Mood EA uses the Momentum Indicator for making profitable entries. It makes use of oversold or overbought conditions of the indicator to enter an order. Vasiliy Strukov is the developer of this FX EA. It was published on the MQL5 site in December 2020. The author is from Russia and has two years of experience in developing Forex trading tools. He has developed 14 products and 3 signals in his portfolio. Other products of the author are Strong Support, Gold Stuff, Idea Pro Gold, and more.

As per the information provided by the developer, the EA enters positions accurately with a good win rate due to its unique approach. In this review, we have analyzed the important aspects of the FX EA that influence your buying decision such as its features, functionality, backtesting, real trading performance, etc.

What is behind the Mood EA?

According to the author, the FX robot uses the momentum indicator to identify precise entry points. The overbought and oversold features of the indicator are used for finding the right entries. Instead of providing information on the setup, the developer asks users to contact him after buying the EA to receive the settings and a bonus.

Key features

There is very minimal info available on the expert advisor as the developer does not reveal details like the currency pairs, timeframe, deposit, leverage, etc. Instead, there is a list of setting parameters such as Money Management, auto lot selection, lot multiplier, TP, SL, trail start, trail stop, drawdown reduction algorithm, and more.

Trading strategy

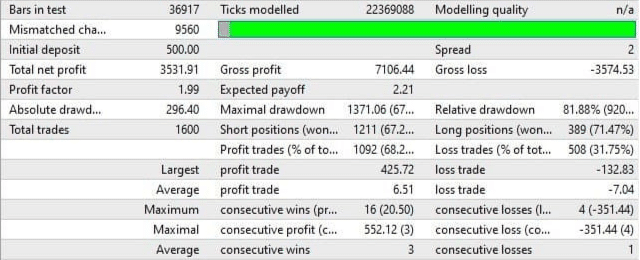

Other than the mention of the Momentum indicator, the vendor does not divulge the strategy this FX EA uses for achieving profitable results. A backtesting report is present on the MQL5 site. Here is a screenshot of the result:

Backtesting results of Mood EA on the MQL5 site

From the above backtesting result, we find that the expert advisor had generated a total net profit of 3531 for an initial deposit of 500. A total of 1600 trades were executed with a profitability of 68% and a profit factor of 1.99. The maximum drawdown is 67%. From the high drawdown, it is clear that the approach used is of a high-risk category. Further, the profits are not very high considering the number of executed trades, and the winning probability is low.

Pricing

To buy this FX EA, you need to pay $50. A free demo is present. The developer does not provide details on the features you get with the package. There is no money-back guarantee present. When compared to the price of competitor FX robots in the market, we find the price is affordable. However, the absence of a refund offer makes us doubt the reliability of the system.

Trading performance of Mood EA

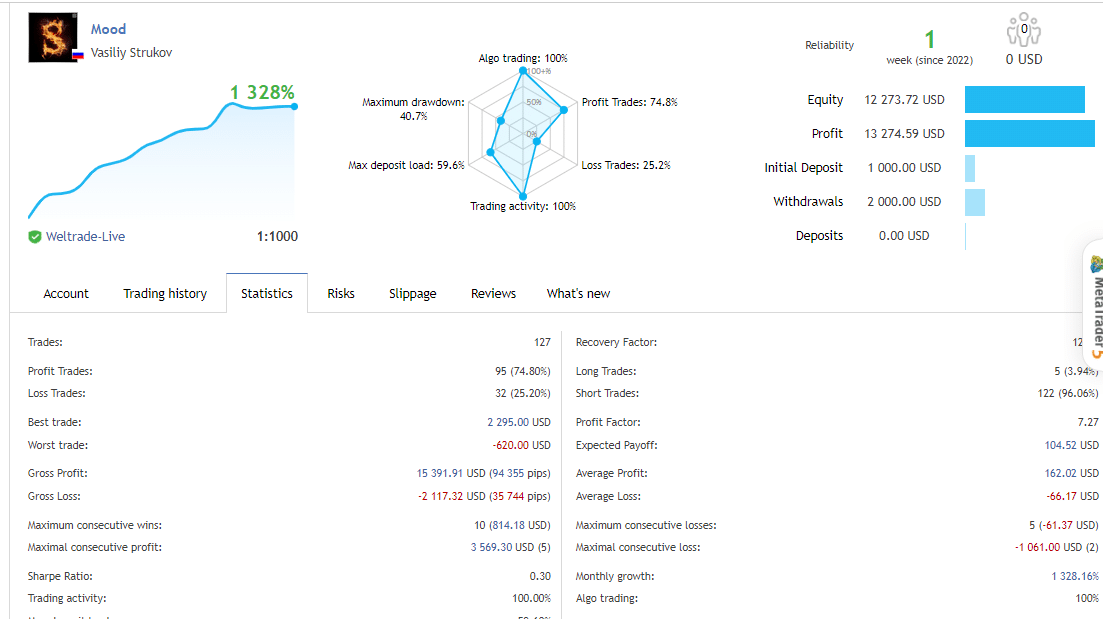

A real live USD account using the Weltrade broker and the leverage of 1:1000 is present for this FX EA. Here is a screenshot of the trading stats:

Trading stats of Mood EA on the MQL5 site

From the above info, we find that the system is performing well with a growth of 1328%. For an initial deposit of $1000, a profit of $13,274 is generated for the account started on April 29, 2022. A maximum drawdown of 40.7% is present and the profitability is 74.8%. A total of 127 trades have been completed by the account.

With only one week of trading, the sample size is very small to predict the performance of the robot. Further, the drawdown present is very high indicating a high-risk approach. Comparing the backtesting with real trading, we find that the drawdown is higher in both results. The high drawdown and low profits confirm that the approach used is risky. Traders would stay away from such systems if they continue to perform poorly.

Customer support

For support, the messaging option on the MQL5 site is the only method available for users. The vendor does not provide a live chat feature or other support methods.

People feedback

Unfortunately, we could not find user feedback for this FX EA on reputed sites like Forexpeacearmy, Trustpilot, etc. But there are 66 reviews on the official site with a rating of 5/5. Most of the feedback on the official site reveals positive testimonials. However, as the MQL5 site promotes the product, there is a high chance of the reviews being manipulated. So we do not consider the user feedback on the official site.

Comments