If trading stocks is about selling high and buying low, looking for oversold stocks may be one of the best strategies out there.

Successful traders often use this strategy to pick up good deals just before the price rises. For this, they use some of the most reliable indicators and analyses to minimize their risk. Of course, the catch is to buy a stock when the market starts giving you signs.

The price is likely to go up. Although the strategy is risky, it is also very profitable, and when done correctly, can earn you a lot of money. Below will explain everything you need to know about oversold stocks, so keep reading to add this technique to your set of strategies.

Most oversold stocks today

Next, we’ll look at some of the most oversold stocks you can invest in right now in 2021/2022.

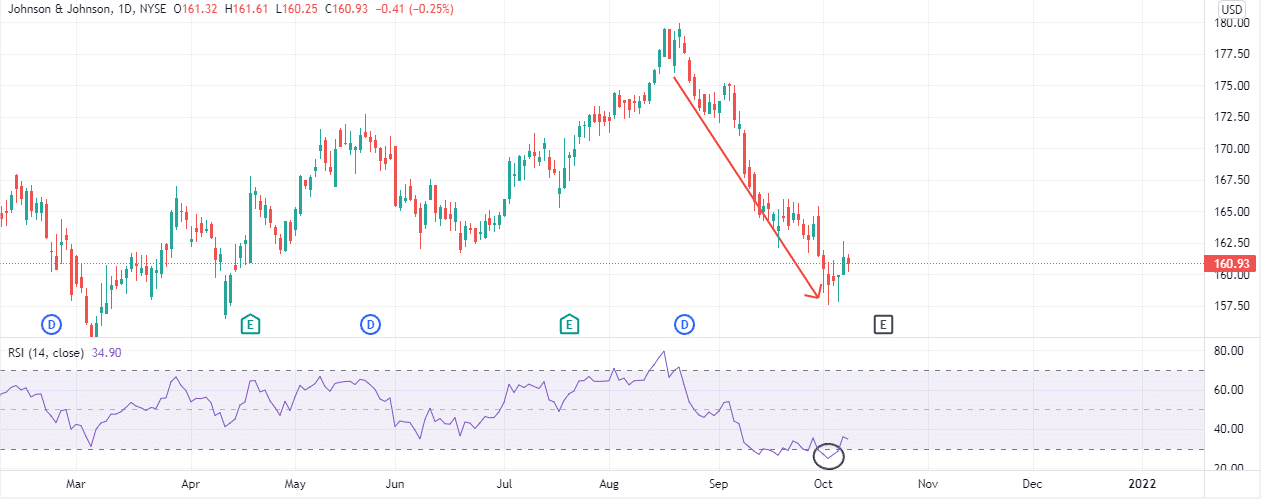

Johnson & Johnson

It is one of the pharmaceutical companies that develop a vaccine for Covid-19. However, on September 21, the company issued a press release and said that a booster dose of their vaccine would raise protection to 94%. But the company is a little late to the party in the US and Europe. However, there are still good chances in other markets for JNJ.

Ticker: JNJ

Price: $190.63

It seems like JNJ is beginning its uptrend

Logitech

The company engages in designing and manufacturing mice and keyboards for PC, tablets, and other digital platforms. In the past three months, the company has lost about 25% of its value. The RSI is 27.26%.

Ticker: LOGI

Price: $87.85

The low RSI level it’s a signal of a reversal

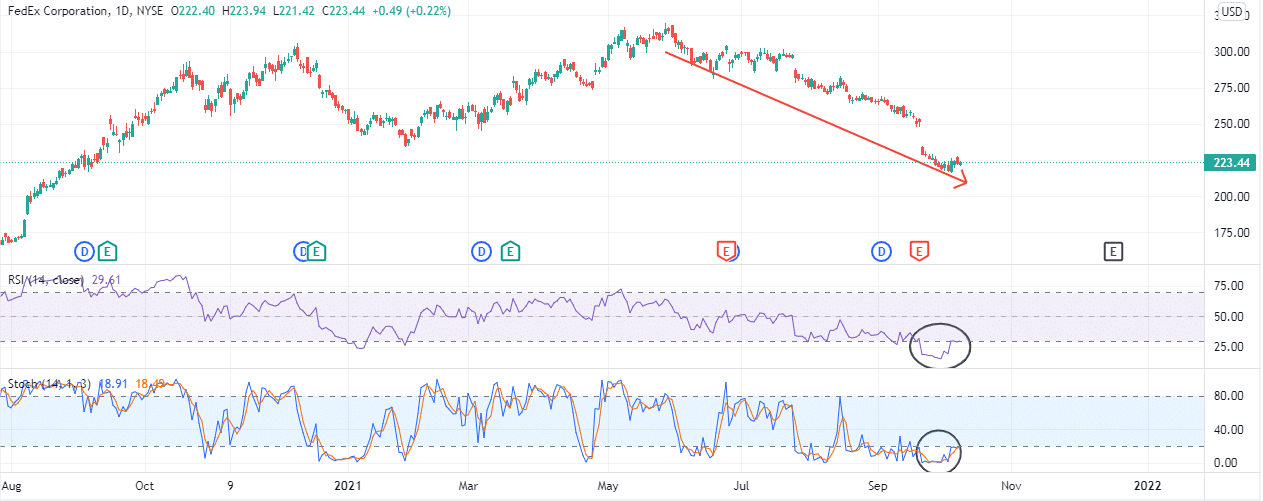

FedEx

FedEx Corp. engages in operations related to transportations, business, and e-commerce. The price of the share has fallen since the beginning of the pandemic. The RSI is at 30.01%

Ticker: FDX

Price: $223.44

FDX’s RSI went as low as 15%

What does oversold stock mean?

When we say that a stock is oversold, we are objectively assessing its current price level. The appreciation could be based on technical or fundamental analysis but is not an indisputable truth, and it’s a matter of interpretation.

By saying that a stock is oversold, we mean that the stocks of a company are being sold at a higher rate than we could expect and that rate is not sustainable, so at one point, the trend will reverse. However, by making this assumption, we also imply that the asset’s price is below its intrinsic value, which will rise soon.

How to find oversold stocks?

As mentioned above, there are two ways of analyzing a stock to conclude that it’s being oversold. Those two ways are:

- Technical analysis

- Fundamental analysis

To determine if a stock is oversold, we use indicators that measure momentum and recent price changes.

Some of the most common indicators used for this purpose are RSI, stochastic oscillator, and MACD. These indicators are also combined with SMA of different periods to get some confirmation.

About fundamental analysis, it is all about trying to calculate the intrinsic value of the stock. P/E ratio is a ratio that is commonly used to understand the financial status of a company. The trader compares the P/E ratio with the previous P/E ratio of the same company, and the trader can decide whether the company is performing well based on this comparison.

Oversold trading strategy

This indicator and analysis are then used for traders to take advantage of the situation and try to buy the stocks at the lowest possible price to get the highest reward. Let’s see how these setups work.

Bullish setup

The bullish setup for this trade is the safest one. It is preferred for the traders since it confirms the reversal of the downtrend. Moreover, by waiting for the price to rise slightly, they minimize risks.

Where to enter?

After a long downtrend, the trader must see the RSI level. If the level is below 20%, that is a signal that there will be a reversal, and the price will rise promptly. Thus, the trader enters the trade right after the stock price goes up a little, confirming the uptrend.

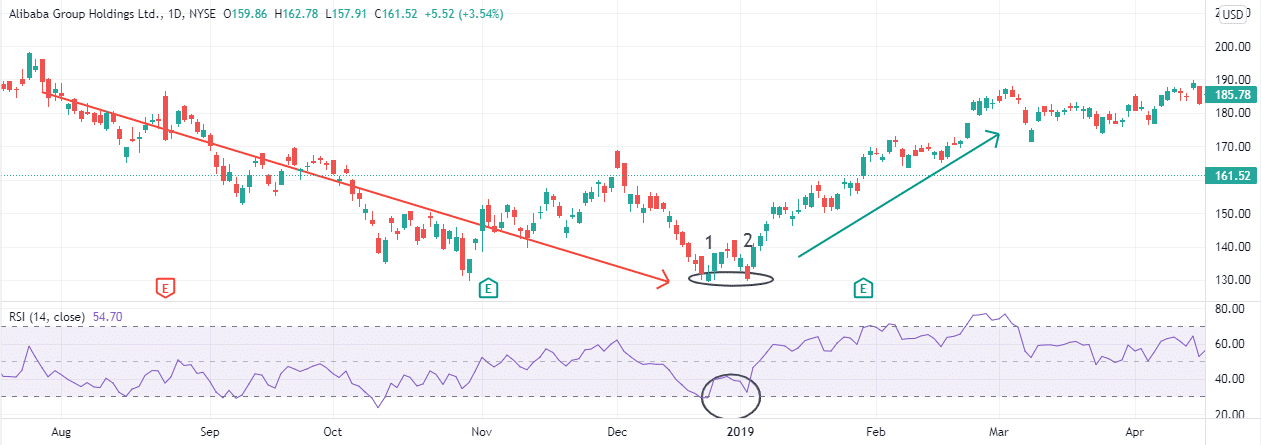

Alibaba’s shares raised after the RSI got below 30%

Where to put stop-loss?

You should set the stop-loss at the lowest point of the previous downtrend.

Where to take profit?

To set the take profit, you need to look out for the Fibonacci retracement level of the previous downtrend.

Bearish setup

The bearish setup is the riskiest. Here, you make the trade before the price makes the turn upwards.

Where to enter?

In this setup, the trader will base his decision only based on the indicators. If the price is falling, there is no guarantee it will reverse at that point, even if the indicator seems to predict it. The price can just keep falling long after you enter your position.

Because of this, you use more than one indicator in the setup. To follow the recent changes in price levels, you can both use RSI or stochastic oscillator, but to confirm the signs, you should see the market volume. If the volume is low, there are fewer sellers, and the liquidity is dropping, so the price will go up soon.

FDX’s stock price is still trending lower, but the indicators predict a reversal

Where to put stop-loss?

Since this is a riskier play, the stop-loss level is crucial. As you are entering your trade before the price reverses, you should expect that the price will drop a little more before the setup plays out for you. Therefore, we recommend setting your stop-loss 10% below your initial investment.

Where to take profit?

The take profit level also depends on the Fibonacci retracement levels. 38,2% and 50% are good targets.

Oversold penny stocks

Investing in penny stocks is a little riskier than investing in regular stocks because of their volatility. However, this is also the feature that makes them so attractive. One big move is likely to happen with this kind of stock. So, you can make big money from them. Let’s see some of the best-oversold penny stocks.

Galecto Inc.

It’s a biotech company focused on the development of treatments for diseases like fibrosis and cancer. It’s currently trading low, although it has good fundamentals. However, it seems like the RSI indicates that this is going to change soon.

Ticker: GLTO

Price: $3.38

Galecto’s RSI level is currently at 21.04

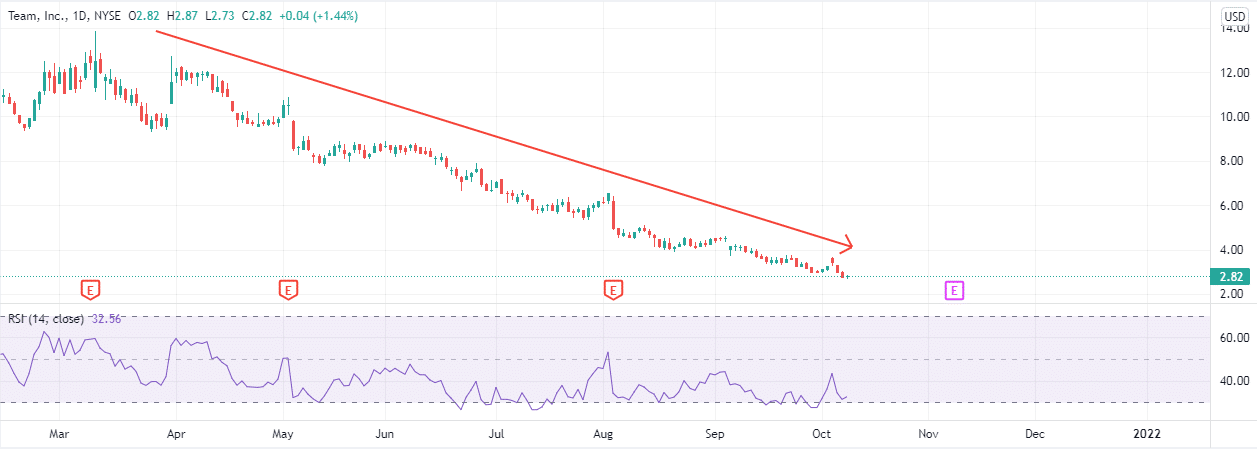

Team Inc.

This is a provider of industrial solutions focused on inspection, maintenance, and repairs. It has lost more than 70% of its value this year, but the technicals predict a recovery.

Ticker: TISI

Price: $2.82

The team’s RSI is barely above 30%

Osmotica Pharmaceutical plc.

It’s a biotech company providing technological service on the delivery of medicines. The stock price has been falling since the beginning of the year, but that trend seems to be ending.

Ticker: OSMT

Price: $1.91

Osmotica’s RSI level is at 23.22%

Main pros and cons of oversold stock buying

Like any investment, buying oversold stocks has its advantages and disadvantages. Let’s see some of them.

Pros |

Cons |

The point of this strategy is to buy the stocks at their lower price. If this is done correctly, the reward is maximum. |

When you buy an oversold stock, there is the high risk that the stock can keep going down, and you lose your money. |

The indicators used to find oversold stocks are free and don’t require much knowledge to interpret. |

On regular stocks, you make money from oversold shares due to the bounce effect, but this doesn’t mean that the company is suddenly in good shape, and therefore the prices won’t go up significantly. |

Whether you use technical or fundamental analysis, you can use both to take advantage of this strategy. |

It’s hard to predict where the bouncing effect is going to stop. You need to pay attention once you enter the position to leave as soon as the price starts falling again. |

Comments