With the advent of technology like high-speed computers and powerful programming languages, people started to think if they could harness the power to make easy money from the financial markets. It appears they have found a way, and now high-frequency trading is starting to dominate every type of market. The HFT market is expected to become a $500 million industry by 2028.

HFT presents an opportunity that many traders would like to get a piece of. Apart from the potential to generate a massive profit, traders think about the possibility of making money passively. In this manner, they can do other things that concern them or have a good time somewhere.

While HFT offers a lot of promise, it carries risks and challenges that every prospective participant should know. In this guide, you will learn what HFT is, the pros and cons, and what a bullish and bearish setup may look like.

What is high-frequency trading?

It is a trading method that utilizes robust computer programs to execute large volumes of trades in a second split. These programs trade the markets multiple times in a day, adding liquidity in the process. These computer programs are like expert advisors, but their capacity is superior. See a sample setup of a trading room using HFT systems in the image below.

With the use of complex algorithms, they can check various markets simultaneously and generate orders if market environments and trading conditions align. The faster the program executes market analysis and orders, the more profit it can bring to the trader. HFT is known to have a high turnover ratio, which refers to the number of orders executed in a given time over the total number of orders in the pipeline at the same interval.

HFT involves the use of powerful computers

How to test the high-frequency trading strategy?

You can test your HFT strategy in at least three ways. These methods apply to any type of strategy you may come up with, though. Below is an explanation of these three approaches.

Manual testing

This test aims to check if the strategy holds water in the past. You want to develop a system that works in a given market condition and is profitable. Because hand testing is time-consuming, you can limit the amount of historical data you will use. Depending on the time frame used, you can employ one year, five years, or even ten years of data. The metric that you need is the win rate. You have to know how many times the signal occurs in a specific period and how many setups were successful.

Automated testing

This is often the second phase of testing an HFT system. After you find a trading system that works through manual testing, you are ready to have it coded to be run on autopilot. You can code it yourself if you have such an ability, or you can ask someone else to do it for you for a fee. The good thing about automated testing is that you can run the program over a large number of past data very quickly. The downside is that the result is based on past performance, which does not guarantee future success.

Forward testing

It is often the final phase of testing any trading system. Although it requires a lot of time to complete, forward testing leads to a way more dependable result. Besides, it uses live market data when finding and executing trade signals. Therefore, at least the actual spread is considered during entries and the varying volatility in the crypto market.

Bullish trading strategy

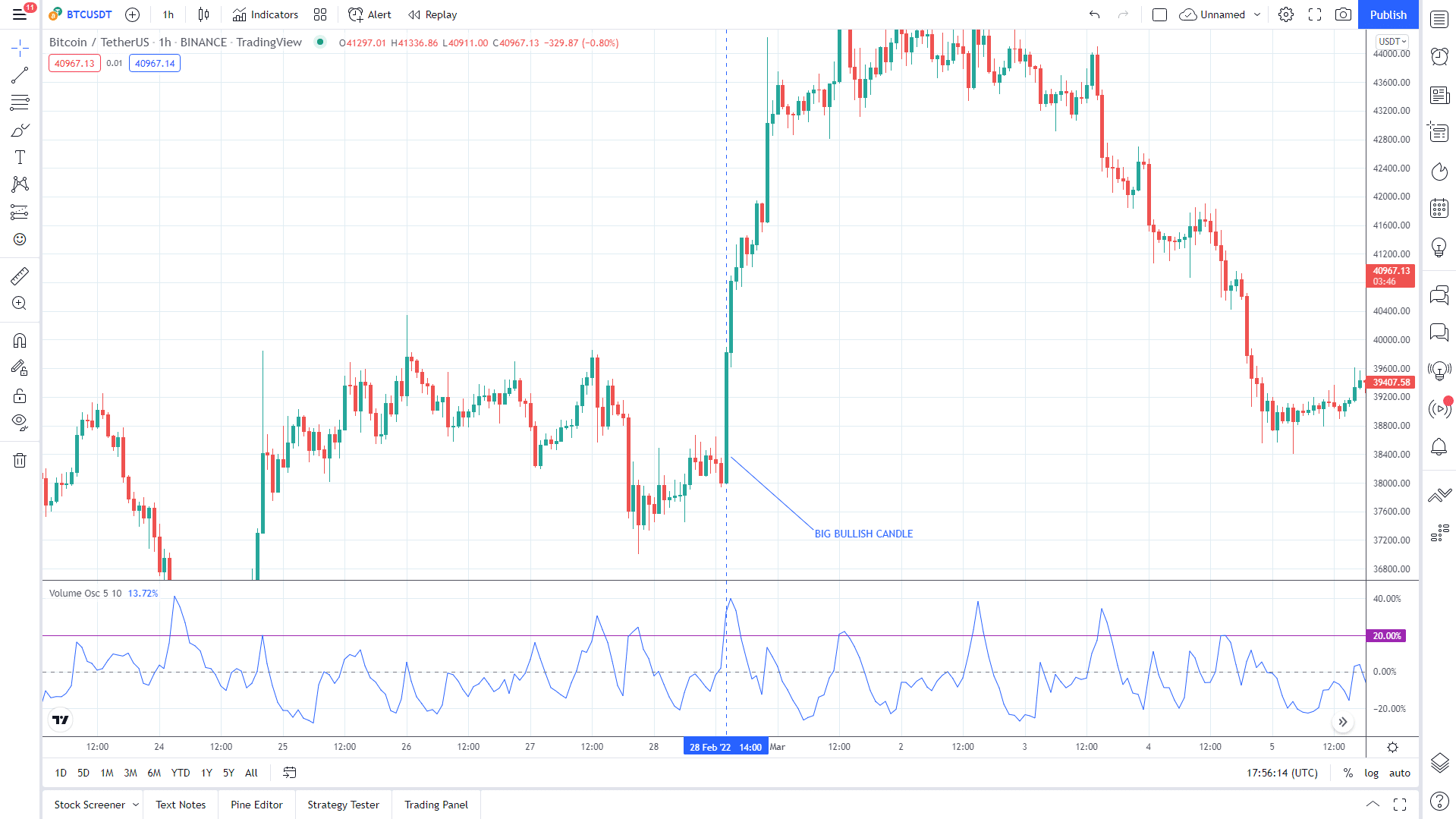

Bitcoin hourly chart

Bullish trading conditions

- Best time frames to use: hourly chart.

- Entry: when volume increases by 20% and a bullish candle forms.

- Stop loss: below the low of the bullish candle.

- Take profit: no specific target, only stop trailing.

You can use virtually any trading strategy when engaging in high-frequency trading. However, HFT is most profitable when the market is fast-moving. This often happens during news events. A news announcement is not always a requirement. As long as volume increases by at least 20%, you can take a trade, but only if the candle is bullish. Refer to the above BTC hourly chart.

Because the crypto market is highly volatile, your HFT strategy cannot do without a stop loss. A trailing stop method maximizes profits and prevents a winner from turning into a loser. Due to the varying reward-risk ratio, the only way for this HFT strategy to work is through a high win rate.

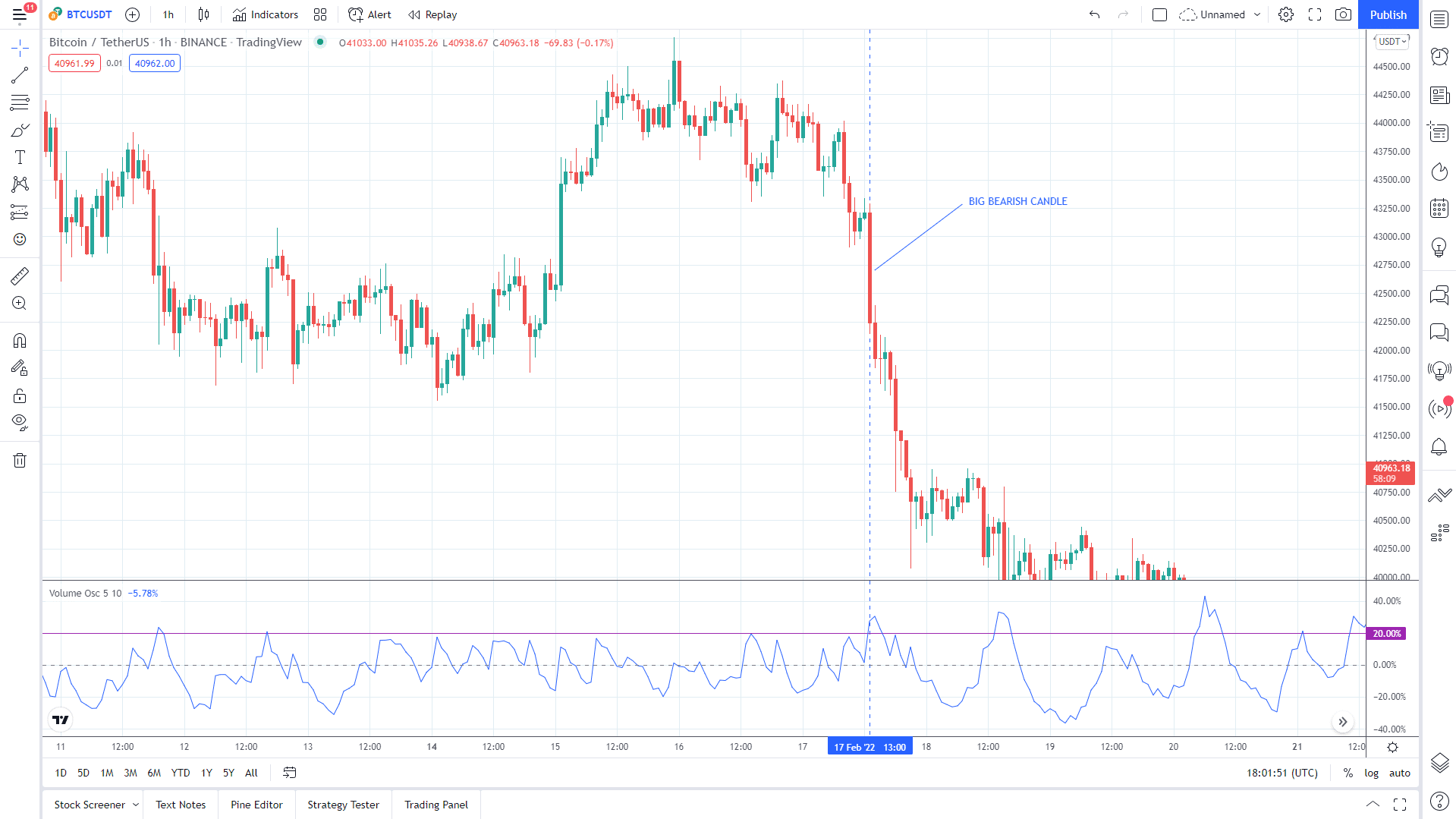

Bearish trading strategy

Bearish trading conditions

- Best time frames to use: hourly.

- Entry: when volume increases by 20% and a bearish candle forms.

- Stop loss: above the high of the bearish candle.

- Take profit: no specific target, only stop trailing.

The above chart shows a bearish entry on the BTC hourly chart. A volume increase of more than 20% triggered the trade, confirmed by forming a bearish candle. A stop loss must be in place to protect the trading account against sudden price reversals. Put your stop loss a little above the high of the bearish candle. This is to limit the risk in the trade. To aim for a big target, you can use a trailing stop.

Pros and cons

HFT is not suitable for everyone. However, before you count yourself out of utilizing this trading approach, try to learn its pros and cons in this section.

| Pros | Cons |

|

|

|

|

|

|

Final thoughts

High-frequency trading might sound like an excellent way to trade the crypto market, but it poses a unique set of challenges that every prospective trader should consider. The most obvious obstacle to taking advantage of this opportunity is the capital needed to set up the system.

Some of the costs involved are getting a data provider and a server, purchasing trading software, buying high-speed computers, and putting up a trading capital. The required capital could be prohibitive for an independent trader to approach, and this is only one part of the setup process.

Comments