The presentation of FXMAC looks simple and doesn’t increase a level of trust. The main page includes just several statements “Start making money with our Forex Managed Accounts. Making it Easy for You.” It isn’t much as for a professional company in the PAMM and MAM field.

We were asked to provide our vision about this company from the side of trust. We noted that the company acts fraudulent in many ways.

What Is Behind FXMAC?

We have some explanations provided about the systems and their specifications.

- The developers provide four investment programs with different risks and deposit requirements.

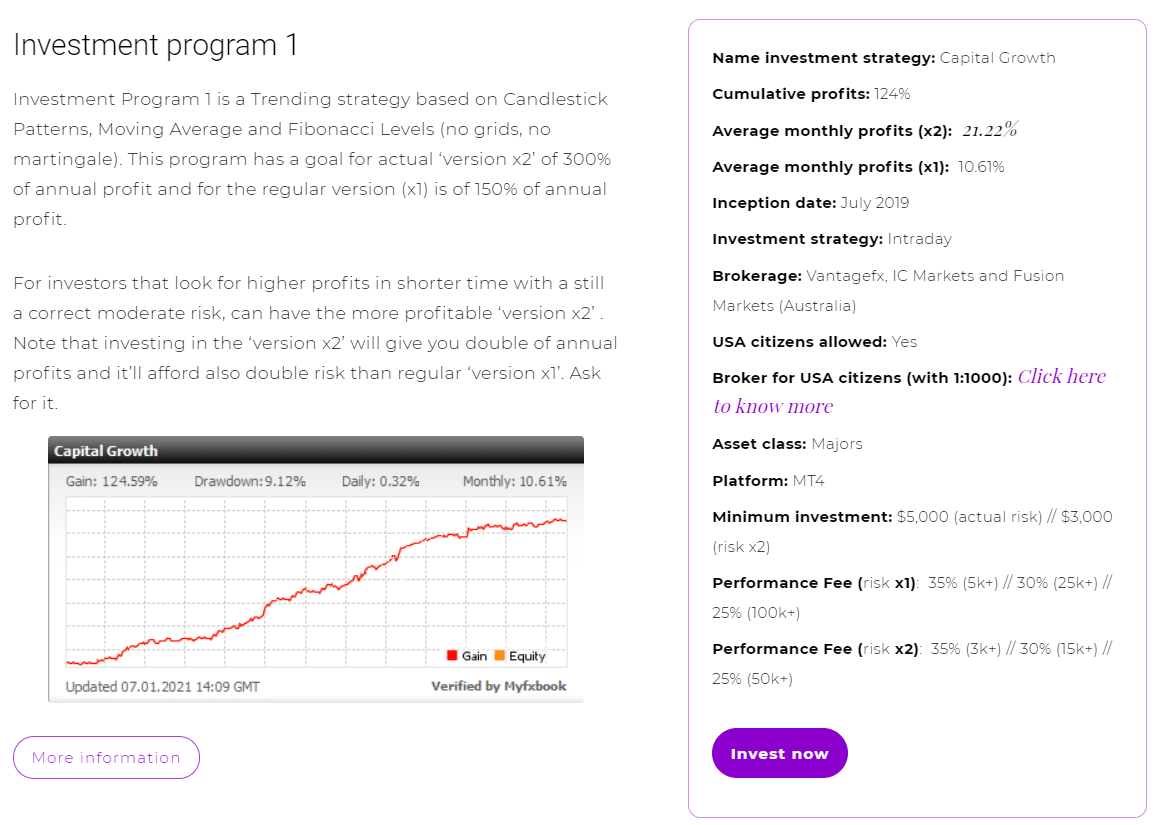

- The first one is “Forex Investment Program 1 is a Trend strategy (no grids, no martingale) based on Candlestick Patterns, Moving Average and Fibonacci Levels.”

- It can provide up to 150% annually.

- The second one can be profitable up to 300% annually.

- It’s doubled risks as well.

- The robot works with hidden SL and TP levels.

- The profit factor is 1.53.

- The maximum drawdown is medium – 20%.

- For an aggressive version, it’s 40%.

- The brokers list includes Vantagefx, Fusion Markets, and IC Markets.

- The common version requires $25,000 on balance.

- The aggressive one requires $15,000.

- The performance fee is 35%.

- LMFX broker allows working with the first package.

- The minimum investment is $5,000 for the first version and $3,000 for the second version.

- We may note the whole list of chosen brokers.

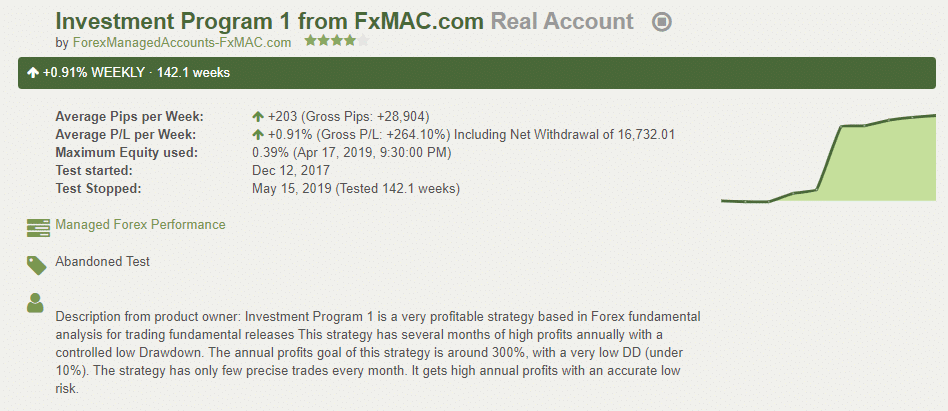

All Myfxbook widgets are just unclickable pictures:

- The total profit has amounted to 124%.

- Average monthly profits are 21.22% for high risk.

- Average monthly profits are 10.61% for low risks.

- Investment strategy: Intraday

- Asset class: Majors

The performance fees which we have to pay monthly are 35% for $5,000, 30% for $25,000, and 25% for $100,000 accounts.

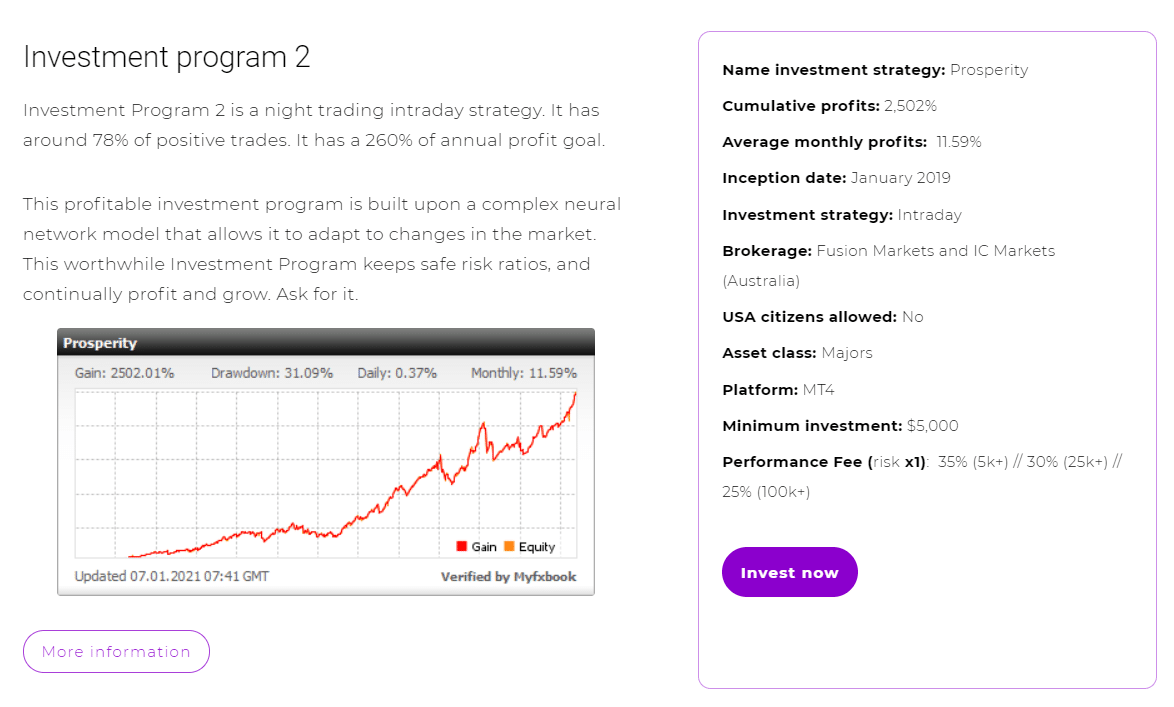

- The second strategy is night intraday trading. It sounds like a night scalper.

- The accuracy rate is up to 78%.

- An annual profit can be as high as 260%.

- “This profitable investment program is built upon a complex neural network model that allows it to adapt to changes in the market.”

- An average monthly gain is 11.59%

- The system works with intraday strategies.

- We may work on the next brokers: Fusion Markets and IC Markets.

- US citizens aren’t allowed to follow it.

- Asset class: Majors.

- The deposit should start from $5,000.

- The performance fees are 35% for $5,000, 30% for $25,000, and 25% for $100,000 accounts.

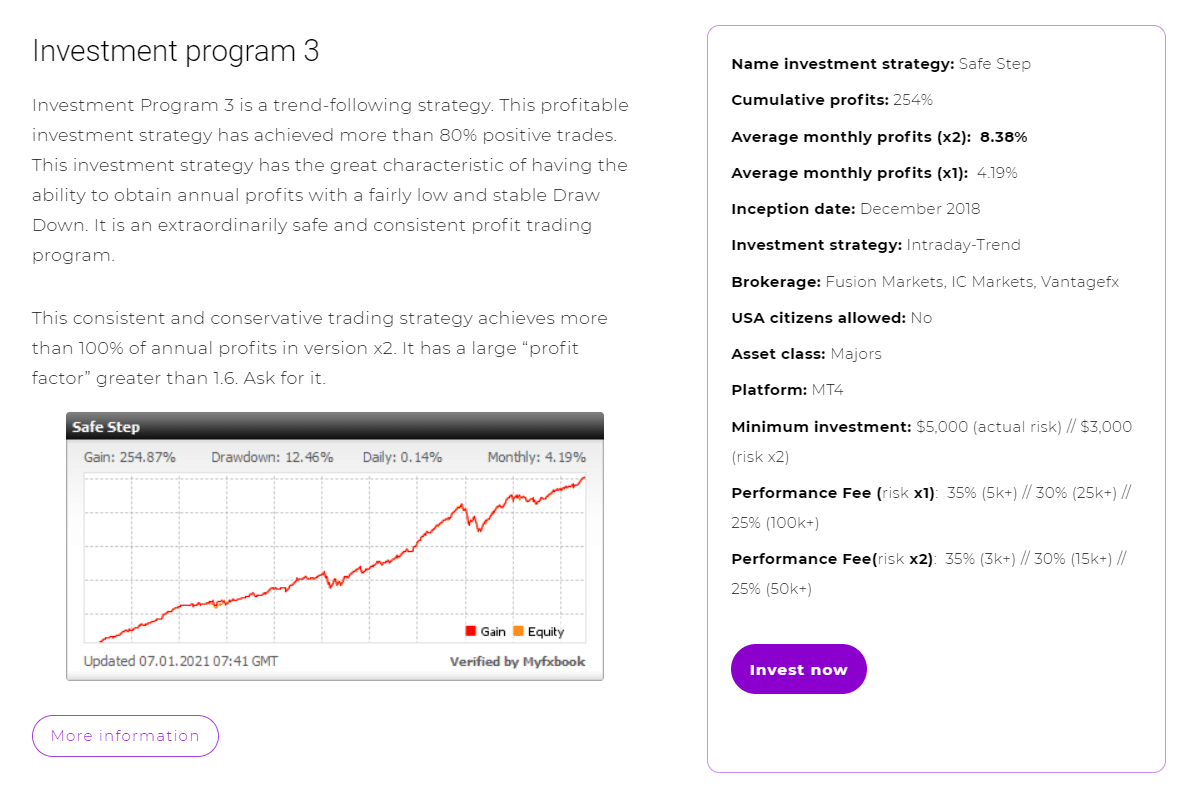

- This system focuses on following a trend and open short-range orders.

- The accuracy rate is up to 80%.

- The drawdowns are low.

- The annual profit is stable and relevant.

- The profit factor is common, 1.6.

- The annual profit is able to be up to 100%.

- An average monthly profit is 8.38%.

- There is a list of broker houses Fusion Markets, IC Markets, Vantagefx.

- US citizens are not allowed.

- We may work with it on MT4.

- Asset class: Majors

- The minimum deposit requirements are $5,000.

- The performance fees are 35% for $5,000, 30% for $25,000, and 25% for $100,000 accounts.

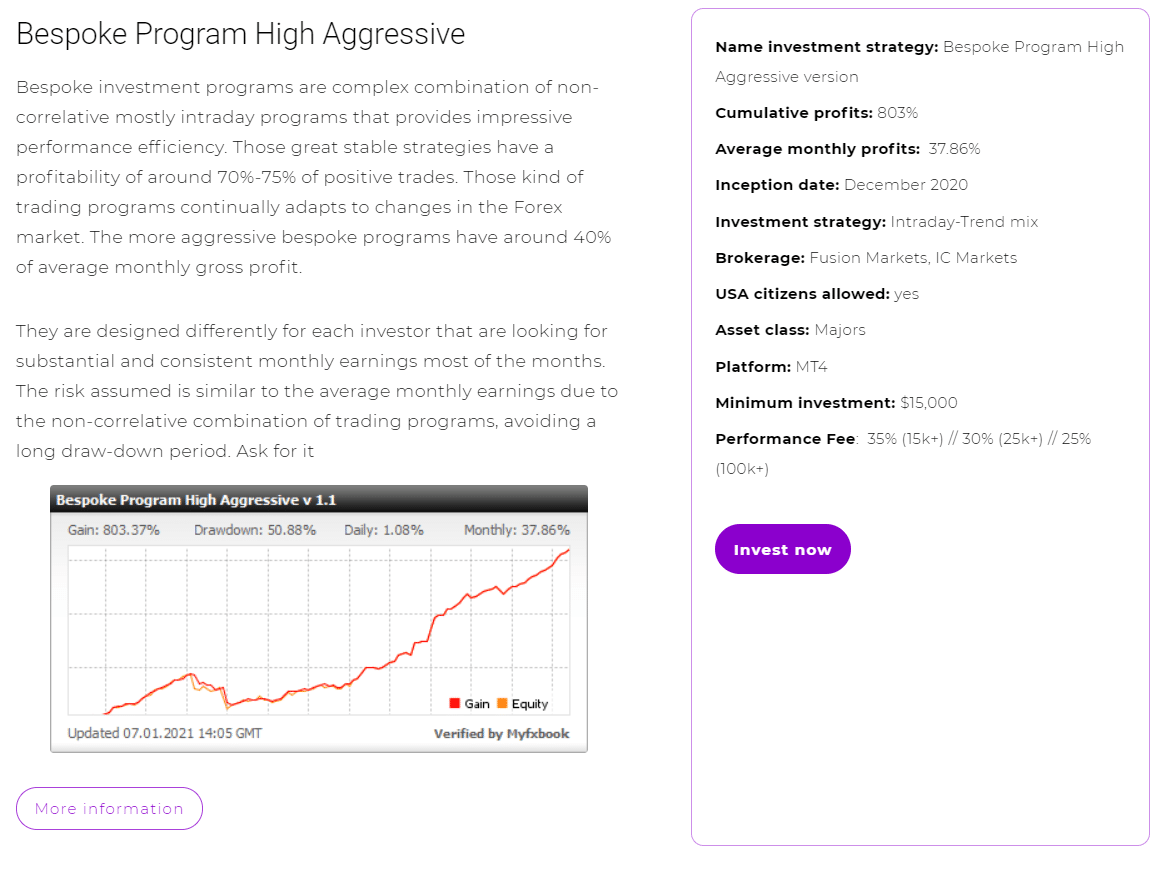

- The final system is “Bespoke Program High Aggressive.”

- “Bespoke investment programs are a complex combination of non-correlative, mostly intraday programs that provide impressive performance efficiency.”

- The accuracy rate is 70-75%.

- We can expect a monthly profit of up to 40%.

- We can set the risk that we want to work with.

- The broker list is the same: Fusion Markets and IC Markets.

- US citizens are allowed.

- The minimum deposit is $15,000.

- Minimum investment: $15,000.

- The performance fees are 35% for $5,000, 30% for $25,000, and 25% for $100,000 accounts.

Key Features

The developers will manage our account, or these orders will be copied automatically.

Trading Strategy

- There are strategies: Trend, Scalping, Price Action, and Intraday trading.

- The currency pairs, as well as time frames, aren’t revealed.

Pricing

There’s no pricing info. We have to contact representatives and discuss the account size and strategy. After that, we will be informed what fees we will be charged. It’s a low level of transparency.

Trading Performance of FXMAC

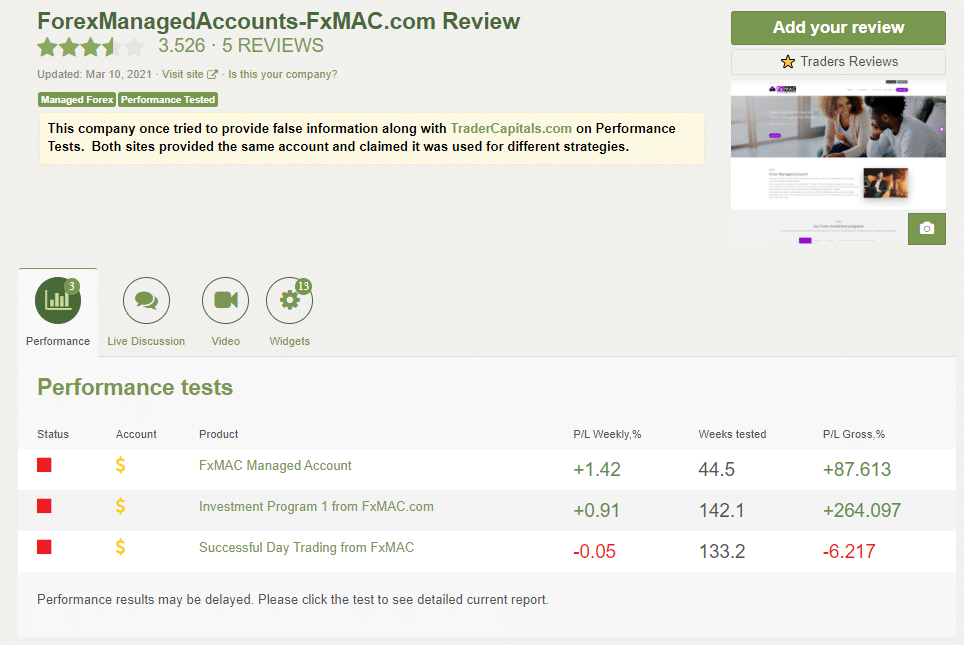

It’s an account that worked between 2017 and 2019 years. An average pips gain was 203 weekly. The weekly profit was +0.91%.

The closed trade profit was $18,486. After a -$16,732 withdrawal, the balance was $1,754. The gross profit was $20,180. The profit factor was 11.92. There were 222 trades traded. It’s quite a low trading frequency. The win rate was 86% for shorts and 74% for longs.

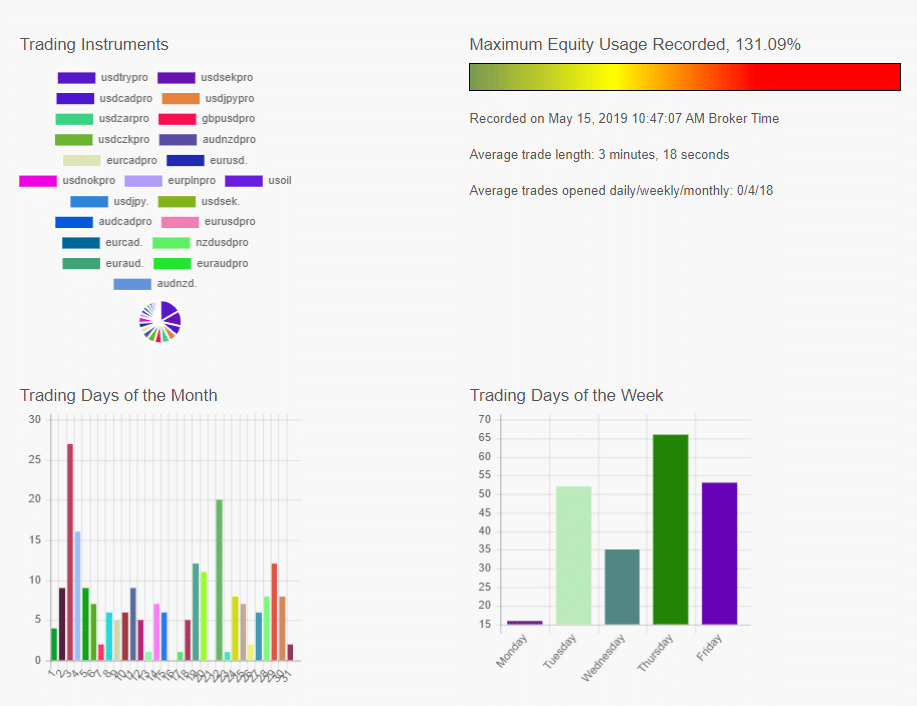

The robot worked with various symbols. The equity usage was high – 131.09%. An average trade length is 3 minutes 18 seconds. Thursday was the most traded day.

Customer Support

The company has mediocre trading support. It takes a lot of time to get an answer.

People Feedback

The company runs a page on Forex Peace Army with a 3.5 rate based on five reviews. There are three stopped, and any actual accounts added. One of them was going to lose.

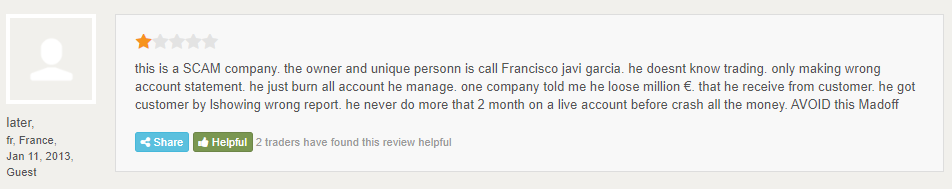

People warned us from being connected with this service. We are not surprised.

Comments