Coffee is a multi-billion dollar industry, yet most people aren’t aware of it. Coffee, along with orange juice, sugar, and chocolate, is one of the so-called “breakfast commodities” sold globally. It’s also the second most traded commodity globally, just behind petroleum.

Coffee beans are the principal source of revenue for more than 26 million small coffee growers in more than 52 coffee-producing countries. In North America and Europe, coffee drinks at a rate that is a third of the water consumption rate. There are 400 million cups of coffee consumed in the United States each day, making it the world’s most significant coffee consumer by far.

Coffee futures contracts and exchange-traded notes that mimic the performance of futures contracts are two ways to invest in the commodity. Keep reading this article to learn about coffee ETFs and how to invest in them.

What are coffee ETFs?

Investors may engage in coffee futures using exchange-traded funds (ETFs) rather than opening a complex futures account. Investing in these funds is limited to keeping tabs on the price of coffee.

How to buy coffee ETFs?

It is up to you how you wish to buy and sell coffee. Investing in stocks and ETFs may be done online by logging into your trading account. However, getting the most significant value on a futures contract starts with talking to your futures broker. Once you’ve completed the transaction, double-check that your coffee trade has been added to your portfolio.

Top five coffee ETF to buy in 2022

Let’s look at the top-five coffee ETFs to buy in 2022.

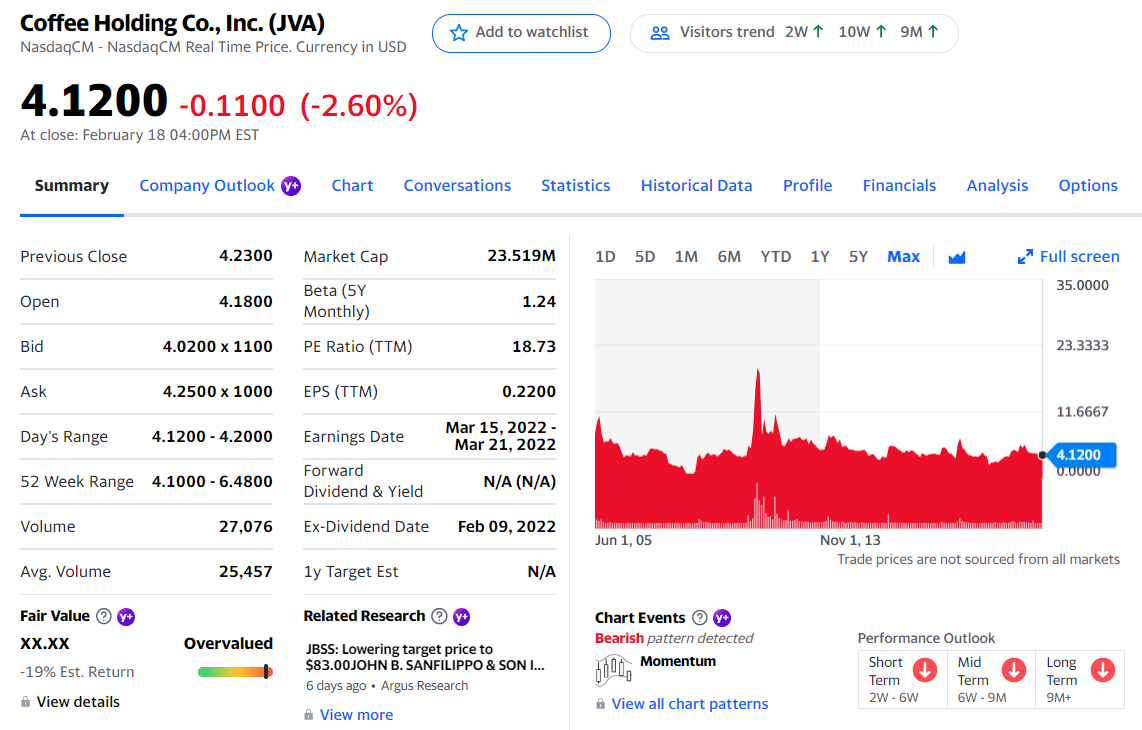

Coffee Holding Co. Inc. (JVA)

JVA summary

Wholesale coffee roaster and distributor Coffee Holding Co., Inc. operates in the United States. For the most part, the firm focuses on making and selling roasted and blended coffees for private-brand clients and its brands and selling green coffee.

The firm also makes and sells coffee roasters. It sells three varieties of coffee:

- Wholesale green coffee

- Private label coffee

- Branded coffee

Wholesale green coffee is imported from throughout the world and sold to big and small roasters and coffee shop operators. Private label coffee refers to roasted, blended, packaged, and sold under the brand and standards of others, such as supermarkets. Branded coffee is coffee that has been roasted and blended following the company’s specifications. The United States, Canada, and a few Asian countries offer their private label and branded coffee products.

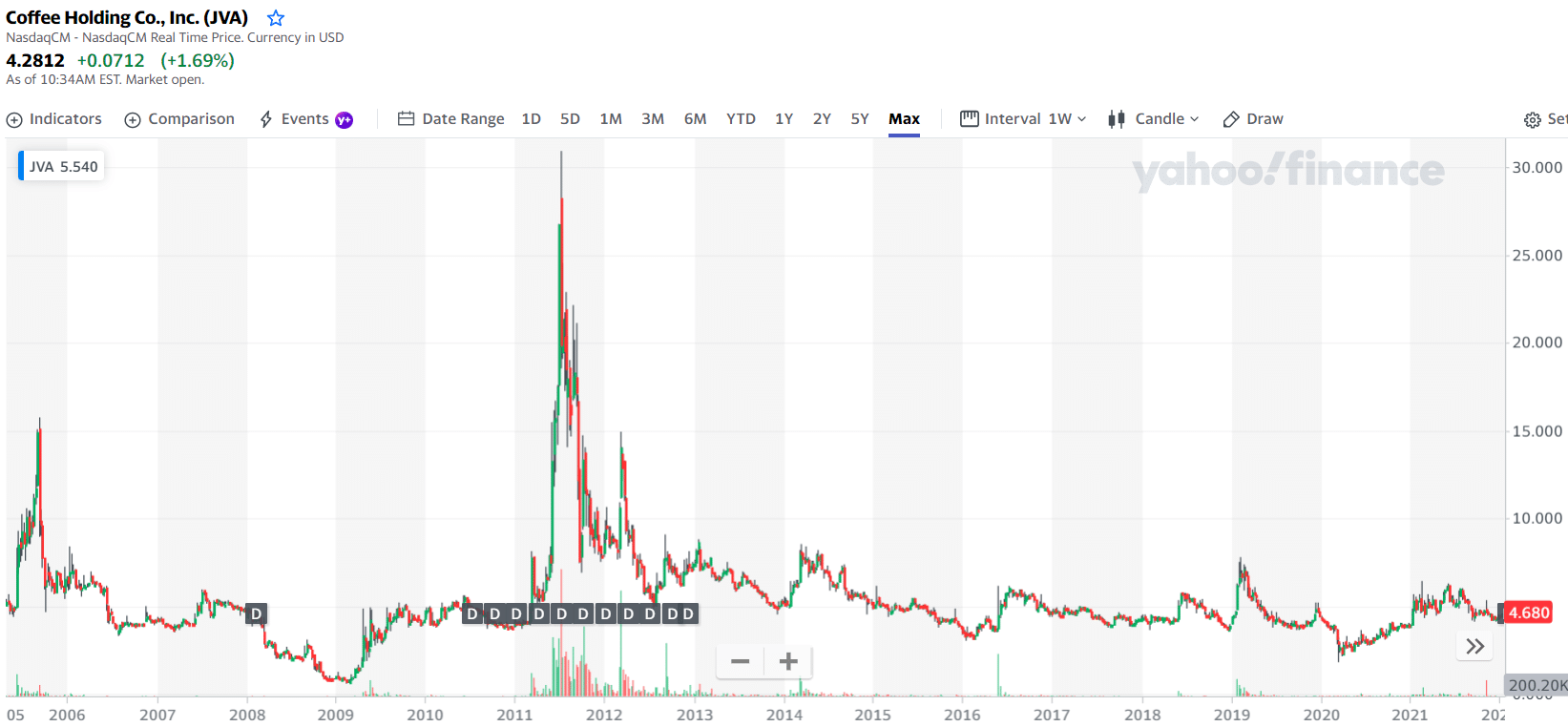

JVA price chart

The first three holdings with their asset percentage are:

- Renaissance Technologies LLC — 6.92%

- The Vanguard Group, Inc. — 5.06%

- Ancora Alternatives LLC — 3.09%

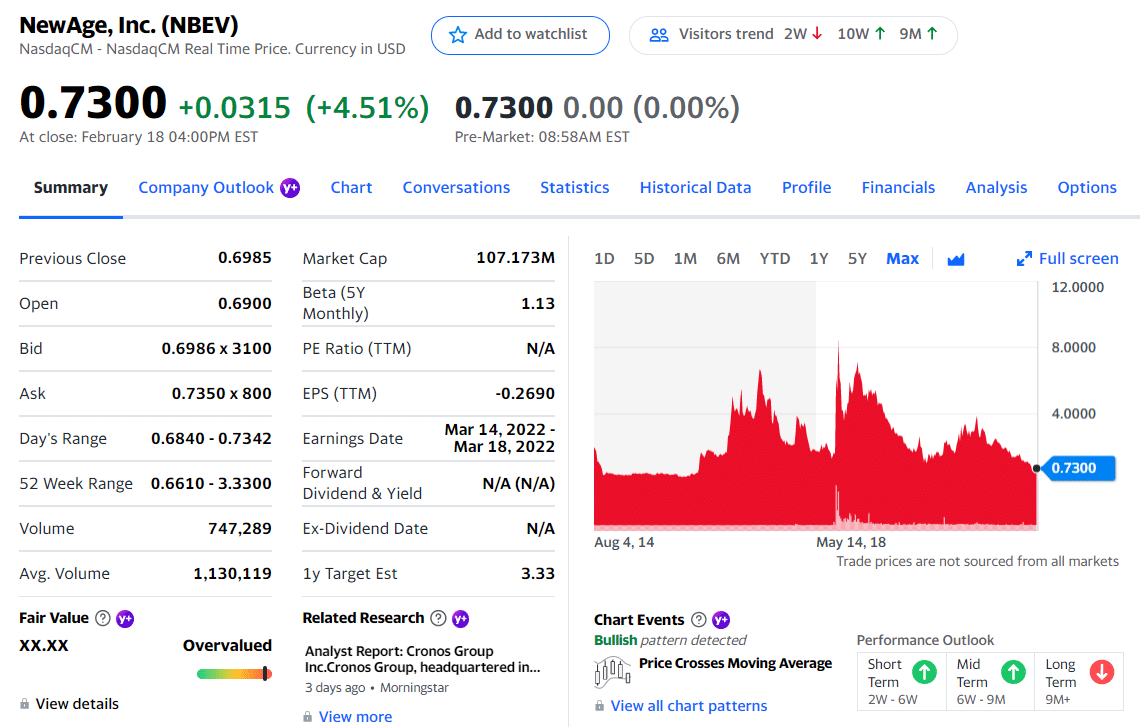

New Age, Inc. (NBEV)

NBEV summary

Nutritional supplements and ready-to-drink drinks are New Age Beverages Corporation (NBEV), a dietary supplement and ready-to-drink beverage firm.

One of the company’s offerings includes RTD teas and coffees and kombuchas, energy drinks, relaxation drinks, coconut waters, functional waters, and rehydration beverages. It also carries Coco-Libre, PediaAde, Tahitian Noni Juice, Bio-Shield, and enhanced. Company products are sold in 50 US states and 60 countries worldwide via direct-store-delivery, brokers and distributors, warehouses, independent product consultants, and e-commerce sites.

The company also sells its products in grocery retail, natural food retail, specialty outlets, hypermarkets, club stores, pharmacies, convenience stores, and gas stations. In addition, Colorado’s Denver is home to the 2010-founded New Age Beverages Corporation.

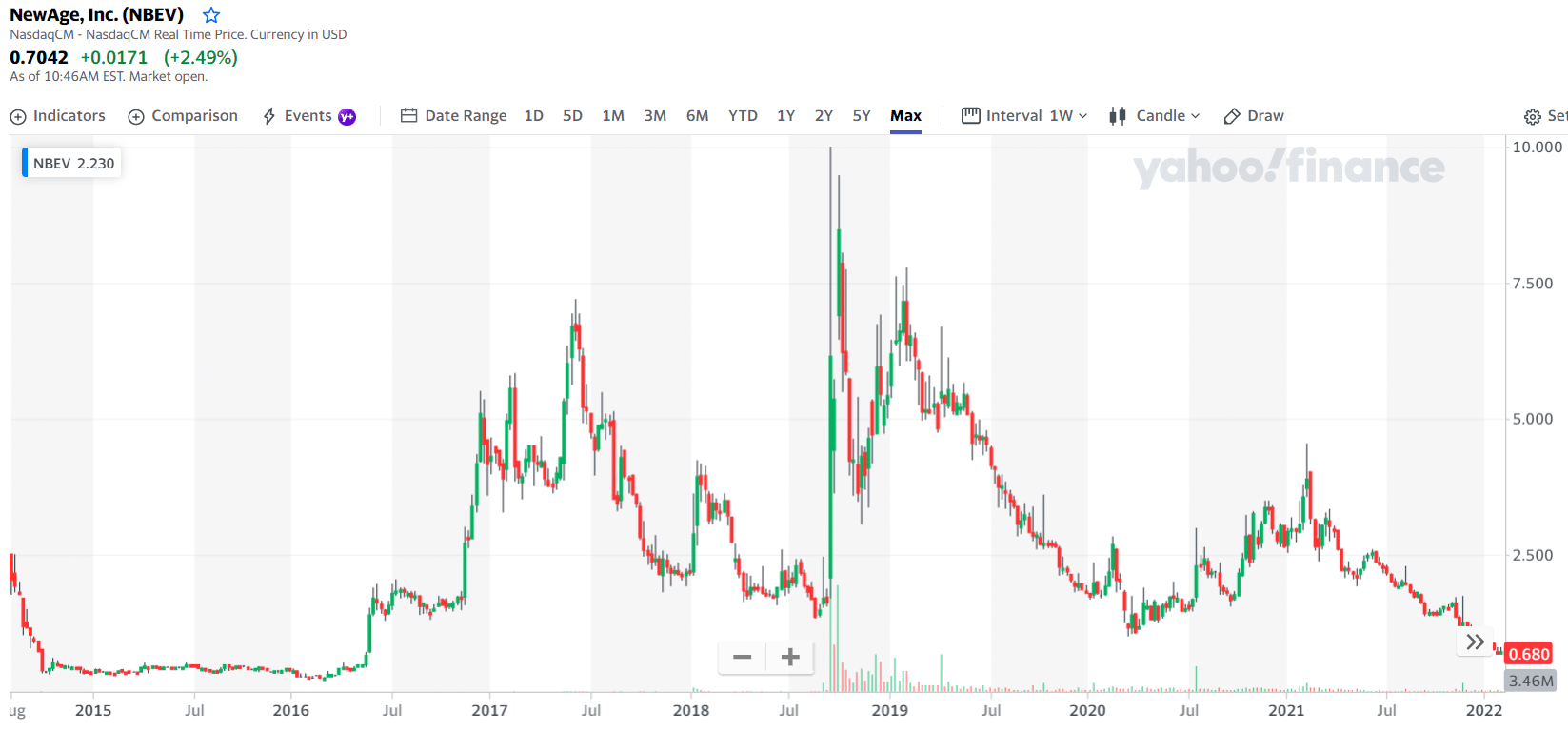

NBEV price chart

The first three holdings with their asset percentage are:

- BlackRock Fund Advisors — 5.44%

- The Vanguard Group, Inc. — 4.34%

- Geode Capital Management LLC — 1.57%

Monster Beverage (MNST)

MNST summary

In addition to developing, marketing, selling, and distributing energy drink liquids and concentrated products like Monster Energy, Monster Beverage Corporation is a holding business. Monster Energy Drinks and Other Strategic Brands Packaged energy beverages from Monster Energy Drinks for bottlers and beverage distributors are sold under the Monster Energy Drinks brand.

Strategic Brands operates a distribution business to provide licensed bottling and canning firms with concentrates and beverage bases. In addition, its American Fruits and Flavor LLC subsidiary provides several independent third-party customers. On April 25, 1990, the company was founded in Corona, California.

Monster Beverage Corporation (MNST), located in Corona, California, is a holding company that develops, markets, distributes energy drinks, natural soft drinks, and concentrates via its consolidated subsidiaries.

The firm represents Monster Energy, Burn, NOS energy drinks, Full Throttle, Relentless, Mother, and many other well-known brands. The company has over 8,000 patents and trademarks throughout its many global markets. In 2016, they added four new beverages to their menu.

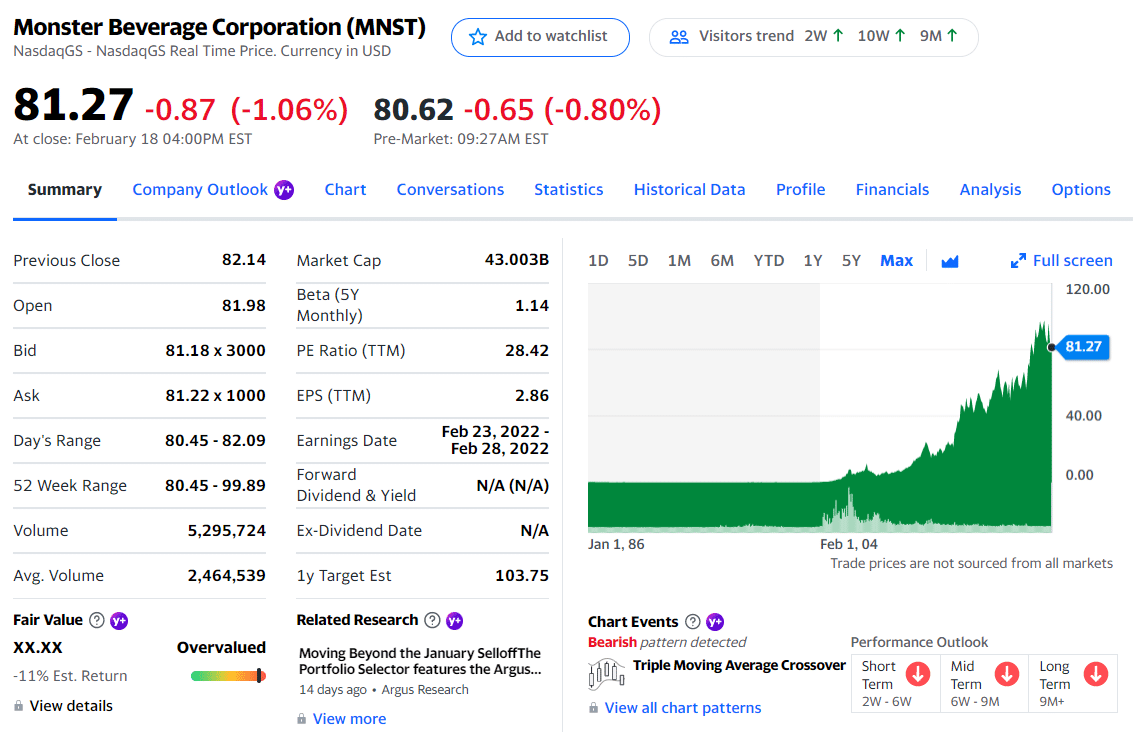

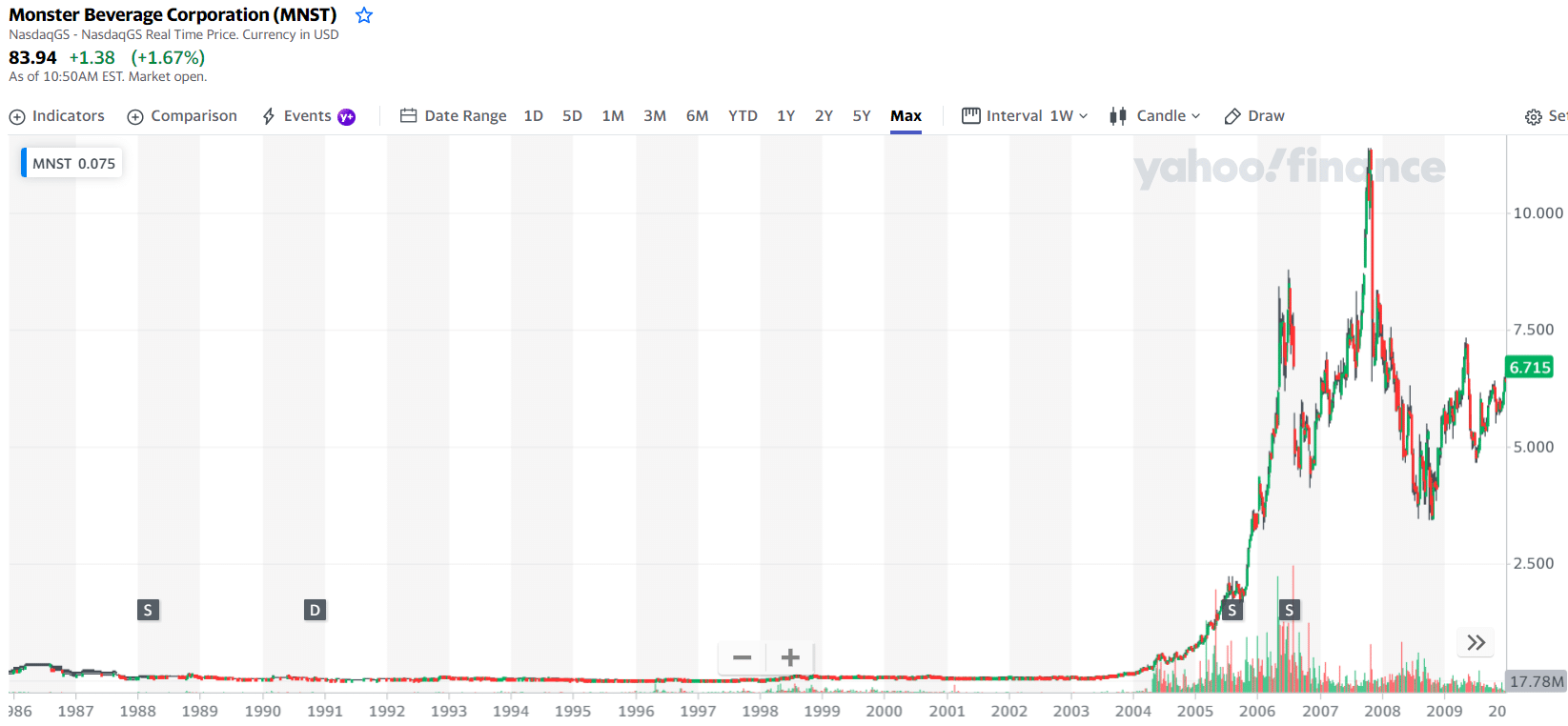

MNST price chart

The first three holdings with their asset percentage are:

- The Vanguard Group, Inc. — 5.58%

- Fidelity Management & Research Co. — 5.13%

- Loomis, Sayles & Co. LP — 3.95%

Starbucks Corporation (SBUX)

SBUX summary

A well-known American specialty coffee roaster and retailer, Starbucks Corporation sells millions of cups of coffee, tea, and other beverages every day via its international network of locations. The company was founded in 1971. It started with a single roastery and storefront in Seattle, Washington, selling just coffee and tea.

Herman Melville’s novel “Moby-Dick” inspired Starbucks, founded by Jerry Baldwin, Zev Siegl, and Gordon Bowker. Starbucks’ current executive chairman, Howard Schultz, began working in 1982. In the same year, Starbucks started supplying coffee to high-end restaurants and espresso bars. The café concept was tested in 1984.

Since June 26, 1992, Starbucks’ common stock has been listed on the NASDAQ under the ticker code “SBU.” Each of the three major stock market indices includes the company.

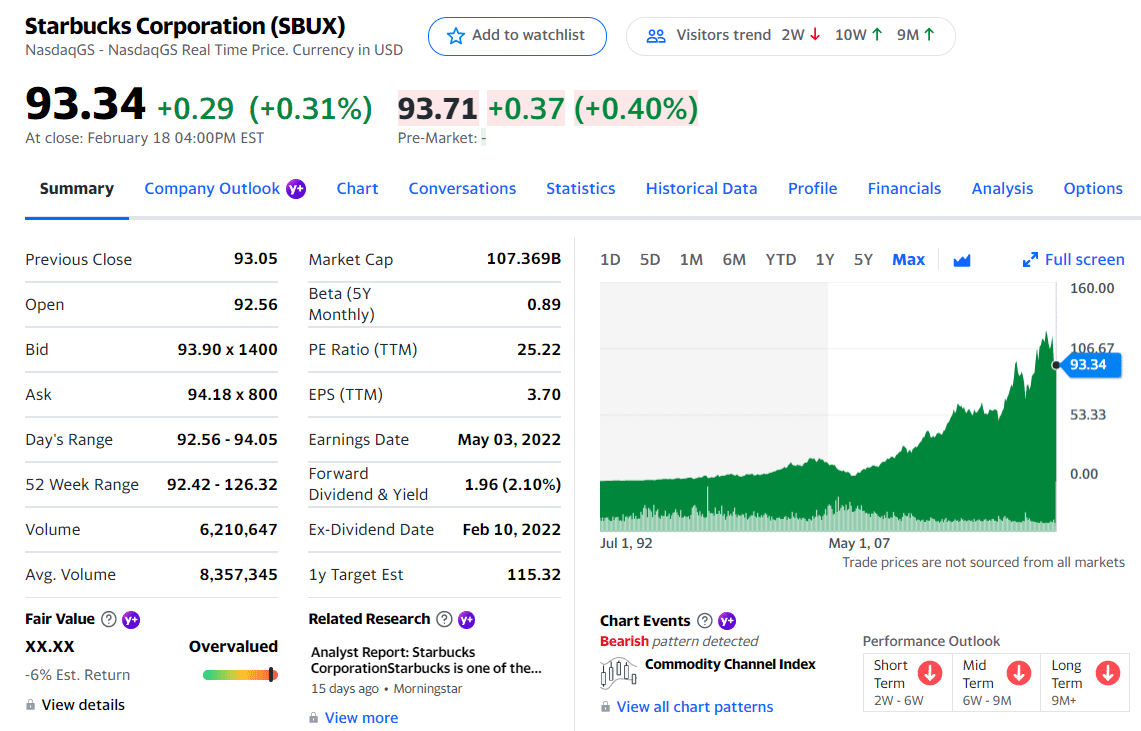

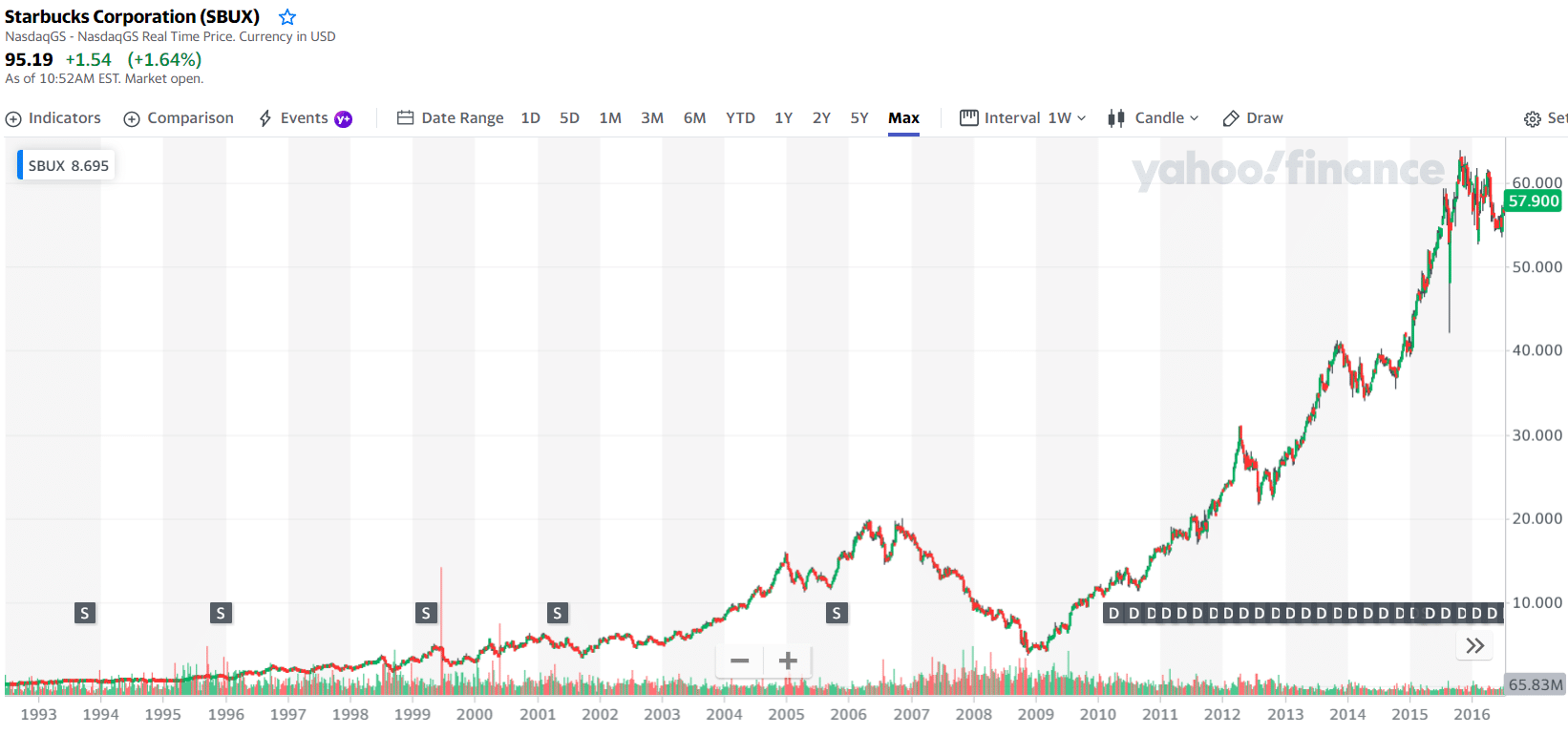

SBUX price chart

The first three holdings with their asset percentage are:

- The Vanguard Group, Inc. — 8.41%

- BlackRock Fund Advisors — 4.40%

- SSgA Funds Management, Inc. — 3.99%

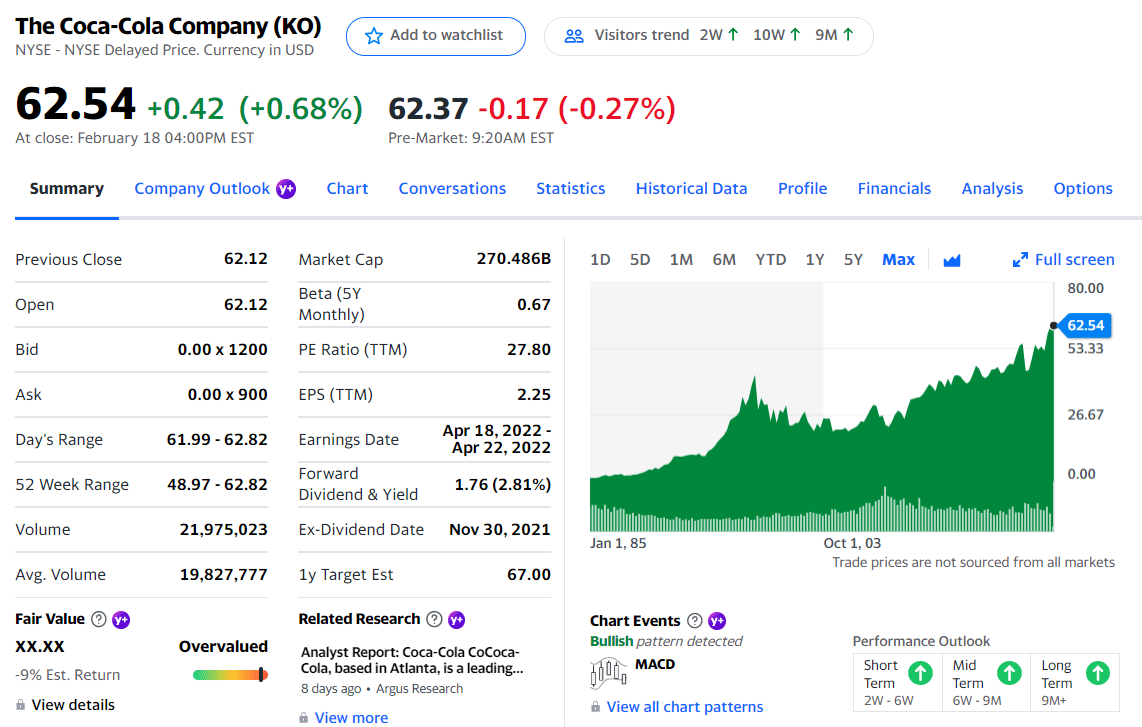

The Coca-Cola Company (KO)

KО summary

Soft drinks and other beverages are manufactured, promoted, and sold by the Coca-Cola Company (KO), a multinational business located in the United States. Coca-Cola, Fanta, Sprite, Schweppes, and Minute Maid are just a few of the world’s best-known beverage brands that you may find at the store.

North America, Europe, Middle East and Africa (EMEA), Latin America, Asia Pacific (APAC), Bottling Investments (BIV), and Global Ventures (GV) are the six operating divisions of The Coca-Cola Company.

They have its headquarters in Atlanta, Georgia Beverage giant Coca-Cola is the world’s largest beverage producer and distributor, with products sold in more than 200 countries. The New York Stock Exchange gives the Coca-Cola Company the ticker code KO. In addition, the S&P 500, Dow Jones Industrial Average, and Russell 1000 contain corporations.

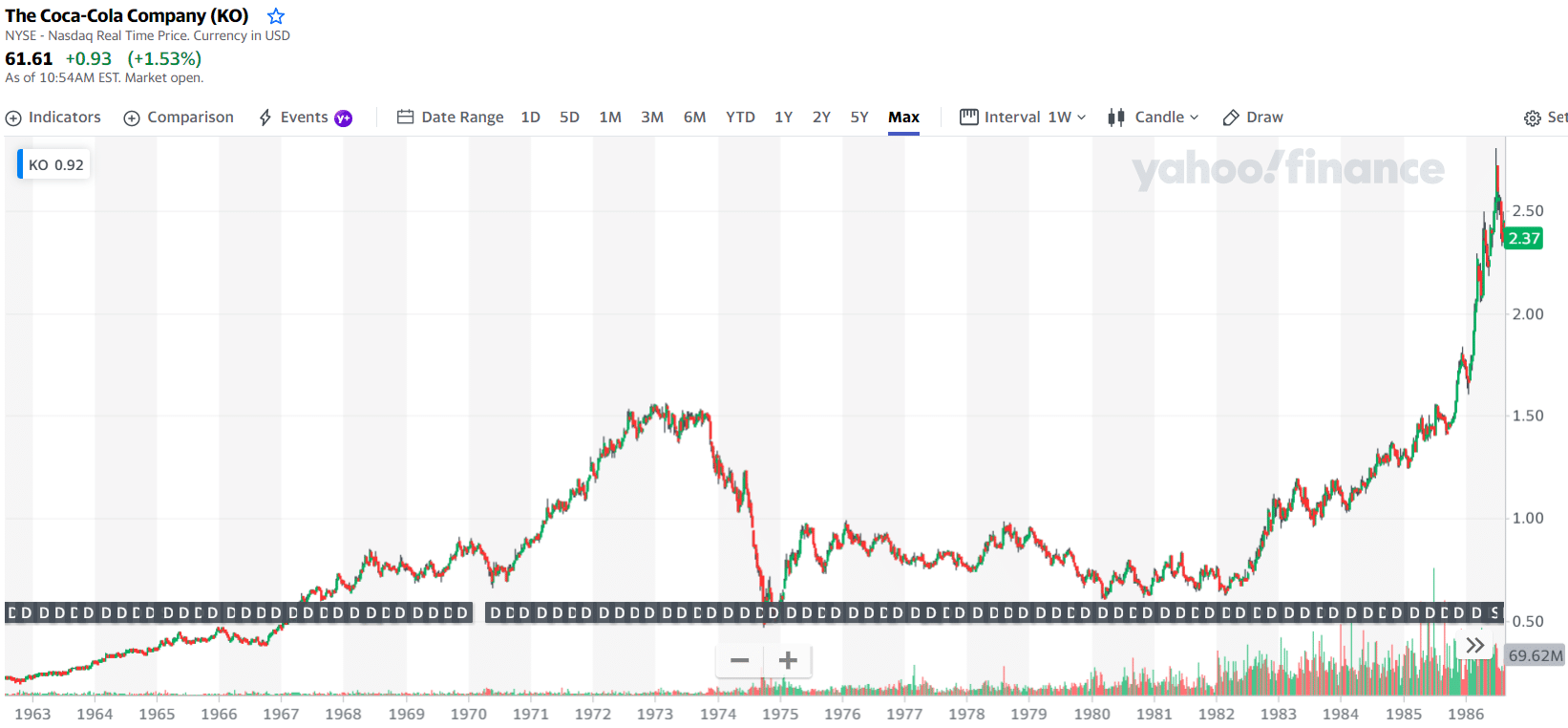

KO price chart

The first three holdings with their asset percentage are:

- Berkshire Hathaway, Inc. — 9.26%

- The Vanguard Group, Inc. — 7.92%

- BlackRock Fund Advisors — 4.13%

Final thoughts

Are coffee ETFs a good investment for you? It makes sense to invest in this kind of company to diversify your portfolio. It is a persuasive argument to invest in EFTs instead of other coffee investments since they are less volatile and entail less risk. Keeping in mind that each investment comes with a degree of risk is essential.

The coffee market has its ups and downs. The entire value and returns on investment may be affected by various circumstances, notwithstanding the current high demand. The capacity to track long-term trends and the flexibility to withdraw your investment monthly if you’re not content with the ETFs’ performance are two advantages of investing in ETFs over other sections of the coffee business.

It’s a straightforward process. There is a greater potential return on investment when trading coffee futures, but there is also a more significant potential loss on investment owing to market volatility. This is why we recommend coffee ETFs above other coffee investment vehicles.

Comments