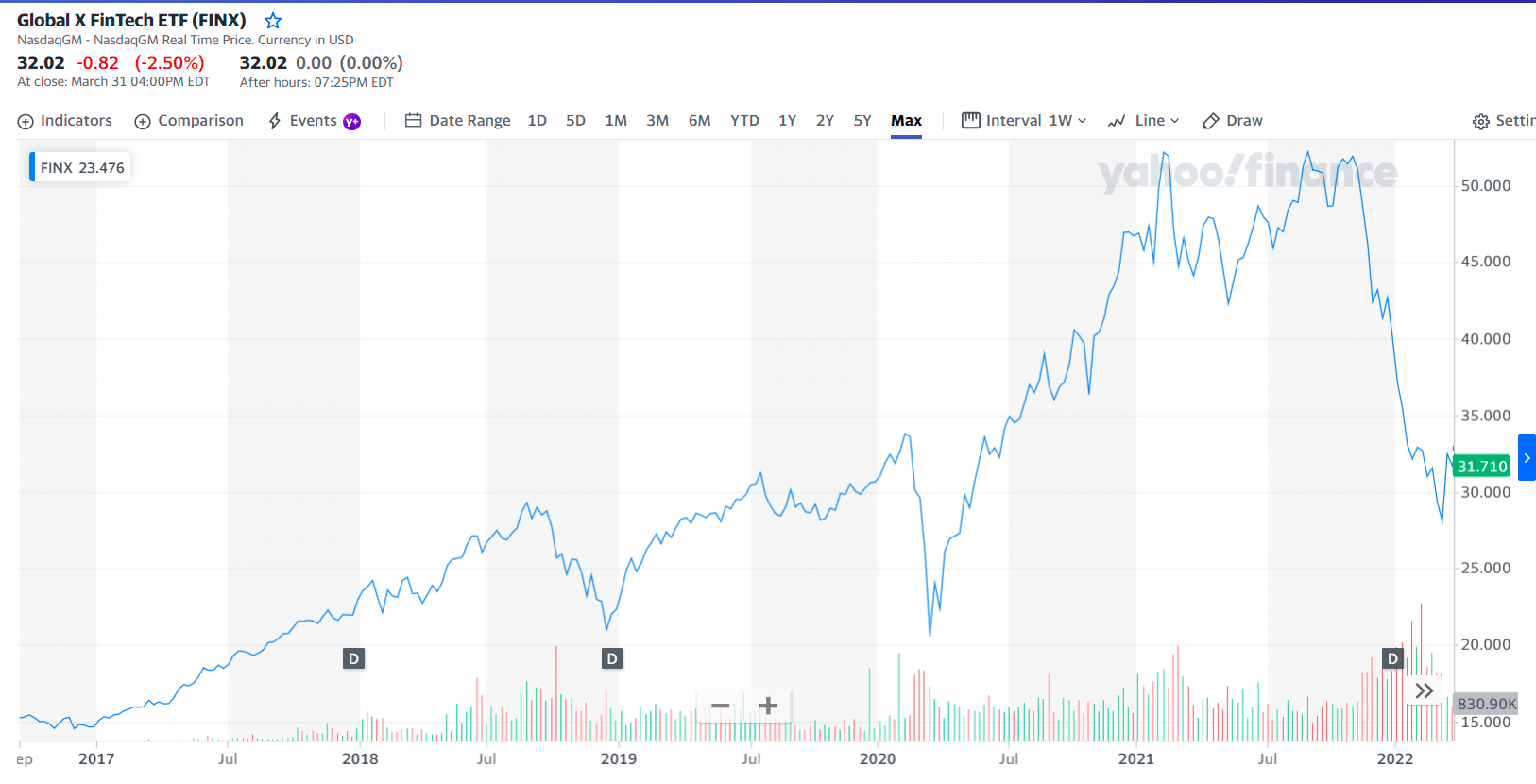

№ 5. Global X FinTech ETF (FINX)

FINX ETF summary

Global X FinTech ETF (FINX) generally tracks the Indxx Global FinTech Thematic Index, holding companies that are leaders in the emerging financial technology sector. The underlying companies seek to digitally transform mature industries like insurance, fundraising, and third-party lending. Almost 78% of the holdings in this fund are focused in the information technology sector, while 14% are concentrated in the financial industry.

FINX price chart

The first three holdings with their asset percentage are:

- Intuit Inc. — 7.43%

- Block Inc. — 7.04%

- Adyen NV — 6.76%

One of the underlying companies in FINX is Block, Inc. (SQ), which is a financial services and digital payments firm based in San Francisco, California. Jack Dorsey, CEO of the Block Inc., aims to make Bitcoin the native cryptocurrency of the internet. BTC is widely referred to as the currency of the Metaverse, and SQ is one of the top contenders in the Metaverse. This makes FINX one of the top funds to buy.

Final thoughts

Many companies in these funds belong to large-cap technology companies, and their shares are considered some of the most stable around. They include well-known social media networks such as Meta platforms to e-commerce kings like Amazon. Whatever you decide to do, it’s key to keep updated with the latest news and market analysis.

Comments