As the forerunner of cryptocurrencies, Bitcoin is leading the way in terms of market capitalization and price valuation. When Bitcoin makes a bull run, other digital currencies follow suit. Since BTC is very volatile, many people prefer to invest rather than trade. This article does not attempt to endorse BTC trading, but if you are looking for ways to trade the main crypto coin, then you have come to the right place.

Top 4 BTC trading strategies

In this section, you will learn four strategies to trade the king of crypto. You might say these strategies look similar to those used in other markets. That might be true, but there are nuggets of wisdom shared here that you can use to build a robust trading strategy.

1. Day trading

Day trading means opening and closing trades within the day. You do not allow trades to go past the day you open them. This way, you avoid overnight fees charged to your account, which might look small individually but could add up to reach a significant amount over time.

When you day trade, you would close your trades before the end of the business day even if the trade is losing or winning. Be aware that day trading Bitcoin or any crypto-asset is a bit risky compared to other financial assets such as currencies. This is because cryptocurrencies are known for their volatile nature.

When trading BTC on a trading platform, you can either buy or sell it. While buying BTC is commonplace, selling this coin is uncommon. Remember that the crypto king sometimes gets crazy and can defy gravity when it is in a bull run.

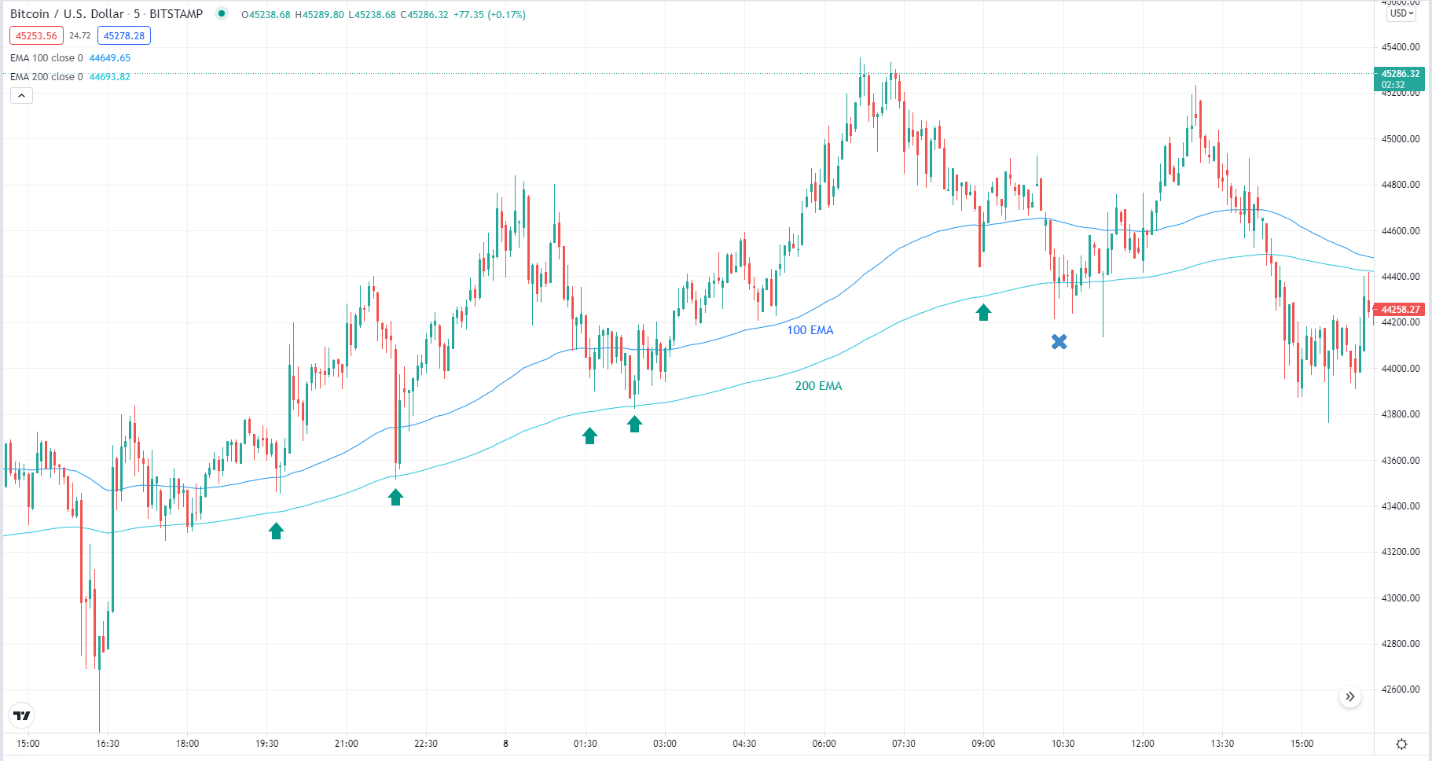

BTC/USD

Consider the above five-minute chart of Bitcoin. When day trading, you will focus on lower time frames such as M5, M15, or M30. The same principle of buying low and selling high applies to this trading profile. The above chart shows buy examples because the trend is relatively bullish. Notice that the price is generally above the 100 and 200 EMAs.

You can use the above entry strategy for BTC day-trading. You will only take buy entries here because the trend is up and only after a pullback. There were five instances where you could have taken buy trades. The area marked with x is not a good entry because the price broke below the 200 EMA. You can use this filter to avoid taking low-quality trades.

2. Trend trading

Trend trading BTC means buying and selling this crypto, depending on the underlying trend. If the trend is bullish, you will look for buy trades. If the trend is bearish, you will look to sell trades. The simplest way to judge the prevailing trend is through moving averages, particularly long-term periods.

The best periods are 100, 200, 400, or anything in between. You can use any moving average, but the exponential type is good enough.

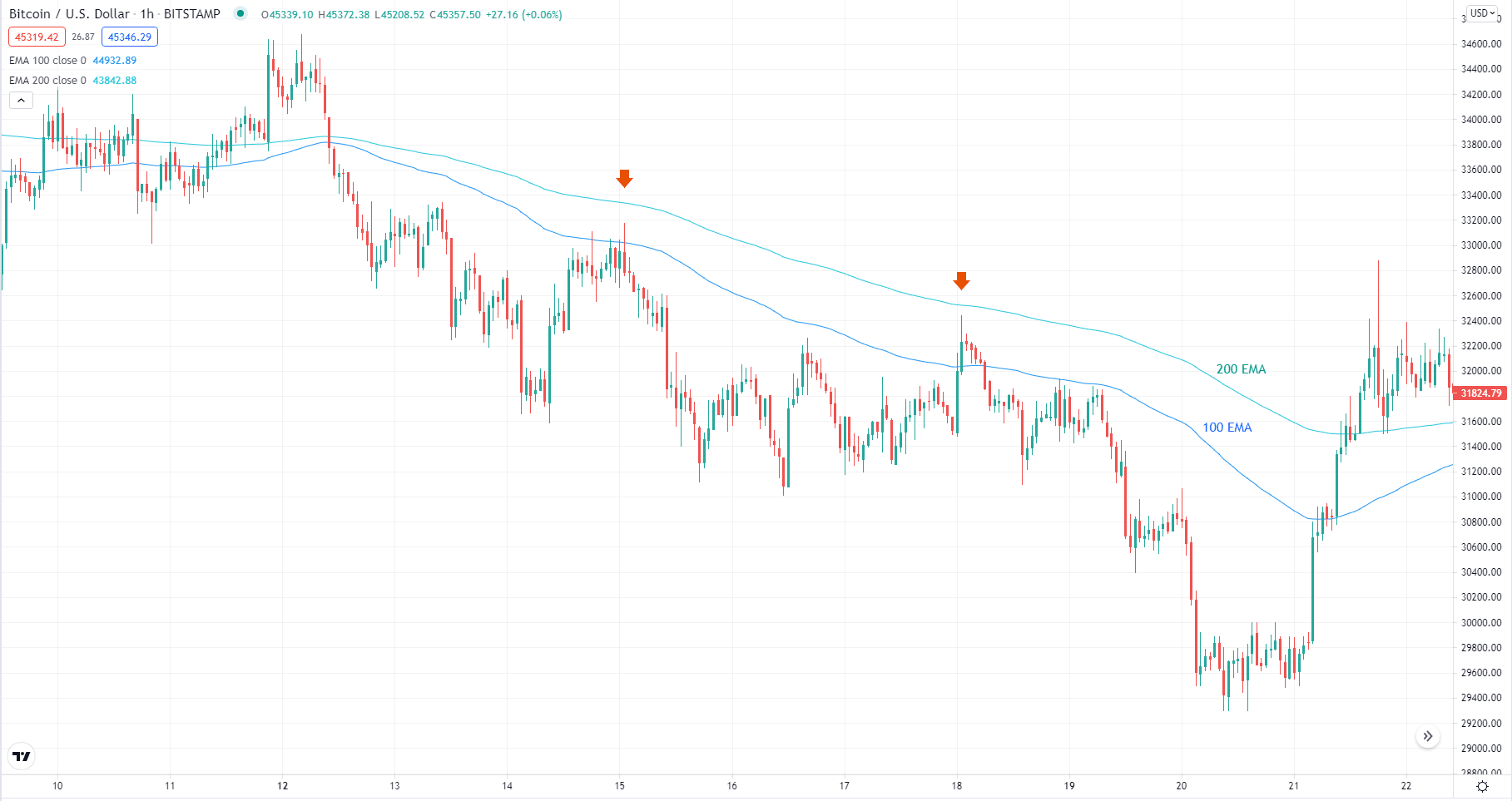

BTC/USD

Pullback trading is a simpler term for trend trading. This is where you wait for the trend of BTC to become apparent, and then you trade accordingly. A pullback entry is somewhat similar to the day trade entry discussed above. The difference is that you are using a higher time frame here, which is hourly. You can choose the H4, daily, or even weekly chart if you have limited trading time.

In the above chart, after the trend of Bitcoin has become evident (i.e., downtrend), there are two occasions when price retests the moving averages and then breaks down. When you see that price penetrates the moving averages but fails to break through, that indicates that the correction phase is coming to an end and the trend might resume soon. When it happens, prepare to open a short position when the price starts to break down.

3. Hedging

It is an advanced trading method used by professional traders, which is not suitable for novice market participants as it requires an in-depth understanding of risk management. Traders use hedging in other markets such as foreign exchange, but it applies to crypto, such as Bitcoin. Investors use hedging more than traders do. This is because of the limited time available for investors to monitor trades.

Hedging means opening both a short position and a long position in one asset. Since the BTC market is predominantly bullish, you would take a long position first and then add an actual or pending short position later when you think Bitcoin is about to retrace and you want to protect your returns. You do not want to see your profits being eroded or turned negative when BTC turns around, so you hedge your position.

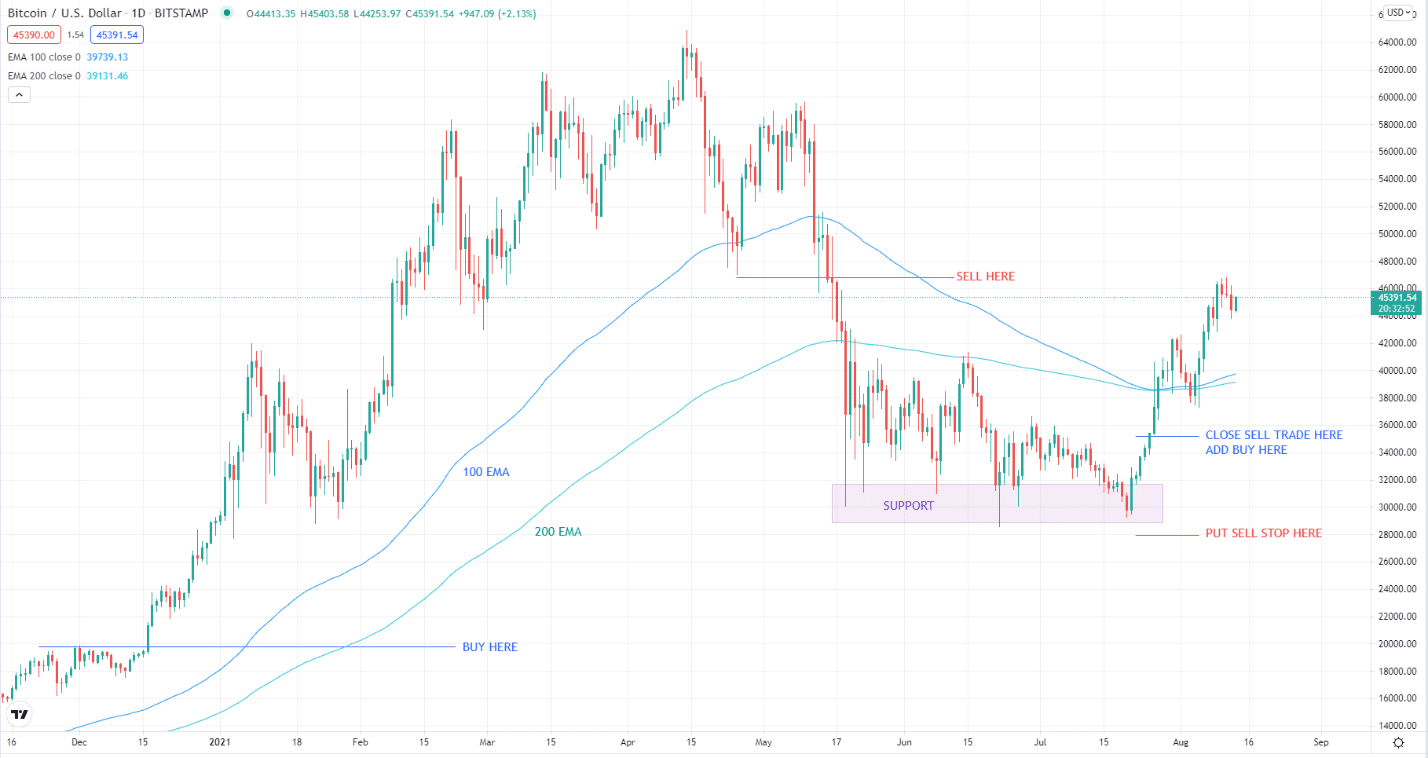

BTC/USD

Consider the above daily chart of BTC. Suppose you bought this coin when its price was around $20,000, as marked above. Then price saw massive growth, yielding you a return of a lifetime. If you want more profits and you believe in Bitcoin’s great potential, you can hold on to your long position and let it run for a bit longer.

When Bitcoin makes a new low by breaking a recent swing low after price topped at around $65,000 in April 2021, you can place a sell stop order as shown in the image. You would use the same volume for your short position as you did for your long position. This way, the floating profit is fixed wherever the market may go. After you shorted Bitcoin at around $47,000, you have seen that the crypto king formed a support area and used it as a launchpad to rally again.

As Bitcoin begins to rally and gets out of consolidation, you can close the short position, add a long position if you like, and place a pending short order a little below support. You put the awaiting sell order in case the price fails to push higher and breaks the support area. As you might have seen, you generated profit during the short-term sell-off while you protected your earnings for the initial position.

4. Buy and hold

Buy and hold (HODL) is an investing strategy popular among stock investors. Since cryptocurrencies are assets that start at low values and appreciate over time, the buy-and-hold method is also suitable in this market. You might ask why we include this method when it is primarily an investing strategy, not a trading strategy. There is a simple explanation for this.

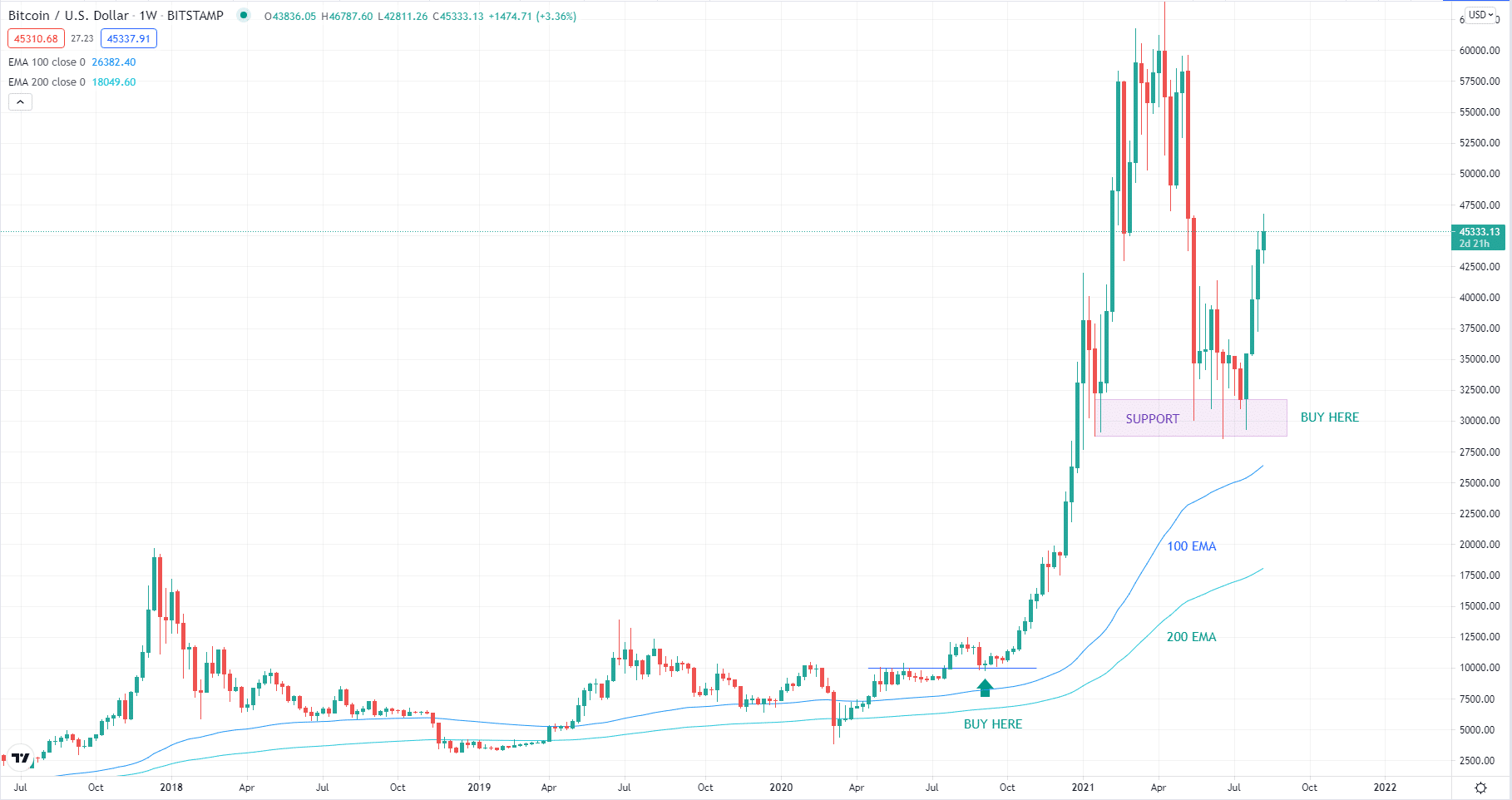

BTC/USD

When crypto assets begin to move to the upside, you can easily see that the bull run and the corrective phase follow a pattern or cycle. This is particularly true for BTC. You know that Bitcoin makes a parabolic move when it rallies, and it is easy to quantify what the next new high will be as measured from the previous high. No one can predict precisely when the leading coin will make that new high, but you have a price in mind at which you would like to close your long position.

Typically, you will not buy BTC for your retirement plan unless you are a great believer in this coin. In contrast, we are more inclined to believe that stocks or companies would grow in value over time. In this case, the buy-and-hold method applies as a trading strategy.

Final thoughts

Trading the crypto king is risky and might not be suitable for everyone. It requires a sound trading strategy, a robust risk management foundation, and a ready mind if you encounter temporary setbacks. Try to use the four scenarios presented above initially in demo trading until you become confident to trade live.

Comments