At present, food stocks are a big subject. However, there are also some significant newcomers in the industry. Mergers and acquisitions are common when companies expand their product lines or breakthrough a peak.

Despite their tendency to follow the latest food trends, they predictably. As the population grows, so does the demand for food. At the same time, technological advancements are improving the intelligence and efficiency of food production.

However, not all food stocks are appropriate for a portfolio. The firm nevertheless needs a good product mix and effective operations to acquire momentum, despite the industry’s poor profits.

The best food stocks will be thoroughly examined in this article, and we’ll explain why we believe they’re a good investment. It’s a great time to be a food entrepreneur since the industry is growing at an astronomical rate. However, even though there are potential supply issues ahead, there are many reasons to be optimistic about the industry’s future.

What are food stocks?

Participants in the food sector include those who sell food and non-alcoholic beverages. This category includes food and beverage wholesalers, grocery shops, and other businesses that sell food and drinks directly to customers.

Restaurants are not included in this category since individuals tend to eat at home more often when the economy is poor. In terms of returns, the food sector, as represented by the S&P Food and Beverage Select Industry Index, has trailed the entire market has returned 12.7 percent compared to 24.3 percent for the Russell 1000 Index as of December 6, 2021.

How to buy food stocks?

eToro is our suggested broker if you’d want to buy food stocks right now. Just follow these easy actions:

- You’ll need to verify your eToro account after you’ve signed up.

- You’ll need to add money to your account before you can begin searching for and trading in your preferred Food stock.

- Press the “Open Trade” button after inputting your position size and double-checking that everything is correct; press the “Open Trade” button.

Top three food stocks to buy in 2022

Let’s look at the top three food stocks to buy in 2022.

No. 1. General Mills (GIS)

Price: $67.99

Eps: 3.63

Market cap: $48.109B

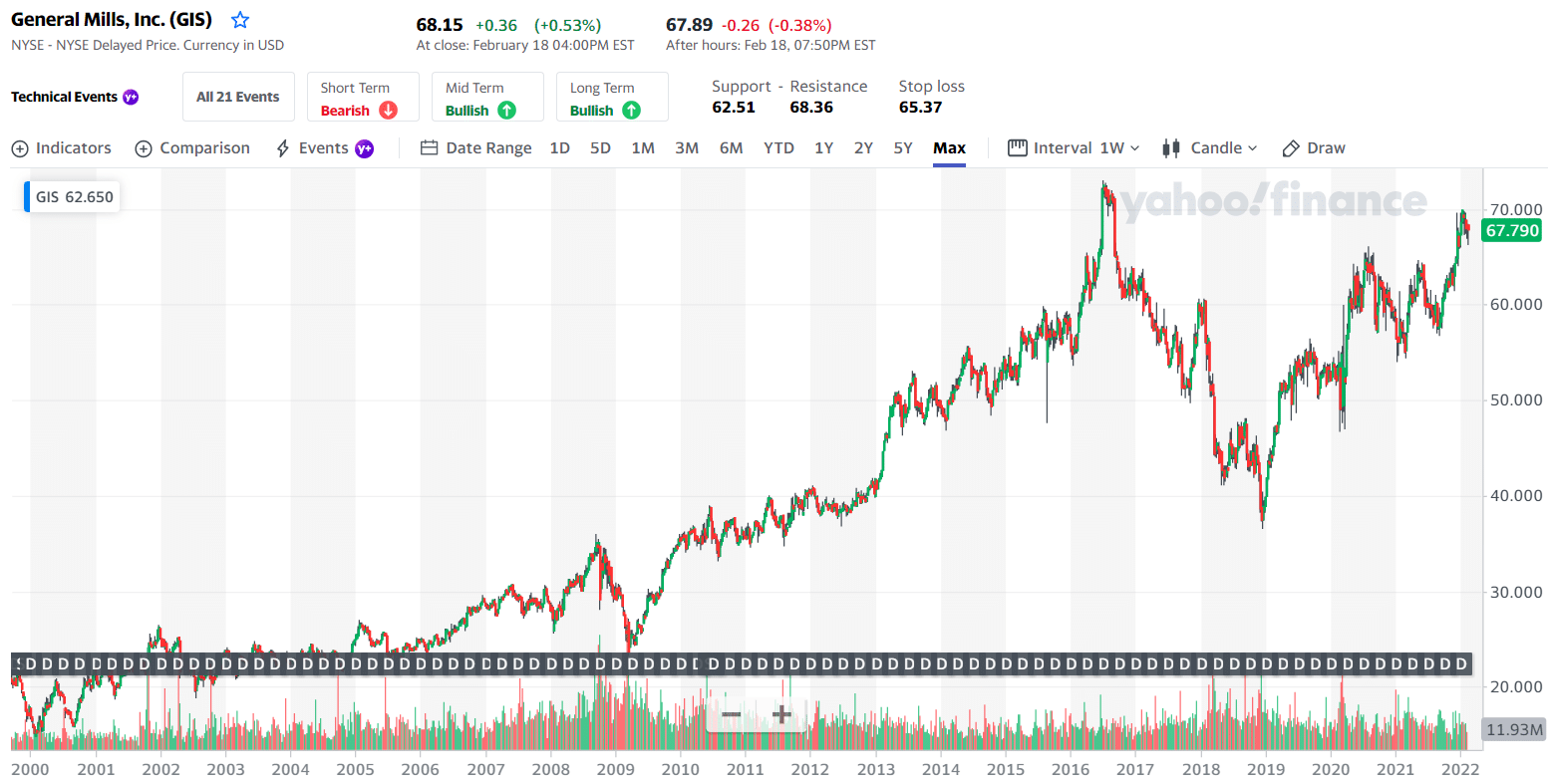

GIS price chart

Several well-known brands are owned by General Mills (GIS), the packaged food industry’s giant. One of the company’s numerous brands is Pillsbury, including Cheerios and Haagen-Dazs.

General Mills benefited from the Covid-19 outbreak in that consumers increased their food consumption at home due to restrictions on going out. As a result, organic goods, dinners, and baking have been driving sales in the company’s primary North American retail business by double digits in recent quarters.

The company’s pet segment is also doing well. General Mills paid $8 billion for Blue Buffalo Pet Products in 2018, and although the price was high, a pandemic-related increase in pet ownership might help the company in the long run.

As soon as the pandemic is over, demand for packaged food is expected to normalize, but General Mills seems to be a solid long-term food firm. The company has a P/E ratio of around 15 and a dividend yield of about 3%.

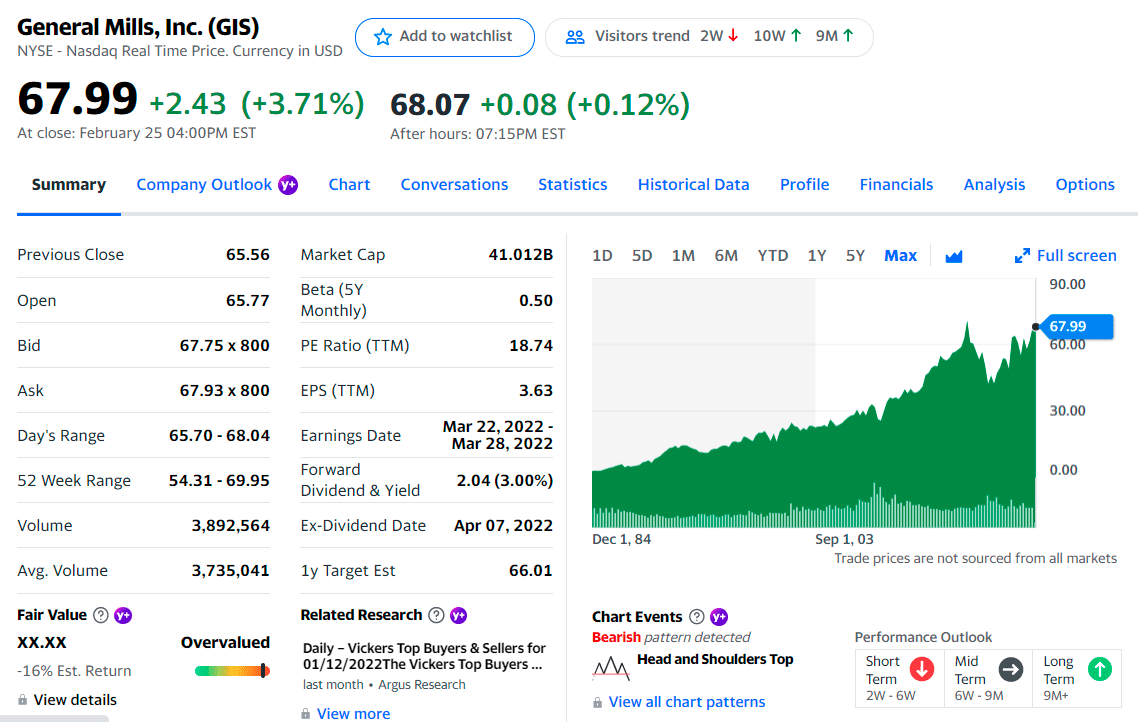

GIS summary

The top three holdings of GIS are as follows:

- Vanguard Group, Inc. — 8.41%

- Blackrock Inc. — 7.52%

- State Street Corporation — 5.71%

No. 2. Tyson Foods (TSN)

Price: $93.37

EPS: 10.13

Market cap: $33.445B

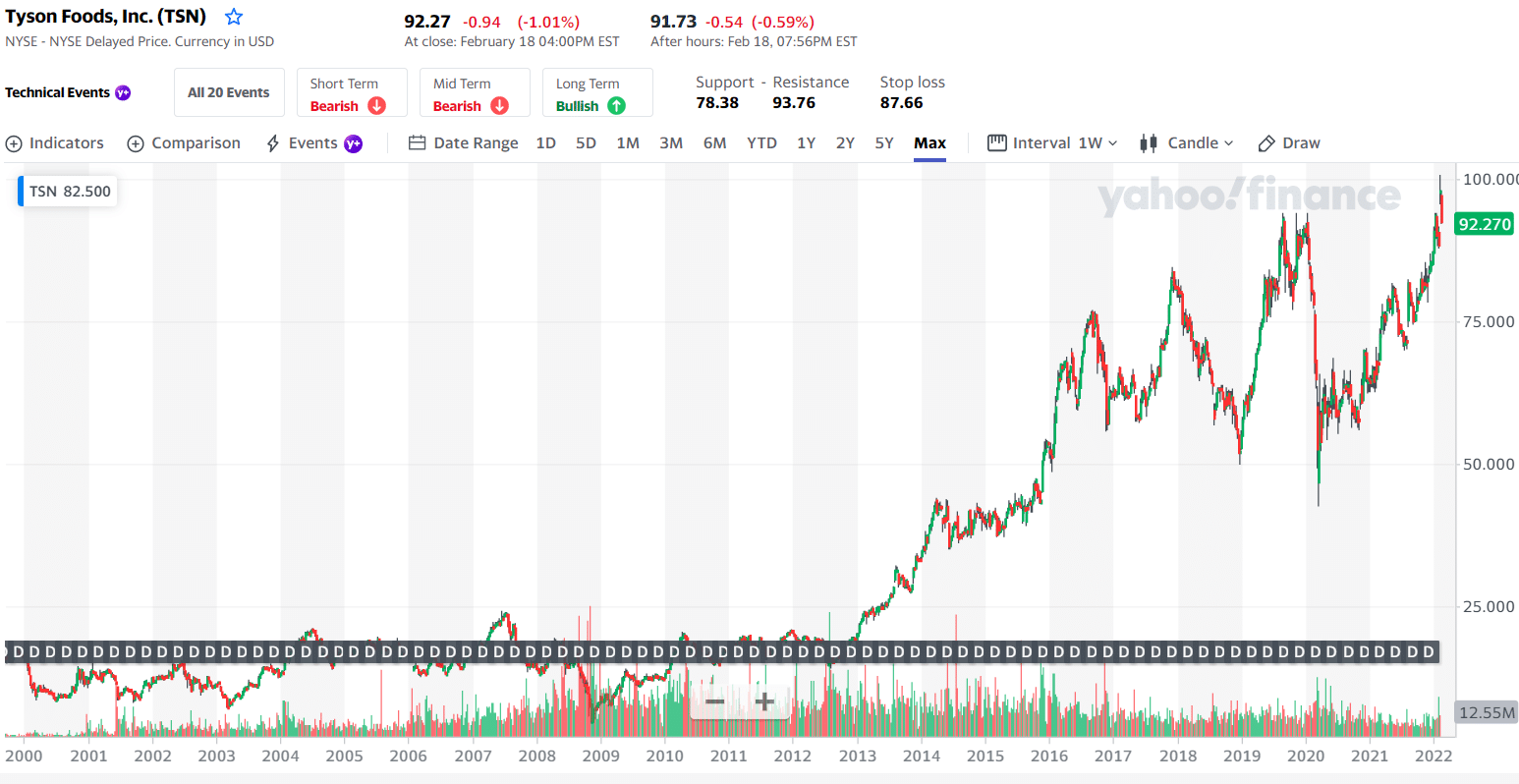

TSN price chart

American diets will continue to rely significantly on processed meat products. Even if you’re not interested in investing directly in the meat sector, Tyson Foods (TSN) is an excellent pick.

Tyson does not have the pricing power of a packaged food company with well-known brands since meat is primarily a commodity. In the United States, the meat processing industry is dominated by a small number of major corporations, such as Tyson Foods. As a result, profits are partly influenced by the supply and demand for beef, pig, and poultry.

The meat industry was in chaos early in the pandemic due to the breakout of Covid-19, which forced some processing plants to shut down. Despite the crisis being over, Tyson’s stock continues to be undervalued. Although the meat processor’s shares fell by almost 30 percent in 2020, its long-term prospects are bright since meat demand usually is consistent, if not growing.

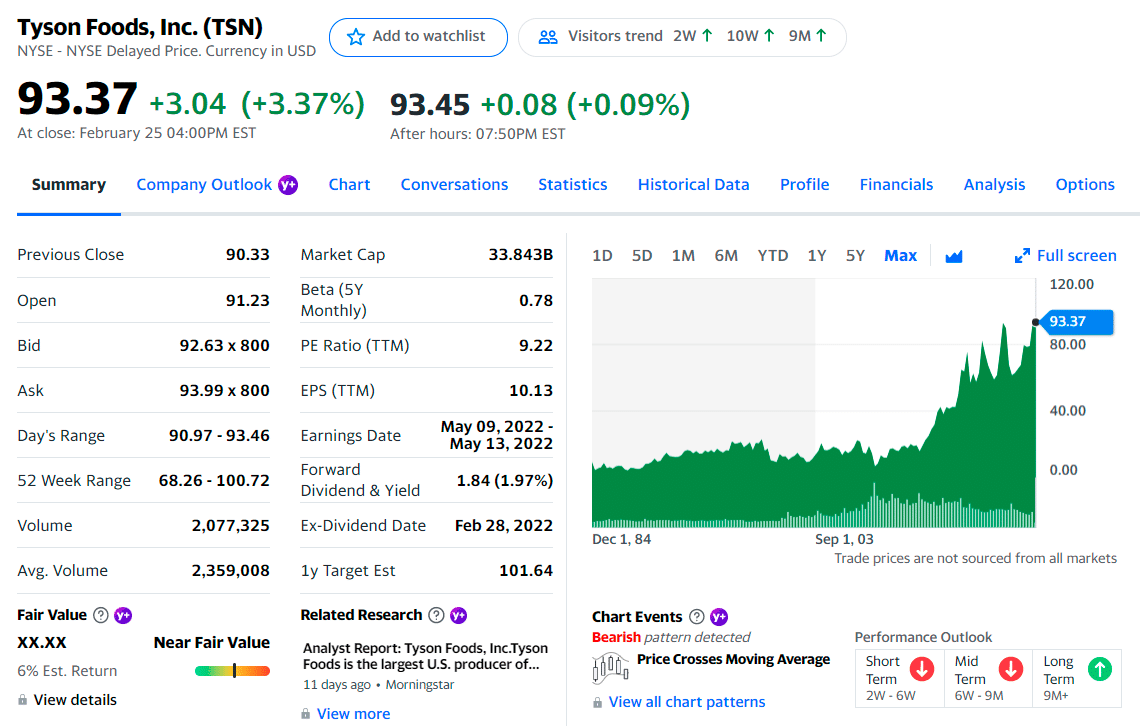

TSN summary

The top three holdings of TSN are as follows:

- Vanguard Group, Inc. — 11.95%

- Blackrock Inc. — 7.13%

- State Street Corporation — 4.89%

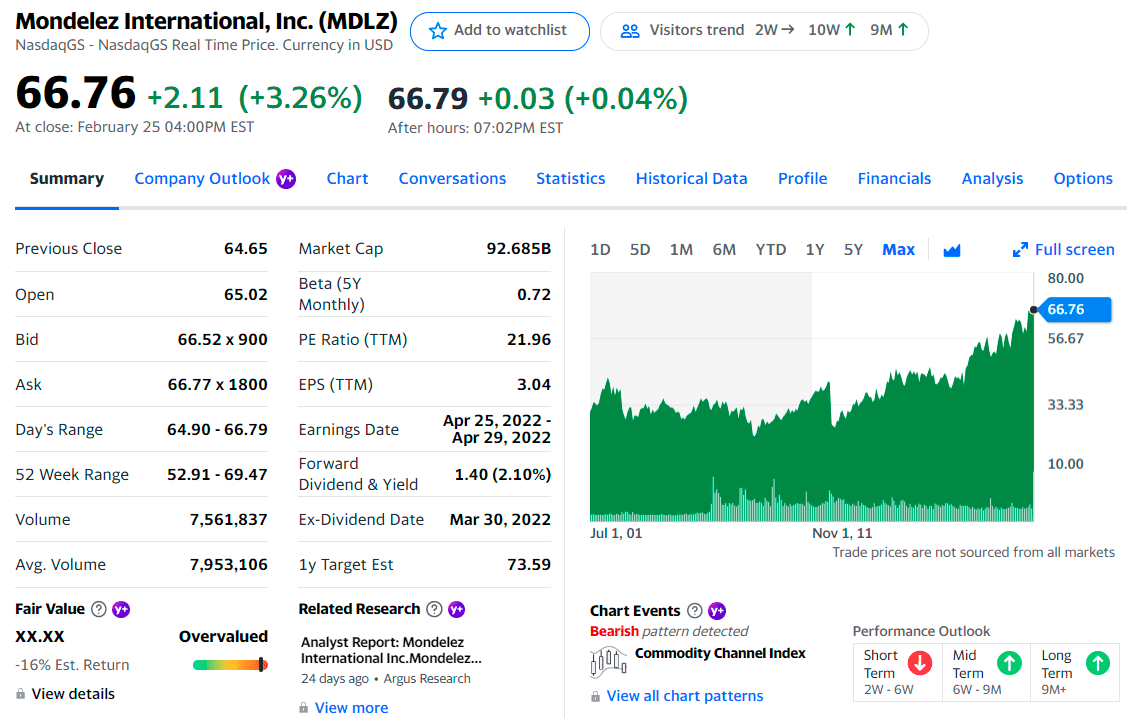

No. 3. Mondelez International (MDLZ)

Price: $66.76

EPS: 3.04

Market cap: 91.63B

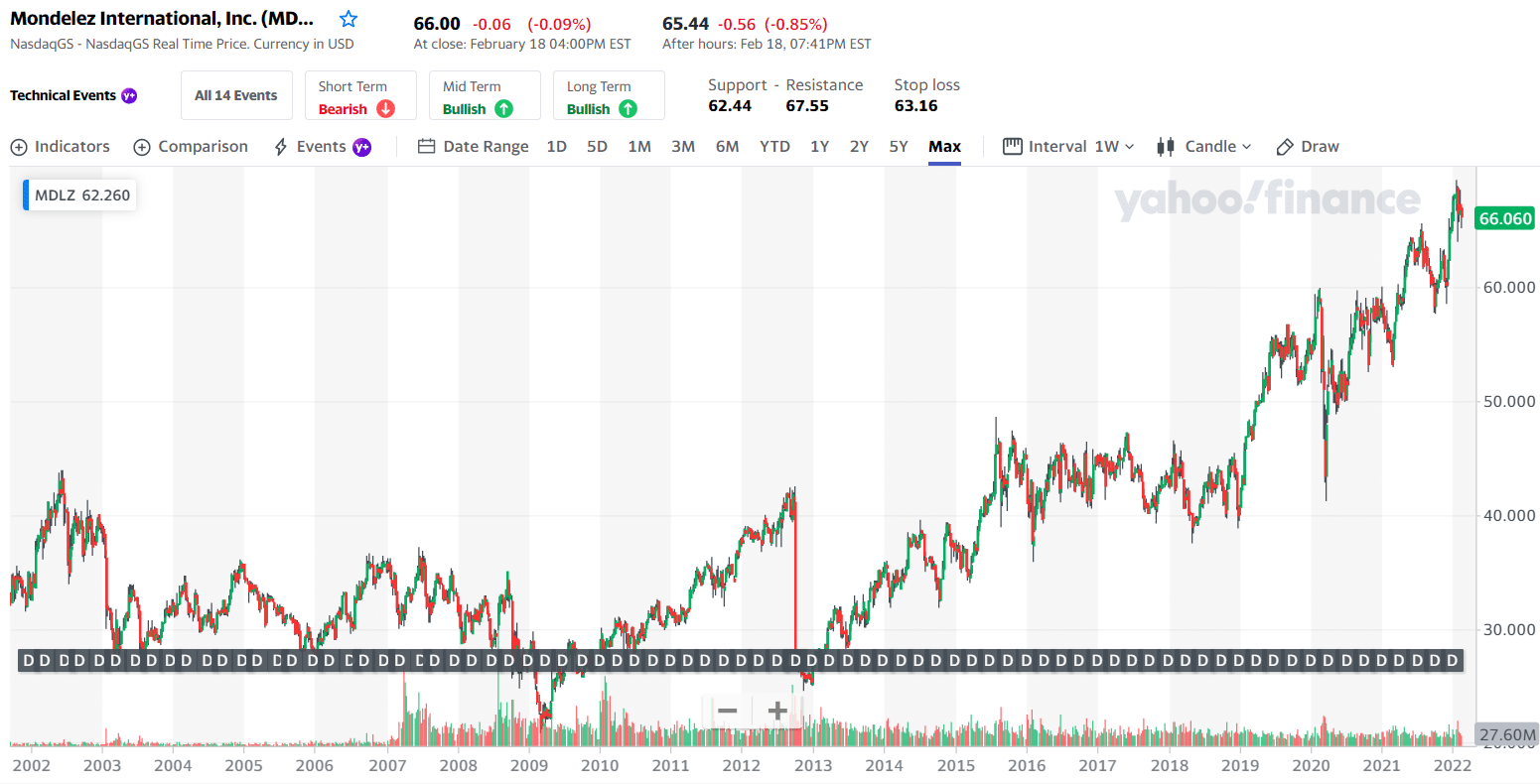

MDLZ price chart

Like General Mills, Mondelez International (MDLZ) boasts many well-known brands. However, there is a bevy of new ones in addition to the previously mentioned brands. In addition to snack brands, the corporation sells its products in more than 150 countries.

In North America, Mondelez expects to see a 15% increase in sales in 2020. However, the value of sales in Latin America decreased due to unfavorable currency fluctuations in Europe. As a result, currency changes will reduce the company’s Latin American sales by $500 million by 2020.

Some at-home food consumption may shift to restaurants as the pandemic comes to an end, but Mondelez’s assortment of popular snacking products remains a vital competitive advantage. So even if they can’t afford to eat out, they will keep buying Oreos.

MDLZ summary

The top three holdings of MDLZ are as follows:

- Vanguard Group, Inc. — 8.14%

- Blackrock Inc. — 6.27%

- State Street Corporation — 4.59%

Final thoughts

Investing in food stocks involves research. Before purchasing shares in a company, conduct some research to learn more about what it does and who it serves. Whether you don’t look at how a company functions, you won’t know if a food stock will be popular in the long run.

If you’ve done your study, the food industry is ripe for investment. Carbohydrate, protein and vegetable trends are creating new markets and opportunities. Spaghetti is a good example. Nowadays, there are gluten-free pasta and cauliflower/veggie pasta options that may be used in place of carbs. But, this is only the beginning when it comes to what’s to come.

Comments