Volatility Factor 2.0 is an advisor that belongs to an FXAutomater family. It was released several years ago. The company has a reputation among traders. The main claim is “The Most Powerful EA On The Forex Market.” It’s time to figure out if the system has received the last update in the near past.

The company has a good reputation among Forex-related traders as product designers. Not all their solutions are updated and profitable. There are many scams as well. Our goal is to understand if we can trust this trading solution or not.

What is behind Volatility Factor 2.0?

Volatility Factor 2.0 settings

Volatility Factor 2.0 features

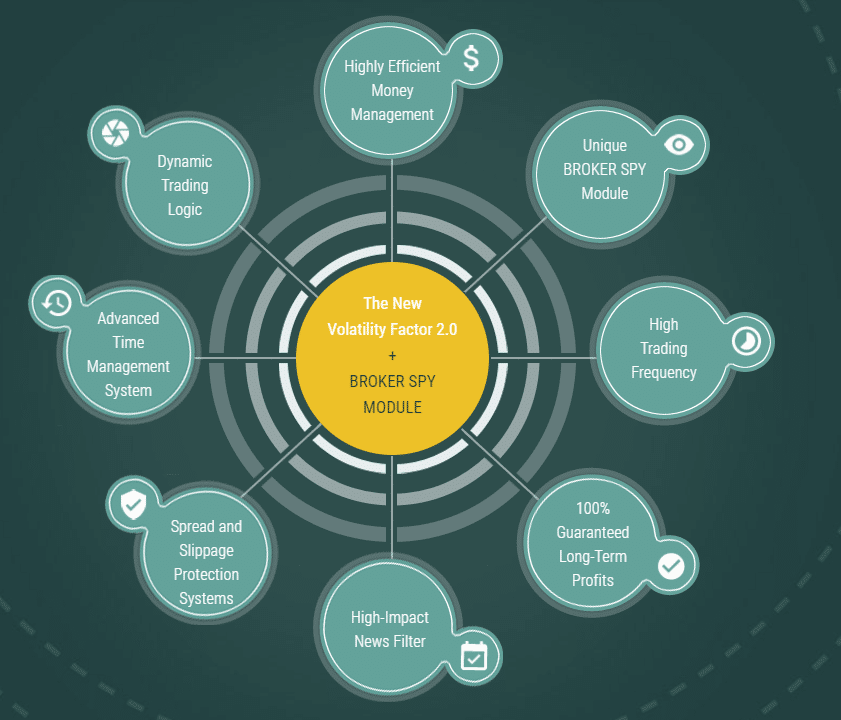

The presentation has many options explained that we want to pay a look at.

-

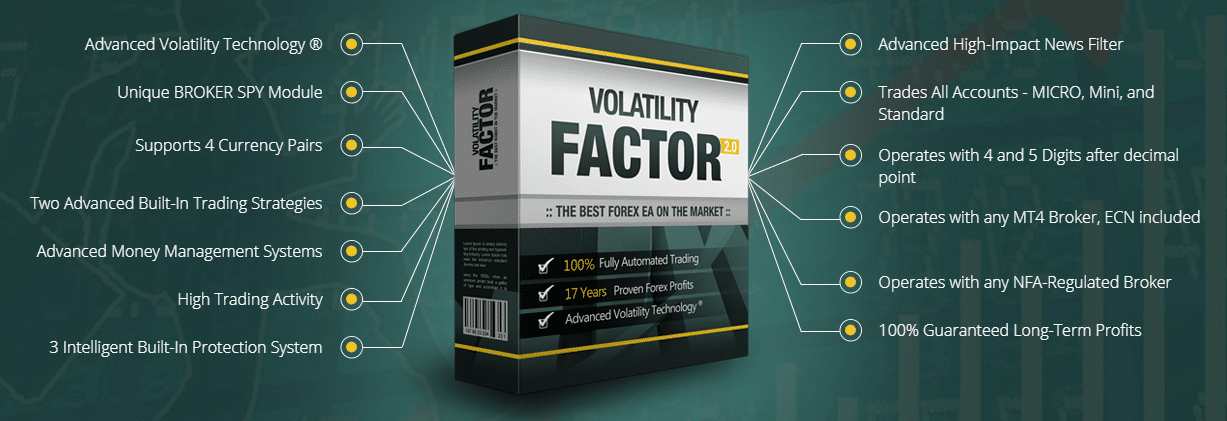

- The system was designed to work completely automatically on a terminal for us.

- The expert advisor was updated to solve critical issues.

- There are two strategies applied.

- The money-management system calculates lots sizes for us.

- It’s a high-frequency trading expert advisor.

- The system has a news filter applied. We may decide not to trade during the high-impact news.

- These accounts are allowed to work with: Standard, Mini, and Micro.

- We have to work on an ECN account only.

- It opens orders based on NFA regulations.

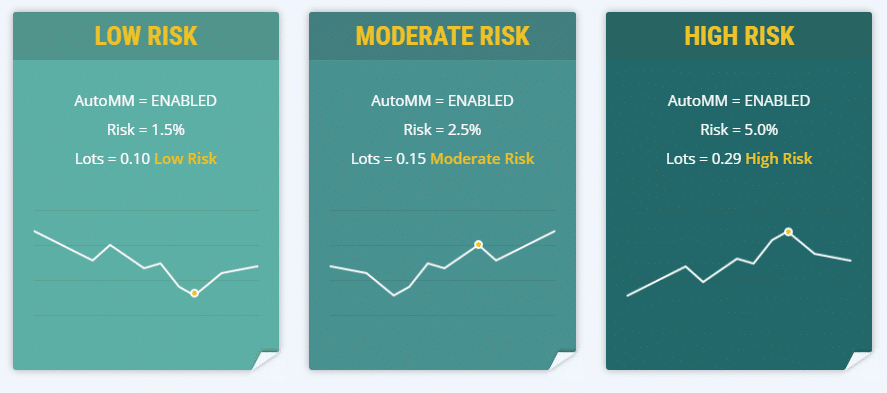

Volatility Factor 2.0 risk setting

We may want to work with three levels of risks. The low risk (1.5%) allows trading with 0.10 lots. The moderate risk (2.5%) – 0.15 lots. The high risk (5.0%) – 0.29 lots.

Volatility Factor 2.0 some of the main claims

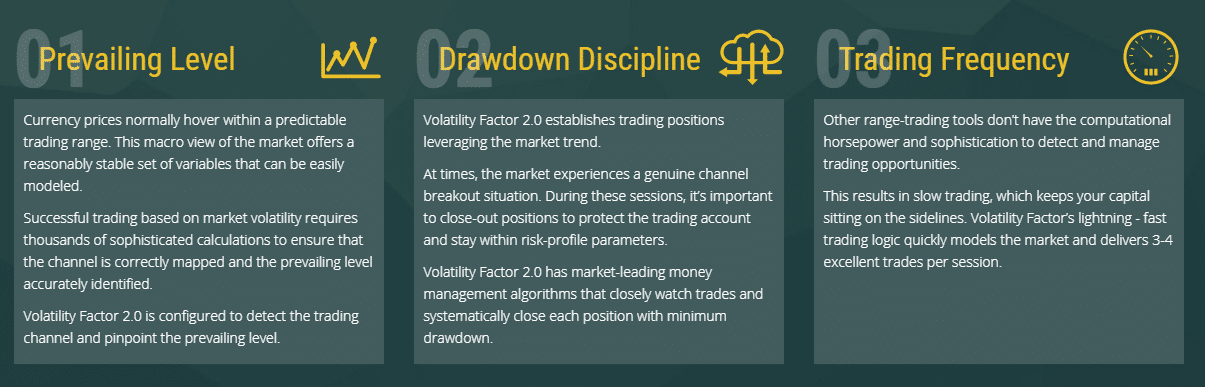

- The system works based on several features/statements: Prevailing Level, Drawdown Discipline, and Trading Frequency.

Key features

- The system works completely automatically for us.

- It calculates the right entry points.

- It opens and closes orders for us.

- There’s a broker spy module that protects our deals from fraudulent brokers.

- It works with only four pairs GBP/USD, EUR/USD, USD/JPY, and USD/CHF.

Trading strategy

- The devs don’t disclose details about a strategy or strategies behind the system.

- It works with GBP/USD, EUR/USD, USD/JPY, and USD/CHF.

- The time frame can be M15.

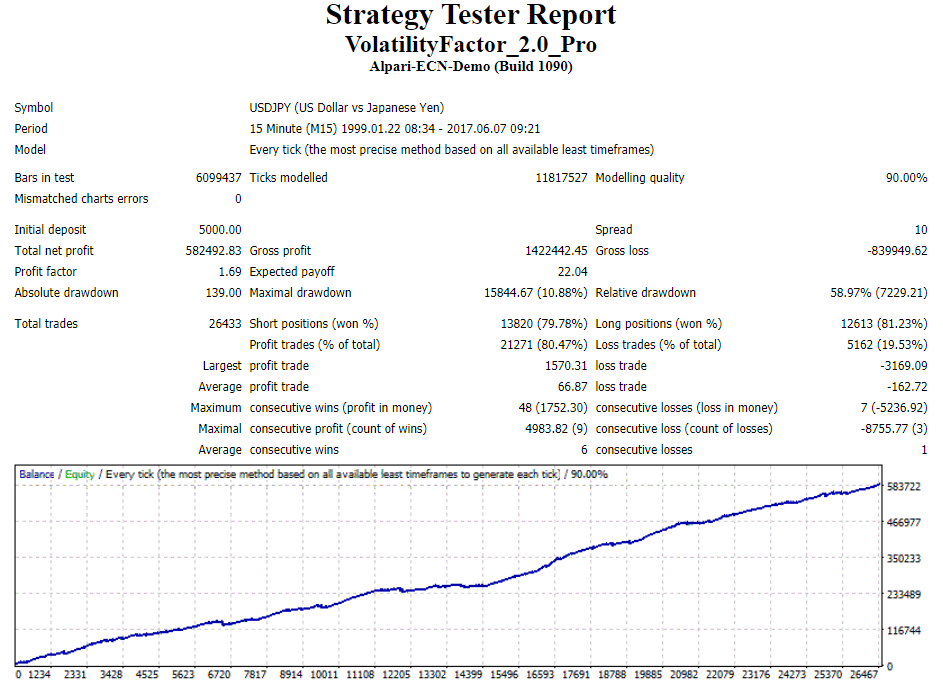

Volatility Factor 2.0 backtest

We have a USD/JPY backtest report from the M15 timeframe. The data was chosen from 1999 to 2017. The modeling quality was 90% with 10 pips spreads. An initial deposit was $5,000. It has turned into $582,492 of the total net profit. The profit factor was 1.69. A maximum drawdown was only 10.88%. It has traded 26,433 orders with a 79% win rate for longs and 81% for shorts.

Pricing

Volatility Factor 2.0 sale

The devs still run a -$120 sale in September 2021.

Volatility Factor 2.0 pricing

Volatility Factor costs $227. The original price was $347. The package includes a single real license, an unlimited number of demo accounts, a unique broker spy module, an advanced news filter, trading on four cross pairs, and a 60-day refund policy.

Trading performance of Volatility Factor 2.0

Volatility Factor 2.0 trading results

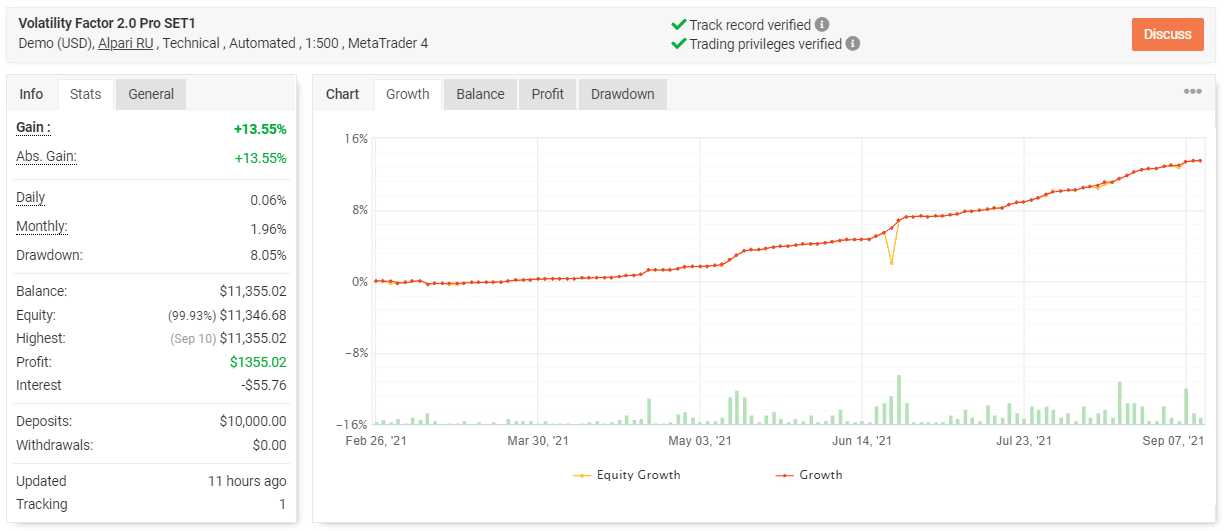

The advisor has been working on a demo account on Alpari RU. The system works with 1:500 leverage. The platform is MetaTrader 4. The account has a verified track record and verified trading privileges. It was created on February 26, 2021, and deposited at $10,000. Since then, the absolute gain has become +13.55%. An average monthly gain is 1.96%. The maximum drawdown is 8.05%. It’s a good number. One investor tracks trading results.

Volatility Factor 2.0 statistics

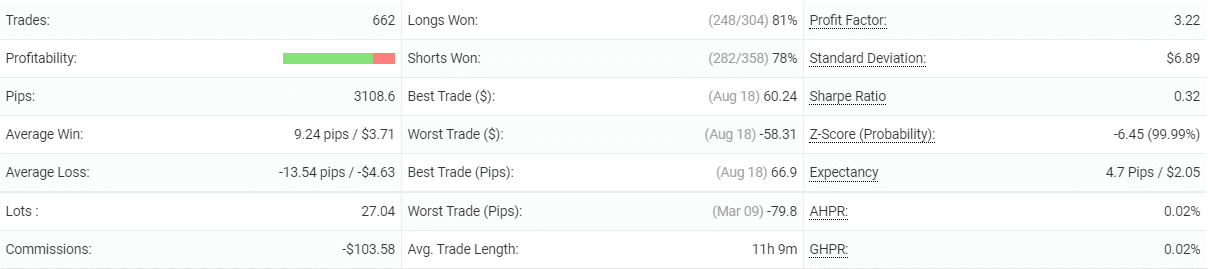

Volatility Factor 2.0 has traded 662 deals with 4108.6 pips. An average win is 9.24 pips when an average loss is -13.54 pips. The accuracy rate is 81% for longs and 78% for shorts. An average trade length is 11 hours. The profit factor is 3.22.

Volatility Factor 2.0 trading pairs

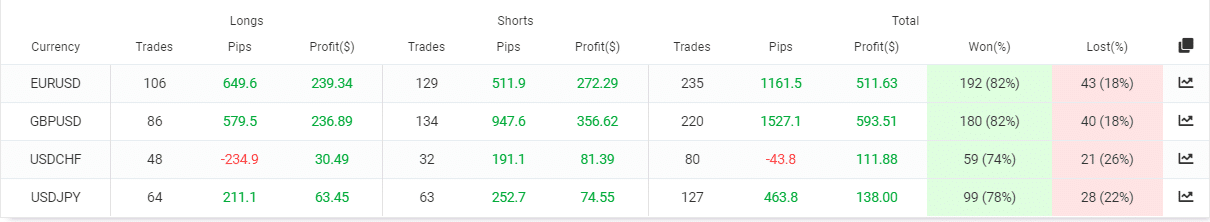

The system runs four mentioned cross pairs. EURUSD is still the most traded pair with 235 orders. Most of the profits were obtained on GBPUSD, $593.

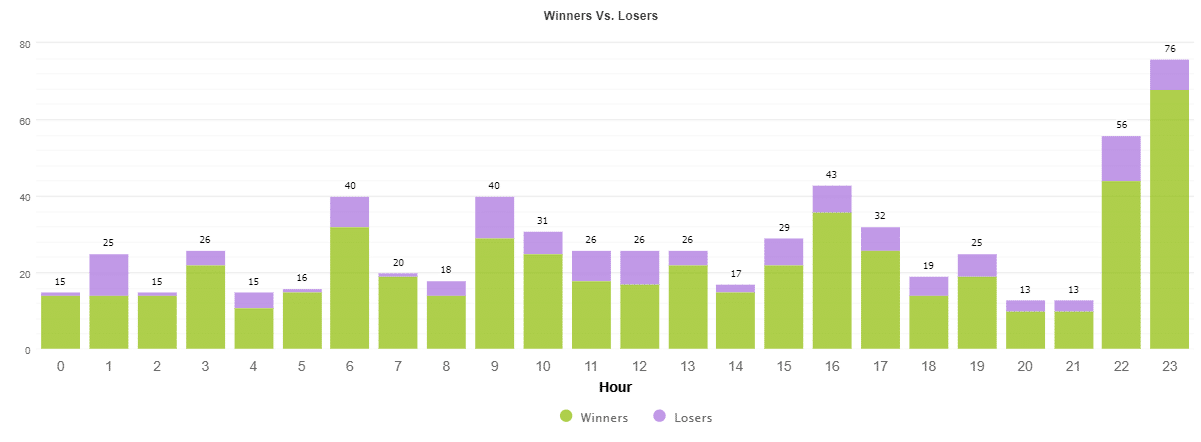

Volatility Factor 2.0 hourly activities

The first strategy works during all sessions. The last one opens scalping orders at night when the market is calm.

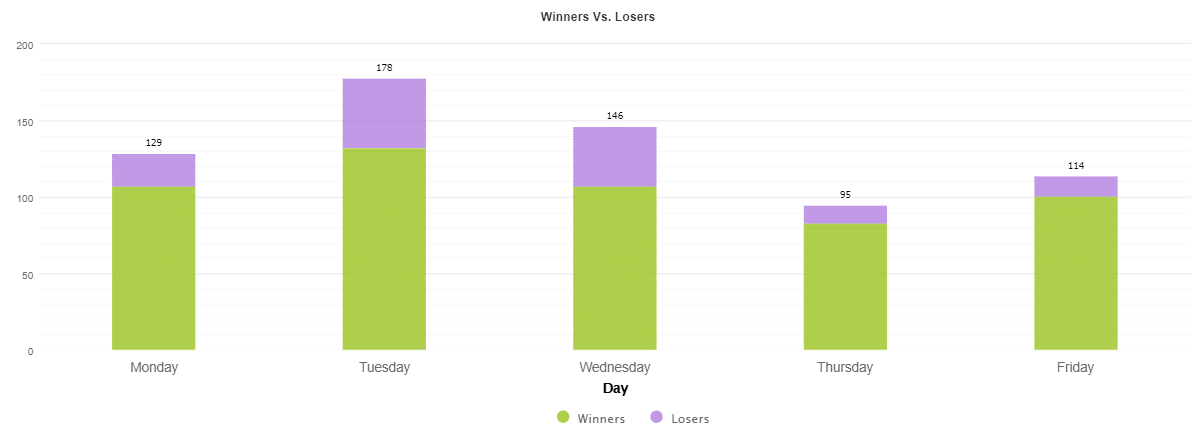

Volatility Factor 2.0 daily activities

Tuesday is the most actively traded day day, with 178 orders.

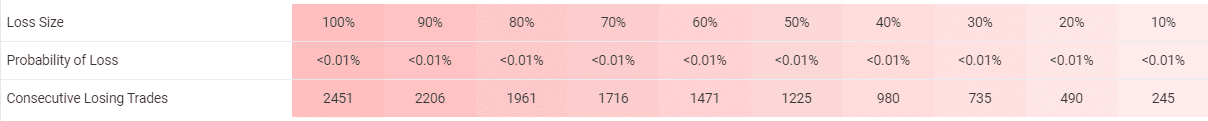

Volatility Factor 2.0 risks

The risks to the account are quite low.

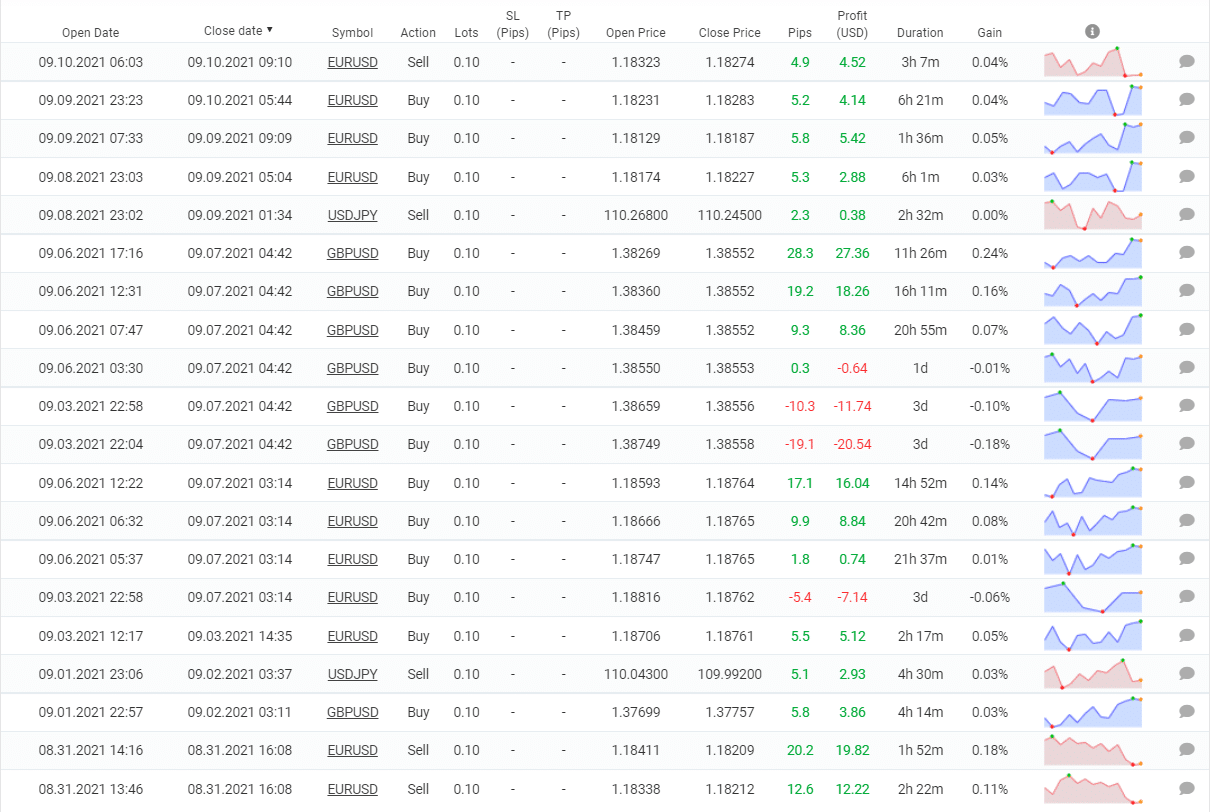

Volatility Factor 2.0 closed orders

The robot, as mentioned, hides SL and TP from a broker. It uses a grid of orders to make more profits.

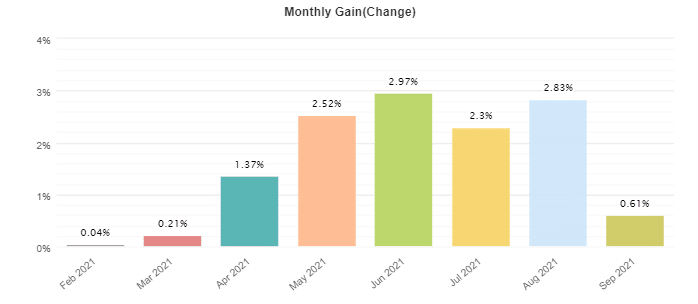

Volatility Factor 2.0 monthly profits

This year, all months are profitable.

Customer support

The developers provide one of the best by knowledgeable and welcoming support on the market. Usually, messages are answered within several hours.

People feedback

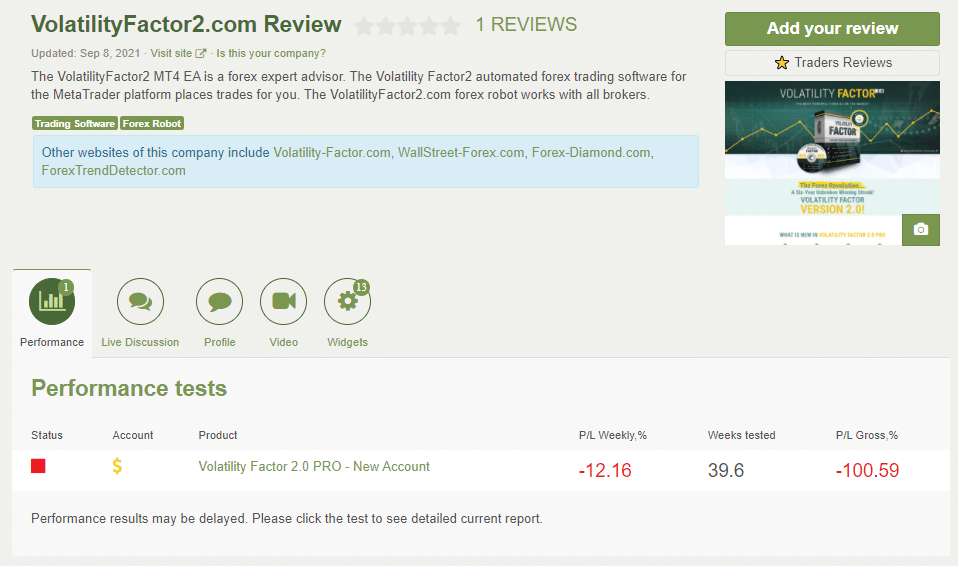

Volatility Factor 2.0 testimonials

The company has a page on Forex Peace Army with a single review and one blown account connected.

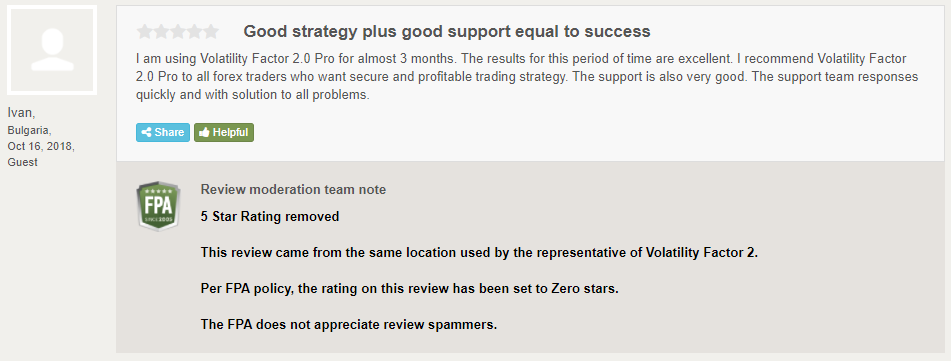

Volatility Factor 2.0 testimonials

The Forex Peace Army warned us that this positive comment was fake.

Comments