Success in financial trading depends on how an investor is budgeting his money. Any attempt to invest more than his capacity signifies that the person may face a terrible event. Therefore, if you care about your funds, the following top five tips may help you grow.

The stock market is one of the stable financial marketplaces where activities happen from a centralized exchange. Therefore there is a possibility of making money by following enormous data regarding the company and the macroeconomy.

However, investors often struggle to cope up with their situation, which counts from unfavorable market conditions. There is no way to eliminate the adverse market conditions from the financial market, and the only way to sustain here is to budget your investment.

We will see the top five budgeting tips for stock traders that may change your style. After completing the whole section, you will know how to invest money wisely with smart budgeting techniques.

Why should you budget your investment for stock trading?

There is no way to predict the price movement of a trading instrument with 100% accuracy in financial trading. Therefore, no one in the world can say which stock will grow in the coming days.

Here, analysts and traders anticipate the price movement based on multiple data and financial backgrounds. If everything works perfectly, the price will follow the anticipation, otherwise not. Therefore, there is always a risk that the price may not follow your desired direction. In that case, you will lose, which is a common feature of a financial market.

What should a trader do?

The business risk is the risk of making a loss associated with the industry, and one controls it. For example, if we talk about agriculture, one of the significant risks is natural disasters. Investors in this sector should accept any loss from the natural disaster in the agriculture sector, and there is no way to ignore it.

In this way, even if you follow a risk management system, you can lose money from stock trading, but you can reduce the risk as low as possible by budgeting your money.

Top five budgeting tips

In the above section, we have seen why budgeting is essential in financial trading. Now move to the key points.

1. Invest wisely

There is no alternative to a wise investment in any sector. If you are a businessman or a service holder, you should not spend all of your savings in the financial market. But, how much you should invest is the key question.

Make a plan of your earning. Keep a portion for secured investment every year to lead a happy life after retirement. Later on, identify stocks that have a lower value and higher potentiality. These highly potential investment opportunities appear after any economic collapse or disaster. Keep your money ready to pick that opportunity.

After securing the future, you can start trading on an intraday or swing basis. However, remember that investing with a HODLing mentality is the primary decision to invest money rather than trading.

2. What to do with profits?

If you are making money from financial trading, you should follow some rules. First, there is no way to believe that you will continuously make money from the stock market or the stock market will remain stable all the time.

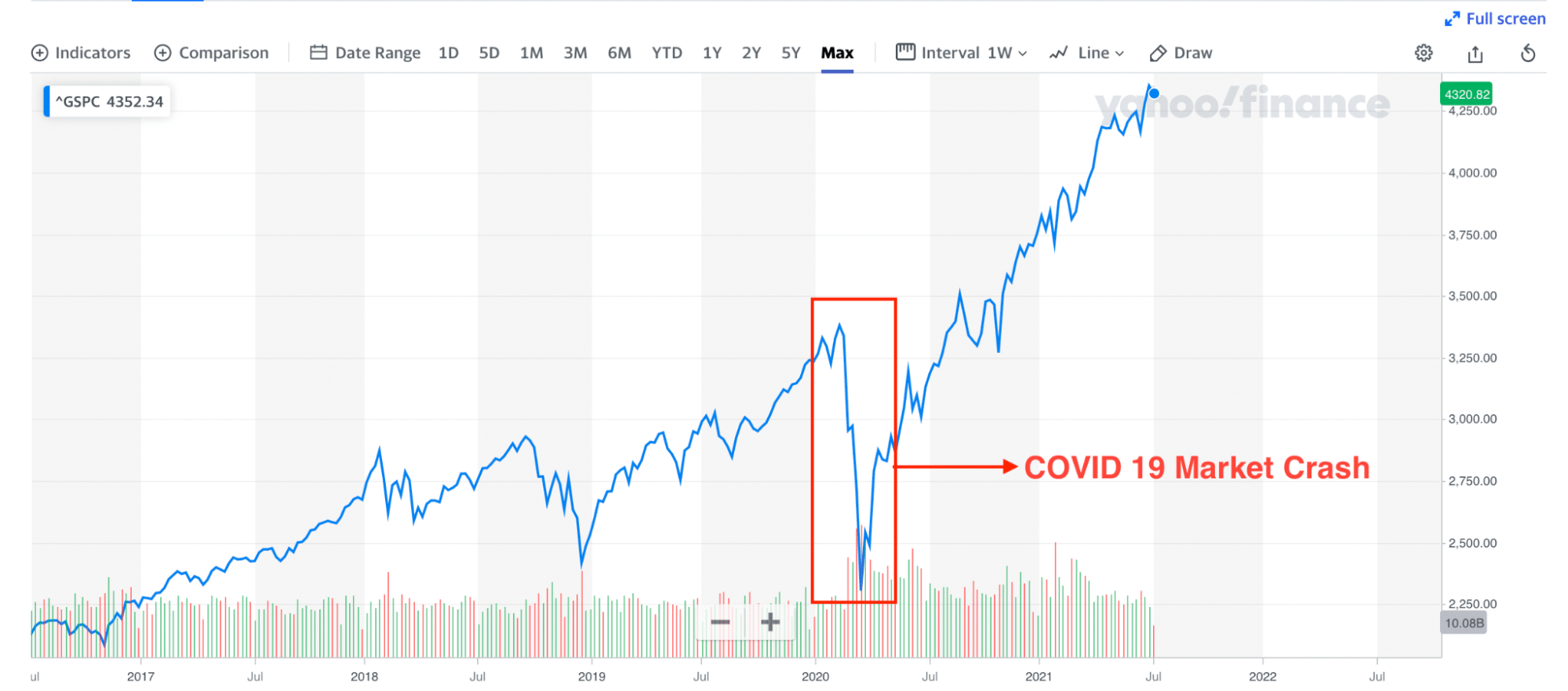

S&P 500 (GSPC) chart

During the Covid-19 pandemic, most major US stock markets collapsed where the S&P 500, NASDAQ 100, and Dow Jones 30 lost almost 50% of their value.

So what should you do in this situation?

You have to make a proper budget for your profit by keeping them safe in a bank account that can cover your daily cost for at least six months. And for the rest part, you can reinvest or spend.

3. What to do after making losses?

Coming to the core point — even if you followed everything mentioned above, there is a possibility of making losses. The stock market is unpredictable, and no one knows what will happen next. Therefore, causing an upset and losing everything from investment is not impossible.

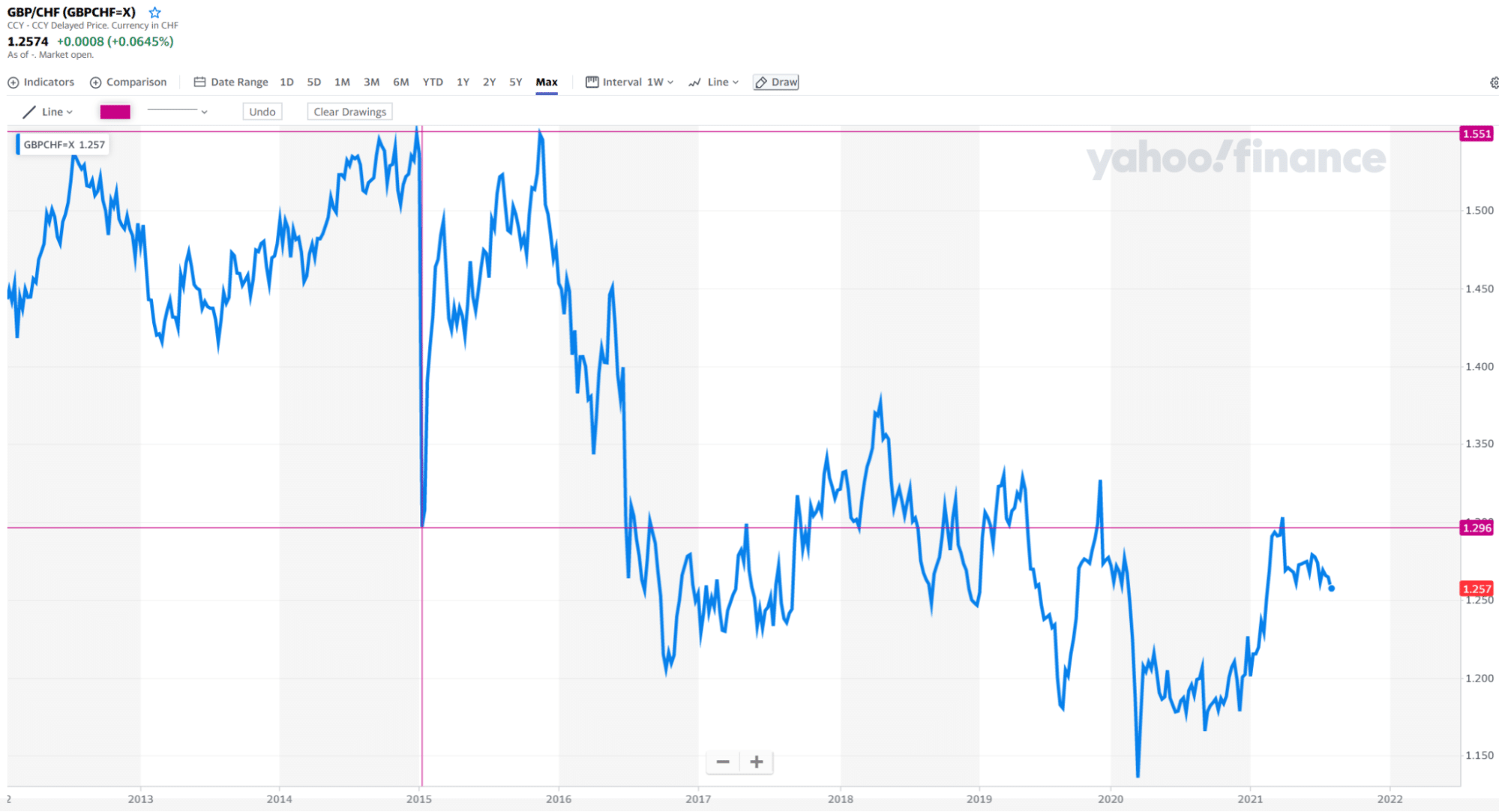

Remember the Swiss market crash in 2015?

Many retail traders and several top-tier brokers got bankrupt. The market moved almost 2000 pips in one minute for all CHF pairs. Therefore, making a proper plan before making a loss will help you to reduce stress. Always keep a backup plan for any uncertain situation.

British Pound / Swiss Franc

4. When to reinvest the money?

Reinvestment is the most reliable way to boost your profit. If you have the quality of making a consistent gain from stock market trading, this option can make you rich quickly.

However, there are some essential requirements that you should follow before starting to reinvest. First, create a trading portfolio for at least six months to determine how much profit you make per month. Here, making a consistent profit is the primary requirement rather than making an excessive gain in a month.

5. Portfolio diversification

Portfolio diversification is the ultimate way to get the maximum benefit from financial trading. For example, if you are a stock trader, you can diversify the portfolio by investing in different sectors.

Moreover, you can expand the investment in stocks, forex, cryptocurrencies, and real estate together to get the ultimate output. In that case, if any sector fails, you have other sectors from where you can generate profits.

Final thoughts

Not only in the stock market, but budgeting is also essential in every sector in our life. The object of financial trading is making money from the investment. In that case, finding a profitable industry with solid money management is required.

Last of all, some risks are not in investors’ hands. Therefore, you can reduce the ultimate risk as low by applying a proper budgeting system to your trading portfolio.

Comments