The US government has been giving most working families historic relief since July 2021. Most tax reliefs when you file your taxes, but this program helps families get advanced payments, and the families are automatically receiving $250 to $300 per child.

In total, you can get from $3,000 to $3,600 per child younger than 17 years old. So on the 15th of each month, families receiving this benefit can expect direct deposits from the IRS or paychecks sent by mail around that date.

To get the benefits of this program, which is the biggest of its type in US history, take a look at these ten steps to learn everything you need about it.

Step 1. When are the remaining child tax credit paydays?

This year the government made an exception and started sending payments from tax reliefs in advance to get working families. The deposits have been sent since July 15, and the payments arrive on the 15th of each month. On the other hand, checks can take a little longer to arrive but still arrive around mid-month.

It is programmed to keep that way until the end of the year, so October’s payment will arrive in less than a week. For the remaining months of the year, the payday it’s also the 15th.

Step 2. Can you unenroll from payments this late in the year?

There are some reasons why you may not want to receive payments this year. Most US families are eligible to receive this benefit, but still, some are not, and a small group of families may change their status for next year.

So, since this is a relief from 2022 taxes, your status may change for next year’s taxes and not be eligible to get this benefit in 2022, so you’ll be forced to repay the IRS. That’s why some families prefer to avoid getting the payments now. To unenroll, you can use the IRS Child Tax Credit Update Portal.

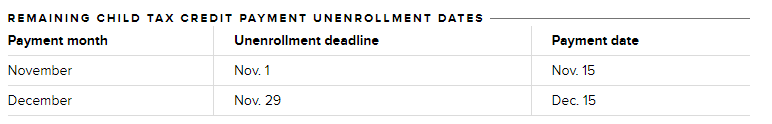

Step 3. Remaining child tax credit payment un enrollment dates.

You can unenroll three days before the first Thursday of the following month.

For October, there is no longer a chance to unenroll since the deadline was October 4. But you still have a chance for the next few months:

- The deadline for November is November 1.

- The deadline for December is November 29.

The last day of the year to unenroll is November 29

Step 4. How can you use the IRS portals for help?

This summer, the IRS launched online portals for families that are not required to file an income tax return. Some of the tools are in English and translated to Spanish. The tool can help you to:

- Check your eligibility for the Child Tax credit.

- Register for advance payments of such credit if you don’t normally have to file a tax return.

- Verify your identity before using this credit update portal.

- Unenroll from advance payments of the Child Tax credit.

- Manage bank account information.

- View your payment history.

- Update your mailing address.

- Report updates that could affect your payment amounts.

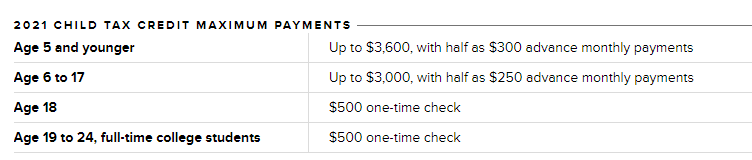

Step 5. How much money can your family expect each month?

For children below the age of six, the total amount of the reliefs is $3600. For kids between the ages of six and 17, the total amount that families will receive is $3600.

Now, that money was divided into two parts. An advanced part for you to receive this year and the normal part you’ll get with your tax refund of 2021. So, only the government is advancing some of that money in the form of monthly payments. Since it started in July and will last until the end of this year, the total payments will be six. So then you only need to divide this year’s amount between six.

For kids under the age of six, you can expect $300, and for kids between six and 17, you’ll get $250.

Step 6. Income qualifications to get the child tax credit this year

Depending on your income, the amount that you receive will vary. Single filers making less than $75,000, heads of households with incomes below $125,000, and married couples making less than $150.000 per year will be eligible to receive the full amount.

Step 7. 2021 child tax credit maximum payments

There are some exceptions for dependents over 17 years. Below we show how much each family gets for each child and dependent.

You can get a return for dependants of 24 years old

Step 8. What if one of my checks is delayed?

As we said earlier, paychecks may arrive a little later than direct deposits. If you are worried because your money has not arrived, you are probably getting the reliefs via mail. If you haven’t registered your banking information, it’s a sure thing that your money will be sent by mail. And even if you have registered your info, if you start getting worried because the payment is taking long, you can use the IRS Update portal to update your information.

Step 9. Is it possible advance payments will affect my taxes in 2022?

Yes. The money received will have an impact on next year’s taxes. Since this is an advance, the money returned to you this year will be discounted from the total amount assigned to your family, so your tax return will be lower next year. Also, if you are no longer eligible for the benefits next year, you will have to return the money to the IRS.

Step 10. Can you still get child tax credit checks if you never file taxes?

Yes! If you didn’t file your tax return, you could still get the payment. On the other hand, parents who don’t file taxes should use the IRS tool to get their money. The deadline to do this process is October 15, and the tool is called the “Non-filer sign-up tool.” Although it is easier for those who filed the 2020 tax return, this group will receive their money without action.

Comments