3D printing is a technique that involves the deposition of successive layers of material to form a printed item. That is self-evident, which explains how the method acquired its additive manufacturing label.

A simple volume search for the keyword “3D printing” demonstrates everything. The interest peaked in 2014 and is expected to increase again in 2022.

Stocks for 3D printing are never a hopeless cause. According to market researchers, the CAGR will be 21% by 2028. The market is expected to reach over $63 billion.

What are 3D printing stocks?

Companies in the 3D printing business provide products and services that enable a wide range of items. Additive manufacturing, another name for 3D printing, creates physical objects from digital models.

In the 3D printing stocks business, companies sell tools and services that can make a wide variety of subjects. 3D printing, also known as additive manufacturing, is when computer designs are used to make real-world items that can be made by printing them.

Polymers that are liquid or powdered, metal powders, and cement can be used. With its revolutionary power, 3D printing could soon change the way industrial logistics and inventory management work.

Experimentation is not a guarantee that you will have a promising future. Consider how the stock has done in the past when making investment decisions. The same or similar things that made a stock rose or fall in the past may still be at play.

How to buy the stocks?

Here are a few easy steps to buy 3D stocks in the stock exchange market.

Step1. Contact a broker

A broker can help you buy and sell stocks, as well as get dividends from the firms in which you invest. To open a bank account with the company, you must supply some financial details.

Locate a broker by conducting an internet search. The great majority of brokers do not charge fees on stock trading and do not demand a significant initial capital investment.

Step 2. Choose suitable investing plans

As a beginner, only buy one or two stocks at a time. With just a few stocks, it’s easy to keep track of and find opportunities. Recently, it has become more common to trade fractional shares, which means you can invest with less money.

Determine the maximum number of shares you can purchase at this moment before proceeding. The good news for novice investors is that a growing number of brokers now provide fractional share trading, which simplifies getting started. Unfortunately, as a result, you may only be able to purchase a small fraction of the most expensive stocks.

Step 3. Deep understanding of the stock market

You need to figure out how much money you are willing to lose on each deal. There are a lot of good day traders who risk less than 1% to 2% of their account balances every time they trade.

Before deciding whether to invest in a company, you should undertake comprehensive research on the business. This will need significant time and effort.

To make wise investments, you must first fully grasp the business, its products, finances, and the industry. As a result, you’ll need to check the company’s Securities and Exchange Commission filings to discover more about its history.

Step 4. Create a trading strategy

Make a list of the stocks you want to buy and keep an eye on the companies you’ve chosen and the overall market. Two ways to get started are to look at business news and visit reputable financial websites.

Market orders work better when the quantity of accessible shares is limited or the business is highly liquid. Therefore, limit orders are appropriate for smaller organizations and people who do not intend to impact their company’s stock price.

Step 5. Monitor your stock’s success in the market

When shares are purchased, the investment process does not end. Rather than that, it persists. Compile a quarterly or annual overview of the profitability and market trends.

As long as your business is profitable, you may be prepared to invest more in this stock. In addition, depending on how much you learn and how much experience you get, you may add new stocks to your portfolio.

Top three 3D printing stocks to buy in 2022

To make a good profit in 2022, here are the top three 3D printing stocks to buy.

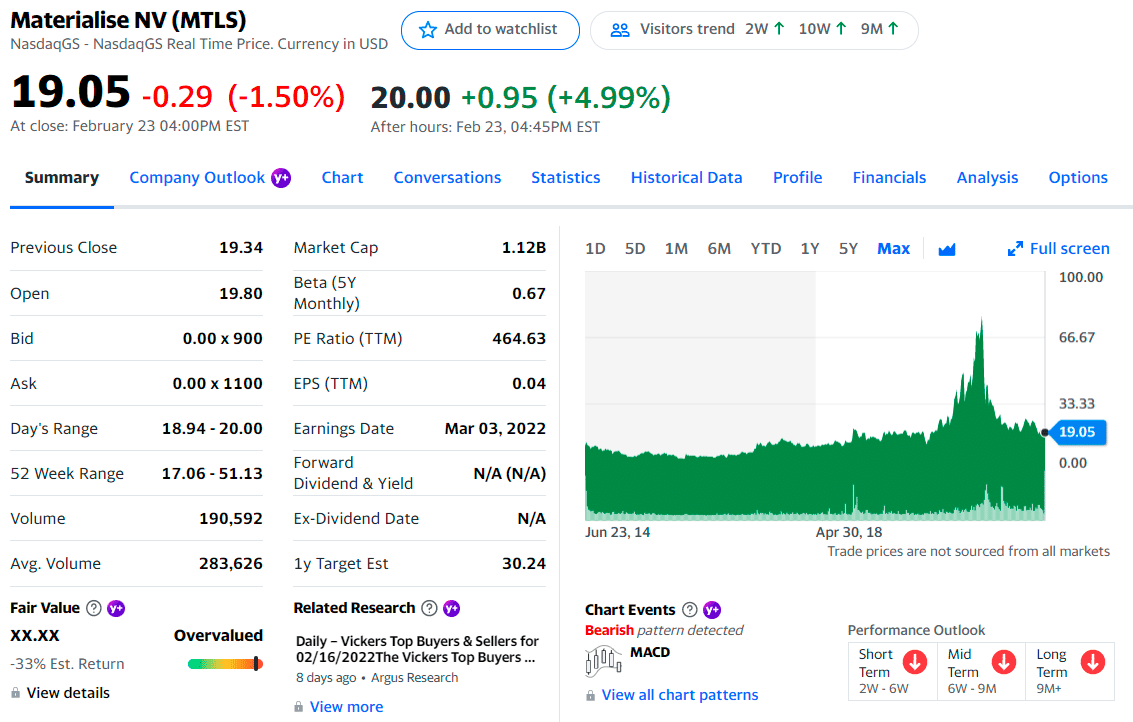

No. 1. Materialise N.V (MTLS)

Price: $19.05

EPS: $0.11

Market cap: $1.166B

MTLS 1-year price change

MTLS is a Belgian-based 3D printing company. In 1990, the firm was founded in Leuven, Belgium, with only one stereolithography machine.

When Materialise initially declared its 2021 targets, they were doubled. Magics and Mimics are two of the most critical software platforms used by the organization. Additionally, the company manufactures customized medical devices and footwear. Additionally, it is a player in the rapidly increasing market for novel eyewear solutions.

MTLS summary

Top three holdings:

- Ark Investment Management — 11.3%

- Invesco Ltd. — 5.4%

- Nikko Asset Management Americas, Inc. — 4.8%

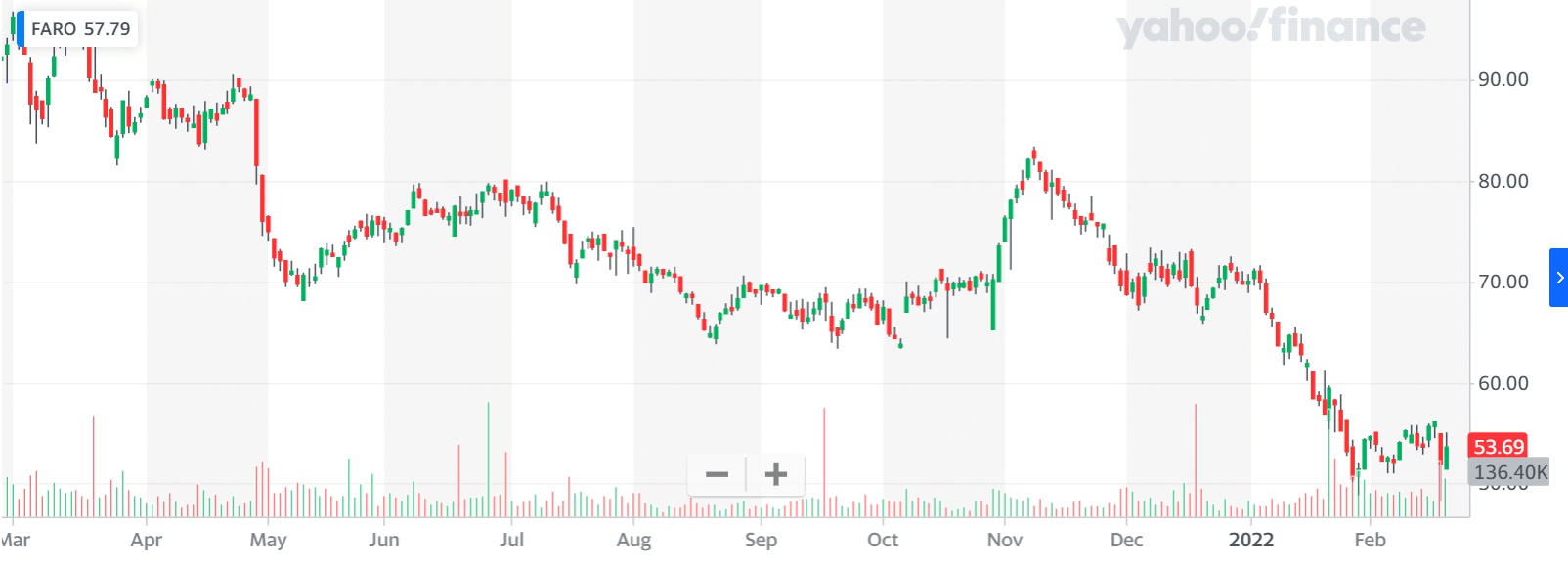

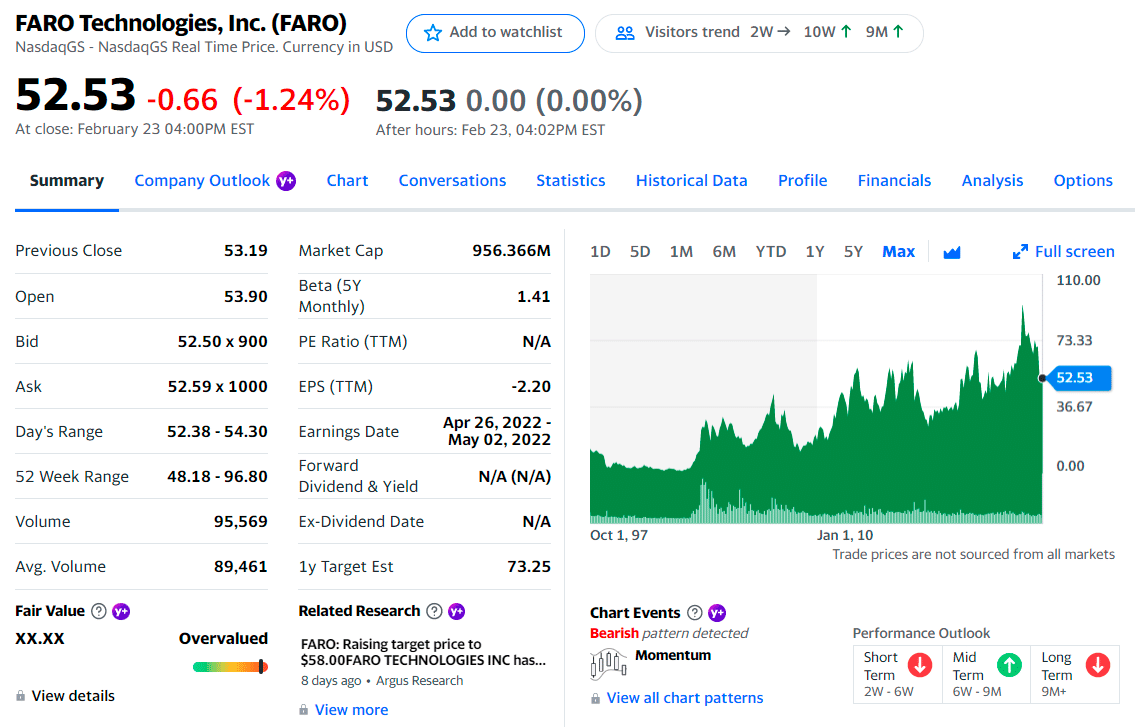

2. FARO Technologies (FARO)

Price: $53.6

EPS: $-2.19

Market сap: $977.4M

FARO 1-year price change

FARO Technologies (FARO) is a global leader in the 3D imaging business as a provider of 3D measurement, imaging, and realization solutions. The firm was founded in 1981 and is headquartered in Miami, Florida.

According to the expert, management’s capacity to “transform” operations is certain. Additionally, the analyst believes that the company’s decision to outsource 3D metrology and scanning product manufacturing will pay off in 2022, which is a positive indicator.

FARO summary

Top three holdings:

- Blackrock Inc. — 17.25%

- Vanguard Group Inc. — 10.9%

- Royce & Associates LP — 5.9%

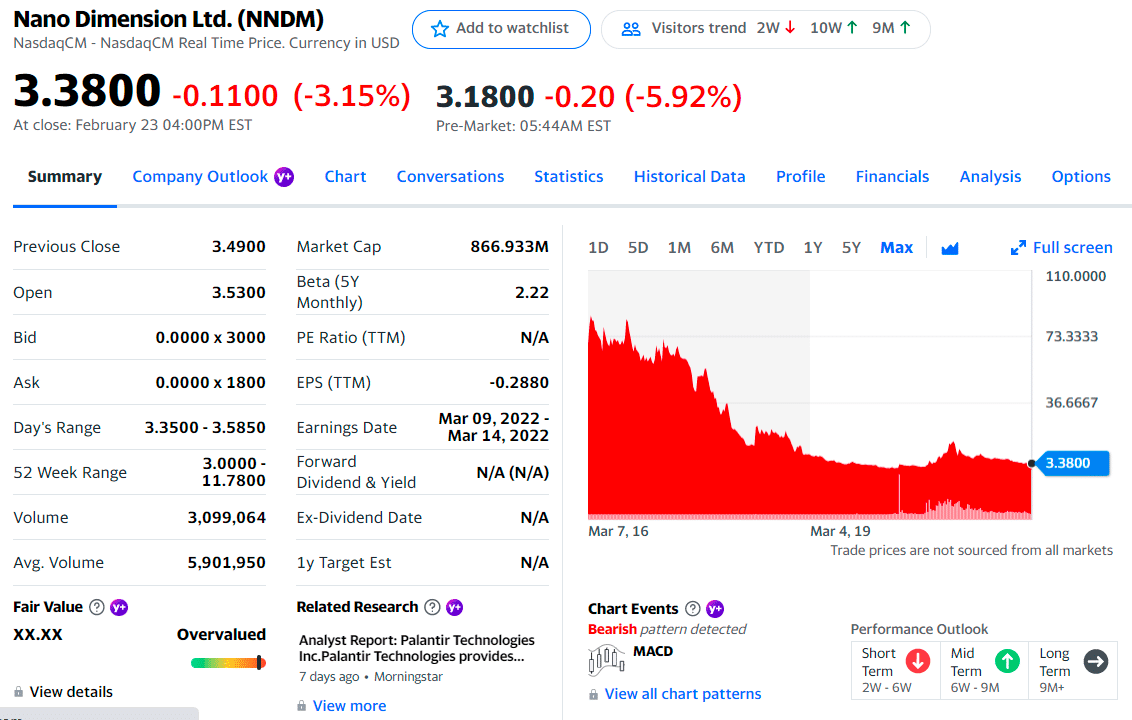

3. Nano Dimension Ltd. (NNDM)

Price: $3.38

EPS: $-0.37

Market cap: $928.4M

NNDM 1-year price change

NND is an Israeli firm that makes additively built electronics in partnership with its subsidiaries based in Israel. The company, established in 2012, currently employs around 90 full-time people.

The corporation has an about $1.4 billion cash reserve. LDM (light-out digital manufacturing) is the company’s main product, which utilizes customized additive printing to produce professional multi-layer circuit boards, radio frequency antennas, and sensors, as well as molded connected components for prototyping.

Despite the stock’s apparent undervaluation, the company recently purchased Essemtec AG and DeepCube. As a result, by 2022, revenues are predicted to have surged by more than 100%.

NNDM summary

NNDM first three holdings:

- Ark Investment Management — 7.9%

- Blackrock Inc. — 2.2%

- State Street Corporation — 1.53%

Final thoughts

In the early 2010s, shares of Additive Manufacturing, which is a computer-controlled method for creating three-dimensional items, soared. Unfortunately, following the boom, many pure-play 3D printing companies failed to meet the high expectations they set for themselves.

The industrial sector is undergoing a revolution as a result of 3D printing. According to some analysts, the industry is likely to double in revenue between 2022 and 2026.

Comments