Creating wealth requires patience and time. Also, it involves taking specific actions about your money. Besides, it is impossible to get rich if you just let your money sleep under your bed. To make the best of extra cash, you have to invest it in bearing profits.

You might think to yourself it is not possible to build wealth with just $100. What is needed is to start investing. The $100 in your possession right now, small as it may seem, has the potential to change your life for good.

Be aware that many ordinary people who have amassed wealth began with small amounts. They started investing their money, rolled over the profits, and watched over as the money grew. You can do the same. You have several options to grow 100 bucks.

This article will point you to where you should put your $100, so it grows little by little. We have listed down five ways to transform your $100 into $1,000 or even more. If you are ready to learn, start with the first approach in the next section.

Strategy 1. Invest in crypto

As a new market, crypto is marked with volatility. The price of crypto assets goes up and down quickly, but the long-term outlook is bullish. Since the whole crypto market is somewhat moving in the same fashion, you can take advantage of this opportunity by buying low-priced crypto assets.

How does it work?

You can invest in crypto through various platforms, such as digital wallets and exchanges. What you need to do is sign up for an account and top up cash. As a new investor, you should start small. Then select your crypto assets of choice. Find popular names with a good market cap but with lower prices. Put your $100 in a few of these assets and wait for their prices to appreciate.

How to start?

Find yourself a reputable crypto exchange. Once done, open an account and provide personal information and other documents to verify it. Then you can start buying crypto using your local currency.

How to manage risk?

You should distribute your funds into two or more crypto assets. For example, you can consider buying $50 worth of Tron (TRX) and $50 worth of Stellar (XLM) if that is your investing plan. There are other low-priced cryptocurrencies you can buy.

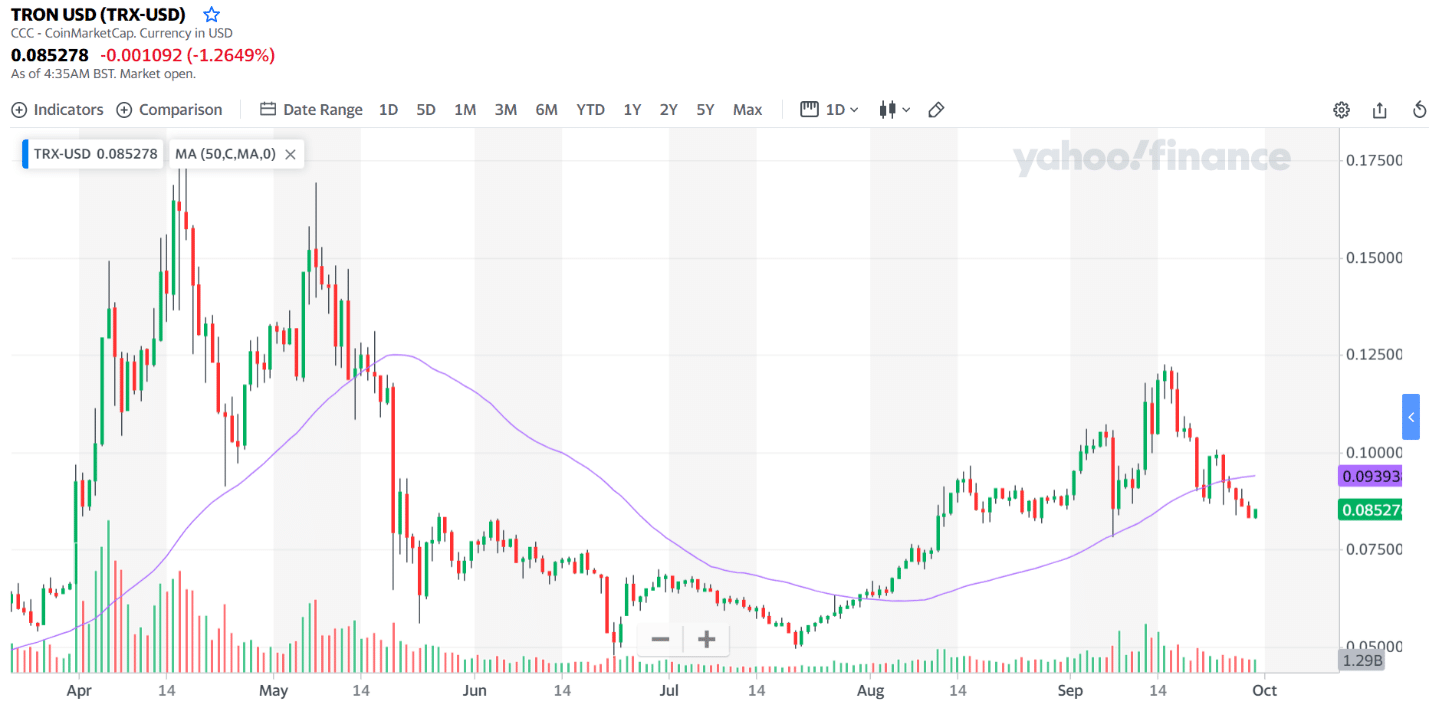

TRON USD (TRX)

Let us see how far your $100 can go. Let us take Tron as your investment of choice. The price of Tron right now is $0.08527 (see above chart). With your $100, you can buy 1,172 Tron coins. Your $100 will become $1,000 when the price of Tron reaches $0.93797. Yes, it would take time, but it is possible.

Strategy 2. Invest in fractional shares

A fractional share, as the name implies, refers to a fraction of a stock. Since owning shares requires significant capital, buying fractional shares is possible with a relatively small fund. This type of investment is suitable for new market participants. You can start with $100, which will allow you to buy multiple fractional shares of stocks.

How does it work?

There are online brokerage firms that allow you to buy fractional shares. One such broker is Robinhood. With this broker, you can buy ten different stocks with your $100, which is an excellent thing. You do not need to put all your $100 in one stock.

How to start?

It is better to select an online brokerage platform that allows you to open an account with no minimum deposit requirement. Also, make sure that such a platform provides fractional shares that you can buy for $100 or less.

How to manage risk?

Diversification is key to every type of investment, and investing in fractional shares is no exception. As pointed out above, you can buy one share for $10. With your $100, you can have ten shares for ten different stocks already.

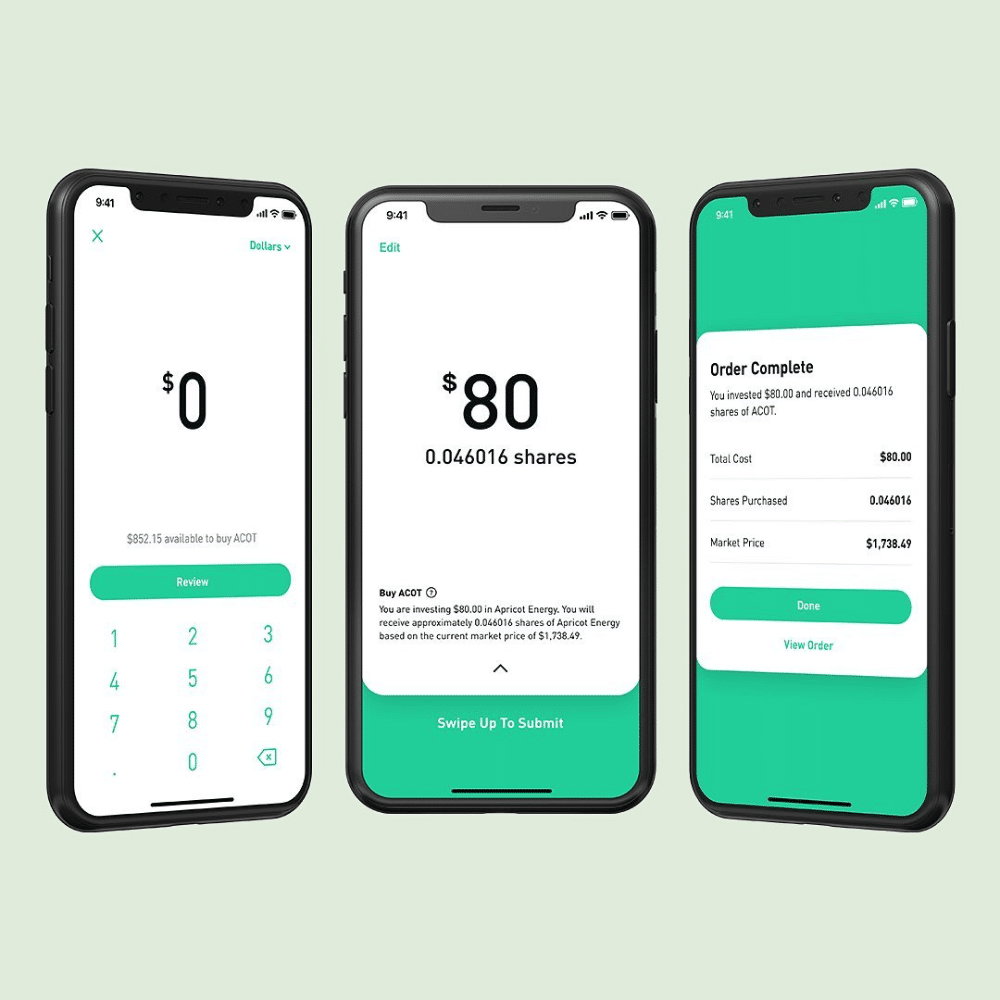

The image below shows an example of buying $80 worth of Apricot Energy in Robinhood. Making such a purchase will allow you to own 0.046016 shares of the stock, hence fractional share.

Sample fractional share in Robinhood

Strategy 3. Open a Roth IRA

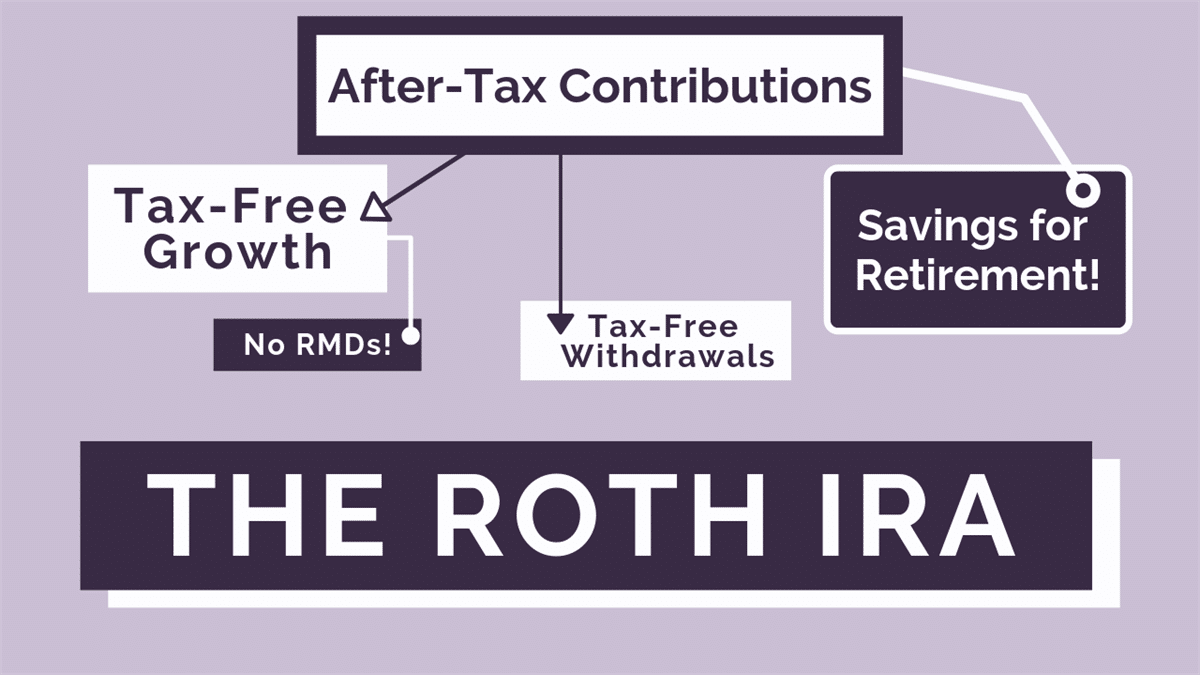

A Roth IRA is a retirement account that you can get while enrolled in another retirement plan such as a traditional 401k. This account requires you to put in cash after tax has been taken out from your income. As a result, you can withdraw profits tax-free when you reach 59.5 years of age or older.

How does it work?

You can open a Roth IRA account by yourself. This is relatively easy considering the number of online brokerage companies offering such a service. Just be mindful of your income. If you are a high earner, you might not qualify to open such an account.

How to start?

It would help if you connected with a brokerage firm to get started. You have several options in this area. These include Stash, Betterment, M1 Finance, and many more. Do your research and go for one that suits your goals and needs best.

How to manage risk?

There is not much risk involved when saving money in a Roth IRA. Just make sure you do not take out cash when the account is not ripe for harvesting. Otherwise, you will get a 10% penalty. As long as you follow the rules, you will reap the full benefits of a Roth IRA. The image below shows some of the benefits of a Roth IRA.

Strategy 4. Open a high-yield savings account

Saving money is a prerequisite to investing. You cannot invest if you do not have capital. If you do save money but put it in a regular savings account, the yearly return you will get is often negligible. If you factor in inflation, you are at a losing end. How to protect your investments against inflation read here.

Therefore, you should put money in a high-yield savings account. You can open such an account without leaving your doorsteps.

How does it work?

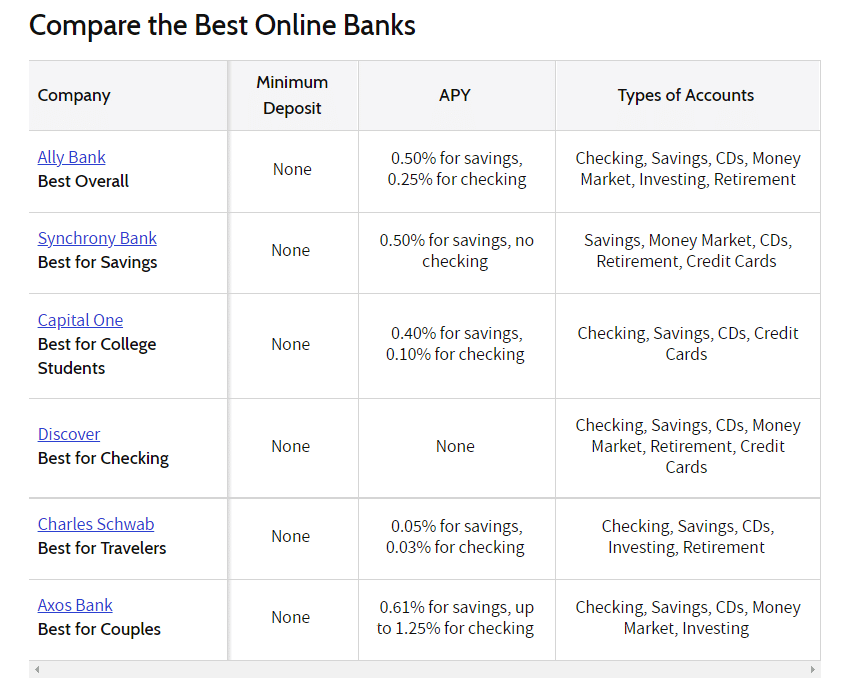

Several online banks provide higher interest rates than the national average. Such banks include Discover, CIT Bank, and Ally Bank. Apart from the interest rate, take a look if an option offers other benefits and has no hidden fees. Your due diligence should consider these points.

How to start?

Do the research and compare available options to determine which one is best. In most cases, you would like a savings account with no minimum deposit, no maintaining balance, and no continuing fees.

How to manage risk?

You can put your $100 in multiple accounts from different online banks. This is possible since some banks do not require a minimum amount. For example, you can put $50 in one account and the remaining $50 in another account. The following image shows a list of online banks not requiring a minimum deposit.

Best online banks in 2021

Strategy 5. Invest in bonds

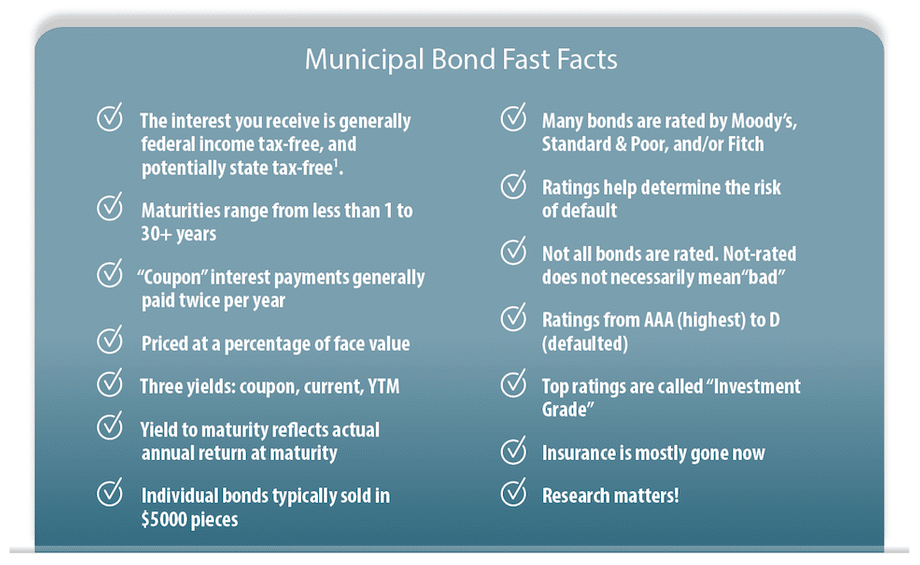

You can invest your $100 in municipal bonds, which are quite like government bonds but with one difference. While local or state governments issue municipal bonds, the Federal government is the one issuing government bonds.

How does it work?

When you take this investing route, you must use a municipal bond mutual fund or ETF. Any of these options provide better diversification and will protect your investment against market volatility. Refer to the image below to learn more about municipal bonds.

How to start?

Virtually all brokerage firms offer municipal bond ETFs. If you do not have a broker right now, you should choose one. Among the good options for you are M1 Finance and Stash. These brokers can facilitate your $100 investment into a municipal bond ETF.

How to manage risk?

In general, investing in municipal bonds is safe. Since the local government backs the investment, a municipal bond default is uncommon. There is still an inherent risk, though, as with any type of investment. To dampen the risk, you can use a municipal bond mutual fund or ETF.

Final thoughts

You don’t need to be a genius to invest wisely. Moreover, to succeed that surpasses the result of 99% of investors, you need to follow basic standard rules.

Get into the habit of saving some part of your income for passive investing. Even if it is a minimal amount, the growth of the market and the magic of compound interest will do their great job on the long horizon. It’s essential just to get started and do it.

Comments